Introduction

What does it truly mean to earn a $16 an hour yearly salary in today's economy? For millions of Americans, this wage is a familiar starting point, a transitional phase, or a long-term reality. It represents the foundation upon which careers are built, families are supported, and financial futures are planned. But beyond the simple math lies a complex landscape of opportunity, challenge, and strategy. This guide is designed to be your definitive resource for understanding every facet of a $16/hour income—not as a final destination, but as a crucial stepping stone on your professional journey.

The reality is that a wage of $16 an hour, which translates to an annual gross income of $33,280, positions an individual at a pivotal economic crossroads. It's a figure that demands careful budgeting, strategic planning, and a clear-eyed view of career progression. My own career journey began with a data entry job that paid a wage very similar to this. I remember the pride of that first full-time paycheck, quickly followed by the dawning realization of how carefully I'd need to manage my funds to meet my goals. That experience taught me an invaluable lesson: your starting salary doesn't define your potential; it defines your starting line.

This article is for anyone currently earning or considering a job that pays $16 an hour. We will move beyond a simple calculation and provide a comprehensive, data-backed analysis. We'll explore which jobs typically fall into this pay bracket, dissect the financial realities of this income level, and, most importantly, lay out a clear, actionable roadmap for how you can leverage your current position to significantly increase your earning potential in the years to come.

### Table of Contents

- [What Does a $16 an Hour Yearly Salary Truly Mean?](#what-does-a-16-an-hour-yearly-salary-truly-mean)

- [Your $16 an Hour Salary: A Deep Dive into the Numbers](#your-16-an-hour-salary-a-deep-dive-into-the-numbers)

- [Key Factors That Influence Your Earning Potential (And How to Move Beyond $16/Hour)](#key-factors-that-influence-your-earning-potential-and-how-to-move-beyond-16hour)

- [Job Outlook and Career Growth: Building Your Future from a $16/Hour Foundation](#job-outlook-and-career-growth-building-your-future-from-a-16hour-foundation)

- [How to Grow Your Income Beyond $16 an Hour: A Step-by-Step Guide](#how-to-grow-your-income-beyond-16-an-hour-a-step-by-step-guide)

- [Conclusion: Your Starting Point Is Not Your Destination](#conclusion-your-starting-point-is-not-your-destination)

What Does a $16 an Hour Yearly Salary Truly Mean?

Before we delve into career paths and growth strategies, it's essential to establish a baseline understanding of what earning $16 per hour represents in practical terms. This wage is not a job title; it's a pay rate common across numerous entry-level and essential-service roles in the United States.

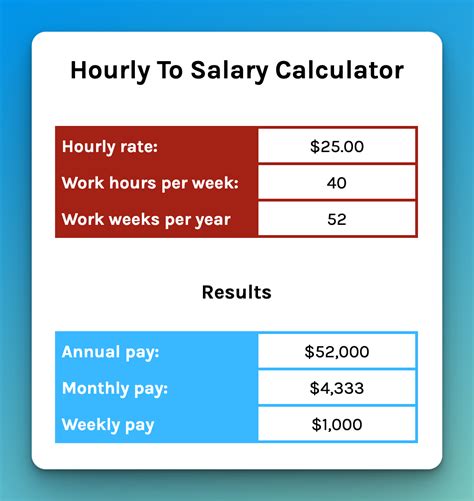

First, let's break down the gross income calculations based on a standard full-time work schedule (40 hours per week, 52 weeks per year):

- Hourly: $16.00

- Daily (8-hour day): $128

- Weekly: $640

- Bi-Weekly: $1,280

- Monthly (approx.): $2,773

- Yearly: $33,280

This annual figure of $33,280 is your gross income—the amount before any taxes, insurance premiums, or other deductions are taken out. Your actual take-home pay, or net income, will be significantly less.

### What Kinds of Jobs Pay $16 an Hour?

A $16/hour wage is characteristic of many roles that form the backbone of our economy. These positions often require a high school diploma or equivalent and provide on-the-job training. They are crucial entry points into the workforce, offering valuable experience in customer service, operations, and administration.

According to data from the U.S. Bureau of Labor Statistics (BLS) and salary aggregators like Payscale, jobs that often have starting wages in the $14-$18 per hour range include:

- Administrative Assistant (Entry-Level): The median pay for administrative assistants is higher, but entry-level roles without specialized skills often start in this range.

- Retail Sales Associate / Cashier: The BLS reports the median hourly wage for retail salespersons as $14.44 in May 2022, with many positions in larger markets or with experienced workers reaching the $16/hour mark.

- Customer Service Representative: Entry-level call center and customer support roles frequently start here. The median pay for the occupation is $18.16 per hour, so $16 is a very common starting point.

- Home Health and Personal Care Aides: With a median pay of $14.87 per hour and booming demand, many agencies offer starting wages at or above $16/hour to attract talent.

