Introduction

Are you currently earning $20 an hour and wondering what that translates to in an annual salary? Perhaps you're looking at job postings in this pay range and trying to understand if it's a sustainable wage and a stepping stone to a fulfilling career. You're standing at a pivotal point—the threshold of turning a job into a profession. A $20 an hour wage, which equates to an annual salary of approximately $41,600, is a significant milestone for millions of Americans. It represents a level of financial stability and opens the door to professional roles with benefits, growth opportunities, and a structured career path.

This guide is designed to be your definitive resource for navigating this critical career transition. We won't just do the math for you; we'll break down the entire ecosystem surrounding this income level. We’ll explore the types of jobs available, the crucial factors that can increase your earnings, the long-term career outlook, and a step-by-step plan to help you secure a salaried position in this range and beyond. I still remember the feeling of landing my first full-time, salaried role after years of juggling hourly positions in retail and hospitality. It wasn't just the relief of a predictable paycheck; it was the profound sense of stability, the access to health insurance, and the quiet confidence that came from knowing I was on a tangible career ladder. My goal is to provide you with that same sense of clarity and confidence as you take your next steps.

---

### Table of Contents

- [What Kinds of Jobs Pay Around $20 an Hour?](#what-does-a-20-an-hour-to-salary-do)

- [The $20 an Hour Salary: A Deep Dive into Your Annual Earnings](#average-20-an-hour-to-salary-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for $20/Hour Professionals](#job-outlook-and-career-growth)

- [How to Land a Salaried Role and Start Your Career](#how-to-get-started-in-this-career)

- [Conclusion: Building Your Future from a Solid Foundation](#conclusion)

---

What Kinds of Jobs Pay Around $20 an Hour?

There isn't one single job title called "a $20 an hour professional." Rather, this pay rate represents a gateway to a wide array of skilled and essential roles across nearly every industry. These are the jobs that form the backbone of our economy—the positions that ensure businesses run smoothly, customers are supported, and essential services are delivered. Professionals in this bracket are often the organizational hubs, the problem-solvers, and the friendly faces of a company.

Their core responsibilities typically involve a blend of administrative prowess, technical skill, and strong interpersonal communication. They might manage schedules, process data, provide technical support, coordinate projects, or handle client relationships. While the specific tasks vary dramatically by industry, the common thread is a need for reliability, attention to detail, and the ability to work effectively within a team.

Let's break down some of the most common roles and their typical daily functions:

- Administrative and Executive Assistants: These professionals are the organizational engines of an office. They manage calendars for executives, schedule meetings, prepare reports and presentations, handle correspondence, and book travel. They are masters of multitasking and gatekeepers of information.

- Customer Success/Service Representatives: In today's service-oriented economy, these roles are crucial. They aren't just answering phones; they are onboarding new clients, resolving complex issues, providing product training, and ensuring customer retention. They often use sophisticated Customer Relationship Management (CRM) software like Salesforce or Zendesk.

- Medical Billers and Coders: In the sprawling healthcare industry, these specialists are vital. They translate medical services from a patient's chart into universal medical codes that are then used to bill insurance companies. Accuracy and knowledge of medical terminology are paramount.

- Bookkeeping, Accounting, and Auditing Clerks: These individuals maintain a company's financial records. They post transactions, process payroll, issue invoices, and reconcile bank statements. They ensure financial accuracy and compliance, often using software like QuickBooks or Excel.

- Entry-Level IT Support Specialists (Help Desk Technicians): As the first line of defense for technology issues, they troubleshoot hardware and software problems for employees, set up new user accounts, install software, and maintain computer systems.

### A "Day in the Life" of a Customer Onboarding Specialist

To make this more concrete, let's imagine a day for "Alex," a Customer Onboarding Specialist at a mid-sized software company, earning a salary equivalent to about $22/hour.

- 8:45 AM: Alex logs on from their remote office. They start by reviewing their calendar and an analytics dashboard in Salesforce. They see three new clients have been assigned to them overnight. They spend 30 minutes reviewing the clients' needs and preparing for the day's kickoff calls.

