Earning a $120,000 annual salary is a significant financial and professional milestone. It signifies a level of expertise, responsibility, and value that places you in the upper echelon of earners in the United States. For many, it's the benchmark where financial security feels more tangible, long-term goals seem more attainable, and career ambitions feel validated. But what does this figure truly represent in practical terms? How does a $120,000 salary translate to an hourly rate, and more importantly, what kind of life and career does it support?

This is more than just a math problem; it's a question about value, career trajectory, and professional identity. The simple calculation—dividing $120,000 by the standard 2,080 work hours in a year—yields an hourly rate of $57.69. However, this number is merely the beginning of the story. It doesn't account for taxes, benefits, bonuses, or the all-too-common reality of working more than 40 hours a week. It doesn't capture the skills, experience, and strategic thinking required to command such a salary.

As a career analyst, I've advised countless professionals aiming for and navigating this income level. I recall a client, a talented marketing manager, who was offered two positions: one was a $120,000 salaried role at a large corporation, and the other was a contract role at a fast-growing startup paying $75 per hour. The hourly role seemed more lucrative on the surface, but a deeper analysis of benefits, expected overtime, and long-term stability revealed that the salaried position was the superior choice for her career goals. This experience underscores a critical lesson: understanding the full picture beyond the base number is paramount.

This comprehensive guide will deconstruct the $120,000 salary milestone. We will move beyond the simple hourly calculation to explore the professional landscape at this level. We will dissect the roles that command this income, the factors that influence your earning potential, and the strategic steps you can take to reach this significant career achievement.

### Table of Contents

- [What Do Professionals Earning $120k Do?](#what-do-professionals-earning-120k-do)

- [Average $120k Salary: A Deep Dive into Compensation](#average-120k-salary-a-deep-dive-into-compensation)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for High-Earners](#job-outlook-and-career-growth-for-high-earners)

- [How to Build a $120k Career: Your Step-by-Step Guide](#how-to-build-a-120k-career-your-step-by-step-guide)

- [Conclusion: Is a $120k Salary Your Next Career Goal?](#conclusion-is-a-120k-salary-your-next-career-goal)

---

What Do Professionals Earning $120k Do?

A $120,000 salary isn't tied to a single job title but rather to a level of contribution and responsibility. Professionals at this level have typically moved beyond entry-level execution and are now responsible for strategy, management, or highly specialized, complex tasks. They are problem-solvers, decision-makers, and key contributors to their organization's success.

While the specific industries vary widely—from tech and finance to healthcare and law—the nature of the work shares common themes:

- Strategic Oversight: Instead of just completing assigned tasks, these professionals help define the tasks. They are involved in planning, setting goals, and developing strategies to meet business objectives. A Marketing Manager at this level isn't just running social media accounts; they are developing the entire Q3 digital marketing strategy and budget.

- Team or Project Leadership: Many $120k roles involve managing people, projects, or both. This includes mentoring junior staff, coordinating cross-functional teams, managing budgets, and ensuring projects are delivered on time and within scope.

- High-Level Individual Contribution: In some fields, particularly in tech and engineering, you can reach this salary without being a people manager. These roles are for "principal" or "senior" individual contributors who possess deep, specialized expertise. A Senior Software Engineer, for example, might be responsible for designing the architecture of a critical new software feature.

- Client and Stakeholder Management: Professionals at this level often serve as a primary point of contact for key clients, vendors, or internal stakeholders. Their communication, negotiation, and relationship-building skills are critical to retaining business and ensuring organizational alignment.

### A "Day in the Life" of a $120k Professional

To make this more concrete, let's imagine a composite "day in the life" for a professional earning around $120,000. This individual could be a Senior Financial Analyst, an IT Project Manager, or a Product Marketing Manager.

- 9:00 AM - 9:30 AM: Start the day by reviewing key performance indicators (KPIs) on a data dashboard and scanning emails to triage urgent requests from leadership or key stakeholders.

- 9:30 AM - 11:00 AM: Lead a cross-functional project meeting. The goal is to align the engineering, marketing, and sales teams on the upcoming launch of a new product. The role here is to facilitate discussion, resolve roadblocks, and ensure everyone is clear on their responsibilities and deadlines.

- 11:00 AM - 1:00 PM: "Deep Work" session. This is two hours of focused, uninterrupted time dedicated to a core strategic task. For the Financial Analyst, this might be building a complex financial model for a potential acquisition. For the IT Manager, it's finalizing the project charter and resource allocation plan for a new system implementation.

- 1:00 PM - 1:30 PM: Lunch, often at the desk while catching up on industry news or an internal company update.

- 1:30 PM - 2:30 PM: One-on-one meeting with a direct report or a junior team member. This time is for mentorship, feedback, and professional development, helping to grow the team's overall capabilities.

