You’ve set your sights on a significant financial milestone: earning a $20 an hour salary. For millions of Americans, this figure represents a crucial step toward financial stability, a departure from minimum wage roles, and a gateway to a more secure future. It’s the kind of income that can transform your budget, expand your opportunities, and provide a solid foundation upon which to build a fulfilling life and career. But what does earning $20 an hour truly mean? What jobs pay at this level? And most importantly, how can you achieve it and then continue to grow beyond it?

Earning $20 per hour translates to an annual gross income of approximately $41,600, assuming a standard 40-hour workweek. This places you squarely within a vital segment of the American workforce, opening doors to careers in administration, healthcare support, skilled trades, customer service, and entry-level technology. It's a wage that commands respect and requires a valuable set of skills. I remember the first time I landed a role that paid the equivalent of this wage early in my career; the feeling wasn't just about the money, but about the validation. It was a clear signal that my skills were in demand and that I was on a tangible career path. This guide is designed to give you that same sense of clarity and empowerment.

This comprehensive article will serve as your ultimate resource for understanding, achieving, and maximizing a $20 an hour salary. We will dissect what this income means for your lifestyle, explore the specific jobs and industries where this pay rate is common, and provide a strategic, step-by-step roadmap to help you get there.

### Table of Contents

- [What a $20 an Hour Salary Really Means for Your Life](#what-a-20-an-hour-salary-really-means-for-your-life)

- [A Deep Dive into Jobs Paying Around $20 an Hour](#a-deep-dive-into-jobs-paying-around-20-an-hour)

- [Key Factors That Influence Your Hourly Wage](#key-factors-that-influence-your-hourly-wage)

- [Job Outlook and Career Growth from a $20/Hour Platform](#job-outlook-and-career-growth-from-a-20hour-platform)

- [How to Secure a Job Paying $20 an Hour (or More)](#how-to-secure-a-job-paying-20-an-hour-or-more)

- [Conclusion: Your Career Starts Now](#conclusion-your-career-starts-now)

What a $20 an Hour Salary Really Means for Your Life

Before we explore the jobs and strategies, it's essential to ground ourselves in the financial reality of this income level. Understanding the numbers is the first step to mastering your financial life and planning for the future.

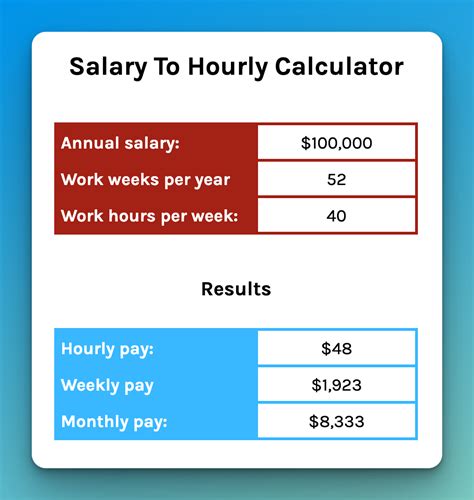

A $20 per hour wage is more than just a number; it's a financial tool. Here’s a breakdown of what it looks like in practice:

- Hourly: $20.00

- Daily (8-hour day): $160.00

- Weekly (40 hours): $800.00

- Monthly (average): $3,467

- Annually (52 weeks): $41,600

These are gross figures, meaning they are calculated before taxes and other deductions. Your take-home pay (net income) will be lower after federal, state, and local taxes, Social Security, Medicare, and any pre-tax deductions like health insurance premiums or 401(k) contributions are taken out. A rough estimate might place your net monthly income between $2,700 and $2,900, depending heavily on your state's tax laws and personal deductions.

### A Sample Budget on a $20/Hour Salary

To make this tangible, let’s apply the popular 50/30/20 budgeting rule to a hypothetical net monthly income of $2,800.

- 50% for Needs (~$1,400): This category covers your essential living expenses.

- Housing (Rent/Mortgage): $900 - $1,100 (This is the most significant variable and highly dependent on your location.)