- Food Service Workers / Team Members: While the median wage is lower, experienced team members or those in lead roles in fast-food or fast-casual restaurants can earn $16/hour, especially in states with higher minimum wages.

- Warehouse Associate / Stocker: These roles, particularly in large e-commerce fulfillment centers, often have starting wages in this exact bracket to manage high-volume logistics.

- Bank Teller (Entry-Level): The median hourly wage for tellers was $17.47 in May 2022, making $16 a typical starting wage for new hires.

### A Day in the Life: The Entry-Level Administrative Assistant

To make this more tangible, let's imagine a "day in the life" of Alex, an entry-level administrative assistant earning $16 an hour at a mid-sized construction company.

> 8:30 AM: Alex arrives, greets the front desk, and starts up their computer. The first task is to scan the main office inbox, flagging urgent emails for the Office Manager and sorting project-related inquiries into designated folders.

>

> 9:00 AM: The daily project meeting begins. Alex's role is to take detailed notes, track action items, and manage the calendar invites for the next meeting.

>

> 10:00 AM: Post-meeting, Alex types up the minutes and distributes them to the project team. They then spend an hour managing office supplies, checking inventory, and placing an order for printer paper, coffee, and other essentials.

>

> 12:00 PM: Lunch break.

>

> 1:00 PM: The afternoon is dedicated to data entry. Alex takes invoices from subcontractors and enters them into the company's QuickBooks system, ensuring each one is coded to the correct project number. This requires meticulous attention to detail.

>

> 3:00 PM: The Office Manager asks Alex to prepare materials for a new-hire orientation tomorrow. This involves printing handbooks, creating name tags, and booking a conference room.

>

> 4:00 PM: Alex spends the last hour answering phone calls, directing inquiries to the right department, and handling the outgoing mail. They perform a final check of their to-do list, ensuring all of today's tasks are complete before tidying up their desk and heading home at 5:00 PM.

This example illustrates a typical day in a role that pays around $16/hour: it's foundational, requires organization and reliability, and provides exposure to the core operations of a business—a perfect platform for future growth.

Your $16 an Hour Salary: A Deep Dive into the Numbers

An annual gross income of $33,280 is a critical figure to understand in the context of the broader U.S. economy and personal finance. It's not just a number; it's the raw material for your financial life. This section will dissect that number, comparing it to national averages and showing how taxes and benefits dramatically shape your actual financial reality.

### How $33,280 Stacks Up: National Context

To understand where a $16/hour wage sits, let's compare it to national benchmarks provided by the U.S. Bureau of Labor Statistics (BLS).

- Federal Minimum Wage: As of late 2023, the federal minimum wage is $7.25 per hour. At $16/hour, you are earning more than double this amount.

- State Minimum Wages: Many states and cities have set their own minimum wages far above the federal level. For example, in California, the statewide minimum wage is $16.00 per hour as of 2024. In Washington, it's $16.28. In these locations, a $16/hour job is the legal minimum, not a competitive wage.

- Median U.S. Wage: According to the BLS, the median hourly wage for all occupations in the U.S. was $23.11 in May 2022. The median annual wage was $48,060. This means that a yearly salary of $33,280 is roughly 69% of the median U.S. wage. Half of all workers in the country earn more than $48,060, and half earn less.

- Federal Poverty Guideline: For 2024, the Federal Poverty Guideline for a single-person household is $15,060. For a two-person household, it's $20,440. A single individual earning $33,280 is well above this line. However, for a single-income family of four (poverty guideline: $31,200), this wage sits precariously close to the poverty threshold, underscoring the immense impact of household size and geographic location.

### Gross vs. Net Pay: The Reality of Your Take-Home Income

Your $33,280 annual salary is not what you'll have available for rent, groceries, and savings. Your net pay, or take-home pay, is what remains after deductions. Let's create an illustrative example.

Assumptions:

- Gross Pay: $2,773 per month

- Filing Status: Single, no dependents

- Location: A state with a moderate income tax (e.g., 5%)

- Benefits: Enrolled in employer-sponsored health insurance.

Sample Monthly Deductions:

| Deduction Type | Estimated Amount | Explanation |

| :--- | :--- | :--- |

| Federal Income Tax | ~$195 | Based on 2024 tax brackets. |

| FICA (Social Security & Medicare) | ~$212 | Fixed at 7.65% of gross pay (6.2% for SS, 1.45% for Medicare). |

| State Income Tax | ~$138 | Assuming a flat 5% state tax. This varies wildly by state. |

| Health Insurance Premium | ~$150 | A typical employee contribution for a basic individual plan. |

| Total Deductions | ~$695 | This is a conservative estimate. |

Net Pay Calculation:

- Gross Monthly Pay: $2,773

- Estimated Monthly Deductions: -$695

- Estimated Net Monthly Pay: ~$2,078

This translates to an annual take-home pay of approximately $24,936. This 25% reduction from gross to net income is a critical factor in understanding the real-world financial power of a $16/hour salary.

