Earning $20 an hour is a significant financial milestone for many professionals. It represents a wage that can provide a stable foundation in many parts of the country and serves as a crucial stepping stone toward higher-paying roles. But what does that hourly rate actually mean in terms of an annual salary? And what kinds of careers operate within this pay range?

This guide breaks down the conversion from a $20 hourly wage to a yearly salary, explores the types of jobs available at this pay level, and details the key factors you can leverage to increase your earnings even further.

What Does a $20/Hour Job Look Like?

While "$20 an hour" isn't a specific job title, it's a common pay rate for a wide variety of essential and skilled roles across numerous industries. These positions often require a specific skill set, post-secondary training, or a few years of valuable experience. They are the backbone of many organizations.

Professionals earning around this rate are typically responsible for:

- Providing skilled administrative support: Managing office operations, coordinating schedules, and handling executive correspondence.

- Delivering direct customer or patient care: Assisting patients in healthcare settings, resolving complex customer issues, or providing technical support.

- Operating specialized equipment or software: Working in entry-level IT roles, performing skilled manufacturing tasks, or managing logistics.

- Performing skilled trades: Working as an apprentice or newly licensed technician in fields like HVAC, plumbing, or automotive repair.

These roles are far from "unskilled labor"; they demand reliability, problem-solving abilities, and a commitment to professional development.

Converting $20 an Hour to an Annual Salary

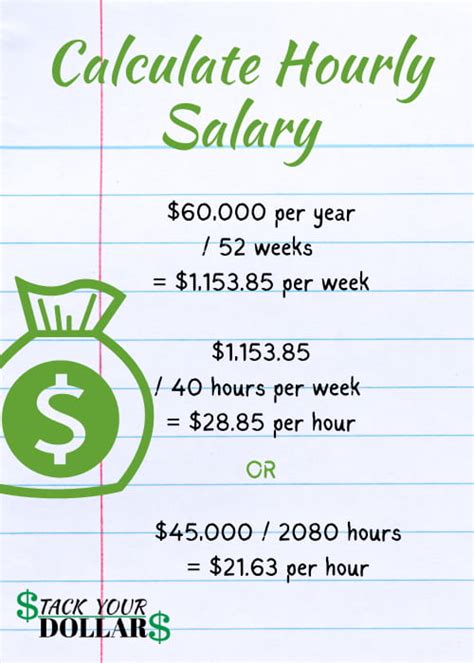

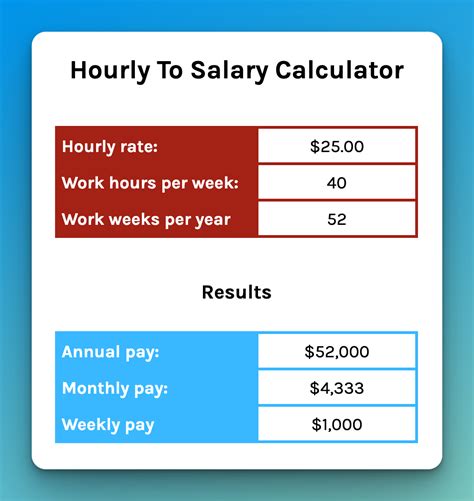

Understanding your total annual compensation is critical for budgeting, financial planning, and career negotiation. The conversion from an hourly rate to a yearly salary is straightforward.

The standard formula assumes a full-time schedule of 40 hours per week for 52 weeks a year.

- Calculation: 40 hours/week × 52 weeks/year = 2,080 hours/year

- Annual Salary: $20/hour × 2,080 hours = $41,600 per year

This $41,600 figure is your gross annual income—the total amount you earn before any deductions are taken out for taxes, health insurance premiums, or retirement contributions.

It's also important to remember that this calculation doesn't include potential overtime pay, bonuses, or the value of benefits like paid time off and employer-sponsored health insurance, which can significantly increase your total compensation package.

Key Factors That Influence Salary

While $41,600 a year is the baseline for a $20/hour job, your actual earnings and potential for growth are influenced by several critical factors. Understanding these levers is the first step toward maximizing your income.

### Level of Education

Education is often the key that unlocks the door to higher-paying jobs. While a high school diploma is sufficient for some roles in this pay range, additional training or a degree can significantly accelerate your earning potential.

- Certifications and Associate's Degrees: Many roles that pay around $20/hour, such as Certified Nursing Assistants (CNAs), Paralegals, and IT Support Technicians, require a specific certification or a two-year associate's degree. According to Payscale, a certified phlebotomist, for example, has a median wage of around $18-$20/hour, with a clear path to higher earnings with specialization.

