Earning $25 an hour represents a significant financial milestone for millions of Americans. It translates to an annual salary of approximately $52,000, a figure that places you squarely in the heart of the nation's workforce and opens up a new level of financial stability and opportunity. It’s the kind of income that can transform your budget from just surviving to consciously planning—for savings, for investments, for a better quality of life. But what does it actually take to reach this benchmark? Which careers offer this potential, and how can you strategically navigate your professional journey to secure a role at this level or beyond?

This isn't just a number; it's a testament to possessing valuable skills, demonstrable experience, and the professional acumen that employers are willing to pay for. It’s a wage that reflects competence and reliability. I’ve spent over fifteen years as a career analyst, and I once coached a client, Sarah, who felt trapped in a cycle of minimum-wage retail jobs. Together, we mapped a path for her to become a certified medical coder. The day she called to tell me she’d landed a job starting at $24.50 an hour, the relief and pride in her voice were palpable; it was the moment her career narrative changed from one of chance to one of choice.

This comprehensive guide is designed to be your roadmap to that same feeling of accomplishment. We will deconstruct the $25-an-hour figure, exploring the diverse jobs that pay this wage, the critical factors that influence your earning potential, and the concrete steps you can take to get there. Whether you are a student planning your future, a professional looking to increase your income, or a career-changer seeking a more sustainable path, this article will provide the expert insights, data-driven analysis, and actionable advice you need to achieve your goal.

### Table of Contents

- [What Kind of Work Pays $25 an Hour?](#what-kind-of-work-pays-25-an-hour)

- [Deconstructing a $25 an Hour Salary: A Deep Dive](#deconstructing-a-25-an-hour-salary-a-deep-dive)

- [Key Factors To Help You Reach and Exceed a $25 an Hour Salary](#key-factors-to-help-you-reach-and-exceed-a-25-an-hour-salary)

- [Job Outlook and Career Growth for Roles in This Range](#job-outlook-and-career-growth-for-roles-in-this-range)

- [How to Land a Job Paying $25 an Hour (or More)](#how-to-land-a-job-paying-25-an-hour-or-more)

- [Conclusion: Taking Control of Your Earning Potential](#conclusion-taking-control-of-your-earning-potential)

What Kind of Work Pays $25 an Hour?

Unlike a specific job title like "Accountant" or "Nurse," a "$25 an hour" role isn't a single destination. Instead, it's a vibrant crossroads where various professions, industries, and experience levels intersect. This pay rate signifies that an employee has moved beyond entry-level competency and possesses a set of skills and knowledge that are in consistent demand. The work is typically characterized by a greater degree of responsibility, specialized knowledge, and independent judgment than roles paying closer to the minimum wage.

Professionals earning this wage are trusted to solve problems, manage processes, and contribute directly to an organization's success. The work often requires formal training, certifications, or a few years of hands-on experience. It’s the pay grade where you’re no longer just following a script; you’re helping to write it.

Let's explore the landscape. Jobs that pay around $25 an hour span across nearly every major sector of the economy:

- Skilled Trades: These hands-on careers are the backbone of our infrastructure and are often accessible without a four-year degree. An apprentice electrician or plumber who has completed their training, or an experienced HVAC technician, can command this wage. Their work is project-based, requires deep technical knowledge, and involves critical problem-solving in residential, commercial, or industrial settings.

- Healthcare Support: With an aging population and ever-advancing medical technology, healthcare offers numerous pathways to a solid middle-class income. A Licensed Practical Nurse (LPN), a certified Medical Coder responsible for translating diagnoses into billing codes, or a senior Phlebotomist with supervisory duties can all earn in the $25/hour range. These roles demand precision, adherence to strict regulations (like HIPAA), and a high level of patient interaction.

- Technology and IT Support: In our digital world, every company is a tech company to some degree. An IT Support Specialist (Tier 2), who handles complex technical issues escalated from the help desk, or a junior Web Developer building and maintaining websites, fits squarely in this bracket. Their work involves troubleshooting, systems management, and ensuring the seamless operation of a company's digital tools.

- Business Operations and Administration: These roles are the essential gears that keep a company running smoothly. An experienced Executive Assistant managing calendars and communications for C-suite leaders, a Paralegal conducting legal research and drafting documents for a law firm, or a Project Coordinator tracking timelines and resources for a marketing team can all expect to earn $25 an hour. These positions require exceptional organizational skills, software proficiency, and professional communication.

