A $14 an hour salary. For many, this figure represents a crucial step onto the economic ladder—a wage that’s nearly double the federal minimum and a tangible improvement over past earnings. For others, it’s a starting line that feels tight, a number that requires careful budgeting and a strategic plan for the future. Regardless of your perspective, earning $14 an hour places you at a pivotal juncture in your professional journey. It’s a wage that supports millions of workers in foundational roles across the U.S. economy, from customer service to healthcare support. But what does it truly mean to live on this income, what careers does it encompass, and most importantly, how can you leverage this position as a launchpad for significant financial and professional advancement?

This guide is designed to be your definitive resource for navigating the world of a $14 an hour salary. We will move beyond the simple hourly number to give you a clear, data-driven picture of the financial realities, the job opportunities available, and the actionable steps you can take to build a prosperous future. Early in my career, my first full-time job paid what felt like a monumental sum, but I’ll never forget the feeling of seeing my first paycheck and realizing the vast difference between the hourly rate and my actual take-home pay. That moment taught me that understanding the full context of your earnings is the first step toward true financial empowerment. This article will provide that context and a roadmap for what comes next.

### Table of Contents

- [What Does a $14 an Hour Job Look Like?](#what-does-a-14-an-hour-job-look-like)

- [The $14 an Hour Salary: A Deep Dive into Your Annual Earnings](#the-14-an-hour-salary-a-deep-dive-into-your-annual-earnings)

- [Key Factors That Influence Your Salary and Growth Potential](#key-factors-that-influence-your-salary-and-growth-potential)

- [Job Outlook and Career Growth from a $14/Hour Starting Point](#job-outlook-and-career-growth-from-a-14hour-starting-point)

- [How to Get a $14/Hour Job and Grow Beyond It: A Step-by-Step Guide](#how-to-get-a-14hour-job-and-grow-beyond-it-a-step-by-step-guide)

- [Conclusion: Your $14 an Hour Salary Is a Starting Point, Not a Destination](#conclusion-your-14-an-hour-salary-is-a-starting-point-not-a-destination)

What Does a $14 an Hour Job Look Like?

Unlike a specific title like "Software Engineer" or "Accountant," a "$14 an hour job" is not a single career but a wage bracket that spans numerous industries and foundational roles. These positions are the backbone of the service economy, often involving direct interaction with customers, clients, or patients. They are essential, requiring a blend of hard-won soft skills and procedural knowledge. While the specific duties vary greatly, there are common threads: these are often entry-level or early-career positions that provide a crucial proving ground for developing professional habits like reliability, communication, and problem-solving.

Here are some of the most common jobs and industries where you might find a starting wage of approximately $14 an hour:

- Retail and Customer Service: This is perhaps the largest sector. Roles include Retail Sales Associates, Cashiers, and entry-level Customer Service Representatives in call centers or online chat support. These jobs are centered on assisting customers, processing transactions, and maintaining a positive brand image.

- Food and Beverage Service: Team Members at fast-casual restaurants, Baristas, and Hosts/Hostesses often fall into this pay range before tips. These fast-paced roles demand efficiency, attention to detail, and excellent interpersonal skills.

- Healthcare Support: The healthcare field offers numerous entry-level opportunities. A Home Health Aide or Personal Care Aide provides essential assistance to the elderly or individuals with disabilities. Entry-level Medical Receptionists or Patient Service Representatives manage appointments and patient check-in at clinics and hospitals.

- Administrative and Clerical Support: An entry-level Office Clerk, Mailroom Clerk, or Data Entry Keyer performs vital functions that keep an office running smoothly. Tasks can include filing, sorting mail, basic data input, and answering phones.

- Logistics and Warehousing: With the boom in e-commerce, jobs for Warehouse Associates, Packers, and Stockers are abundant. These roles involve receiving goods, organizing inventory, and fulfilling orders, often in a physically active environment.

#### A Day in the Life: "Alex," an Entry-Level Customer Service Representative

To make this more concrete, let's imagine a day in the life of "Alex," who works from home as a Customer Service Representative for a large online retailer, earning $14 an hour.

- 8:45 AM: Alex logs into their computer. They check their email for any overnight updates from their supervisor and open the necessary software: the Customer Relationship Management (CRM) tool, the internal chat system, and the phone queue software.

