The figure "$15 an hour" has become a major focal point in conversations about wages, cost of living, and economic fairness. For many, it represents a crucial stepping stone into the workforce or a benchmark for a livable wage. But what does earning $15 an hour actually mean for your annual income and long-term career prospects?

Annually, a $15/hour wage translates to $31,200 per year before taxes, assuming a standard 40-hour workweek. While this is significantly higher than the federal minimum wage, it falls below the national median hourly wage for all occupations, which was $23.11 as of May 2023 (Source: U.S. Bureau of Labor Statistics).

This article will break down what a $15 per hour salary truly means, explore the types of jobs that pay in this range, and most importantly, detail the key factors you can leverage to increase your earning potential and advance your career.

What Does $15 an Hour Look Like Annually?

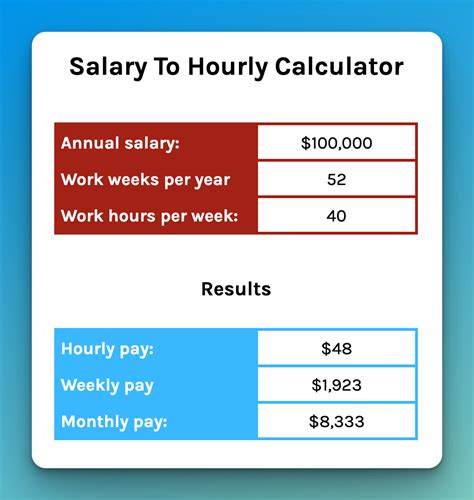

To understand the financial reality of a $15/hour wage, it's helpful to break it down. The calculation is based on a full-time schedule of 40 hours per week for 52 weeks a year.

$15/hour x 40 hours/week x 52 weeks/year = $31,200/year

Here is a clearer look at the gross income (before taxes and deductions):

| Pay Period | Gross Income |

| :--- | :--- |

| Yearly | $31,200 |

| Monthly | $2,600 |

| Weekly | $600 |

| Daily (8-hour day)| $120 |

It is critical to remember that this is your *gross pay*. Your *net pay*, or take-home pay, will be lower after federal, state, and local taxes, Social Security, Medicare, and any other deductions like health insurance premiums or 401(k) contributions are taken out.

Jobs That Commonly Pay Around $15 an Hour

A $15/hour wage is typical for many essential entry-level and service-oriented positions across the country. These roles are foundational to our economy and often serve as excellent entry points for building work experience.

Here are a few examples of occupations where the median pay is in the vicinity of $15 per hour:

- Retail Salespersons: These professionals assist customers, handle transactions, and manage inventory. The median hourly wage for retail salespeople was $14.86 in May 2023 (Source: BLS).

- Home Health and Personal Care Aides: A rapidly growing field, these aides provide assistance to people with disabilities or chronic illnesses in their homes. Their median hourly wage was $16.12 in May 2023 (Source: BLS).

- Cashiers: Responsible for processing payments in retail environments, the median wage for cashiers was $14.44 per hour in May 2023 (Source: BLS).

- Entry-Level Customer Service Representatives: While the overall median for this broad category is higher ($18.91/hour), many entry-level positions, particularly in call centers or retail settings, start in the $15 to $17 per hour range (Source: Salary.com, 2024).

Key Factors That Influence Salary

While $15 an hour is a common starting point, it is rarely a ceiling. Several key factors can significantly impact your earning potential, allowing you to move into higher-paying roles.

Level of Education

Your educational background is a primary driver of income. While most roles paying $15/hour require a high school diploma or equivalent, pursuing further education can open doors to higher pay. For instance:

- Certifications: Earning a professional certification can provide a direct pay bump. A Personal Care Aide who becomes a Certified Nursing Assistant (CNA) can expect to earn a higher wage.

- Associate's Degree: Completing a two-year degree in a field like business administration, IT support, or paralegal studies can qualify you for roles that start well above the $15/hour mark.

- Bachelor's Degree: A four-year degree typically leads to the highest entry-level salaries and long-term earning potential across nearly all industries.

Years of Experience

Experience is one of the most powerful tools for increasing your salary. An entry-level employee in any field will naturally earn less than a seasoned professional.

- Entry-Level (0-2 years): This is where salaries around $15/hour are most common. The focus is on learning the core functions of the job.

- Mid-Level (3-7 years): With a few years of proven performance, you can command a higher wage or be promoted to a supervisory role. A retail associate might become a shift supervisor, moving from $15/hour to $19-$22/hour.

- Senior-Level (8+ years): Senior professionals and managers who started in entry-level roles can often double their initial hourly wage or move onto a salaried track with significantly higher compensation.

Geographic Location

Where you live and work has a massive impact on your salary. Wages are often adjusted to reflect the local cost of living.

- High Cost of Living (HCOL) Areas: In cities like New York, San Francisco, or Boston, $15/hour is often the legal minimum wage or just above it. While wages are higher, so are expenses for housing, transportation, and goods.

- Low Cost of Living (LCOL) Areas: In many parts of the Midwest and South, a $15/hour wage can go much further. According to Payscale's Cost of Living Calculator, a salary of $31,200 in Tupelo, Mississippi provides similar purchasing power to a salary of over $50,000 in New York City. Understanding your local market is key to evaluating any wage offer.

Company Type

The size, industry, and structure of a company can influence its pay scales.

- Large Corporations: Companies like Amazon, Target, and Walmart often have standardized starting wages of $15/hour or more nationwide. They also tend to offer more robust benefits packages and structured paths for internal advancement.

- Small Businesses: A local "mom-and-pop" shop may have less flexibility in its payroll and may offer wages that are closer to the state's minimum wage.

- Industry: A role in a high-margin industry like tech support or specialized manufacturing will almost always pay more than an equivalent role in a lower-margin industry like fast food.

Area of Specialization

Developing specialized skills can quickly move you up the pay scale, even within the same job title. For example, a general customer service representative might earn $16/hour. However, a representative who specializes in technical support for software products or billing for medical services may earn $20-$25/hour due to the specific knowledge required (Source: Glassdoor, 2024). Seek opportunities to become the go-to expert in a specific area to increase your value.

Job Outlook

The job outlook for roles that typically pay around $15 an hour is mixed, which underscores the importance of strategic career planning.

- High Growth: Fields like healthcare support are booming. The BLS projects that employment for Home Health and Personal Care Aides will grow by 22% between 2022 and 2032, which is much faster than the average for all occupations. This demand will likely continue to push wages up.

- Decline: Conversely, some roles are being impacted by automation. The BLS projects employment for Cashiers and Retail Salespersons to decline over the next decade.

This data sends a clear message: leveraging a $15/hour job to gain experience is a great strategy, but focusing on acquiring skills for in-demand sectors is crucial for long-term career security and growth.

Conclusion

A wage of $15 an hour, or $31,200 annually, serves as a vital entry point into the workforce for millions of Americans. While it can be a challenging income to live on, especially in high-cost areas, it should be viewed as a starting line, not a finish line.

The key takeaway is that your starting wage does not define your career potential. By focusing on the factors you can control—gaining experience, pursuing education and certifications, developing specializations, and making strategic moves based on location and industry—you can build a clear and achievable path toward a more prosperous future. Use the knowledge of what influences salary as a roadmap to guide your professional development and unlock your full earning potential.