### A "Day in the Life" at $25 an Hour

To make this more concrete, let's imagine a composite "Day in the Life" for a professional earning this wage. This individual could be a bookkeeper, a project coordinator, or a skilled technician. While their specific tasks differ, their core functions share a common DNA.

8:45 AM: Arrive at the office (or log into the remote work portal). Grab a coffee and review the day's priorities. This isn't a list handed down from a manager; it's a plan they've developed based on ongoing project needs. They check their email and professional messaging apps (like Slack or Microsoft Teams) for any urgent overnight developments.

9:15 AM: The first block of "deep work" begins. For the Paralegal, this means drafting a motion based on a partner's notes and conducting legal research using Westlaw or LexisNexis. For the IT Specialist, it's tackling a tricky escalated ticket involving a network connectivity issue, requiring them to diagnose the problem by methodically testing different variables. For the skilled Carpenter, it's arriving on-site, interpreting a complex blueprint, and beginning the precision framing for a custom build.

11:00 AM: Collaboration time. Our professional joins a team meeting. The Project Coordinator presents a status update on their project's budget and timeline, using software like Asana or Jira to illustrate progress and flag potential roadblocks. They are expected to contribute solutions, not just report problems.

12:30 PM: Lunch break. A true break to recharge.

1:30 PM: The afternoon is dedicated to a mix of tasks. The Medical Coder spends hours meticulously reviewing patient charts, ensuring every diagnosis and procedure is accurately coded in the system using ICD-10 guidelines—work that directly impacts the hospital's revenue cycle. The Executive Assistant is juggling multiple priorities: booking complex international travel for their executive, proofreading a major report, and liaising with other department heads to schedule a critical board meeting.

3:30 PM: Problem-solving. An unexpected issue arises. A supplier has delayed a critical component for the HVAC Technician. A line of code has created a bug on the website for the Junior Developer. This is where their value is truly demonstrated. They don't just pass the problem up the chain. They troubleshoot, contact vendors, collaborate with a senior developer, and work towards a solution independently.

4:45 PM: Wrap-up. They update their project tracking software, respond to final emails, and create a priority list for the next day. They have a clear sense of what they accomplished and what's next on the horizon. This sense of ownership and forward momentum is a hallmark of work at this professional level.

Deconstructing a $25 an Hour Salary: A Deep Dive

An hourly wage of $25 is more than just a number on a paystub; it's a key that unlocks a different level of financial planning and lifestyle. To truly understand its impact, we need to break it down into its annual, monthly, and weekly equivalents and consider the entire compensation picture.

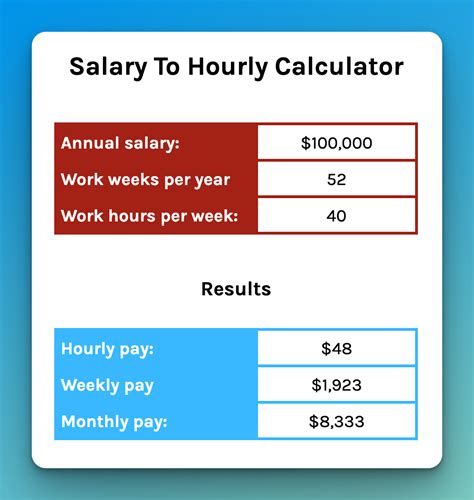

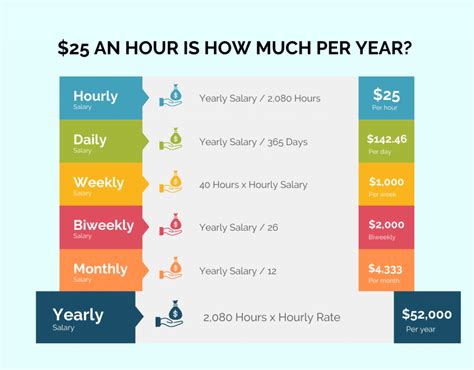

At its most basic, the calculation is straightforward:

- Annual Salary: $25/hour x 40 hours/week x 52 weeks/year = $52,000 per year (gross)

- Monthly Income: $52,000 / 12 months = $4,333 per month (gross)

- Weekly Income: $25/hour x 40 hours/week = $1,000 per week (gross)

This gross income of $52,000 is a significant figure. According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all workers in the U.S. was $48,060 in May 2023. This means that earning $52,000 places you comfortably above the national median, a position of relative financial strength.

