Earning $20 an hour is a significant financial benchmark for millions of professionals. It translates to an annual salary of approximately $41,600 before taxes, a figure that represents a stable entry into the American middle class in many parts of the country. For some, it’s a fantastic starting wage right out of college or a training program; for others, it's a solid, dependable income that supports a family.

But what does it really mean to earn $20 an hour? What jobs pay this wage, and more importantly, how can you leverage your skills and experience to earn it—and then surpass it? This guide will break down the numbers, explore the key factors that determine your earning potential, and provide a data-driven look at your career prospects.

What Do Jobs Paying $20 an Hour Involve?

Since "$20 an hour" is a pay rate rather than a specific job title, it encompasses a wide variety of roles across numerous industries. These positions are often the backbone of the economy, requiring a blend of technical skill, customer interaction, and specialized knowledge. They are typically beyond minimum wage and often require a high school diploma plus some level of training, certification, or on-the-job experience.

Common responsibilities for jobs in this pay range include:

- Providing skilled administrative or operational support (e.g., Administrative Assistants, Bookkeepers).

- Delivering specialized customer or patient care (e.g., Pharmacy Technicians, Medical Assistants).

- Operating specific machinery or performing skilled manual tasks (e.g., some manufacturing roles, entry-level skilled trades).

- Handling complex customer inquiries and technical issues (e.g., Tier 2 Customer Support Specialists).

These roles are crucial for the day-to-day functioning of businesses, healthcare facilities, and financial institutions.

The Average Salary: Deconstructing the $20 an Hour Wage

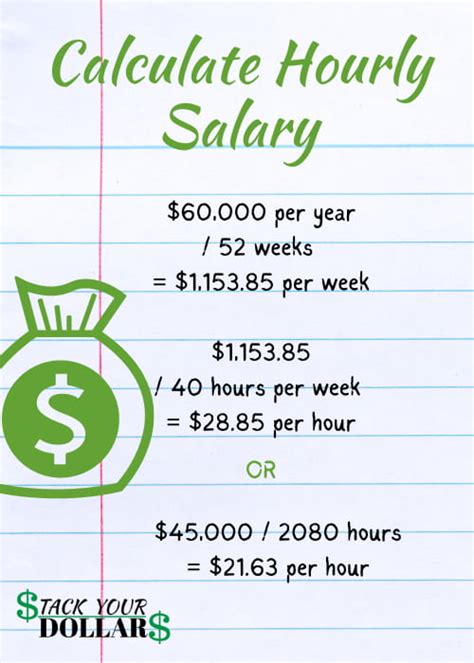

A $20 an hour wage is a clear benchmark, but it's essential to understand its context. Annually, this wage calculates to:

- $20/hour x 40 hours/week = $800 per week

- $800/week x 52 weeks/year = $41,600 per year

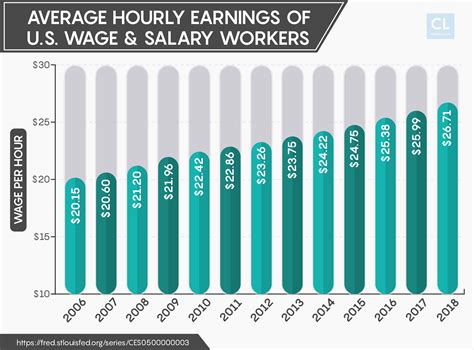

How does this compare nationally? According to the U.S. Bureau of Labor Statistics (BLS), the median usual weekly earnings for full-time wage and salary workers was $1,139 in the first quarter of 2024, which annualizes to about $59,228 (or roughly $28.47/hour). This means a $20/hour wage is below the national median, but it's a very common pay scale.

For jobs that typically pay around $20/hour, the salary range can be quite broad. For instance, data from Salary.com shows a skilled Administrative Assistant might earn between $18 and $24 per hour, with the median right around the $20 mark. This range is influenced by the factors we will discuss next.

Key Factors That Influence Salary

Your ability to earn $20 an hour—and exceed it—is not random. It's a combination of several key factors. Understanding these levers is the first step toward maximizing your income.

###

Level of Education

While a four-year degree is not always necessary to reach this wage, post-secondary education or certification is a powerful accelerator.