- 2:30 PM - 4:00 PM: Stakeholder presentation. Presenting the findings of the financial model or the project plan to a director or VP. This requires translating complex information into a clear, compelling narrative and confidently answering challenging questions.

- 4:00 PM - 5:30 PM: Respond to accumulated emails and work on ad-hoc requests. This might involve providing data to another department, reviewing a contract, or collaborating on a document with a colleague. The salaried reality often means the day doesn't end sharply at 5:00 PM, especially when deadlines are tight. This is a key difference from a strictly hourly role.

This day illustrates the blend of strategic thinking, collaborative leadership, and deep subject matter expertise that defines work at the $120k level. It's less about the hours clocked and more about the value delivered during those hours.

---

Average $120k Salary: A Deep Dive into Compensation

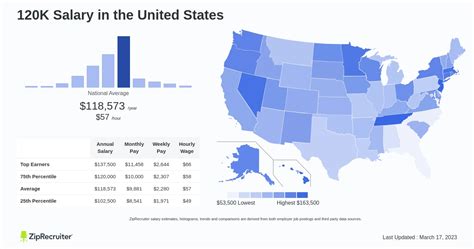

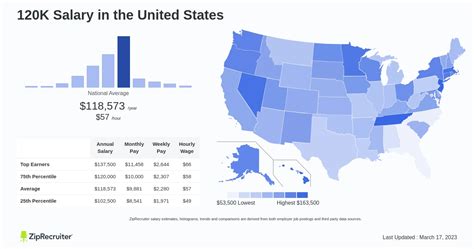

A $120,000 salary places an individual well above the national average. According to the U.S. Bureau of Labor Statistics (BLS), the median usual weekly earnings for full-time wage and salary workers in the fourth quarter of 2023 was $1,145, which annualizes to approximately $59,540. Therefore, earning $120,000 means you are making more than double the median American worker.

However, this salary is not a ceiling; in many professional careers, it's a mid-career stepping stone. For others, it may represent the peak of a successful senior-level position. The context of where $120k falls on the spectrum depends heavily on your field, experience, and location.

Salary aggregators provide a clearer picture of where this income level sits within professional hierarchies. Data from Salary.com and Payscale consistently show that $120,000 is a common salary benchmark for experienced professionals and managers across numerous industries.

### Salary Brackets by Experience Level

To understand the journey to a $120k salary, it's helpful to see how compensation typically progresses through a career. These are generalized brackets and can vary significantly by industry and role.

| Career Stage | Years of Experience | Typical Salary Range (National Average) | Example Job Titles |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $55,000 - $75,000 | Junior Analyst, Associate Developer, Marketing Coordinator |

| Mid-Career | 3-8 Years | $75,000 - $115,000 | Software Engineer, Financial Analyst, Project Manager, Marketing Manager |

| Senior/Lead | 8-15+ Years | $110,000 - $160,000+ | Senior Software Engineer, Lead Data Scientist, Senior Manager, Director |

| Executive/Principal| 15+ Years | $160,000 - $250,000+ | Senior Director, VP, Principal Architect, Chief Officer |

As the table illustrates, the $120,000 mark is typically achieved in the late mid-career to senior level. It reflects a transition from being a competent individual contributor to becoming a leader or a highly sought-after expert in your domain.

### Deconstructing Total Compensation: Beyond the Base Salary

For high-earning professionals, the base salary is often just one piece of a much larger puzzle. Understanding the components of a total compensation package is essential, especially when comparing offers or evaluating your current earnings.

- Base Salary: This is the fixed, predictable amount you earn, in this case, $120,000. It's the foundation of your compensation.

- Annual Performance Bonus: This is a variable cash payment tied to individual, team, and company performance. For a $120k role, a typical bonus target might range from 10% to 20% of the base salary. A strong year could add an extra $12,000 to $24,000 to your earnings. According to Payscale, the average bonus for a professional earning around this amount can be substantial, making it a critical part of the overall pay structure.

- Stock Options or Restricted Stock Units (RSUs): Highly common in the tech industry and publicly traded companies, equity is a form of compensation that gives you ownership in the company. RSUs are shares of company stock granted to you, which vest over a period (typically four years). At a large tech firm, an annual RSU grant for a senior engineer could be worth $40,000 to $100,000+ per year, dramatically increasing total compensation.

- Commission: For sales and business development roles, commission is the primary driver of earnings. A sales executive might have a base salary of $80,000 but an "on-target earnings" (OTE) goal of $160,000, with the additional $80,000 coming from commissions on deals closed.