Of course, gross income is not the same as take-home pay. After federal, state, and local taxes, Social Security, and Medicare (FICA) are deducted, the net income will be lower. The exact amount will vary significantly based on your filing status (single, married, etc.), state of residence, and any pre-tax deductions like 401(k) contributions or health insurance premiums. As a rough estimate, a single person with no dependents might see their take-home pay be around $3,200 - $3,600 per month. This is the figure you must use for budgeting for housing, transportation, food, savings, and discretionary spending.

### Salary Ranges and Career Progression

While $25 an hour is our benchmark, it's rarely a fixed, static number. It's often a midpoint in a broader salary range for a given role. A job might be advertised with a pay band of $22 to $28 per hour, with the exact figure depending on the factors we'll explore in the next section.

More importantly, $25 an hour is often a stepping stone, not a final destination. It represents a crucial pivot point where a professional has established their value and is poised for future growth. The table below illustrates how different professions can lead to a $25/hour wage at various stages of a career.

Table: Diverse Pathways to a $25 an Hour Salary

| Career Stage | Job Title Example | Typical Hourly Range | Industry/Sector | Required Education/Experience |

| :--- | :--- | :--- | :--- | :--- |

| Early Career (1-3 Years) | Junior Web Developer | $24 - $35/hr | Technology | Bachelor's Degree or Coding Bootcamp + Portfolio |

| | IT Support Specialist II | $23 - $30/hr | Technology / Corporate | Associate's Degree or Certs (e.g., CompTIA A+) + 2 yrs exp. |

| | Staff Accountant | $25 - $38/hr | Finance / Accounting | Bachelor's Degree in Accounting |

| Mid-Career (3-8 Years) | Executive Assistant | $24 - $36/hr | Corporate / Any | High School + 5-7 yrs relevant experience |

| | Paralegal | $25 - $40/hr | Legal | Associate's Degree or Paralegal Certificate + 3-5 yrs exp. |

| | Licensed Practical Nurse (LPN) | $23 - $30/hr | Healthcare | State-approved educational program (approx. 1 year) + License |

| | Electrician (Journeyman) | $25 - $45+/hr | Skilled Trades | Apprenticeship (4-5 years) + State Licensure |

| Experienced/Specialist | Senior Medical Coder | $25 - $35/hr | Healthcare | Certification (e.g., CPC) + 5+ years experience |

| | Experienced Bookkeeper | $22 - $32/hr | Small Business / Finance | Experience + Certification (e.g., QuickBooks ProAdvisor) |

| | Graphic Designer | $23 - $38/hr | Marketing / Creative | Bachelor's Degree + Strong Portfolio + 3-5 yrs experience |

*Salary data is aggregated and averaged from sources including the BLS Occupational Outlook Handbook, Salary.com, and Glassdoor, updated for 2023-2024 trends.*

This table highlights a critical point: the path to $25/hour is not monolithic. A recent computer science graduate might land a job at this rate right out of college. In contrast, an administrative professional might build their skills and experience over five or six years to achieve the same income level as an Executive Assistant. A skilled tradesperson invests years in a paid apprenticeship to reach journeyman status and the corresponding wage.

### Beyond the Hourly Wage: The Total Compensation Package

A focus solely on the hourly rate can be misleading. A comprehensive understanding of your earnings requires looking at the total compensation package. This is especially true for full-time, permanent roles, which often come with benefits that carry significant monetary value. When evaluating a job offer, consider:

- Health Insurance: Employer-sponsored health, dental, and vision insurance is a major benefit. A family plan can be worth over $20,000 per year, with the employer typically covering a large portion (e.g., 70-80%) of the premium. This is a massive, tax-free financial benefit.

- Retirement Savings: The most common plan is a 401(k) or 403(b) for non-profits. The key feature to look for is an employer match. A common match is 50% of your contributions up to 6% of your salary. For a $52,000 salary, this is an extra $1,560 per year of free money toward your retirement.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A typical package might offer 10 vacation days, 5 sick days, and 8 paid holidays, totaling 23 paid days off. At $25/hour ($200/day), this is equivalent to $4,600 of paid leave per year.