- 9:00 AM: The phone and chat queues open. Alex takes their first call of the day from a customer wanting to know the status of a recent order. Using the CRM, Alex pulls up the customer's account, finds the tracking number, and clearly communicates the expected delivery date.

- 10:30 AM: A more complex chat comes through. A customer received a damaged item. Alex follows a specific protocol: apologize sincerely, request a photo of the damage for documentation, and process a replacement order. This requires empathy, attention to detail, and the ability to navigate multiple systems simultaneously.

- 12:30 PM: Lunch break. A chance to step away from the screen and recharge.

- 1:30 PM: Alex joins a brief team huddle via video call. Their supervisor shares a common issue they've been seeing—a website glitch affecting a specific coupon code—and provides the team with a script and a workaround solution.

- 3:00 PM: An angry customer calls, frustrated about the coupon code glitch. Alex listens patiently without interrupting, validates the customer's frustration, and then confidently applies the workaround learned in the huddle. The customer, initially upset, ends the call by thanking Alex for their help. This is a small victory that requires strong de-escalation skills.

- 5:30 PM: The queues close. Alex finishes up their notes (dispositions) for the last few interactions, ensuring each case is properly documented. They send a quick chat message to their supervisor to sign off for the day.

In this single day, Alex used communication, problem-solving, technical navigation, and emotional intelligence—all critical skills that, when honed, pave the way for a higher-paying role in the future.

The $14 an Hour Salary: A Deep Dive into Your Annual Earnings

Understanding your hourly wage is one thing; comprehending its impact on your annual budget and lifestyle is another. Let's break down the numbers to get a full, transparent picture of what a $14 an hour salary truly means for your finances.

#### Gross Income Calculation

Assuming a standard full-time schedule of 40 hours per week for 52 weeks a year, the calculation is straightforward:

- Weekly Gross Income: $14/hour × 40 hours = $560

- Monthly Gross Income: $560/week × 4.33 weeks/month (average) ≈ $2,425

- Annual Gross Income: $14/hour × 2,080 hours/year = $29,120

This gross annual income of $29,120 is the starting point for all financial planning. It's the number you'll see on a job offer and the figure used to calculate taxes and other deductions.

#### From Gross Pay to Net (Take-Home) Pay

Your gross pay is not what you'll have available to spend. Various deductions will be taken from your paycheck, resulting in your net pay. These typically include:

- Federal Income Tax: Depends on your filing status (single, married, etc.) and withholdings.

- State Income Tax: Varies by state (some states, like Texas and Florida, have no state income tax).

- FICA Taxes: This is a standard deduction that includes Social Security (6.2%) and Medicare (1.45%).

- Health Insurance Premiums: If you opt into an employer-sponsored health plan.

- Retirement Contributions: Such as a 401(k) plan.

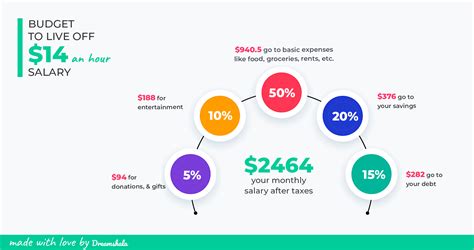

As a conservative estimate, you can expect total deductions to be between 15% and 25% of your gross pay. Let's use 20% as an example:

- Estimated Annual Net Income: $29,120 × (1 - 0.20) = $23,296

- Estimated Monthly Net Income: $23,296 ÷ 12 = $1,941

This $1,941 per month is a more realistic figure for creating a budget for rent, utilities, groceries, transportation, and other living expenses. This reality underscores a critical point: at this income level, every dollar counts, and effective budgeting is not just a good idea—it's essential for financial stability. According to a 2023 report from PYMNTS and LendingClub, approximately 61% of U.S. adults are living paycheck to paycheck, a figure that is often higher for those in this income bracket.

#### Total Compensation: More Than Just the Hourly Wage

While the hourly rate is the headline number, the total compensation package can dramatically alter the value of a job. When comparing offers, look beyond the $14/hour and consider:

- Health Insurance: A job offering an affordable, comprehensive health insurance plan can be worth thousands of dollars a year compared to a job with no benefits, forcing you to buy a costly plan on the marketplace.