- 9:30 AM: First onboarding call of the day. Alex walks a new client, a small marketing agency, through the initial setup of the software. They are patient, clear, and answer a dozen questions, ensuring the client feels confident and supported.

- 11:00 AM: Alex dedicates a block of time to "proactive outreach." They check on clients who are one week into their onboarding journey, sending them helpful articles from the knowledge base and offering to schedule a quick check-in call to address any roadblocks.

- 12:30 PM: Lunch break.

- 1:30 PM: Alex joins the weekly team meeting. The team discusses common customer pain points, shares success stories, and brainstorms ways to improve the onboarding workflow. Alex suggests creating a new video tutorial for a particularly tricky feature, and their manager encourages them to spearhead the project.

- 2:30 PM: Second onboarding call. This one is with a larger, more complex client. Alex demonstrates more advanced features and collaborates with the client to map out a custom implementation plan for their team.

- 4:00 PM: Alex spends the last hour of their day on administrative tasks. They update all their client records in Salesforce with detailed notes, respond to emails, and begin scripting the video tutorial they proposed earlier.

- 5:15 PM: Alex reviews their schedule for tomorrow and logs off, feeling a sense of accomplishment from helping clients succeed and contributing a new idea to their team.

This example illustrates the blend of structured tasks (calls), problem-solving (troubleshooting), and proactive, creative work that defines many professional roles at this salary level.

The $20 an Hour Salary: A Deep Dive into Your Annual Earnings

Understanding your total compensation is the first step in assessing your financial health and career trajectory. While a simple calculation gives you a baseline annual figure, a true salaried position offers a package that is far more valuable than just the gross pay.

### The Basic Calculation: From Hourly to Annual

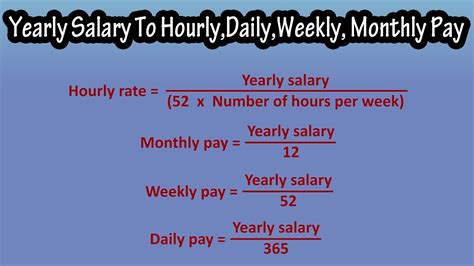

First, let's establish the baseline. The standard formula for converting an hourly wage to an annual salary assumes a 40-hour work week and 52 weeks in a year.

$20 per hour x 40 hours per week = $800 per week

$800 per week x 52 weeks per year = $41,600 per year

This $41,600 figure is your gross annual salary, before taxes, deductions, and other withholdings. It serves as a solid starting point for comparison. According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all workers was $48,060 in May 2023. This means a salary of $41,600 places you squarely within the typical range for a significant portion of the American workforce, particularly for those in entry-level or early-career professional roles.

### Salary Ranges by Experience Level

A $20/hour salary is often a starting point, not a final destination. As you gain experience and skills, your earning potential grows significantly. Here’s a look at a typical salary progression for roles that often start in the $40,000 - $45,000 range.

| Experience Level | Typical Years of Experience | Annual Salary Range | Common Job Titles |

| :--------------- | :------------------------ | :------------------ | :---------------- |

| Entry-Level | 0-2 Years | $38,000 - $48,000 | Administrative Assistant, Customer Service Rep, Data Entry Clerk, IT Help Desk Tier 1 |

| Mid-Career | 3-7 Years | $49,000 - $65,000 | Executive Assistant, Senior Customer Success Specialist, Bookkeeper, IT Support Tier 2, Project Coordinator |

| Senior/Specialist | 8+ Years | $65,000 - $85,000+ | Office Manager, Customer Success Team Lead, Staff Accountant, Systems Administrator, Project Manager |

*Source: Data compiled and synthesized from 2024 reports by the U.S. Bureau of Labor Statistics (BLS), Salary.com, and Payscale.*

For example, Salary.com reports that the median salary for an Administrative Assistant I in the United States is around $45,091 as of early 2024. However, an Administrative Assistant III (a more senior role) has a median salary of $56,762, and an Executive Assistant can command a median of $74,611. This clearly illustrates the upward mobility available from that initial $20/hour starting point.

