For professionals who thrive on building relationships, solving complex problems, and being the vital link between a company and its customers, the role of a Client Service Associate (CSA) is a compelling career path. But beyond job satisfaction, what is the financial potential of this role? The answer is promising, with a typical salary range spanning from $45,000 to over $75,000 annually, heavily influenced by industry, location, and expertise.

This in-depth guide will break down the client service associate salary, explore the key factors that drive earnings, and provide a clear picture of what you can expect to make in this dynamic and essential profession.

What Does a Client Service Associate Do?

Before diving into the numbers, it’s crucial to understand the role. A Client Service Associate is far more than a traditional customer service representative. They are the primary point of contact for a portfolio of clients, often in complex industries like finance, technology, or professional services.

Their core responsibilities include:

- Building and maintaining strong client relationships.

- Onboarding new clients and guiding them through products or services.

- Responding to complex inquiries and resolving issues with expert knowledge.

- Handling administrative tasks, processing transactions, and maintaining client records.

- Collaborating with internal teams (like sales, finance, or technical support) to ensure client success.

In essence, a CSA is a trusted partner who ensures clients receive exceptional value and support, directly impacting client retention and company growth.

Average Client Service Associate Salary

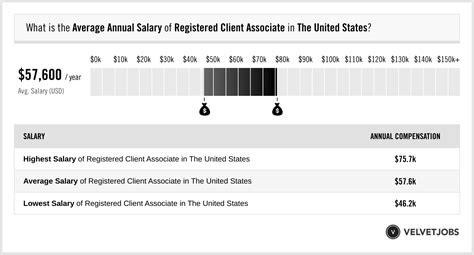

Salary data shows a strong and consistent earning potential for CSAs, with significant room for growth. While a broad average provides a useful benchmark, the true picture emerges when we look at the typical salary range.

- Average Base Salary: According to leading salary aggregators, the average salary for a Client Service Associate in the United States typically falls between $51,000 and $58,000 per year.

- Payscale reports an average base salary of approximately $51,500 per year.

- Salary.com places the median salary slightly higher at $52,145 per year, with a common range between $46,279 and $59,186.

- Glassdoor reports a higher estimated total pay (including potential bonuses) of around $58,900 per year.

- Typical Salary Range: The most common salary range reflects the progression from entry-level to experienced professional.

- Entry-Level (0-2 years): Typically starts in the $42,000 to $50,000 range.

- Mid-Career (3-7 years): Can expect to earn between $50,000 and $65,000.

- Senior/Lead (8+ years): Experienced CSAs, especially those in high-demand industries, can command salaries of $65,000 to $80,000+, with lead and management roles pushing even higher.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups this role within the broader category of "Customer Service Representatives," which has a lower median pay of $40,570 per year (May 2023). This is because the BLS category includes all types of customer-facing roles, including those in retail and call centers. The "Client Service Associate" title typically signifies a more specialized, higher-paying position within professional industries.

Key Factors That Influence Salary

Your specific salary as a Client Service Associate will be determined by a combination of critical factors. Understanding these levers is key to maximizing your earning potential.

### Level of Education

While a bachelor's degree is not always a strict requirement, it significantly impacts earning potential and career opportunities. A high school diploma or an associate's degree may be sufficient for some entry-level positions. However, employers in high-stakes industries like finance or technology overwhelmingly prefer candidates with a bachelor's degree in fields such as Business, Finance, Communications, or Economics. This educational background signals a stronger foundation in analytical thinking and professional communication, justifying a higher starting salary.

### Years of Experience

Experience is arguably the most significant driver of salary growth for a CSA. As you accumulate years in the field, you develop deeper product knowledge, more sophisticated problem-solving skills, and stronger client management abilities.

- 0-2 Years (Entry-Level): You are learning the ropes, mastering the company's systems, and handling more straightforward client requests. Your salary will be at the lower end of the spectrum.

- 3-7 Years (Mid-Career): You can manage a larger portfolio of clients, handle complex and escalated issues independently, and may begin to mentor junior associates. Your value to the company increases, and so does your salary.

- 8+ Years (Senior): You are a subject-matter expert. You may manage the firm's most valuable clients, lead a team of associates, or specialize in a highly complex product area. This level of expertise commands a premium salary and often includes performance bonuses.

### Geographic Location

Where you work matters. Salaries for Client Service Associates vary dramatically based on the cost of living and the concentration of high-paying industries in a particular metropolitan area.

- High-Cost Areas: Cities with major financial or tech hubs, such as New York, NY; San Francisco, CA; and Boston, MA, offer the highest salaries to compensate for the high cost of living. In these locations, it's common for mid-career CSAs to earn well above the national average.

- Mid-Tier Areas: Major cities like Chicago, IL; Dallas, TX; and Atlanta, GA, offer strong salaries that are competitive with a more moderate cost of living.

- Lower-Cost Areas: Salaries will be closer to or slightly below the national average in smaller cities and rural regions where the cost of living is significantly lower.

### Company Type and Industry

The industry you work in is a massive determinant of your salary. A CSA in a high-growth, high-margin industry will almost always earn more than one in a lower-margin sector.

- Financial Services: This is the highest-paying sector for CSAs. Roles at investment banks, wealth management firms (like Fidelity or Charles Schwab), and hedge funds are complex and require a deep understanding of financial products and regulations. These roles often come with significant bonus potential.

- Technology (SaaS, FinTech): Fast-growing tech companies rely on skilled CSAs (often called Client Success Associates) to ensure customer retention. Salaries are highly competitive and may include stock options as part of the compensation package.

- Professional Services: Law firms, accounting firms, and top-tier consulting firms pay well for polished, professional CSAs who can manage discerning corporate clients.

- Healthcare: As the healthcare industry becomes more consumer-focused, the need for skilled client relations professionals is growing, offering competitive salaries.

### Area of Specialization

Within these industries, further specialization can unlock higher pay. A generalist CSA is valuable, but a specialist is indispensable. For example, a CSA in wealth management who obtains their FINRA Series 7 and Series 66 licenses becomes dramatically more valuable and can command a significantly higher salary than an unlicensed counterpart. Similarly, a CSA who specializes in a complex enterprise software platform becomes an expert that the company cannot afford to lose.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) projects a 4% decline from 2022 to 2032 for the broad "Customer Service Representatives" category, this statistic requires careful interpretation. The decline is largely driven by the automation of simple, repetitive customer inquiries through chatbots and AI.

However, the outlook for skilled Client Service Associates who handle complex, high-touch, and relationship-based work remains strong. Companies will always need human experts to manage valuable client portfolios, solve nuanced problems, and provide the strategic support that automation cannot. The demand for CSAs in growing sectors like finance, technology, and specialized healthcare is expected to remain robust.

Conclusion

The role of a Client Service Associate offers a rewarding career with a clear and promising financial trajectory. While a national average provides a starting point, your ultimate earning potential is in your hands.

Key Takeaways for Aspiring CSAs:

- Aim for a Strong Foundation: A bachelor's degree in a relevant field opens the door to top-tier employers.

- Target High-Growth Industries: Focus your job search on finance, technology, and professional services to maximize your salary.

- Embrace Specialization: Pursue industry-specific certifications or become an expert in a niche product or service.

- Never Stop Learning: The more experience and expertise you gain, the more you will earn.

By strategically focusing on these key factors, you can build a successful and financially rewarding career as a Client Service Associate, becoming an indispensable asset to any organization you join.