Introduction

An $18 an hour salary. For many, this figure represents a significant milestone. It’s a tangible step up from minimum wage, a marker of acquiring valuable skills, and the point where a career, not just a job, starts to feel possible. Annually, this equates to a gross income of approximately $37,440, a salary that places you squarely within a critical segment of the American workforce. But what does earning $18 an hour truly mean for your lifestyle, your budget, and your future? Is it a comfortable living wage, a temporary stepping stone, or a long-term plateau?

This guide is designed to be your definitive resource for understanding the world of an $18-an-hour career. We will move beyond the simple math and delve into the practical realities: the types of jobs available at this pay grade, the critical factors that can elevate your earnings, and the strategic steps you can take to build a prosperous and fulfilling career path starting from this very foundation.

I remember my first full-time role after a series of part-time gigs; it paid the modern equivalent of about $18 an hour. The feeling was a mix of exhilarating independence—finally able to cover my own rent and bills without a complex web of side hustles—and the sobering realization that true financial freedom required a long-term plan. That experience taught me that a salary is not just a number; it's a launchpad, and its potential is determined by the vision and strategy you apply to it.

This comprehensive analysis will provide you with the data-driven insights and actionable advice needed to make the most of an $18/hour salary and use it as a powerful catalyst for your professional growth.

### Table of Contents

- [Decoding the $18 an Hour Salary: A Financial Snapshot](#decoding-the-18-an-hour-salary-a-financial-snapshot)

- [Jobs That Typically Pay $18 an Hour: A Deep Dive](#jobs-that-typically-pay-18-an-hour-a-deep-dive)

- [Key Factors To Move Beyond $18/Hour](#key-factors-to-move-beyond-18hour)

- [Job Outlook and Career Growth from an $18/Hour Starting Point](#job-outlook-and-career-growth-from-an-18hour-starting-point)

- [How to Land a Job Paying $18/Hour (or More)](#how-to-land-a-job-paying-18hour-or-more)

- [Conclusion: Your Career is More Than a Number](#conclusion-your-career-is-more-than-a-number)

Decoding the $18 an Hour Salary: A Financial Snapshot

Before exploring the careers that offer this wage, it's essential to understand the financial reality of earning $18 per hour. This figure is the gross amount, before taxes and other deductions. Understanding your net (or take-home) pay is the first step toward effective financial planning.

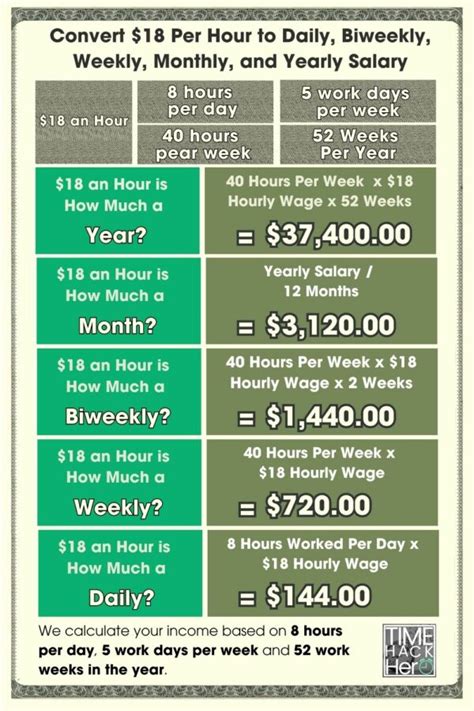

The Annual Breakdown:

- Hourly Rate: $18.00

- Weekly Income (40-hour week): $18 x 40 = $720

- Monthly Income (avg. 4.33 weeks/month): $720 x 4.33 = $3,117.60

- Annual Gross Income: $18 x 40 hours/week x 52 weeks/year = $37,440

This annual figure is your starting point. From here, you must account for deductions.

From Gross to Net: What You Actually Take Home

Your take-home pay will be significantly less than $37,440 after taxes and other potential deductions. While exact amounts vary based on your state, marital status, and dependents, a reasonable estimate for total deductions is between 20-25%.

- Federal Income Tax: Based on the 2024 tax brackets, a single filer earning $37,440 would fall into the 12% marginal tax bracket.

- FICA Taxes (Social Security & Medicare): This is a flat 7.65% on all earnings (6.2% for Social Security up to the annual limit and 1.45% for Medicare).

- State Income Tax: This varies dramatically, from 0% in states like Texas and Florida to over 9% in states like California for this income level.

- Other Deductions: This can include contributions to health insurance premiums, 401(k) or other retirement plans, and union dues.

Assuming a combined tax and deduction rate of 22%, your approximate net income would be:

- Estimated Annual Net Income: $37,440 x (1 - 0.22) = $29,203

- Estimated Monthly Net Income: $29,203 / 12 = $2,433

This monthly figure of ~$2,433 is the realistic amount you have to work with for budgeting your life.