### Budgeting on $16 an Hour: A Sample Breakdown

Living on roughly $2,078 per month is achievable but requires disciplined budgeting, especially in mid-to-high cost of living areas. Using the popular 50/30/20 rule (50% for Needs, 30% for Wants, 20% for Savings/Debt) provides a useful framework.

Monthly Budget Example (Net Income: $2,078):

- 50% Needs ($1,039):

- Rent/Housing: This is the biggest challenge. Finding an apartment where rent and utilities are under ~$800 is extremely difficult in most urban areas, often requiring roommates.

- Groceries: ~$250

- Transportation (Gas/Public Transit): ~$150

- Utilities (Electric, Gas, Internet): ~$150

- Phone Bill: ~$50

- 30% Wants ($623):

- Dining Out/Entertainment: ~$200

- Shopping (Clothing, etc.): ~$150

- Hobbies/Subscriptions (Netflix, Gym): ~$100

- Miscellaneous: ~$173

- 20% Savings & Debt Repayment ($416):

- Emergency Fund: Priority #1. Building at least 3-6 months of living expenses.

- Retirement Savings (401k): Crucial, especially if there's an employer match.

- Debt Repayment (Student Loans, Credit Card): Aggressively paying down high-interest debt.

This budget illustrates that while covering basic needs is possible, there is very little room for error. An unexpected car repair or medical bill could easily derail the plan, highlighting the absolute necessity of building an emergency fund.

### The Hidden Value: Total Compensation

Finally, it's vital to look beyond the hourly wage to your total compensation package. A $16/hour job with excellent benefits can be far more valuable than a $17/hour job with none.

Key benefits to evaluate:

- Health Insurance: Does the employer offer medical, dental, and vision insurance? How much of the premium do they cover? A generous subsidy can be worth thousands of dollars a year.

- Paid Time Off (PTO): How many vacation, sick, and personal days do you get? This is paid time where you are not working, directly increasing the effective value of your wage.

- Retirement Savings (401(k) or 403(b)): Does the company offer a retirement plan? More importantly, do they offer a match? An employer match (e.g., "we match 100% of your contributions up to 4% of your salary") is free money and the single most powerful tool for wealth building. For a $33,280 salary, a 4% match is an extra $1,331 per year directly into your retirement account.

- Tuition Reimbursement: Some companies will help pay for college courses or certifications. This is an incredibly valuable benefit for career advancement.

- Disability and Life Insurance: These benefits provide a critical safety net for you and your family.

When comparing job offers, always analyze the total compensation, not just the headline hourly rate.

Key Factors That Influence Your Earning Potential (And How to Move Beyond $16/Hour)

A $16 per hour wage is a starting line, not a finish line. Your ability to substantially increase your income depends on a combination of strategic choices and personal development. Understanding the factors that directly influence salary is the first step toward creating a plan for career and financial growth. This section explores the six most critical drivers of compensation and how you can leverage them to your advantage.

### `

`Level of Education`

`Education remains one of the most reliable predictors of lifetime earning potential. While many $16/hour jobs only require a high school diploma, investing in further education or certification is a proven path to higher pay grades.

- The Data: The U.S. Bureau of Labor Statistics (BLS) provides compelling data on the correlation between education and median usual weekly earnings (data from 2022):

- High School Diploma: $853/week (~$21.32/hr)

- Some College, No Degree: $935/week (~$23.37/hr)

- Associate's Degree: $1,005/week (~$25.12/hr)

- Bachelor's Degree: $1,432/week (~$35.80/hr)

- Master's Degree: $1,661/week (~$41.52/hr)

- Strategic Application: This data shows a clear financial incentive for each level of education completed.

- Certifications: For someone in an administrative role, earning a certification like the Microsoft Office Specialist (MOS) or becoming a Certified Administrative Professional (CAP) can immediately justify a raise or qualify you for higher-paying positions. These are often faster and cheaper to obtain than a full degree.

- Associate's Degree: A two-year degree from a community college in a high-demand field like Paralegal Studies, Nursing (ASN), or Information Technology can be a powerful catalyst. It moves you from a generalist to a specialist, with starting salaries often in the $25-$30/hour range.

- Bachelor's Degree: A four-year degree unlocks a vast number of professional careers in fields like finance, marketing, human resources, and project management, where starting salaries are typically well above the $16/hour mark.

### `

`Years of Experience`

`Experience is the currency of the workplace. The skills, knowledge, and judgment you gain over time are valuable to employers, and your compensation should reflect that growth. The key is to move from being an entry-level performer to a reliable, experienced professional, and eventually, a senior-level expert or leader.

