For ambitious professionals in the world of finance, securing a role at a prestigious firm like Goldman Sachs is a significant career milestone. Among the most sought-after positions is that of Vice President (VP), a title that signifies expertise, leadership, and substantial earning potential. A VP role at this bulge-bracket investment bank can push total compensation well into the six-figure range, often approaching or exceeding half a million dollars annually.

This article provides a data-driven look into the salary of a Vice President at Goldman Sachs, breaking down compensation structures, key influencing factors, and the overall career outlook to help you understand what it takes to reach and succeed in this demanding yet highly rewarding role.

What Does a Vice President at Goldman Sachs Do?

First, it's crucial to understand the role of a VP in the investment banking hierarchy. Unlike a traditional corporation where a VP is a senior executive, in investment banking, the VP is a mid-to-senior level professional. The typical progression is: Analyst -> Associate -> Vice President -> Director -> Managing Director.

A VP at Goldman Sachs is the engine of deal execution and team management. Their primary responsibilities include:

- Project Leadership: Overseeing the day-to-day execution of deals, such as mergers and acquisitions (M&A), initial public offerings (IPOs), or debt financing.

- Team Management: Directly managing and mentoring a team of Associates and Analysts, ensuring the quality and accuracy of financial models, pitchbooks, and due diligence.

- Client Interaction: Serving as a key point of contact for clients, participating in meetings, and building relationships.

- Strategic Contribution: Contributing to the strategic direction of deals and beginning to develop their own network for future business generation.

The VP role is a demanding bridge between the junior ranks, who perform the analytical heavy lifting, and the senior bankers (Directors and Managing Directors), who are primarily responsible for winning new business.

Average Vice President Salary at Goldman Sachs

Compensation in investment banking is famously composed of two main parts: a base salary and a significant, performance-based annual bonus. This structure is designed to reward high performance and align employee incentives with the firm's profitability.

The total compensation for a Vice President at Goldman Sachs is highly competitive and reflects their critical role within the firm.

- Average Base Salary: According to the latest data from sources like Salary.com and Glassdoor, the base salary for a Vice President at Goldman Sachs typically falls within the range of $225,000 to $275,000 per year.

- Annual Bonus: The bonus is the highly variable component and is tied to individual, divisional, and firm-wide performance. It can range from 50% to over 100% of the base salary. This can add an additional $150,000 to $300,000+ to their annual earnings.

- Total Compensation: Combining the base salary and bonus, the average total compensation for a Goldman Sachs VP is typically between $400,000 and $550,000 annually. Top performers in highly profitable divisions can potentially earn even more.

*(Source: Salary data is synthesized from 2023-2024 reports from Glassdoor, Salary.com, and industry reports from sources like Litquidity and Levels.fyi.)*

Key Factors That Influence Salary

While the average figures are impressive, actual earnings can vary significantly based on several key factors. Understanding these drivers is essential for anyone aspiring to maximize their earning potential.

###

Level of Education

A strong educational background is a prerequisite for a career at Goldman Sachs. Most professionals who reach the VP level hold a bachelor's degree from a top-tier university. Furthermore, many VPs have a Master of Business Administration (MBA), often from an elite program like those at Harvard, Wharton, or Stanford. An MBA not only provides advanced financial and strategic knowledge but also serves as a primary recruiting pipeline for the post-MBA Associate role, which is the direct path to becoming a VP.

###

Years of Experience

Experience is arguably the most significant factor in determining compensation. The path to VP is structured and time-based:

- Analyst: 2-3 years post-undergrad.

- Associate: 3-4 years post-MBA or after a direct promotion from Analyst.

Therefore, a newly promoted VP typically has at least 5-7 years of direct investment banking experience. As a VP gains seniority within that title (e.g., a "VP Year 3" vs. a "VP Year 1"), their base salary and, more importantly, their target bonus percentage will increase.

###

Geographic Location

Investment banking is a global industry, but compensation is heavily concentrated in major financial centers. VPs working in New York City, the firm's headquarters, can expect to earn at the top of the pay scale. Other major hubs like London and Hong Kong also offer highly competitive compensation packages. Salaries may be adjusted slightly lower in other U.S. financial centers where Goldman has a significant presence, such as San Francisco, Chicago, or Salt Lake City, although they remain exceptionally high.

###

Firm Performance and Reputation

While this article focuses on Goldman Sachs, it's helpful to understand the context. As a top "bulge bracket" bank, Goldman Sachs consistently pays at or near the top of the market to attract and retain the best talent, alongside peers like Morgan Stanley and J.P. Morgan. The firm's overall profitability in a given year directly impacts the bonus pool available for its employees, meaning a banner year for Goldman Sachs often translates into larger bonuses for its VPs.

###

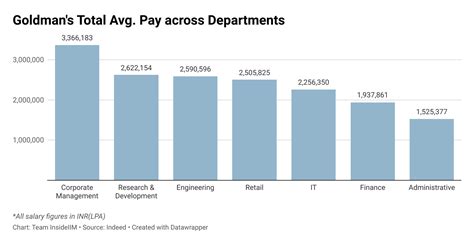

Area of Specialization

Within Goldman Sachs, different divisions have different levels of profitability, which directly affects bonus payouts. A VP in a division that had a blockbuster year will likely see a much larger bonus than a colleague in a slower division. Key areas include:

- Investment Banking Division (IBD): This includes classic M&A advisory and capital markets. VPs in hot sectors like Technology, Media, and Telecom (TMT) or Healthcare often see some of the highest bonuses.

- Global Markets (Sales & Trading): Compensation here is heavily tied to trading performance and the market's volatility.

- Asset & Wealth Management: VPs in this division may have a slightly different compensation structure, sometimes including commissions or incentives based on assets under management (AUM).

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) provides broad outlooks for related professions. For Financial Managers, the BLS projects a job growth of 16% from 2022 to 2032, which is much faster than the average for all occupations. This indicates strong, sustained demand for skilled financial professionals.

However, it is critical to note that competition for roles at elite firms like Goldman Sachs is, and will remain, extraordinarily intense. While the overall industry is healthy, securing a VP position requires a consistent track record of exceptional performance, strong leadership skills, and the ability to thrive in a high-pressure environment.

Conclusion

A Vice President position at Goldman Sachs represents a pinnacle of achievement in the financial services industry. It offers the opportunity to lead complex, high-stakes transactions and comes with a compensation package that reflects the immense value and expertise required.

For prospective students and finance professionals, the key takeaways are:

- Total Compensation is Key: Look beyond the base salary; the annual bonus is where top performers are truly rewarded, with total earnings often reaching $400,000 to $550,000 or more.

- The Path is a Marathon: Reaching the VP level requires years of dedication, starting with a top-tier education and progressing through the demanding Analyst and Associate ranks.

- Performance is Everything: Your salary and career trajectory are directly tied to your performance, the success of your team, and the overall profitability of the firm.

For those with the drive, intellect, and resilience to succeed, a career as a Vice President at Goldman Sachs is not just a job—it's an opportunity to operate at the highest level of global finance.