- Paid Time Off (PTO): How many vacation, sick, and personal days do you receive? Paid time off is a crucial benefit for rest, recovery, and work-life balance.

- Retirement Savings: Does the company offer a 401(k) or similar plan? Even better, do they offer a company match? A common match is 50% of your contributions up to 6% of your salary. For an income of $29,120, if you contribute 6% ($1,747), your employer would add an extra $873—that's free money for your future.

- Overtime Opportunities: Is overtime available and paid at 1.5 times your hourly rate ($21/hour)? In warehouse or customer service roles with peak seasons, overtime can significantly boost your annual earnings.

- Bonuses and Tips: For some roles, like in food service, tips can substantially increase your effective hourly wage. Some companies may also offer small performance-based or holiday bonuses.

- Tuition Assistance or Professional Development: Some larger companies (like Starbucks, Walmart, and Amazon) offer programs to help pay for college degrees or professional certifications. This is an incredibly valuable benefit that serves as a direct investment in your future earning potential.

#### The Career Progression Ladder: From $14 an Hour Onward

A $14/hour wage is a starting point. With experience and skill development, your income can and should grow. Here is a typical salary progression for a role that might start at this level, such as a Customer Service Representative.

| Career Stage | Years of Experience | Typical Hourly Wage Range | Typical Annual Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $14 - $17/hour | $29,000 - $35,000 | Handling basic inquiries, following scripts, data entry, learning core systems. |

| Mid-Career | 2-5 Years | $18 - $22/hour | $37,000 - $46,000 | Handling complex/escalated issues, mentoring new hires, working with less supervision. |

| Senior/Specialist | 5+ Years | $23 - $28+/hour | $48,000 - $58,000+ | Team Lead, Quality Assurance, Trainer, Subject Matter Expert on a specific product/service. |

*Sources: Salary data is a composite based on 2023-2024 data from the U.S. Bureau of Labor Statistics (BLS) for Customer Service Representatives, Payscale, and Salary.com. Ranges can vary significantly based on the factors discussed in the next section.*

This progression demonstrates a clear path. The goal is to master the entry-level duties quickly and actively seek out the responsibilities of the next level to justify a move into a higher pay bracket.

Key Factors That Influence Your Salary and Growth Potential

Your hourly wage is not set in stone. It is a dynamic figure influenced by a powerful combination of factors. Understanding these levers is the key to maximizing your current earnings and charting a course for a higher income. At the $14/hour level, some factors have a disproportionately large impact, especially geography and in-demand skills.

### Geographic Location: The Most Powerful Factor

Where you live is arguably the single most important variable affecting the value and context of a $14 an hour salary. This is due to two primary forces: Cost of Living and State/Local Minimum Wage Laws.

Cost of Living (COL): A $29,120 annual salary provides a very different lifestyle in Jackson, Mississippi, than it does in Boston, Massachusetts. COL includes the average cost of housing, groceries, transportation, and other necessities. A higher COL means your dollars don't stretch as far. For example, according to Payscale's Cost of Living Calculator, the COL in Boston is 77% higher than in Jackson. This means that to maintain a similar standard of living, a salary of $29,120 in Jackson would need to be over $51,500 in Boston.

Minimum Wage Laws: The federal minimum wage has been $7.25/hour since 2009. However, many states and cities have enacted much higher minimums. As of early 2024, Washington state has a minimum wage of $16.28/hour, and California's is $16.00/hour. In these states, a $14/hour job is below the legal minimum for most employers. Conversely, in states that adhere to the federal minimum, like Texas or Georgia, $14/hour is a competitive starting wage for many entry-level positions.

| State/Region | Typical Minimum Wage (2024) | Context of a $14/Hour Job |

| :--- | :--- | :--- |

| Washington, California, Parts of New York | $16.00+ | Below the state-mandated minimum wage. |

| Illinois, New Jersey, Virginia | $13.00 - $15.00 | At or very near the state-mandated minimum. |

| Ohio, Michigan, Florida | $10.00 - $12.00 | A decent entry-level wage, above the minimum. |

| Texas, Georgia, Wyoming, Pennsylvania | $7.25 (Federal Minimum) | A strong entry-level wage, nearly double the minimum. |

*Source: U.S. Department of Labor, State Minimum Wage Laws.*

What this means for you: If you have geographic mobility, moving from a high-cost-of-living area to a low-cost one can dramatically increase your disposable income, even if your wage remains the same. Alternatively, targeting jobs in states with a higher minimum wage floor ensures a better starting salary.