- Utilities (Electric, Gas, Water, Internet): $150 - $200

- Groceries: $250 - $350

- Transportation (Car Payment, Insurance, Gas, Public Transit): $200 - $300

- Minimum Debt Payments: Varies

- 30% for Wants (~$840): This is for lifestyle choices that enhance your quality of life.

- Dining Out/Entertainment: $200 - $300

- Shopping (Clothing, Hobbies): $150 - $250

- Subscriptions (Streaming, Gym): $50 - $100

- Vacation Fund: $100+

- 20% for Savings & Debt Repayment (~$560): This is your wealth-building engine.

- Emergency Fund: Prioritize building 3-6 months of living expenses.

- Retirement Savings (401(k), IRA): Contribute at least enough to get any employer match.

- Extra Debt Payments (Student Loans, Credit Cards): Targeting high-interest debt first.

- Other Savings Goals (Down Payment, New Car): Varies.

This budget illustrates that a $20/hour salary can provide a stable, comfortable lifestyle in many parts of the country, especially for a single person or a dual-income couple. However, in high-cost-of-living urban centers, this budget would be stretched thin, highlighting the critical importance of geographic location, which we'll discuss later.

### A "Day in the Life" of a $20/Hour Earner

Imagine a typical Tuesday. You wake up with a sense of purpose, knowing your job contributes meaningfully to a team. You might be an administrative assistant preparing a briefing for your manager, a medical coder ensuring patient records are accurate, or an IT help desk technician solving a colleague's frustrating software issue. Your workday is structured, and you have clear responsibilities. You can afford to buy a coffee on the way to work without guilt, but you’ve likely packed a lunch to help stay on budget. After work, you might hit the gym, meet friends for a reasonably priced dinner, or take an online course to develop a new skill. The financial stress that often accompanies lower-wage jobs has lessened, replaced by a forward-looking mindset focused on financial goals and career advancement. This is the stability and opportunity that a $20/hour wage can unlock.

A Deep Dive into Jobs Paying Around $20 an Hour

A $20/hour wage ($41,600/year) is a common pay benchmark for a wide variety of essential and accessible professions. These roles often require a high school diploma plus some specialized training, an associate's degree, or a few years of relevant experience. They are the backbone of many industries, from healthcare to finance to technology.

Below is a detailed look at several common jobs where the median or average pay falls within the $18 to $24 per hour range. We'll cite data from the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, a gold standard for career data, supplemented with real-world ranges from aggregators like Payscale and Salary.com.

### Common Jobs in the $20/Hour Range

| Job Title | BLS Median Pay (May 2023) | Typical Entry-Level Education | Brief Role Description |

| :--- | :--- | :--- | :--- |

| Administrative Assistant | $21.55/hour ($44,830/year) | High School Diploma | Provides clerical and administrative support, manages schedules, handles communication, and organizes files. |

| Bookkeeping, Accounting, & Auditing Clerk| $22.45/hour ($46,690/year) | Some College, No Degree | Records financial transactions, updates statements, and checks financial records for accuracy. Requires strong attention to detail. |

| Medical Assistant | $19.43/hour ($40,410/year) | Postsecondary Nondegree Award | Performs administrative and clinical tasks in hospitals, clinics, and doctors' offices. A rapidly growing field. |

| Customer Service Representative | $19.08/hour ($39,680/year) | High School Diploma | Interacts with customers to handle inquiries, process orders, and resolve complaints. Higher-paying roles often require specialized product knowledge. |

| IT Support Specialist (Help Desk Technician)| $28.30/hour ($58,870/year)* | Postsecondary Nondegree Award | Provides technical assistance to computer users. Entry-level roles often start in the $20-$25/hour range. |

| Pharmacy Technician | $19.14/hour ($39,810/year) | High School Diploma + Training | Helps pharmacists dispense prescription medication to customers or health professionals. |

| Phlebotomist | $19.55/hour ($40,670/year) | Postsecondary Nondegree Award | Draws blood for tests, transfusions, donations, or research. Requires precision and good interpersonal skills. |

| Social and Human Service Assistant | $19.34/hour ($40,220/year) | High School Diploma | Assists social workers and psychologists in providing client services, often working with specific populations like the elderly or families. |