- The Trajectory: Let's trace a hypothetical career path for a Customer Service Representative to illustrate the impact of experience, using data aggregated by Payscale.

- Entry-Level (0-1 Year): Average pay might be $16.50/hour. At this stage, you are learning the systems, products, and standard procedures.

- Mid-Career (2-5 Years): Average pay rises to $19.25/hour. You are now a proficient problem-solver, handle complex customer issues with little supervision, and may begin training new hires. You have demonstrated reliability and skill.

- Experienced (5-10 Years): Average pay increases to $22.00/hour. You might now be a Senior Representative, a Team Lead, or have moved into a specialized role like a "Tier 2 Support Specialist" or "Customer Success Manager."

- Senior/Managerial (10+ Years): A Customer Service Manager can earn an average salary of over $65,000/year (~$31.25/hr). At this level, you are managing teams, setting strategy, and are responsible for departmental performance.

- How to Accelerate It: Don't just wait for experience to accumulate. Actively seek it out. Volunteer for new projects, ask to shadow colleagues in other departments, and proactively identify and solve problems. Document your accomplishments—don't just list your duties on your resume, list your achievements (e.g., "Reduced average call handling time by 15% by creating a new troubleshooting guide").

### `

`Geographic Location`

`Where you live is arguably one of the most significant factors determining both your salary and, more importantly, your purchasing power. A $16/hour wage feels drastically different in rural Arkansas than it does in Boston, Massachusetts.

- Cost of Living (COL): High-COL areas like New York City, San Francisco, and Washington D.C. have much higher wages to compensate for exorbitant housing, transportation, and daily expenses. A job might pay $22/hour in these cities for the same work that pays $16/hour in a low-COL area like Omaha, Nebraska, or Birmingham, Alabama. However, the higher wage may not fully cover the increased expenses.

- State and City Minimums: As mentioned, many states and cities have minimum wages at or above $16/hour. In Seattle, Denver, or Chicago, a $16/hour job is an entry-level, minimum-wage position. In a state with a $7.25 minimum wage, it's considered a more competitive starting rate.

- Metropolitan vs. Rural: Wages are almost universally higher in major metropolitan areas than in rural ones due to a larger concentration of businesses and a higher demand for labor.

- Example Salary Variation for an Administrative Assistant (Data from Salary.com, 2024):

- Fayetteville, Arkansas (Low COL): Median Salary: $37,500 (~$18.00/hr)

- Chicago, Illinois (High COL): Median Salary: $46,000 (~$22.11/hr)

- San Jose, California (Very High COL): Median Salary: $53,500 (~$25.72/hr)

- Strategic Consideration: If you have the flexibility to relocate, moving to a mid-sized city with a strong job market but a moderate cost of living (sometimes called a "sweet spot" city) can be a powerful way to maximize the value of your income.

### `

`Company Type & Size`

`The type of organization you work for has a profound impact on your compensation and benefits package.

- Startups: Early-stage startups may be cash-strapped and offer salaries at or below the market rate. However, they might compensate with equity (stock options), which could become very valuable if the company succeeds. They also tend to offer rapid growth opportunities and broad responsibilities.

- Large Corporations (Fortune 500): These companies typically have structured pay bands and offer the most competitive salaries and comprehensive benefits packages (excellent health insurance, generous 401(k) matches, etc.). A job at a large tech or finance firm will almost always pay more than the equivalent role at a small local business.

- Small to Medium-Sized Businesses (SMBs): Compensation can vary widely. Some may pay market rate, while others may lag. Benefits might be less robust than at large corporations. The culture is often more tight-knit, and you may have a more direct impact on the business.

- Non-Profits: Non-profit organizations are mission-driven and often operate on tighter budgets. Salaries are typically lower than in the for-profit sector. However, the work can be incredibly rewarding, and they may offer other perks like flexible work schedules.

- Government (Federal, State, Local): Government jobs are known for their stability, excellent benefits (pensions are still common), and clear, structured pay scales (like the GS scale for federal employees). While starting pay may be comparable to the private sector, the benefits and job security are often superior.

### `

`Area of Specialization`

`The single most effective way to move beyond a $16/hour wage is to transition from a generalist role to a specialist role. Specialization makes you more valuable and harder to replace.

Imagine our administrative assistant, Alex. After a year of learning the basics, they have several paths to specialization:

- Path 1: Marketing Specialization. Alex starts helping the marketing team with social media scheduling and email newsletters. They take an online course in digital marketing and get a Google Analytics certification. They can now apply for a Marketing Coordinator role, where the national median salary is over $50,000/year (~$24/hr).

- Path 2: Finance Specialization. Alex excels at the invoicing and data entry tasks. They take community college courses in bookkeeping and become a QuickBooks Certified User. They can now transition to a Bookkeeping Clerk or Junior Accountant role, with average pay starting around $20-$22/hour.

- **Path