### A "Day in the Life" Budget at $18/Hour

Let's apply the popular 50/30/20 budgeting rule to this estimated take-home pay to see what lifestyle it might support.

- 50% for Needs (~$1,217/month): This category covers essentials.

- Housing: Rent and utilities. This is the biggest challenge. The median rent for a one-bedroom apartment in the U.S. surpassed $1,400 in 2023. At $1,217 for *all* needs, finding solo housing that fits the "30% of gross income" rule ($935/month) is extremely difficult in most urban and suburban areas. This often means living with roommates, in a lower-cost-of-living area, or dedicating a much larger portion of your income to housing.

- Transportation: Car payment, insurance, gas, public transit passes.

- Groceries: Basic food necessities.

- Insurance: Health insurance premiums not covered by an employer.

- 30% for Wants (~$730/month): This is your flexible spending.

- Dining out, entertainment (movies, concerts), streaming services, hobbies, shopping for non-essentials, and vacations. This budget allows for a modest social life and some personal enjoyment, but requires careful tracking to avoid overspending.

- 20% for Savings & Debt Repayment (~$486/month): This is your future-building fund.

- Building an emergency fund (3-6 months of living expenses).

- Paying off high-interest debt (credit cards, personal loans).

- Saving for retirement (contributing to an IRA or a 401(k), especially to get an employer match).

- Saving for other long-term goals like a down payment or further education.

Conclusion: An $18/hour salary is a livable wage in many parts of the country, particularly in low-cost-of-living areas or with a roommate. However, it requires disciplined budgeting, especially to achieve significant savings goals. It provides a stable floor but offers limited buffer for major unexpected expenses, making an emergency fund a top priority.

Jobs That Typically Pay $18 an Hour: A Deep Dive

An $18/hour wage is characteristic of many essential roles that form the backbone of our economy. These are often positions that require a high school diploma plus some specialized training, a certificate, an associate's degree, or a few years of relevant experience. They span across numerous industries, from healthcare to technology to skilled trades.

Below is a detailed look at common job categories and specific roles where an $18/hour salary is a typical starting or median wage. All data is cross-referenced with the U.S. Bureau of Labor Statistics (BLS), Payscale, Salary.com, and Glassdoor for accuracy.

### 1. Administrative and Office Support

These roles are crucial for the smooth operation of nearly every business. They require organization, communication skills, and proficiency with office software.

- Administrative Assistant: The quintessential office professional. Responsibilities include managing schedules, answering phones, handling correspondence, organizing files, and providing general support to a team or department.

- Salary Data: Payscale reports a national average of $18.39 per hour for Administrative Assistants. The BLS notes the 2023 median pay for Secretaries and Administrative Assistants was $45,370 per year ($21.81/hour), indicating that $18/hour is a very common starting point before gaining experience.

- Medical Secretary / Administrative Assistant: A specialized version of the above, working in a healthcare setting. This role involves scheduling patient appointments, managing medical records, handling billing and insurance information, and communicating with patients.

- Salary Data: The BLS reports the 2023 median pay for Medical Secretaries and Administrative Assistants was $40,640 per year ($19.54/hour). Entry-level positions frequently start in the $16-$18/hour range.

- Bank Teller: The face of a bank's branch, tellers handle customer transactions like deposits, withdrawals, and loan payments. They must be detail-oriented, trustworthy, and possess strong customer service skills.

- Salary Data: According to Salary.com, the average teller salary in the U.S. is around $36,870 annually, which is about $17.72 per hour. Many major banks have raised their minimum starting wages to $18-$20 per hour to attract talent.

### 2. Healthcare Support

With an aging population and expanding healthcare services, support roles are in high demand. Many of these positions offer a direct and meaningful impact on patient well-being and can be a gateway to more advanced careers in nursing or medicine.

- Certified Nursing Assistant (CNA): CNAs work under the supervision of nurses to provide basic care to patients in hospitals, nursing homes, and long-term care facilities. Duties include helping patients with daily activities like bathing and dressing, taking vital signs, and reporting changes in patient condition.

- Salary Data: The BLS indicates the 2023 median pay for Nursing Assistants was $38,130 per year ($18.33/hour). This is a field where wages are highly dependent on location and facility type.

- Phlebotomist: A specialized technician trained to draw blood from patients for clinical testing, transfusions, or donations. This role requires precision, attention to detail, and the ability to work well with anxious patients.

- Salary Data: The BLS reports a 2023 median pay of $41,810 per year ($20.10/hour). Entry-level phlebotomists, especially those who have just completed their certification program, can expect to start in the $17-$19/hour range.