*Note: The BLS median for IT Support is higher, but numerous sources like Payscale confirm that entry-level (Tier 1) positions frequently start in the $20-$25/hour bracket, making it a key stepping-stone role.*

### In-Depth Look at Key Roles

1. Administrative & Executive Assistants: According to the BLS, the median pay for Administrative Assistants was $21.55 per hour in May 2023. These professionals are organizational hubs. They do more than answer phones; they manage complex calendars, prepare reports, coordinate meetings and events, and often act as a gatekeeper for executives. An entry-level administrative assistant might start closer to $18/hour, but with 2-4 years of experience and proven skills in software like Microsoft 365 or Google Workspace, reaching and exceeding $20/hour is highly attainable.

2. Bookkeeping Clerks: The BLS reports a median hourly wage of $22.45 for bookkeeping, accounting, and auditing clerks. These roles are critical for the financial health of any business. They require meticulous attention to detail and proficiency with accounting software like QuickBooks or Xero. While a formal degree isn't always necessary, certifications like the Certified Bookkeeper (CB) credential can significantly boost earning potential and credibility.

3. Medical Assistants: The healthcare support field is booming, and Medical Assistants are at its core. The BLS notes their median pay at $19.43 per hour. This role offers a dynamic blend of administrative tasks (scheduling, billing) and clinical duties (taking vital signs, assisting with procedures). The path typically involves completing a certificate or associate's degree program, and credentials like the Certified Medical Assistant (CMA) are highly valued.

4. Entry-Level IT Support: This is a fantastic entry point into the lucrative tech industry. While the overall median is higher, Salary.com shows the average salary for a Help Desk Support Specialist I is around $48,000/year (~$23/hour). These professionals are the first line of defense for technical problems. Success in this role is built on problem-solving skills, customer service excellence, and foundational knowledge validated by certifications like the CompTIA A+. Earning $20-$22 an hour to start is very common, with a clear path for rapid salary growth.

### Beyond the Hourly Wage: The Total Compensation Package

When evaluating a job offer, it's a mistake to focus solely on the hourly rate. A job paying $19/hour with excellent benefits can be far more valuable than a $21/hour job with no benefits. Total compensation includes:

- Health Insurance: Employer-sponsored health, dental, and vision insurance can save you thousands of dollars a year in premiums and out-of-pocket costs.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A generous PTO policy is a significant quality-of-life benefit.

- Retirement Savings Plans: A 401(k) or 403(b) plan, especially one with an employer match, is essentially free money for your retirement. An employer matching 50% of your contributions up to 6% of your salary is a 3% pay raise.

- Bonuses and Profit Sharing: Some companies offer performance-based bonuses or share a portion of their profits with employees, adding a variable but potentially substantial amount to your annual income.

- Tuition Reimbursement: A powerful benefit that allows you to pursue further education or certifications with financial assistance from your employer, directly fueling your future earning potential.

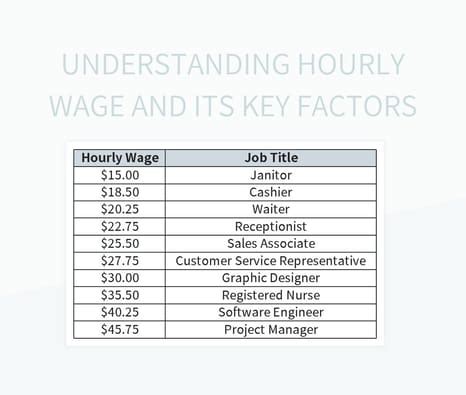

Key Factors That Influence Your Hourly Wage

Achieving a $20 an hour salary isn't a matter of luck; it's the result of a strategic combination of factors. Two people with the same job title can have vastly different pay rates based on their unique blend of education, experience, location, and skills. Understanding these levers is the key to not only reaching the $20/hour mark but accelerating well beyond it. This section breaks down the six most critical factors that determine your earning potential.