### Beyond the Paycheck: The True Value of a Salaried Compensation Package

One of the most significant differences between hourly work and a salaried position is the benefits package, which can add 20-30% or more to your total compensation. When you evaluate a job offer, you must look beyond the base salary.

- Health Insurance: This is often the most valuable benefit. A company-sponsored health plan can be worth thousands of dollars per year. The average annual premium for employer-sponsored health insurance in 2023 was $8,435 for single coverage and $23,968 for family coverage, with employers covering a large portion of that cost, according to the Kaiser Family Foundation (KFF). An hourly job often offers no or minimal health benefits, leaving you to purchase expensive plans on the marketplace.

- Paid Time Off (PTO): Salaried professionals typically receive paid vacation days, sick days, and paid holidays. A typical package might include 10-15 vacation days, 5-7 sick days, and 10 federal holidays. That’s 25-32 paid days off per year—essentially a full month of paid time where you are not working. For a person earning $41,600, this benefit alone is worth over $3,200.

- Retirement Savings Plans: The most common plan is a 401(k), where you contribute a portion of your pre-tax salary. Most companies offer a "match," meaning they will contribute money to your account as well. A common match is 50% of your contributions up to 6% of your salary. On a $41,600 salary, if you contribute 6% ($2,496), your company would add an additional $1,248 of free money to your retirement fund each year.

- Other Financial Benefits:

- Bonuses: Many roles are eligible for performance-based annual or quarterly bonuses, which can range from 2% to 10% of your base salary.

- Profit-Sharing: Some companies distribute a portion of their annual profits among employees.

- Stock Options/RSUs: Particularly in tech companies or startups, you may be granted equity, giving you a stake in the company's success.

- Life and Disability Insurance: Many employers provide group term life insurance and short-term/long-term disability insurance at no cost to you, providing a critical financial safety net.

- Professional Development: Companies often provide a budget for courses, certifications, and conferences to help you grow your skills, an investment in your future earning potential.

When you add it all up, a job offer of $41,600 per year could have a Total Compensation Value of $55,000 or more once you factor in the monetary value of benefits. This is a crucial distinction to make when moving from an hourly to a salaried mindset.

Key Factors That Influence Salary

While $41,600 is a useful benchmark, your actual salary can vary significantly based on a combination of factors. Understanding these levers is the key to maximizing your earning potential throughout your career. This section is the most critical for planning your professional journey, as it outlines exactly where you should focus your efforts to command a higher salary.

###

Level of Education

Your educational background provides the foundational knowledge for your career and is often a primary screening tool for employers.

- High School Diploma or GED: A diploma is the minimum requirement for most of the professional roles we've discussed. It can secure entry-level positions, particularly in customer service or data entry, but upward mobility may be limited without further education or significant on-the-job training.

- Associate's Degree (A.A., A.S.): A two-year degree from a community college is a powerful and cost-effective tool. It often provides specialized, career-focused training. For example, an Associate's in Accounting can lead directly to bookkeeping roles, while an Associate's in IT can land you a Help Desk position. The BLS notes that in 2022, median weekly earnings for those with an Associate's degree were about 15% higher than for those with only a high school diploma. This credential signals a higher level of commitment and specialized knowledge to employers.

- Bachelor's Degree (B.A., B.S.): A four-year degree remains the gold standard for many professional and corporate roles. It unlocks a wider range of opportunities and typically leads to a higher starting salary and a steeper career trajectory. Many management and senior specialist roles list a Bachelor's degree as a firm requirement. According to the BLS, median weekly earnings for Bachelor's degree holders in 2022 were approximately 57% higher than for those with just a high school diploma.

- Certifications: In many fields, industry-recognized certifications can be as valuable—or even more valuable—than a formal degree. They demonstrate specific, in-demand skills.

- For IT: CompTIA A+, Network+, or Security+ certifications are essential for support and networking roles.

- For Administrative Professionals: The Certified Administrative Professional (CAP) designation can boost credibility and earning potential.

- For Bookkeepers: Becoming a Certified QuickBooks ProAdvisor or a Certified Bookkeeper (CB) can lead to higher-paying clients and positions.