### Industry and Company Type & Size

The industry you work in and the type of company that employs you create different financial opportunities.

- Industry: A job with the title "Receptionist" will likely have a different pay scale and benefits package in a high-growth tech startup versus a small, non-profit community clinic. Industries with higher profit margins or greater demand for labor, such as logistics (driven by e-commerce) and healthcare (driven by an aging population), may offer more robust pay and benefits. The U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook provides median pay data by industry for many roles, showing these variations. For instance, the median pay for Receptionists in healthcare and social assistance ($37,020/year in 2022) is often higher than in other sectors.

- Company Size:

- Large Corporations (e.g., Amazon, Walmart, Target, Bank of America): These companies often have standardized, rigid pay scales but frequently offer superior benefits packages, including comprehensive health insurance, 401(k) matching, and tuition assistance programs. Their scale allows them to offer pathways to promotion within a structured corporate ladder.

- Small to Medium-Sized Businesses (SMBs): Pay may be more negotiable and flexible, but benefits can be less comprehensive. However, working at an SMB can offer greater visibility and the chance to take on a wider range of responsibilities, accelerating your skill development.

- Startups: Often cash-strapped, they might offer a base salary around $14/hour but could include equity (stock options) as part of the compensation. This is a high-risk, high-reward scenario where you trade guaranteed income for potential future wealth.

- Government/Non-Profit: These roles often provide excellent job security and strong benefits (especially pensions and healthcare) but may have slower salary growth compared to the private sector.

### In-Demand Skills: Your Lever for Higher Pay

This is the factor over which you have the most direct control. While experience takes time to accumulate, skills can be learned. Developing specific, valuable skills is the fastest way to increase your worth to an employer and command a higher wage.

Foundational Soft Skills (Table Stakes):

These are the non-negotiable skills required to succeed in almost any $14/hour job. Mastering them makes you a top performer and primes you for promotion.

- Reliability and Punctuality: Simply showing up on time, every time, is a highly valued trait.

- Communication: The ability to listen, understand, and convey information clearly and professionally, both verbally and in writing.

- Problem-Solving: Not just identifying problems, but taking the initiative to find solutions or knowing who to ask for help.

- Teamwork: Collaborating effectively with colleagues and contributing to a positive work environment.

- De-escalation: For customer-facing roles, the ability to manage conflict and calm frustrated individuals is a superpower.

"Plus-Up" Hard Skills (The Pay Boosters):

These are specific, teachable skills that can add a pay differential or open doors to higher-paying roles.

- Technical Proficiency:

- CRM Software: Experience with platforms like Salesforce, HubSpot, or Zendesk is highly sought after for customer service and sales roles.

- Microsoft Office Suite: Advanced proficiency in Excel (pivot tables, VLOOKUPs), PowerPoint, and Word is valuable in any office setting.

- Point of Sale (POS) Systems: Expertise in modern POS systems (like Square or Toast) can lead to shift lead roles in retail or food service.

- Specialized Certifications:

- Healthcare: A Certified Nursing Assistant (CNA), Phlebotomist, or Certified Medical Assistant (CMA) can earn significantly more than a general home health aide. These certifications can often be completed in a matter of months.

- Logistics: A Forklift Operator Certification is an immediate ticket to a higher wage in any warehouse or distribution center.

- Food Service: A ServSafe Manager certification demonstrates knowledge of food safety and can be a prerequisite for a kitchen management role.

- Language Skills: Being bilingual, especially in Spanish, is a major asset in customer-facing roles across the United States. Many companies offer an hourly pay differential (e.g., an extra $1.00/hour) for bilingual employees.

### Level of Education and Experience

While a four-year degree is not required for most jobs in this wage bracket, education and experience are the primary drivers of long-term career trajectory.

- Education:

- High School Diploma/GED: This is the typical baseline requirement.

- Associate's Degree: A two-year degree from a community college