- Bonuses and Profit Sharing: While not always guaranteed, many roles in this pay bracket are eligible for performance-based bonuses or company-wide profit sharing. This can add anywhere from a few hundred to several thousand dollars to your annual income.

- Other Perks: Don't underestimate the value of other benefits like life insurance, disability insurance, tuition reimbursement, wellness stipends, and flexible work arrangements. A company that offers to pay for a certification course could be giving you a benefit worth $2,000 and boosting your future earning potential simultaneously.

When you sum these benefits, a job offering $25 an hour could have a total compensation value closer to $65,000 or more, making it far more lucrative than a freelance gig at the same hourly rate with no benefits.

Key Factors To Help You Reach and Exceed a $25 an Hour Salary

Reaching the $25-per-hour threshold is a result of a strategic combination of factors. Your value in the job market is a complex equation, and understanding the variables is the first step toward solving for a higher income. Whether you're aiming for this specific number or looking to push past it, mastering these key areas will be your most effective strategy. This section provides a deep dive into the six primary drivers of salary potential.

### 1. Level of Education and Certification

Formal education remains a cornerstone of earning potential, but the landscape is more nuanced than ever. It's not just about the degree you hold; it's about the market demand for the knowledge it represents.

- High School Diploma / GED: While a diploma is a foundational requirement for most jobs in this pay range, it's typically not sufficient on its own. The pathway to $25/hour for someone with a high school education usually involves significant on-the-job training, an apprenticeship, or specialized certifications. Example: An administrative assistant might start at $18/hour and work their way up to an Executive Assistant role at $25/hour over 5-7 years.

- Apprenticeships and Trade Schools: This is one of the most direct and cost-effective routes to a high-paying career. Programs for electricians, plumbers, HVAC technicians, and carpenters combine paid on-the-job training with classroom instruction. An apprentice may start at $16-$18/hour, but upon achieving journeyman status after 4-5 years, their wage can easily jump to $25-$35/hour or more, without the burden of student loan debt.

- Associate's Degree (A.A., A.S.): A two-year degree from a community college is a powerful and often-overlooked tool. It's highly effective for specific, in-demand fields. Example: An Associate of Science in Nursing (ASN) leads to becoming a Registered Nurse (a role that typically starts well above $25/hr). An Associate's Degree in Paralegal Studies is often the standard requirement for paralegal roles, which, according to [Payscale](https://www.payscale.com/research/US/Job=Paralegal/Salary), have a median pay of around $25/hour.

- Bachelor's Degree (B.A., B.S.): For many corporate and professional roles, a four-year degree is the price of admission. It opens doors to fields like finance, accounting, marketing, human resources, and technology. A recent graduate with a B.S. in Computer Science or a B.A. in Accounting can often secure a starting salary in the $25-$30/hour range ($52k-$62k annually). The degree signals to employers a baseline of analytical, communication, and critical thinking skills.

- Certifications: In the modern economy, skills are the primary currency. Industry-recognized certifications can dramatically increase your value, sometimes more than a traditional degree. They prove mastery of a specific tool, methodology, or body of knowledge.

- In Tech: A CompTIA A+ or Network+ can get you in the door for IT support. A Certified Associate in Project Management (CAPM) or a Google Project Management Certificate can land you a Project Coordinator role.

- In Healthcare: A Certified Professional Coder (CPC) certification is essential for medical coding. A Licensed Practical Nurse (LPN) must pass the NCLEX-PN.

- In Finance: Becoming a QuickBooks Certified ProAdvisor can elevate a bookkeeper's status and earning potential.

### 2. Years and Quality of Experience

Experience is arguably the most powerful lever you can pull to increase your salary. Employers pay for proven results and the wisdom that comes from navigating real-world challenges.

- Entry-Level (0-2 years): At this stage, you're learning the ropes. Your salary is often at the lower end of the band for your role. The focus should be on absorbing as much as possible, building a track record of reliability, and mastering the core functions of your job. An entry-level administrative assistant might earn $18-$20/hour.