- For Project Management: The Certified Associate in Project Management (CAPM) is an excellent entry-level certification that shows you understand the principles of managing projects.

Strategy: If you have a high school diploma, consider an affordable Associate's degree in a high-demand field. If you have a degree, supplement it with industry-specific certifications to make your resume stand out and justify a higher salary.

###

Years of Experience

Experience is arguably the single most important factor in salary growth. Employers pay a premium for proven performers who can solve problems independently and mentor others. The salary data consistently reflects a stairstep increase as you move through career stages.

- Entry-Level (0-2 years): In this stage, you are learning the ropes. Your salary will likely be at the lower end of the range for your role, around $38,000 to $48,000. Your focus should be on absorbing as much information as possible, being reliable, and mastering the core functions of your job.

- Mid-Career (3-7 years): You've moved beyond basic competency and are now a fully proficient contributor. You can handle complex tasks with minimal supervision and may begin to take on informal leadership responsibilities, like training new hires. Your salary should see a significant jump into the $49,000 to $65,000 range. This is often the stage where you might get promoted from a "Coordinator" to a "Specialist" or from "Assistant I" to "Assistant III."

- Senior Level (8+ years): At this stage, you are a subject matter expert. You may manage a team, oversee complex projects, or be the go-to person for the most challenging issues. Your role becomes more strategic. An Office Manager, a Senior Executive Assistant supporting a C-level executive, or a Systems Administrator falls into this category. Salaries can range from $65,000 to $85,000 or more. For instance, Payscale data from 2024 shows that an Executive Assistant with over 10 years of experience earns an average total compensation of over $70,000.

Strategy: Document your accomplishments at every stage. Don't just list your duties on your resume; quantify your impact. For example, instead of "Managed office supplies," write "Renegotiated vendor contracts for office supplies, saving the company $5,000 annually." These metrics are your leverage in salary negotiations and performance reviews.

###

Geographic Location

Where you live and work has a massive impact on your paycheck, primarily due to variations in cost of living and labor market demand. A $45,000 salary might afford a comfortable lifestyle in one city but feel like a struggle in another.

Employers use geographic pay differentials to adjust salaries. Here’s a comparison for a role like a "Bookkeeper," which has a national median salary of around $47,000 according to the BLS.

- High-Cost Metropolitan Areas:

- San Jose, CA: +29% (approx. $60,600)

- New York, NY: +22% (approx. $57,300)

- Boston, MA: +18% (approx. $55,400)

- Average-Cost Metropolitan Areas:

- Dallas, TX: +3% (approx. $48,400)

- Chicago, IL: +5% (approx. $49,300)

- Atlanta, GA: +1% (approx. $47,500)

- Lower-Cost Areas:

- Birmingham, AL: -9% (approx. $42,800)

- Cleveland, OH: -4% (approx. $45,100)

*(Data derived from analysis of cost-of-living and salary trends from Salary.com and Payscale.)*

The rise of remote work has complicated this factor. Some companies pay a national standard rate regardless of location, which can be a huge financial boon for employees in lower-cost areas. Others have implemented location-based pay, adjusting your salary if you move. When considering remote roles, it's essential to clarify the company's policy on this.

Strategy: Use online salary calculators (from Glassdoor, Salary.com, etc.) to benchmark what your target role pays in your specific city. If you live in a high-cost area, be prepared to negotiate for a salary that reflects that reality. If you have the flexibility to move or work remotely, you may find your income goes much further in a lower-cost-of-living state.

###

Company Type & Size

The type of organization you work for influences not just your salary but also the culture, pace, and nature of your benefits.

- Startups (1-50 employees): Startups may offer a base salary that is slightly below the market average. To compensate, they often offer potentially lucrative stock options, a fast-paced environment with lots of responsibility, and rapid growth opportunities. The risk is higher, but so is the potential reward and learning experience.

- Mid-Sized Companies (51-500 employees): This can often be the sweet spot. They are more stable than startups but less bureaucratic than large corporations. Salaries are typically competitive, and there is often a good balance of structured processes and entrepreneurial spirit.

