You see the job posting: "$20 an hour." It catches your eye. It feels solid, respectable. It represents a significant step up for many, a stable entry point for others. Annually, this figure translates to approximately $41,600 a year, a salary that places you squarely within the workforce of America. But what does that number truly mean for your career, your finances, and your future? Is it a destination, or is it a launchpad?

This guide is designed to answer those questions and more. We will move beyond the simple hourly rate to deconstruct what a $20/hr career path truly entails. This is not just about a wage; it's about the jobs that offer it, the lifestyle it supports, and the strategic steps you can take to grow far beyond it. I once coached a young professional who had just landed their first $20/hr job as an administrative coordinator. They felt they had "made it," and in many ways, they had. But the most valuable advice I shared was to view that achievement not as a ceiling, but as a newly constructed floor from which to build an incredible career.

Whether you are aspiring to earn $20 an hour, currently in a role at this pay level, or using it as a stepping stone to something greater, this comprehensive analysis will provide the expert insights, data-driven facts, and actionable strategies you need to take control of your professional journey.

### Table of Contents

- [What Kind of Jobs Pay $20 an Hour?](#what-kind-of-jobs-pay-20-an-hour)

- [Deconstructing a $20/Hour Salary: What $41,600 a Year Really Means](#deconstructing-a-20hour-salary-what-41600-a-year-really-means)

- [Key Factors That Influence Your Earnings Potential (Beyond $20/hr)](#key-factors-that-influence-your-earnings-potential-beyond-20hr)

- [Job Outlook and Career Growth for Roles in the $20/hr Range](#job-outlook-and-career-growth-for-roles-in-the-20hr-range)

- [How to Secure (and Excel in) a $20 an Hour Job](#how-to-secure-and-excel-in-a-20-an-hour-job)

- [Conclusion: Your Career is More Than a Number](#conclusion-your-career-is-more-than-a-number)

What Kind of Jobs Pay $20 an Hour?

A $20 an hour wage, or roughly $41,600 annually, is not tied to a single profession. Instead, it represents a crossroads of industries, a pay grade common to a vast array of essential and skilled roles that form the backbone of our economy. These are not just "jobs"; they are the starting points for meaningful careers in healthcare, technology, finance, skilled trades, and administration.

These positions typically require a high school diploma or equivalent, often supplemented by some college, an associate's degree, or a specialized certification. They demand a blend of technical proficiency, critical thinking, and strong interpersonal skills.

Here is a look at some of the most common occupations where a $20/hour wage is a typical starting point or median salary, with data often reflecting national averages that can be influenced by the factors we'll discuss later.

Common Jobs in the $20/Hour Range:

- Administrative and Office Support:

- Administrative Assistant: The organizational hub of an office. The median pay for Administrative Assistants is $20.91 per hour, or $43,500 per year (BLS, 2023).

- Bookkeeping, Accounting, and Auditing Clerks: Responsible for producing accurate financial records for organizations. Their median pay is $22.34 per hour (BLS, 2023).

- Executive Assistant: A more advanced administrative role supporting C-level executives. While entry-level may start near $20/hr, the median pay is significantly higher at $32.48 per hour, showing a clear growth path (BLS, 2023).

- Healthcare Support:

- Medical Assistant: Perform administrative and clinical tasks in hospitals, offices of physicians, and other healthcare facilities. The median pay is $18.94 per hour, with many certified roles in higher-cost-of-living areas easily exceeding $20/hr (BLS, 2023).

- Medical Records and Health Information Specialists: Organize and manage health information data. The median pay is $22.84 per hour (BLS, 2023).

- Pharmacy Technician: Help pharmacists dispense prescription medication. Their median hourly wage is $18.78, with hospital settings and certifications often pushing wages above the $20 mark (BLS, 2023).

- Customer and Client Services:

- Customer Service Representative: The front line of a business, handling complaints, processing orders, and providing information. The median pay is $18.86 per hour, but specialized or technical support roles often pay more (BLS, 2023).