### 1. Level of Education and Certification

Your formal education and professional certifications are the bedrock of your qualifications. They signal to employers that you have a foundational level of knowledge and a commitment to your field.

- High School Diploma/GED: This is the minimum requirement for many of the jobs listed, like customer service or basic administrative roles. At this level, reaching $20/hour will likely depend more heavily on accumulating years of on-the-job experience.

- Associate's Degree: A two-year degree from a community college can be a powerful and cost-effective accelerator. For roles like IT Support Specialist, Paralegal, or some healthcare technicians, an associate's degree is often the preferred entry-level qualification and can help you start at a higher pay rate, often directly in the $20-$25/hour range. According to the BLS, in 2022, median weekly earnings for those with an associate's degree were about 15% higher than for those with only a high school diploma.

- Bachelor's Degree: While many $20/hour jobs don't require a four-year degree, having one can open doors to higher-paying versions of these roles or put you on a faster track to management. For example, an administrative assistant with a bachelor's degree might more quickly become an executive assistant or office manager, positions that routinely pay well over $30/hour.

- Certifications: This is arguably the most impactful factor for many roles in this pay band. Certifications are targeted, skill-based credentials that prove your proficiency in a specific area. They are often faster and cheaper to obtain than a degree and provide a direct return on investment.

- For IT: The CompTIA A+ is the industry standard for entry-level help desk roles. Adding Network+ or Security+ can quickly push your value above the $25/hour mark.

- For Administration: The Microsoft Office Specialist (MOS) certification proves your expertise in essential software. For more advanced professionals, the Certified Administrative Professional (CAP) is a highly respected credential.

- For Bookkeeping: Becoming a QuickBooks Certified User or earning the Certified Bookkeeper (CB) designation from the American Institute of Professional Bookkeepers (AIPB) can directly lead to higher hourly rates and more complex client work.

- For Healthcare: Certifications like CMA (Certified Medical Assistant), CPhT (Certified Pharmacy Technician), or CPT (Certified Phlebotomy Technician) are often required and are directly tied to pay scales.

### 2. Years of Experience

Experience is the great equalizer and a powerful driver of salary growth. Employers pay for proven performance and the wisdom that comes from navigating real-world challenges.

- Entry-Level (0-2 years): In this stage, you are learning the ropes. Your pay will likely be at the lower end of the spectrum for your role, perhaps in the $17-$19/hour range. Your focus should be on absorbing as much as possible, being reliable, and building a track record of success.

- Mid-Career (2-5 years): You are now a fully proficient and reliable contributor. You can handle most tasks independently and may even begin to mentor new hires. This is the period where most people in these roles cross the $20/hour threshold and move towards the $22-$26/hour range. You can now leverage your experience to negotiate a raise or move to a new company for a significant pay bump.

- Senior/Experienced (5+ years): With extensive experience, you become an expert. You can handle the most complex tasks, lead projects, and provide strategic value. A senior Administrative Assistant becomes an Executive Assistant, a Tier 1 Help Desk tech becomes a Tier 2/3 Systems Administrator. At this level, pay can reach $28-$35+/hour. Your value is in your deep knowledge, efficiency, and problem-solving capabilities.

Salary Growth Trajectory (Example: Administrative Professional)

| Experience Level | Typical Hourly Range | Key Responsibilities & Skills |

| :--- | :--- | :--- |

| Entry-Level (0-2 Yrs) | $17 - $20 | Basic scheduling, data entry, answering phones, proficient in MS Office basics. |

| Mid-Level (2-5 Yrs) | $20 - $26 | Complex calendar management, preparing reports, coordinating small events, intermediate Excel/PowerPoint skills. |

| Senior-Level (5+ Yrs) | $26 - $35+ | Supporting C-level executives, managing large projects, supervising junior staff, advanced software skills (e.g., SharePoint, Asana). |

### 3. Geographic Location

Where you live is one of the single most significant factors determining your real and nominal wage. The same job with the same responsibilities can pay drastically different amounts in different cities and states due to variations in cost of living, labor demand, and state laws. A $20/hour salary in a low-cost-of-living area can afford a much higher quality of life than in an expensive metropolitan center.