- Large Corporations (500+ employees): These companies typically have very structured and well-defined salary bands. Your pay will be predictable and often accompanied by a robust, top-tier benefits package (excellent health insurance, generous 401k match, etc.). Career progression may be slower but is usually more clearly defined. Companies like Google, Microsoft, or major banks are known for paying at the top of the market for even administrative and support roles.

- Non-Profit Organizations: These organizations are mission-driven. Salaries are often 5-15% lower than in the for-profit sector for comparable roles. However, they can offer excellent work-life balance, a strong sense of purpose, and sometimes unique benefits like student loan forgiveness programs (e.g., Public Service Loan Forgiveness).

- Government (Local, State, Federal): Government jobs are known for their exceptional stability, strong benefits, and pensions—a benefit that is almost extinct in the private sector. While base salaries may start slightly lower than in the private sector, the total compensation, when factoring in job security and retirement benefits, is often highly competitive over the long term. The federal government's General Schedule (GS) pay scale provides transparent salary information; many entry-level professional roles start at the GS-5 to GS-7 level, which corresponds to the $20/hour range.

Strategy: Reflect on your personal priorities. Do you value stability and benefits above all? A large corporation or government role might be best. Do you thrive on risk and rapid growth? A startup could be a great fit. Tailor your job search accordingly.

###

Area of Specialization

Generalist roles are a great way to start, but specialization is the key to significantly increasing your income. By developing deep expertise in a high-value niche, you become less of a commodity and more of a sought-after expert.

Consider the evolution of a customer service professional:

- General Customer Service Rep ($20/hour): Answers general inquiries via phone and email.

- Technical Support Specialist ($25/hour): Specializes in troubleshooting a specific software or hardware product. Requires technical aptitude.

- SaaS Onboarding Specialist ($28/hour): Specializes in guiding new clients through the implementation of a complex Software-as-a-Service product. Requires project management and client relationship skills.

- Salesforce Administrator ($40+/hour): Specializes in customizing and managing the Salesforce CRM platform, a highly in-demand technical skill. Requires certification and deep platform knowledge.

The same pattern holds true in other fields:

- An Administrative Assistant can specialize in becoming a Legal Assistant or Paralegal, significantly increasing their earning potential.

- A Bookkeeper can specialize in a specific industry (e.g., construction or non-profit accounting) or upskill to become an Accountant by pursuing a Bachelor's degree and CPA certification.

Strategy: After a year or two in a generalist role, identify areas within your work that are particularly challenging, valuable to the company, or interesting to you. Proactively seek out projects and training in that area. This is the most direct path to breaking through salary plateaus.

###

In-Demand Skills

Beyond your job title, the specific skills you possess are what truly drive your value. Modern workplaces at all levels require a blend of durable "soft" skills and marketable "hard" skills.

High-Value Hard Skills:

- Software Proficiency: Advanced knowledge of Microsoft Office Suite (especially Excel—pivot tables, VLOOKUPs), Google Workspace, and industry-specific software (e.g., QuickBooks for finance, Adobe Creative Suite for marketing, Salesforce or Zendesk for sales/service).

- Data Management & Analysis: The ability to work with spreadsheets, databases, and data visualization tools to interpret information and generate reports.

- Project Management Tools: Familiarity with platforms like Asana, Trello, or Jira, which are used to manage tasks and workflows.

- Basic Technical Skills: Understanding of basic IT troubleshooting, HTML/CSS for web updates, or social media management can make you an invaluable asset in a non-tech role.

- Bilingualism: Fluency in a second language, particularly Spanish, is a highly sought-after skill in customer-facing roles and can often command a salary premium.

Essential Soft Skills:

- Communication (Written and Verbal): The ability to write clear, professional emails and to communicate effectively and empathetically with colleagues and clients.

- Problem-Solving: Moving beyond simply identifying problems to proactively proposing and implementing solutions.

- Time Management & Organization: The ability to prioritize tasks, manage deadlines, and work efficiently in a busy environment.

- Adaptability: A willingness to learn new technologies and processes as the business evolves.

- Emotional Intelligence: The ability to understand and manage your own emotions and to recognize and influence the emotions of those around you. This is critical for teamwork and