- Bank Teller: Standard pay hovers just below this mark, but with experience, tellers can advance to "Lead Teller" or "Personal Banker" roles that pay in the $20-$25/hr range.

- Skilled Trades and Technicians:

- Entry-Level IT Support (Help Desk Tier 1): Assisting users with hardware and software issues. While national medians vary, most urban markets see starting wages for these roles in the $18-$24/hr range.

- Automotive Service Technicians and Mechanics: The median pay is $22.79 per hour, reflecting the specialized skill required (BLS, 2023).

- Maintenance and Repair Worker, General: These jacks-of-all-trades earn a median wage of $21.57 per hour (BLS, 2023).

### A "Day in the Life" Example: The Skilled Administrative Coordinator

To make this tangible, let's imagine a day for "Alex," an Administrative Coordinator earning $22 an hour at a mid-sized tech company.

- 8:45 AM: Alex arrives, fires up the computer, and reviews the calendars for the three department heads they support. They notice a scheduling conflict for a critical project meeting and immediately draft an email with proposed new times.

- 9:15 AM: The daily flood of emails has begun. Alex triages them, responding to internal inquiries, forwarding client requests to the sales team, and flagging urgent items for the department director.

- 10:30 AM: Alex processes expense reports from the previous week's conference, ensuring all receipts are attached and coded correctly in the company's accounting software.

- 12:00 PM: Lunch.

- 1:00 PM: Alex is tasked with researching and getting quotes for a team-building offsite event. They spend an hour calling venues, comparing catering packages, and compiling the options into a clear, concise spreadsheet.

- 2:30 PM: A new hire is starting next Monday. Alex coordinates with IT to ensure their laptop and accounts are ready, prepares their welcome packet, and adds their onboarding meetings to the team calendar.

- 4:00 PM: The director asks Alex to pull data from Salesforce and format it into a preliminary report for the weekly leadership meeting. Alex uses their basic Excel skills to create pivot tables and charts to visualize the data.

- 5:15 PM: After a final check of emails and tomorrow's calendar, Alex logs off, having spent the day problem-solving, communicating, and organizing—skills that are foundational for future growth into roles like Office Manager or Project Coordinator.

Deconstructing a $20/Hour Salary: What $41,600 a Year Really Means

An hourly wage is just a number. To understand its true impact, you must translate it into annual income, factor in real-world deductions, and assess the full value of the compensation package. A $20/hour job is not just about the paycheck; it's about the financial stability and benefits that come with it.

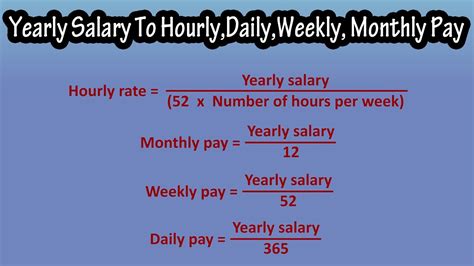

### From Hourly to Annually: The Gross Calculation

First, let's do the basic math. A standard full-time work year is considered to be 2,080 hours (40 hours per week x 52 weeks per year).

- Hourly: $20.00

- Weekly: $20 x 40 hours = $800

- Monthly: ($800 x 52 weeks) / 12 months = $3,466.67

- Annually: $20 x 2,080 hours = $41,600

This $41,600 is your gross annual income. It's the top-line number you see on your offer letter, but it's not the amount that will hit your bank account.

### Gross vs. Net Pay: The Reality of Take-Home Income

Your net pay, or take-home pay, is your gross pay minus deductions. Understanding these is critical for budgeting and financial planning.

1. Federal Income Tax: The amount withheld depends on your filing status (Single, Married Filing Jointly, etc.), the number of allowances claimed on your W-4 form, and current tax brackets. For a single filer with no dependents, this could be around 10-12% of their income at this level.