- Profit Sharing: Some companies, particularly in finance, law, and consulting, distribute a portion of their annual profits to employees. This can be a significant addition to income, though it's dependent on the company's profitability.

- Benefits Package: The value of benefits should never be underestimated. A comprehensive package includes:

- Health Insurance: A good employer plan can be worth $10,000 - $20,000 annually in premium contributions.

- Retirement Savings (401k/403b): An employer match is free money. A common match is 50% of your contributions up to 6% of your salary. On a $120,000 salary, this is an extra $3,600 per year. A more generous match can double that.

- Paid Time Off (PTO): A generous PTO policy (4+ weeks) and paid holidays provide valuable work-life balance.

- Other Perks: These can include tuition reimbursement, wellness stipends, parental leave, and professional development budgets.

When you are considering a contract role paying, for example, $65/hour ($135,200 annually), you must subtract the cost of self-funded health insurance, the lack of a 401k match, and the absence of paid time off. Suddenly, the $120,000 salaried role with a strong benefits package and a potential 15% bonus ($138,000 total) looks far more appealing.

---

Key Factors That Influence Your Salary

Reaching a $120,000 salary is not a matter of luck; it's the result of a confluence of factors. Understanding and strategically navigating these elements is the key to accelerating your earning potential. This section provides an in-depth analysis of the most critical drivers of high salaries.

### ### Level of Education

While experience often trumps education later in a career, your academic foundation sets the initial trajectory and can unlock higher-paying specializations.

- Bachelor's Degree: For most professional roles that reach the $120k level, a bachelor's degree is the standard requirement. Degrees in high-demand fields like Computer Science, Engineering, Finance, and Economics provide a direct path to lucrative careers.

- Master's Degree: An advanced degree can act as a significant salary accelerator.

- Master of Business Administration (MBA): An MBA from a top-tier program is one of the most reliable paths to a high six-figure salary. According to a 2023 report from the Graduate Management Admission Council (GMAC), the median starting salary for graduates of top-50 MBA programs often exceeds $150,000. It's particularly valuable for career switchers or those aiming for leadership roles in management, consulting, or finance.

- Specialized Master's Degrees: A Master's in a technical field like Data Science, Cybersecurity, or Financial Engineering can provide the deep expertise that commands a premium salary. For instance, Glassdoor data shows that a Data Scientist with a Master's degree can earn 10-15% more than one with only a Bachelor's.

- Certifications: In many fields, particularly IT and project management, professional certifications are as valuable as a degree. They validate specific, in-demand skills.

- Project Management Professional (PMP): The Project Management Institute (PMI) reports that PMP certified project managers earn, on average, 16% more than their non-certified peers globally.

- Cloud Certifications (AWS, Azure, GCP): Certifications like AWS Certified Solutions Architect – Professional can significantly boost an IT professional's salary, often pushing them well past the $150k mark.

- Chartered Financial Analyst (CFA): This is the gold standard in the investment management profession and is a direct path to high-paying roles in finance.

### ### Years of Experience

Experience is arguably the single most important factor in salary growth. Your value to an employer increases as you move from theoretical knowledge to proven, real-world application.

- 0-2 Years (Entry-Level): The focus is on learning and execution. Salaries are typically in the $55k-$75k range, even in strong fields.

- 3-5 Years (Mid-Level): You have developed autonomy and can manage small projects or complex tasks independently. This is often where salaries approach the $100k mark. A software engineer with 4 years of experience, for example, might earn $110,000 on average, according to Payscale.

- 6-9 Years (Senior Level): You are now a subject matter expert or a team lead. You are expected to mentor others and contribute to strategy. This is the sweet spot where the $120k-$150k range becomes standard for high-performers in strong industries.

- 10+ Years (Lead/Principal/Manager): With a decade or more of experience, your value lies in strategic leadership, influencing entire departments, and solving the most complex business problems. Salaries can climb to $160,000, $180,000, and beyond. A Senior IT Manager with 12 years of experience, for example, has an average salary of around $145,000, per Salary.com.

### ### Geographic Location

Where you live and work has a profound impact on your salary. Companies adjust pay based on the local cost of labor and cost of living. The rise of remote work has complicated this, but geography remains a dominant factor.

- Top-Tier Cities (Highest Pay): Major tech and finance hubs offer the highest nominal salaries in the country. To earn $120k here might require less experience than elsewhere.

- Examples: San Francisco/San Jose, CA; New York, NY; Boston, MA; Seattle, WA.

- The Catch: The cost of living in these cities is exceptionally high. A $150,000 salary in San Francisco might have the same purchasing power as a $90,000 salary in a mid-sized city.

- Second-Tier Cities (High Growth): These cities offer a strong balance of high salaries and a more reasonable cost of living. They are often growing tech or business hubs.

