For professionals who are meticulous, analytical, and enjoy ensuring a critical business function runs flawlessly, a career in payroll can be both rewarding and stable. As the gatekeepers of employee compensation, Payroll Specialists play an indispensable role in any organization. This career offers a clear path for growth and a competitive salary, with top professionals earning upwards of $75,000 or more, depending on their expertise and location.

If you're considering this essential career, this guide will break down everything you need to know about a Payroll Specialist's salary, the factors that influence it, and the future of the profession.

What Does a Payroll Specialist Do?

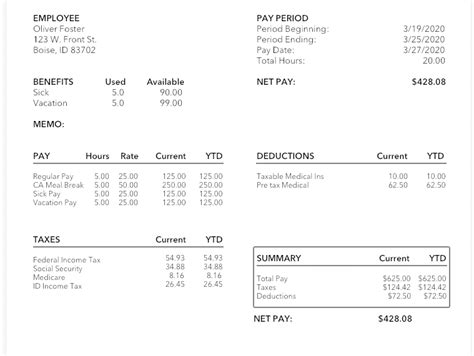

At its core, a Payroll Specialist ensures every employee in an organization is paid accurately and on time. This goes far beyond simple data entry. The role requires a deep understanding of tax regulations, company policies, and benefits administration.

Key responsibilities include:

- Data Management: Collecting and verifying timekeeping information, including hours worked, overtime, and paid time off.

- Wage Calculation: Calculating gross wages, as well as handling all deductions for taxes (federal, state, local), health insurance, retirement contributions (like a 401(k)), and other garnishments.

- Payment Processing: Issuing payments to employees through direct deposit or physical checks.

- Compliance and Regulation: Staying up-to-date with labor laws and tax obligations to ensure the company remains compliant, avoiding costly fines and legal issues.

- Reporting: Preparing payroll reports for management, accounting departments, and government audits.

- Employee Support: Acting as the primary point of contact for employees with questions about their pay, deductions, or tax forms.

Average Payroll Specialist Salary

The salary for a Payroll Specialist can vary significantly, but we can establish a strong baseline by looking at data from several authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for "Payroll and Timekeeping Clerks" was $50,170 in May 2023. This figure represents the midpoint, with half of the specialists earning more and half earning less.

However, data from major salary aggregators, which often include a wider range of experience levels and specializations, suggests a higher average.

- Salary.com reports the median U.S. salary for a Payroll Specialist is approximately $64,369 as of late 2024.

- Payscale lists the average base salary at around $55,200 per year.

- Glassdoor places the total pay average at $58,000 per year.

A typical salary range for a Payroll Specialist in the United States is between $45,000 for an entry-level position and $75,000+ for a senior or lead specialist with significant experience and certifications.

Key Factors That Influence Salary

Your earning potential as a Payroll Specialist isn't static. It's influenced by a combination of your qualifications, location, and the type of company you work for. Here’s a breakdown of the most critical factors.

### Level of Education

While a bachelor's degree isn't always a strict requirement, your educational background plays a key role in your starting salary and long-term career trajectory.

- High School Diploma / Associate's Degree: Many entry-level payroll positions are accessible with a high school diploma and some on-the-job training or an associate's degree in accounting or business.

- Bachelor's Degree: A bachelor's degree in Accounting, Finance, or Human Resources can lead to higher starting salaries and provides a stronger foundation for advancing into leadership roles like Payroll Manager or Director.

- Professional Certifications: This is where you can significantly boost your value. The Certified Payroll Professional (CPP) designation from the American Payroll Association (APA) is the gold standard in the industry. According to Payscale, professionals with a CPP certification can earn nearly 10-20% more than their non-certified peers.

### Years of Experience

Experience is arguably the most significant factor in determining your salary. As you gain more experience, you can handle more complex payrolls, navigate intricate compliance issues, and take on leadership responsibilities.

- Entry-Level (0-2 years): In this stage, you'll likely earn in the $45,000 - $52,000 range. The focus is on learning core processes, data entry, and basic calculations.

- Mid-Career (3-7 years): With solid experience, you can expect to earn between $53,000 - $65,000. You'll be trusted with more autonomy, handle multi-state payrolls, and assist with reporting and audits.

- Senior/Lead (8+ years): Highly experienced specialists often earn $66,000 - $75,000+. These professionals may mentor junior staff, lead system implementations, manage complex compliance issues, and are on the direct path to management roles.

### Geographic Location

Where you work matters. Salaries for Payroll Specialists are higher in metropolitan areas with a high cost of living and strong demand for financial professionals.

According to BLS data, the top-paying states for this profession include:

- District of Columbia: ~$72,400 (mean wage)

- Washington: ~$63,130

- California: ~$62,490

- Massachusetts: ~$61,160

Cities like San Francisco, San Jose, New York City, and Seattle will consistently offer higher-than-average salaries to compensate for the higher cost of living. Conversely, salaries will typically be lower in rural areas and states with a lower cost of living.

### Company Type

The size and industry of your employer can have a major impact on your paycheck.

- Large Corporations vs. Small Businesses: Large, multinational corporations often have more complex payroll needs (e.g., multi-state and international employees) and the resources to pay more. They also tend to have more structured career paths and salary bands.

- Industry: High-revenue industries like Technology, Finance, and Biotechnology typically pay more for payroll talent than sectors like retail or non-profit.

- Payroll Service Providers: Working for a company like ADP or Paychex can offer a unique career path. While salaries are competitive, the experience gained serving multiple clients can be invaluable and highly marketable.

### Area of Specialization

As you advance in your career, you can develop specialized skills that are in high demand and command a premium salary.

- International Payroll: Specialists who can manage the complexities of paying employees in different countries, including currency conversions and diverse international labor laws, are highly sought after.

- Payroll Systems: Expertise in specific payroll platforms (e.g., Workday, Oracle, ADP Vantage) is extremely valuable, especially for companies undergoing system implementations or upgrades.

- Compliance and Auditing: A deep specialization in tax law, wage and hour regulations, and audit defense can make you an indispensable asset to any organization.

Job Outlook

The U.S. Bureau of Labor Statistics projects that employment for payroll and timekeeping clerks will decline by 5% from 2022 to 2032. It's crucial to understand the context behind this number.

This decline is largely driven by the automation of routine, data-entry tasks. However, this does not mean the profession is disappearing. Instead, it is evolving. The need for skilled Payroll Specialists who can manage sophisticated software, ensure complex compliance, interpret data, and solve problems is expected to remain strong.

The future of payroll belongs to those who embrace technology and position themselves as strategic partners within their organization. Continuous learning and professional certifications like the CPP will be key differentiators for career security and growth.

Conclusion

A career as a Payroll Specialist offers a stable and rewarding path for detail-oriented individuals. While the national median salary hovers between $50,000 and $65,000, your earning potential is directly in your hands.

By pursuing higher education, gaining valuable experience, earning a prestigious certification like the CPP, and choosing to work in a high-demand location or industry, you can build a lucrative and secure career. The role is shifting from clerical work to strategic management—an exciting evolution for anyone ready to become an expert in the critical field of employee compensation.