2. FICA Taxes (Social Security and Medicare): This is a flat tax. As of 2024, you pay 6.2% for Social Security (on income up to $168,600) and 1.45% for Medicare. That's a total of 7.65% deducted from every paycheck.

3. State and Local Income Taxes: This is the biggest variable. Seven states have no state income tax (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Wyoming), while others like California and New York have higher, progressive rates. Some cities also impose a local income tax.

4. Pre-Tax Deductions: These are costs taken out of your paycheck *before* taxes are calculated, which lowers your taxable income. Common examples include:

- Health, dental, and vision insurance premiums.

- Contributions to a 401(k), 403(b), or other retirement plans.

- Contributions to a Health Savings Account (HSA) or Flexible Spending Account (FSA).

Example Net Pay Calculation:

Let's estimate the take-home pay for our single filer earning $41,600, living in a state with a moderate 5% income tax.

| Description | Calculation | Amount |

| :--- | :--- | :--- |

| Gross Annual Income | | $41,600 |

| FICA Taxes | $41,600 \* 7.65% | -$3,182 |

| Federal Income Tax (est.) | Varies, approx. 12% bracket | -$3,500 |

| State Income Tax (est.) | $41,600 \* 5% | -$2,080 |

| Health Insurance Premium (est.) | $150/month \* 12 | -$1,800 |

| 401(k) Contribution (5%) | $41,600 \* 5% | -$2,080 |

| Estimated Annual Net Pay | | ~$28,958 |

| Estimated Monthly Take-Home | $28,958 / 12 | ~$2,413 |

*Disclaimer: This is a simplified estimate. Your actual net pay will depend on your specific W-4 elections, state/local laws, and the cost of your chosen benefits.*

This calculation is sobering, but it's vital. A $41,600 salary does not mean you have $3,467 a month to spend. Budgeting must be based on your net income.

### The Total Compensation Package: More Than Just the Hourly Wage

A savvy career analyst looks beyond the wage to the total compensation package. This is where a $20/hr job at one company can be vastly superior to another.

- Health Insurance: A good employer-sponsored health plan can be worth thousands of dollars a year. The average annual premium for employer-sponsored single coverage was $8,435 in 2023, with employees contributing an average of $1,401 (Source: KFF 2023 Employer Health Benefits Survey). A company covering a high percentage of this premium offers significant value.

- Retirement Savings: A 401(k) or 403(b) plan is a powerful wealth-building tool. The key is the employer match. A common match is 50% of your contributions up to 6% of your salary. For a $41,600 salary, if you contribute 6% ($2,496), your employer adds an additional $1,248. That's free money and a guaranteed 50% return on your investment.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. The U.S. average is around 10-14 days of vacation after the first year. A generous PTO policy is a significant quality-of-life benefit.

- Bonuses and Profit Sharing: While less common for hourly roles, some companies offer annual or quarterly bonuses based on company or individual performance, adding a potential boost to your annual earnings.

- Overtime Pay: As an hourly (non-exempt) employee, you are legally entitled to overtime pay—typically 1.5 times your regular rate—for any hours worked over 40 in a week. For someone earning $20/hr, overtime is paid at $30/hr. This can be a substantial way to increase income, though it shouldn't be relied upon as a permanent solution.

- Other Perks: Don't underestimate other benefits like tuition reimbursement, professional development stipends, wellness programs, and commuter benefits. A company that invests in your education is directly investing in your ability to earn more in the future.

When evaluating a job offer, always ask for the full benefits summary. A $20/hr job with a great 401(k) match and low-cost health insurance can be financially superior to a $22/hr job with poor benefits.