- Medical Assistant: A versatile role with both administrative and clinical duties. Medical Assistants may take patient histories, measure vital signs, assist physicians during exams, give injections, and schedule appointments.

- Salary Data: The median pay for Medical Assistants in 2023 was $42,000 per year ($20.19/hour), per the BLS. An $18/hour wage is a very typical starting salary for a newly certified MA.

### 3. Skilled Trades and Logistics

These hands-on roles are critical for manufacturing, construction, and supply chain management. They often involve operating machinery, working with tools, and ensuring the physical flow of goods and services.

- Warehouse Associate / Forklift Operator: These professionals manage the receiving, storing, and shipping of goods in a warehouse or distribution center. Operating a forklift is a key skill that often commands a higher wage.

- Salary Data: Payscale shows the average hourly rate for a Forklift Operator is $18.57. Base-level warehouse associate pay may be lower, but the addition of equipment operation skills typically pushes the wage to the $18/hour mark or higher.

- Entry-Level Maintenance Technician: Responsible for the general upkeep and repair of buildings and equipment. Tasks can include basic plumbing, electrical work, carpentry, and preventative maintenance on machinery.

- Salary Data: Glassdoor reports an average base pay of around $42,000/year ($20/hour), with entry-level and apprentice positions commonly starting around $18/hour as skills are developed on the job.

- Manufacturing Production Technician: Works on an assembly line or in a manufacturing plant, operating machinery, assembling products, and conducting quality control checks to ensure products meet specifications.

- Salary Data: The pay for assemblers and fabricators varies widely by industry. The BLS reports a median of $19.63/hour, making $18/hour a common rate for less specialized or entry-level production roles.

### 4. Customer Service and Client Support

These professionals are the voice of a company, helping customers with inquiries, resolving problems, and ensuring a positive experience.

- Customer Service Representative: This broad title covers roles in call centers, online chat support, and retail environments. They answer questions about products or services, process orders, and handle complaints.

- Salary Data: The BLS reports a median pay of $18.99/hour for Customer Service Representatives as of 2023. This is one of the most common jobs at this pay level.

- Client Support Specialist (Entry-Level Tech): In the tech world, this role provides basic troubleshooting and support for software or hardware products. It's often a stepping-stone into more advanced IT careers.

- Salary Data: While more advanced IT support pays more, entry-level, Tier 1 help desk roles often start in the $18-$22/hour range, according to data from Robert Half Technology.

Key Factors To Move Beyond $18/Hour

Earning $18 an hour is a solid foundation, but for most, it's not the final destination. Strategic career management is about understanding the levers you can pull to increase your earning potential. Your salary is not a fixed label but a dynamic number influenced by a combination of your skills, experience, and choices. This section provides an in-depth analysis of the six key factors that determine your pay and offers actionable advice on how to leverage them to move beyond the $18/hour mark.

### `

`Level of Education & Certification`

`Formal education remains a powerful determinant of lifetime earnings. While many $18/hour jobs require only a high school diploma or equivalent, advancing your education is one of the most reliable paths to a higher salary.

- From High School to Associate's Degree: Earning a two-year Associate's degree from a community college can be a high-return investment. For example, an administrative assistant ($18/hr) might pursue an Associate of Applied Science in Paralegal Studies. The BLS reports that the median pay for paralegals and legal assistants is $60,970 per year ($29.31/hour). Similarly, a CNA ($18/hr) could earn an Associate's Degree in Nursing (ADN) to become a Registered Nurse (RN), whose median pay is $86,070 per year ($41.38/hour).

- The Power of a Bachelor's Degree: A four-year Bachelor's degree opens up a vast new landscape of professional roles. According to the BLS, in 2023, median weekly earnings for full-time workers age 25 and over with a Bachelor's degree were $1,498, compared to $916 for those with a high school diploma. That's a 63% increase in earning potential. A customer service rep ($18/hr) with a knack for analytics could pursue a Bachelor's in Marketing or Business Analytics, targeting roles like a Marketing Analyst (median pay: $74,540/year) or Operations Analyst (median pay: $82,360/year).

- Industry-Recognized Certifications: For those not pursuing a full degree, certifications are a potent tool for salary negotiation. They act as a standardized, third-party validation of your skills.

- For Administrative Professionals: The Certified Administrative Professional (CAP) offered by the International Association of Administrative Professionals (IAAP) can demonstrate a high level of expertise and lead to senior assistant or office manager roles.

- For IT Support: A Tier 1 help desk technician earning $18/hour can dramatically increase their value by earning the CompTIA A+ and Network+ certifications. This can open the door to Network Administrator roles, which have a median pay of $95,360/year ($45.85/hour) according to the BLS.

- For Skilled Trades: A general maintenance tech ($18/hr) who obtains a certification in HVAC (Heating, Ventilation, and Air Conditioning) can move into a specialized role. The median pay for HVACR mechanics and installers is $59,620/year ($28.66/hour).