- Examples: Austin, TX; Denver, CO; Raleigh, NC; Atlanta, GA.

- Analysis: A $120,000 salary in these cities can afford a very comfortable lifestyle. This is often the target location for professionals seeking high pay without the extreme costs of coastal hubs.

- Mid-Sized/Lower-Cost-of-Living Areas: In these locations, a $120,000 salary is a very high income, often reserved for top executives, specialized physicians, or successful business owners. Reaching this salary as a standard professional employee can be more challenging.

- Remote Work Impact: Companies are still navigating remote pay strategies. Some pay based on the company's headquarters location (e.g., SF salary regardless of where you live). Others are adopting location-based pay, adjusting salaries based on the employee's geographic location. This is a critical factor to clarify during negotiations for remote roles.

### ### Company Type & Size

The type of organization you work for can influence your compensation structure, culture, and work-life balance.

- Large Tech Companies (FAANG & Co.): These are the top payers, especially when considering total compensation. A mid-level engineer at a company like Google or Meta can easily clear $200,000 - $250,000 in total compensation (base + bonus + stock). A $120k base salary here is often considered a junior to mid-level benchmark.

- Startups: Compensation is a mix of cash and equity. An early-stage startup might offer a lower base salary (e.g., $100,000 instead of $130,000) but supplement it with a significant grant of stock options, which could be worthless or worth millions in the future.

- Established Fortune 500 Corporations (Non-Tech): These companies (in sectors like consumer goods, manufacturing, or healthcare) offer competitive salaries, strong benefits, and stability. A $120k salary here typically corresponds to a manager or senior professional role. Bonus structures are common, but large equity grants are less so than in tech.

- Government & Non-Profit: Salaries in these sectors are generally lower than in the for-profit world. A $120,000 salary in a government or non-profit role is typically reserved for senior-level management or highly specialized technical experts. The trade-off is often better work-life balance, job security, and a strong sense of mission.

### ### Area of Specialization

Your choice of industry and specialization within that industry is a fundamental determinant of your earning potential. A $120k salary is far more accessible in some fields than others.

- Technology: This is one of the most direct routes to a high salary.

- *Roles:* Software Development, Cybersecurity, Cloud Engineering, Data Science, AI/Machine Learning. A mid-level professional in any of these fields can expect to earn $120k or more, especially in major metro areas. BLS data confirms that software developers have a median pay of $132,270 per year (as of May 2023).

- Finance: Lucrative but often demanding.

- *Roles:* Investment Banking, Private Equity, Corporate Finance, Financial Planning & Analysis (FP&A), Quantitative Analysis. An experienced FP&A Manager or Investment Banking Associate will comfortably exceed the $120k mark.

- Healthcare: High earnings are often linked to advanced education.

- *Roles:* Nurse Practitioner (Median Pay: $128,490 per BLS), Physician Assistant (Median Pay: $130,020 per BLS), Pharmacist, Healthcare Administrator.

- Engineering (Non-Tech):

- *Roles:* Petroleum Engineer, Chemical Engineer, Aerospace Engineer. Experienced engineers in these specialized, high-stakes fields often earn well over $120k.

- Sales & Marketing:

- *Roles:* Enterprise Sales Executive, Sales Engineer, Product Marketing Manager, Senior Digital Marketing Manager. In sales, total compensation is heavily tied to performance. For marketing, roles that are closer to product, revenue, and data analytics tend to pay more.

### ### In-Demand Skills

Beyond your job title, specific skills can make you a more valuable—and thus higher-paid—candidate.

- High-Value Hard Skills:

- Cloud Platforms: Deep expertise in AWS, Microsoft Azure, or Google Cloud Platform is in constant demand.

- Data Analysis & Programming: Proficiency in Python, R, SQL, and data visualization tools like Tableau is critical for roles in data science, analytics, and finance.

- AI/Machine Learning: Skills in building and deploying ML models are at the absolute cutting edge and command premium salaries.

- Cybersecurity: Knowledge of network security, ethical hacking, and risk management is crucial as cyber threats grow.

- Agile/Scrum Methodologies: For project and product managers, being certified and experienced in agile frameworks is a standard requirement for top-paying roles.

- Crucial Soft Skills (Power Skills):

- Leadership & Influence: The ability to motivate a team and influence senior stakeholders without direct authority is a hallmark of a senior professional.

- Strategic Communication: Clearly articulating complex ideas to diverse audiences (technical and non-technical) is essential.

- Negotiation & Conflict Resolution: Whether negotiating a multi-million dollar contract or resolving a dispute between team members, these skills create immense value.

- Business Acumen: Understanding the financial and strategic drivers of the business allows you to connect your work directly to the bottom line, justifying your high salary.

---