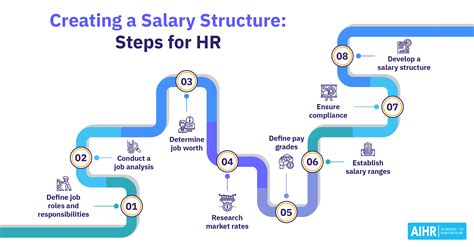

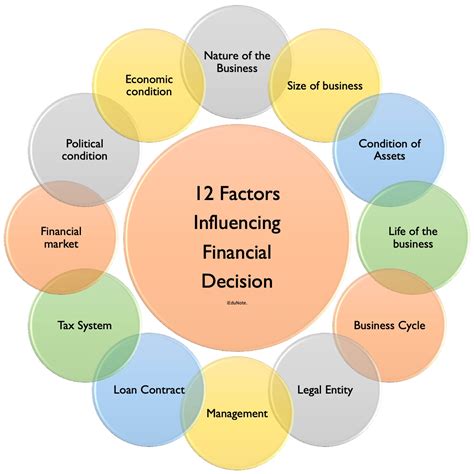

Key Factors That Influence Your Earnings Potential (Beyond $20/hr)

Earning $20 an hour is a fantastic milestone, but it should be viewed as a baseline. Your long-term career and salary growth depend on a set of key, controllable factors. Understanding and strategically leveraging these variables is the difference between stagnating at $41,600 a year and building a path toward $60,000, $80,000, and beyond. This section is your roadmap for maximizing your earning potential.

###

Level of Education and Certification

Your educational background is the foundation upon which your career is built. While many $20/hr jobs are accessible with a high school diploma, adding formal education and targeted certifications is the most reliable way to increase your value and pay grade.

- High School Diploma/GED: This is the entry ticket for many of the roles we've discussed, such as customer service, some administrative positions, and entry-level trade roles.

- Associate's Degree (A.A., A.S.): A two-year degree from a community college can significantly boost earning potential. For example, a paralegal or legal assistant with an associate's degree has a median pay of $28.53 per hour (BLS, 2023). It signals a higher level of commitment and specialized knowledge.

- Bachelor's Degree (B.A., B.S.): A four-year degree unlocks a much wider range of professional roles and higher starting salaries. An administrative assistant with a B.A. is more likely to be on a track for an Executive Assistant or Office Manager role. Workers with a bachelor's degree have median weekly earnings of $1,432, compared to $907 for those with only a high school diploma (Source: BLS, 2023). That's a staggering 58% increase in weekly income.

- Certifications: This is the most powerful tool for immediate salary growth without committing to a full degree program. Certifications validate specific, in-demand skills.

- IT: An entry-level IT Support person earning $20/hr can see their salary jump to $25-$30/hr after earning the CompTIA Network+ or Security+ certification.

- Administrative: The Professional Administrative Certification of Excellence (PACE) or becoming a Certified Administrative Professional (CAP) can distinguish you and justify a higher salary or promotion to a senior/executive assistant role.

- Bookkeeping: Becoming a Certified QuickBooks ProAdvisor or a Certified Bookkeeper (CB) can move you from a data-entry clerk to a trusted financial professional commanding a higher rate.

- Healthcare: A Pharmacy Technician who earns CPhT certification is more desirable and can command higher pay. A Medical Assistant who becomes a Certified Medical Assistant (CMA) will see similar benefits.

Action Plan: Identify a certification relevant to your desired career path. Many companies offer tuition reimbursement; use it to pay for the course and exam.

###

Years of Experience

Experience is the currency of the professional world. In almost every field, your value—and therefore your salary—grows as you transition from a novice to a seasoned expert. This is not just about time served; it's about the accumulation of skills, institutional knowledge, and proven results.

- Entry-Level (0-2 years): In this stage, you are learning the ropes. Your salary will typically be at or near the market starting rate, which could be in the $18-$22/hr range. Your focus is on mastering core job functions, being reliable, and demonstrating a willingness to learn.

- Mid-Career (3-8 years): You have moved from competence to proficiency. You can work independently, troubleshoot complex problems, and begin to mentor junior colleagues. This is where significant salary growth occurs. An Administrative Assistant might become a Senior Administrative Assistant or an Executive Assistant, with pay rising to the $25-$35/hr range ($52,000 - $72,800/year). A Tier 1 Help Desk tech becomes a Tier 2 Systems Administrator. According to Payscale, a worker with 5-9 years of experience earns an average of 14% more than someone in an entry-level position.