### `

`Years of Experience`

`Experience is the currency of the workplace. As you move from an entry-level employee to a seasoned professional, your value—and your salary—should increase accordingly. This growth is not automatic; it requires you to actively learn, take on more responsibility, and master your domain.

Let's chart a hypothetical career progression for a Warehouse Associate starting at $18/hour:

- Entry-Level (0-2 years): Warehouse Associate ($18/hour, ~$37,440/year)

- Focus: Learning basic processes, operating equipment (forklift, pallet jack) safely, meeting picking/packing quotas.

- To Grow: Demonstrate reliability, exceed performance metrics, and show a willingness to learn new systems (like Warehouse Management System software).

- Mid-Career (3-5 years): Warehouse Lead or Team Supervisor ($22-$25/hour, ~$45,760 - $52,000/year)

- Focus: Now supervising a small team, training new hires, coordinating daily tasks, and troubleshooting logistical issues. You're responsible not just for your own output, but for the team's.

- To Grow: Develop leadership and communication skills. Take courses in supply chain management or logistics. Ask to be involved in inventory planning and process improvement projects.

- Senior-Level (5+ years): Warehouse Manager ($30-$40+/hour, ~$62,400 - $83,200+/year)

- Focus: Full operational responsibility for the warehouse. This includes managing staff, overseeing the entire supply chain process (inbound/outbound), managing the budget, ensuring safety compliance, and implementing efficiency improvements.

- Salary Data: Salary.com shows the median salary for a Warehouse Manager is around $88,000/year, with the range typically falling between $75,000 and $103,000. This demonstrates a clear and lucrative career path founded on initial experience.

### `

`Geographic Location`

`Where you work is one of the single most significant factors influencing your salary and your purchasing power. An $18/hour wage can feel comfortable in a low-cost-of-living (LCOL) area but insufficient in a high-cost-of-living (HCOL) city. Companies adjust their pay scales based on the local market rate for talent and the cost of living.

Illustrative Comparison: Medical Assistant Salary ($18/hour national baseline)

| City | Average Hourly Wage for Medical Assistant (Source: Salary.com, 2024) | Cost of Living Index (Council for Community and Economic Research, Q3 2023 - U.S. Average = 100) | Analysis |

| :--- | :--- | :--- | :--- |

| San Jose, CA | $27 | 153.9 (53.9% above average) | The much higher wage is necessary to offset the extremely high cost of living, particularly housing. Earning $18/hour here would be exceptionally difficult. |

| Chicago, IL | $22 | 116.3 (16.3% above average) | The wage is higher than the national baseline, but so is the cost of living. Your purchasing power might be similar to or slightly less than the national average. |

| Dallas, TX | $21 | 102.5 (2.5% above average) | A strong wage combined with a cost of living that is close to the national average. This represents a good balance of income and affordability. |

| Omaha, NE | $20 | 89.9 (10.1% below average) | While the absolute wage is slightly lower than in Dallas or Chicago, the significantly lower cost of living means your $20/hour salary has much greater purchasing power here. An $18/hour wage would go much further. |

Actionable Advice:

- Use Cost of Living Calculators: Before accepting a job or moving, use tools like NerdWallet's or Payscale's cost of living calculator to compare your current salary to a potential offer in a new city.

- Consider Remote Work: The rise of remote work has created a new arbitrage opportunity. If you can secure a role with a company based in an HCOL area (that pays accordingly) while living in an LCOL area, you can maximize your purchasing power.

### `

`Company Type & Size`

`The type of organization you work for can have a profound impact on your compensation, benefits, and work environment.

- Large Corporations (e.g., Fortune 500):

- Pros: Typically offer higher base salaries and more structured salary bands with clear paths for promotion. They have robust benefits packages (comprehensive health insurance, generous 401(k) matches, paid time off).

- Cons: Can be more bureaucratic, and individual impact may feel less visible.

- *Example:* An administrative assistant at Google or Microsoft will likely earn significantly more than the national average and have access to world-class benefits.

- Startups:

- Pros: May offer equity (stock options) as part of compensation, which can be highly lucrative if the company succeeds. Roles are often broader, allowing for rapid skill development.

- Cons: Base salaries might be lower than at large corporations. Job security is lower, and benefits can be less comprehensive. Long hours are often the norm.

- *Example:* An entry-level client support specialist might accept $18/hour at a startup if they also receive stock options and believe in the company's growth potential.

- Non-Profits:

- Pros: Mission-driven work that can be personally fulfilling.

- Cons: Salaries are almost always lower than in the for-profit sector due to budget constraints.

- *Example:* A program assistant at a local community non-profit may earn $18/hour, driven by a passion