- High School Diploma/GED: With only a diploma, reaching $20/hour often requires significant on-the-job experience in fields like retail, hospitality, or customer service.

- Certifications & Associate's Degrees: This is where many $20/hour jobs are concentrated. For example, a Medical Assistant with a certification, a Pharmacy Technician who is CPhT certified, or a bookkeeper with a QuickBooks certification can readily command this wage. An Associate's degree in fields like paralegal studies or IT support also puts you in a strong position.

###

Years of Experience

Experience is arguably the most significant factor. An entry-level employee in a given role will almost always earn less than a seasoned professional.

- Entry-Level (0-2 years): In many administrative or technical roles, you might start in the $16-$18/hour range and work your way up to $20/hour within a couple of years.

- Mid-Career (3-7 years): With several years of proven success, professionals in these roles can expect to earn between $20 and $25 per hour. At this stage, you are no longer just performing tasks; you are solving problems, training others, and improving processes.

- Senior-Level (8+ years): A highly experienced professional, such as an Executive Assistant or a senior bookkeeper, can earn well over $25-$30 per hour.

###

Geographic Location

Where you live and work has a massive impact on your salary due to variations in cost of living and local demand for labor. A $20/hour wage feels very different in rural Arkansas than it does in New York City.

According to Payscale, a salary of $41,600 in Indianapolis, Indiana would need to be approximately $65,728 in San Francisco, California to maintain the same standard of living. Employers in high-cost-of-living (HCOL) areas must offer higher wages to attract talent. Conversely, $20/hour can provide a very comfortable lifestyle in a low-cost-of-living (LCOL) area.

###

Company Type & Industry

The type of company you work for and the industry it operates in are major salary determinants. A large, profitable corporation in a high-margin industry (like technology or finance) can typically afford to pay its support staff more than a small non-profit or a local retail business. An administrative assistant at a major tech company like Google might earn significantly more than an administrative assistant at a small law firm, even with similar experience.

###

Area of Specialization

Within any given field, specialization pays. A generalist may have broad opportunities, but a specialist can command a higher wage for their specific expertise.

- Administrative: An Executive Assistant who supports C-suite executives will earn more than a general office administrator.

- Healthcare: A Medical Assistant who specializes in a high-demand field like dermatology or cardiology may have higher earning potential.

- Customer Service: A Technical Support Representative who can troubleshoot complex software issues will earn more than a general call center agent handling basic billing inquiries.

Job Outlook

The job outlook for roles that pay around $20 an hour is mixed and depends heavily on the specific occupation. It's crucial to choose a field with strong future prospects.

Citing the U.S. Bureau of Labor Statistics (BLS), here is the projected growth from 2022 to 2032 for several common occupations in this pay range:

- Medical Assistants: Projected to grow 14%, which is much faster than the average for all occupations. This is driven by the aging population and increased demand for preventative medical services.

- Bookkeeping, Accounting, and Auditing Clerks: Projected to decline 2%. This is largely due to technological changes and automation of routine tasks. To succeed here, specialization in advanced software and analytical skills is key.

- Customer Service Representatives: Projected to have little or no change (a 1% decline). While many roles are being automated, the need for skilled representatives to handle complex issues remains.

- Pharmacy Technicians: Projected to grow 6%, which is faster than average, as demand for prescription medications continues to rise.

This data clearly shows that aligning yourself with a growing sector like healthcare is a strategic move for long-term career stability and income growth.

Conclusion

Earning $20 an hour, or $41,600 a year, is a respectable and achievable goal for many Americans. It serves as a solid foundation for financial security and can be a launchpad for a highly successful career.

The key takeaways for any professional looking to achieve or surpass this income level are:

1. Context is Everything: Understand that $20/hour is a strong wage in many regions but may be a starting point in more expensive areas.

2. Invest in Skills: Education, certifications, and specialized training are the most reliable ways to increase your market value.

3. Experience is Your Asset: Consistently seek opportunities to take on more responsibility and solve bigger problems to accelerate your journey from entry-level to senior-level pay.

4. Choose Your Path Wisely: Target industries and roles with a strong job outlook, like those in the healthcare sector, to ensure long-term demand for your skills.

Think of a $20 an hour wage not as a final destination, but as a strong foundation upon which you can build a rewarding and prosperous career.