- Senior/Expert (8+ years): At this level, you are a strategic asset. You may be managing a team (e.g., Office Manager, IT Manager), handling the most complex accounts, or serving as the subject matter expert for your department. Your salary should reflect this expertise, often pushing well beyond $35-$40/hr. Senior Executive Assistants in major markets can earn over $100,000 annually.

Action Plan: Document your accomplishments at every stage. In your annual review, don't just say you've been there for another year. Present a portfolio of projects completed, problems solved, and value added. This justifies your request for a merit-based raise.

###

Geographic Location

Where you live and work is one of the most significant factors determining your salary. A $20/hr wage provides a comfortable lifestyle in a low-cost-of-living (LCOL) area but may be a financial struggle in a high-cost-of-living (HCOL) city. Employers must adjust pay to account for the local market.

The U.S. Bureau of Labor Statistics (BLS) provides detailed Occupational Employment and Wage Statistics (OEWS) that illustrate this starkly. Let's take Bookkeeping, Accounting, and Auditing Clerks, who have a national median wage of $22.34/hr.

- Top-Paying Metropolitan Areas:

- San Jose-Sunnyvale-Santa Clara, CA: $32.18/hr

- Washington-Arlington-Alexandria, DC-VA-MD-WV: $27.67/hr

- Seattle-Tacoma-Bellevue, WA: $27.27/hr

- Lower-Paying Nonmetropolitan Areas:

- Southwest Mississippi: $16.59/hr

- Southeast Oklahoma: $17.29/hr

This means a bookkeeper in San Jose, CA, earns nearly double what their counterpart in rural Mississippi does for the same job. Of course, the cost of housing, food, and transportation in San Jose is also exponentially higher. The rise of remote work has complicated this, with some companies paying a national rate regardless of location, while others adjust pay based on the employee's home address.

Action Plan: When job searching, use a cost-of-living calculator (like those on NerdWallet or Payscale) to compare offers in different cities. A $45,000 salary in Des Moines, Iowa might give you more disposable income than a $60,000 salary in Boston, Massachusetts.

###

Company Type & Size

The type of organization you work for has a direct impact on your compensation structure, benefits, and culture.

- Startups: Often cash-strapped, startups might offer a base salary at or slightly below the market rate. They may compensate for this with potentially valuable stock options, a fast-paced environment with rapid learning opportunities, and a more relaxed culture.

- Large Corporations (Fortune 500): These companies typically have highly structured and well-defined salary bands. The pay is often competitive and comes with robust, comprehensive benefits packages (excellent health insurance, strong 401(k) match, wellness programs). Career progression can be more linear but is often clearer.

- Small and Medium-Sized Businesses (SMBs): This is a mixed bag. Pay can vary widely. Some SMBs offer competitive pay to attract talent, while others may lag behind. Benefits may be less comprehensive than at large corporations. The advantage is often a bigger impact on the business and a close-knit team culture.

- Non-Profits: Mission-driven organizations often operate on tighter budgets, which can translate to slightly lower salaries. They often make up for this with a strong sense of purpose, good work-life balance, and sometimes, generous PTO policies.

- Government (Federal, State, Local): Government jobs are known for stability, job security, and excellent benefits, particularly pensions and healthcare. The pay is determined by structured grade levels (e.g., the GS scale for federal jobs). While starting pay might be competitive, salary growth can sometimes be slower and more rigid than in the private sector.

Action Plan: Align your job search with your priorities. If stability and benefits are paramount, target large corporations and government agencies. If you thrive on risk, rapid growth, and potential high rewards, look at startups.

###

Area of Specialization

Within any given job title, specialization can create massive pay disparities. Becoming an expert in a niche, high-demand area is a direct path to higher earnings.

- **Administrative