- High-Cost-of-Living (HCOL) Areas: In cities like San Francisco, New York City, Boston, and Los Angeles, a $20/hour salary ($41,600/year) is often insufficient to live comfortably without roommates or significant financial strain. However, wages are inflated to compensate. A job that pays $20/hour in the Midwest might pay $28-$30/hour in these cities.

- Medium-Cost-of-Living (MCOL) Areas: Cities like Austin, Denver, and Chicago fall in the middle. Wages are competitive, and a $20/hour salary can provide a stable lifestyle, though housing will still be a major expense.

- Low-Cost-of-Living (LCOL) Areas: In many parts of the Midwest and South (e.g., cities in Ohio, Alabama, or Kansas), $20/hour is a very solid wage. It can comfortably cover all living expenses and allow for significant savings.

Illustrative Salary Comparison (Role: Bookkeeper)

| City | Average Hourly Rate (Source: Salary.com, 2024) | Notes on Cost of Living |

| :--- | :--- | :--- |

| San Jose, CA | ~$29/hour | Extremely high COL. The higher wage is offset by housing costs that are 200%+ the national average. |

| New York, NY | ~$28/hour | Very high COL. Similar to San Jose, the nominal wage is high but purchasing power is limited. |

| Chicago, IL | ~$25/hour | High COL. Wages are strong, but housing and taxes are significant factors. |

| Dallas, TX | ~$23/hour | Average COL. A $23/hr wage here provides a comfortable standard of living. |

| Omaha, NE | ~$22/hour | Low COL. This wage provides significant purchasing power and a high quality of life. |

The Rise of Remote Work: The increasing prevalence of remote work is changing this dynamic. If you can secure a remote job with a company based in a HCOL area while you live in a LCOL area, you can maximize your purchasing power—a strategy known as "geographic arbitrage."

### 4. Company Type & Size

The type of organization you work for has a major impact on compensation structure and culture.

- Large Corporations (Fortune 500): These companies typically offer higher base salaries and more structured pay scales. They are also known for having comprehensive benefits packages (excellent health insurance, generous 401(k) matches, PTO). The path for advancement is often clear but can be competitive.

- Startups: Startups may offer a slightly lower base salary, closer to the $20/hour mark, but might compensate with stock options or equity. The environment is often fast-paced with opportunities for rapid learning and responsibility growth. Benefits can be less robust than at large corporations.

- Small & Medium-Sized Businesses (SMBs): Compensation can vary widely. A successful local law firm or accounting practice might pay its administrative and bookkeeping staff very well, while a struggling small business may pay less. You often have a more direct impact on the business's success.

- Non-Profit Organizations: Non-profits are mission-driven, which can be personally rewarding. However, they generally have tighter budgets and may offer slightly lower salaries than for-profit companies. They often compensate with a positive work culture and good work-life balance.

- Government (Federal, State, Local): Government jobs are known for their stability, excellent benefits (pensions, healthcare), and predictable work hours. While the hourly wage might be on par with the private sector (e.g., using the GS pay scale for federal jobs), the total compensation package is often superior when accounting for benefits and job security.

### 5. Area of Specialization

Within a broad job category, specializing in a high-demand niche is a surefire way to increase your earnings. Generalists are valuable, but specialists are often paid a premium.

- Administrative Field: A general Administrative Assistant may earn $20/hour. However, specializing as a Legal Assistant/Paralegal or an Executive Assistant to C-suite leaders can push your wage to $30-$40/hour or more due to the specialized knowledge and high level of trust required.

- IT Support: A general Tier 1 Help Desk technician can start around $22/hour. Specializing in Cybersecurity, Cloud Computing (AWS/Azure), or Network Administration creates a direct path to roles that pay $60,000, $70,000, and beyond.

- Customer Service: A general call center agent might earn $18/hour. A Technical Support Representative who can troubleshoot complex software or hardware, or a Bilingual Customer Service Professional fluent in a high-demand language like Spanish, will command a higher rate.

- Finance/Bookkeeping: A general bookkeeper can earn $22/hour.