- Mid-Career (3-8 years): This is the sweet spot for significant salary growth. You've moved from competence to proficiency. You can work independently, manage small projects, and begin to mentor junior colleagues. That administrative assistant, after 5 years, has become an Executive Assistant to a VP, now earning $28/hour. They have deep institutional knowledge and are trusted implicitly. According to [Salary.com](https://www.salary.com/), the median salary for an Executive Assistant in the US is around $70,000/year, or $33.65/hour, showing a clear growth path.

- Senior/Expert Level (8+ years): At this stage, you are a strategic asset. You're not just doing the work; you're improving the process. You may be managing a team, overseeing a major function, or serving as the go-to expert in a specialized area. The senior paralegal is now a paralegal manager, earning $40+/hour. The journeyman electrician has become a master electrician, running their own business and commanding $60+/hour.

The *quality* of your experience matters as much as the quantity. Simply occupying a role for five years is not enough. You must actively seek out challenging projects, quantify your achievements on your resume (e.g., "streamlined the invoicing process, reducing payment delays by 15%"), and take on leadership opportunities to accelerate your salary growth.

### 3. Geographic Location

Where you live is one of the most significant—and least flexible—factors influencing your salary. The same job with the same responsibilities can pay dramatically different amounts based on the local cost of living and labor market demand.

- High Cost of Living (HCOL) Areas: Major metropolitan centers like New York City, San Francisco, Boston, and Los Angeles have the highest salaries. A Project Coordinator role that pays $25/hour ($52k/year) in a mid-sized city might pay $35/hour ($73k/year) in San Francisco. However, this higher salary is often completely offset by exorbitant costs for housing, transportation, and taxes. A $73k salary in San Francisco may give you the same or even less disposable income than a $52k salary in Omaha, Nebraska.

- Medium Cost of Living (MCOL) Areas: Cities like Austin, Denver, Atlanta, and Charlotte offer a strong balance. They have robust job markets driving competitive wages but without the extreme costs of the HCOL hubs. These are often ideal locations for professionals in the $25/hour range, as their income goes further.

- Low Cost of Living (LCOL) Areas: Smaller cities and rural areas will generally offer lower salaries. That same Project Coordinator might earn $21/hour ($44k/year) in a small Midwestern town. While the sticker price is lower, the significantly reduced cost of living can make it an attractive financial proposition.

- The Rise of Remote Work: The post-pandemic shift to remote work has complicated this equation. Some companies have adopted location-based pay, adjusting salaries based on where the employee lives. Others have moved to a single national pay scale, which can be a huge financial boon for employees in MCOL or LCOL areas who can now access HCOL-level salaries. When applying for remote roles, it is crucial to clarify the company's policy on geographic pay adjustments.

### 4. Company Type & Size

The type of organization you work for has a profound impact on your compensation, both in terms of base salary and total benefits.

- Large Corporations (Fortune 500): These companies typically offer the highest base salaries and the most comprehensive benefits packages. They have structured pay bands, regular performance reviews, and clear paths for advancement. An IT Support Specialist at a large tech company like Google or Microsoft will likely earn significantly more than one at a small local business.

- Startups: Compensation at startups is a mixed bag. Early-stage startups may offer a lower base salary (e.g., $22/hour) but compensate with potentially valuable stock options. The work environment is often fast-paced with immense learning opportunities, but job security can be lower. Well-funded, late-stage startups often compete directly with large corporations on salary and benefits.

- Small and Medium-Sized Businesses (SMBs): These are the most common type of employer. Salaries are often tied to local market rates and the company's profitability. There may be less bureaucracy but also fewer formal opportunities for promotion. However, you can often have a greater impact and gain a broader range of experience.

- Non-Profit Organizations: Non-profits are mission-driven, which can be personally rewarding. However, they typically have tighter budgets and offer lower salaries than their for-profit counterparts. An administrative role at a charity might pay 10-15% less than the same role at a corporation. They may, however, offer better work-life balance or other unique benefits.

- Government (Federal, State, Local): Government jobs are known for their stability, excellent benefits (pensions are common), and work-life balance. While base salaries might not always match the top-tier private sector, the total compensation package is often superior. The pay structure is rigid and transparent, based on established grade levels (e.g., the GS scale for federal employees).

### 5. Area of Specialization

Generalists are valuable, but specialists command higher pay. Developing deep expertise in a high-demand niche within your field is one of the fastest ways to increase your income.

- Within IT: A general IT Support Specialist might earn $24/hour.