Earning $20 an hour is a significant financial milestone for millions of workers. It represents a substantial step above the federal minimum wage and opens the door to greater financial stability. But what does that hourly rate actually translate to over the course of a year? The simple answer is $41,600 annually for a standard full-time job.

However, that number is just the starting point. Your actual take-home pay, career trajectory, and the lifestyle this wage supports are influenced by a host of factors, from your geographic location to your industry. In this guide, we'll break down the numbers, explore the types of jobs that pay in this range, and analyze the key factors that can help you earn $20 an hour—and beyond.

What Kind of Jobs Pay Around $20 an Hour?

An hourly wage of $20 is a common benchmark across numerous industries, often for roles that require a specific skill set, some post-secondary training, or a few years of relevant experience. These are not typically entry-level, minimum-wage positions but rather represent the next step in a career journey.

Jobs that often fall within the $18 to $25 per hour range include:

- Administrative Supervisor or Executive Assistant: These professionals are the backbone of an office, managing schedules, coordinating projects, and ensuring smooth daily operations.

- Pharmacy Technician: Working under the supervision of a pharmacist, they dispense prescription medication, manage inventory, and provide customer service. The BLS notes their median pay is right in this range.

- Skilled Trades Apprentice or Journeyman: Electricians, plumbers, and carpenters in the early to mid-stages of their careers often earn in this bracket as they build experience.

- Bookkeeping or Accounting Clerk: Responsible for maintaining financial records, processing invoices, and managing payroll for businesses.

- Customer Service Team Lead: Experienced customer service professionals who handle escalated issues and supervise a team of representatives.

- Medical Assistant: A vital role in clinics and hospitals, they handle both administrative and clinical tasks, from scheduling appointments to taking patient vital signs.

Calculating the Annual Salary for a $20 an Hour Wage

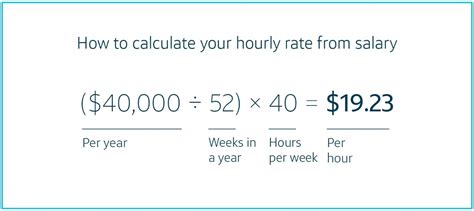

The most common method for calculating an annual salary from an hourly wage assumes a standard 40-hour work week and 52 weeks in a year.

The Calculation:

$20 per hour × 40 hours per week × 52 weeks per year = $41,600 per year

Here’s how that breaks down over different time periods (before taxes):

| Time Period | Gross Earnings (at $20/hour) |

| :--- | :--- |

| Per Day (8-hour day) | $160 |

| Per Week (40 hours) | $800 |

| Per Month (approx.) | $3,467 |

| Per Year (2080 hours) | $41,600 |

It's crucial to remember that $41,600 is your gross annual income. Your net income, or take-home pay, will be lower after federal, state, and local taxes, as well as deductions for Social Security, Medicare, health insurance, and retirement contributions (like a 401k).

Key Factors That Influence Salary

While $41,600 is the mathematical equivalent of $20 an hour, several factors determine whether a specific job pays more or less. Understanding these elements is key to maximizing your earning potential.

###

Level of Education

While many roles in the $20/hour range do not require a bachelor's degree, having specialized training or certification can significantly boost your starting pay. For instance, a basic administrative assistant might start closer to $17/hour, but one with a certification as a Certified Administrative Professional (CAP) can command a higher wage. Similarly, roles like Pharmacy Technician or Medical Assistant require formal post-secondary training and certification, which justifies the higher pay scale. A two-year associate's degree in a relevant field can also make you a more competitive candidate for jobs starting at or above this level.

###

Years of Experience

Experience is one of the most powerful drivers of wage growth. An entry-level employee in a particular field might earn $16-$18 per hour. However, after 3-5 years of dedicated experience, developing skills, and demonstrating reliability, that same employee can easily negotiate a wage of $20-$25 per hour. Salary.com data frequently shows a clear progression in pay from entry-level to senior positions within the same job title, reinforcing the value of tenure and expertise.

###

Geographic Location

Where you live and work dramatically impacts the value of your paycheck. A $20/hour wage provides a very different lifestyle in a low-cost-of-living area compared to an expensive major metropolitan center. Employers adjust their pay scales to reflect the local market.

For example, according to 2023 data from the U.S. Bureau of Labor Statistics (BLS), the mean hourly wage for Administrative Assistants is higher in major cities like San Francisco or New York than in smaller cities in the Midwest or South. You might earn $25/hour for a role in a high-cost city, while the exact same job pays $19/hour in a more affordable region. When evaluating a job offer, always consider the local cost of living.

###

Company Type and Industry

The type of company and industry you work in plays a major role. Large, profitable corporations in high-growth sectors like technology, finance, or pharmaceuticals often have higher pay scales than small businesses, non-profits, or government agencies. A bookkeeper at a major tech firm will likely earn more than a bookkeeper at a local charity, even if their core responsibilities are similar. According to Glassdoor data, employees at companies with over 10,000 employees tend to report higher average salaries than those at companies with fewer than 50 employees.

###

Area of Specialization

Developing a niche skillset can unlock higher pay. Within a broad career field, specialization makes you a more valuable and harder-to-replace asset.

- An Executive Assistant who specializes in supporting C-suite executives in the legal industry will earn more than a general office administrator.

- A Medical Assistant who is certified in a specific procedure like phlebotomy or EKG may receive higher pay.

- A Skilled Tradesperson with expertise in a high-demand area like industrial HVAC systems will command a premium over a general residential handyman.

Job Outlook

The job outlook for roles paying around $20 an hour is generally stable and tied to the health of the overall economy. Many of the key professions in this pay range are essential to business operations and healthcare.

For instance, the U.S. Bureau of Labor Statistics (BLS) projects the following growth between 2022 and 2032:

- Medical Assistants: A projected growth of 14%, which is much faster than the average for all occupations. This is driven by the aging population and the growing demand for preventative medical services.

- Bookkeeping, Accounting, and Auditing Clerks: A slight decline is projected as technology automates some tasks, but the field is still massive, with over 1.5 million jobs and thousands of openings expected each year to replace workers who retire or change careers.

- Pharmacy Technicians: A projected growth of 6%, faster than average, as the need for prescription medications from an aging population continues to rise.

This data suggests that many of the career paths at this wage level offer long-term stability and consistent demand.

Conclusion: Is $20 an Hour a Good Wage?

An hourly wage of $20, equating to $41,600 a year, is a respectable and attainable goal that provides a solid foundation for many individuals and families. Whether it is considered a "good" wage ultimately depends on personal circumstances, primarily your geographic location and financial responsibilities.

For professionals looking to reach or surpass this benchmark, the path forward is clear:

- Invest in Skills: Gain relevant certifications or degrees to increase your market value.

- Build Experience: Demonstrate your expertise and reliability over time to justify higher pay.

- Consider Specializing: Develop a niche skill set to stand out from the crowd.

- Be Strategic: Understand that location and company type are major factors, and position yourself accordingly.

Ultimately, earning $20 an hour is a fantastic achievement. By using it as a stepping stone and focusing on strategic career development, it can be the launchpad for even greater financial and professional success.