- Bachelor's Degree: For fields like finance, marketing, or human resources, a bachelor's degree is often the entry-level requirement. New graduates may start in the $20-$25/hour range ($41k-$52k annually) and advance quickly with experience.

### Years of Experience

Experience is one of the most powerful factors in salary determination. An entry-level employee and a seasoned professional in the same role can have vastly different pay rates.

- Entry-Level (0-2 years): In many administrative or customer service roles, new employees might start closer to $16-$18 per hour. Reaching the $20/hour mark often comes after one or two years of proven performance.

- Mid-Career (3-8 years): With several years of experience, you become more efficient, knowledgeable, and independent. An administrative assistant with five years of experience, for example, might be promoted to an Executive Assistant role, earning closer to $25-$30/hour ($52k-$62k annually), according to data from aggregators like Salary.com.

### Geographic Location

Where you live and work has a massive impact on your salary. A $41,600 salary provides a very different lifestyle in Omaha, Nebraska, than it does in New York City or San Francisco due to vast differences in the cost of living.

Employers in high-cost-of-living (HCOL) areas must offer higher wages to attract talent. For instance, the U.S. Bureau of Labor Statistics (BLS) data shows that the mean hourly wage for office and administrative support occupations can be significantly higher in metropolitan areas like San Jose, CA, or Boston, MA, compared to the national average. A job that pays $20/hour in a mid-sized city might pay $25/hour or more in an HCOL urban center just to keep pace with housing and living expenses.

### Company Type

The size, industry, and structure of a company can influence its pay scales and benefits.

- Large Corporations: Major corporations often have standardized pay bands and may offer more robust benefits packages (health insurance, 401(k) matching), which add to your total compensation.

- Startups and Small Businesses: Smaller companies might offer a base salary around the $20/hour mark but could provide other incentives like flexible work arrangements or potential for faster advancement.

- Government and Non-Profit: Government jobs are known for their stability and excellent benefits, even if the base pay is sometimes slightly lower than in the private sector. Non-profits may have tighter budgets, but the mission-driven work can be a powerful non-monetary benefit for many.

### Area of Specialization

Developing a niche skillset is a surefire way to increase your value and your wage. Within a broad job category, specialists almost always earn more than generalists.

- Example in Healthcare: A general Medical Assistant might earn around $18-$20/hour. However, a Medical Assistant who specializes in a high-demand area like dermatology or cardiology can often command a higher wage.

- Example in IT: An entry-level IT helpdesk technician might earn $20/hour. But a technician with a CompTIA Security+ certification who can handle basic cybersecurity tickets may earn $23-$26/hour. According to the BLS Occupational Outlook Handbook, roles with more specialized technical demands consistently report higher median pay.

Job Outlook

The future is bright for many of the professions that fall within the $20/hour pay range. The U.S. Bureau of Labor Statistics (BLS) projects steady to strong growth in several key areas through 2032.

- Medical Assistants: The BLS projects a 14% growth for Medical Assistants, which is much faster than the average for all occupations. The median pay in May 2023 was $20.19 per hour ($42,000 per year).

- Customer Service Representatives: While overall growth is projected to decline slightly, there will still be hundreds of thousands of openings each year to replace workers who transfer or exit the labor force. The median pay was $18.99 per hour ($39,500 per year) in May 2023.

- Bookkeeping, Accounting, and Auditing Clerks: These essential roles had a median pay of $22.42 per hour ($46,640 per year) as of May 2023, offering a stable career path in nearly every industry.

These statistics confirm that jobs in this pay range are not only plentiful but also serve as gateways to stable, long-term careers.

Conclusion

Translating $20 an hour into an annual salary of $41,600 provides a clear financial baseline. However, the real story is one of opportunity. This pay rate is a launchpad into dozens of stable and growing professions.

For individuals considering a career path in this range, the key takeaways are:

1. Your Salary is a Starting Point: Use this wage as a foundation to build upon.

2. Invest in Yourself: Pursue certifications, specialized training, or a degree to dramatically increase your earning potential.

3. Experience is Currency: Every year of dedicated work makes you more valuable to current and future employers.

4. Be Strategic: Consider how your location, company choice, and area of specialization can be optimized to meet your career goals.

By understanding these dynamics, you can take control of your career trajectory, moving from a solid hourly wage to a truly rewarding and prosperous annual salary.