Introduction

Are you aiming for a $20 per hour wage? Perhaps you've just been offered a job at that rate, or maybe it’s the next financial milestone in your career journey. Reaching the $20-per-hour mark is a significant achievement for millions of workers. It represents an annual salary of approximately $41,600 before taxes, a figure that can provide a stable foundation in many parts of the country. But what does life really look like at this income level? What kinds of jobs pay this wage, and more importantly, what is the long-term career potential? This guide is designed to answer all those questions and more, serving as your definitive resource for understanding, achieving, and ultimately growing beyond a $20 per hour salary.

This figure holds a special significance for me. My first full-time job after getting a technical certification paid just under this amount, and I remember the immense pride and independence I felt. It was the first time I could comfortably cover my own rent, build a small emergency fund, and plan for the future—but it also lit a fire in me to understand how I could leverage that starting point into a more prosperous long-term career.

This comprehensive article, grounded in data from authoritative sources like the U.S. Bureau of Labor Statistics, will serve as your roadmap. We will deconstruct what a $20 per hour salary truly means for your budget and lifestyle, explore the diverse range of jobs available at this pay grade, and detail the critical factors that can help you increase your earnings. Whether you're just starting out, considering a career change, or looking to maximize your income potential, this guide will provide the expert insights and actionable steps you need to succeed.

### Table of Contents

- [What Does a $20 Per Hour Job Look Like?](#what-does-a-20-per-hour-job-look-like)

- [Deconstructing the $20/Hour Salary: A Deep Dive into Your Annual Earnings](#deconstructing-the-20-hour-salary-a-deep-dive-into-your-annual-earnings)

- [Key Factors That Influence Your Earning Potential Beyond $20/Hour](#key-factors-that-influence-your-earning-potential-beyond-20-hour)

- [Job Outlook and Career Growth from a $20/Hour Foundation](#job-outlook-and-career-growth-from-a-20-hour-foundation)

- [Your Step-by-Step Guide to Landing a $20/Hour Job (and Beyond)](#your-step-by-step-guide-to-landing-a-20-hour-job-and-beyond)

- [Conclusion: Your Career is a Journey, Not a Destination](#conclusion-your-career-is-a-journey-not-a-destination)

What Does a $20 Per Hour Job Look Like?

A $20 per hour wage isn't tied to a single profession; rather, it's a pay scale that cuts across numerous industries and roles. These positions often require a specific skill set, post-secondary training, or a few years of relevant experience, distinguishing them from entry-level, minimum-wage jobs. They are the backbone of our economy, filled by dedicated individuals who keep businesses, healthcare systems, and administrative functions running smoothly.

Jobs in this bracket typically fall into several key categories:

- Skilled & Technical Trades: These roles require hands-on skills and often involve apprenticeships or vocational training. Examples include Automotive Service Technicians, Maintenance and Repair Workers, and Carpenter Apprentices.

- Administrative & Office Support: The organizational hubs of any company, these positions demand strong communication, software proficiency, and attention to detail. Roles like Administrative Assistants, Executive Assistants, and Bookkeeping Clerks frequently fall within this pay range.

- Healthcare Support: As the healthcare industry expands, so does the need for support staff. Medical Assistants, Phlebotomists, and Pharmacy Technicians are crucial roles that often command around $20 per hour, especially with certification and experience.

- Entry-Level Technology: The tech industry offers strong starting points. An IT Help Desk Technician or a Junior Web Developer at a smaller company or in a lower cost-of-living area might start in this range before advancing.

- Customer & Client Services: More advanced or specialized customer service roles, such as a Tier 2 Customer Support Specialist or a Client Relationship Coordinator, often pay around this level, requiring problem-solving skills and product expertise.

The common thread among these diverse roles is responsibility. At $20 per hour, you are typically trusted to work more independently, manage specific projects or tasks, and apply specialized knowledge to solve problems.

### A Day in the Life: An IT Help Desk Technician

To make this more concrete, let's walk through a typical day for "Alex," an IT Help Desk Technician earning $21 per hour at a mid-sized marketing firm.

> 8:45 AM: Alex arrives, grabs a coffee, and logs into the ticketing system. Three new tickets came in overnight: one employee can't access the VPN from home, another's monitor is flickering, and a third needs access to a new software suite for an upcoming project.

>

> 9:00 AM - 11:00 AM: Alex prioritizes the tickets. The VPN issue is most urgent. Alex calls the employee, patiently walks them through troubleshooting steps, and discovers their home network firewall is blocking the connection. Alex guides them on creating an exception, resolving the issue in 20 minutes. Next, Alex heads to the user's desk to investigate the flickering monitor, determines it's a faulty cable, and replaces it with a spare from the IT closet. Finally, Alex processes the software request, ensuring the proper approvals are attached before granting the license.

>

> 11:00 AM - 12:30 PM: Alex works on a recurring task: onboarding new hires. This involves setting up laptops with the company's standard software image, creating user accounts in various systems (email, Slack, project management tools), and preparing their security badges. It's detailed, methodical work that is crucial for a new employee's first day.

>

> 1:30 PM - 3:30 PM: After lunch, Alex focuses on a small project: documenting the process for setting up the new conference room AV equipment. This involves testing the hardware, taking screenshots, and writing a clear, step-by-step guide for non-technical users. This proactive work will reduce future support tickets.

>

> 3:30 PM - 5:15 PM: The afternoon is a mix of responding to new, incoming tickets—a password reset, a printer jam, a question about using a new feature in Microsoft Teams—and continuing documentation work. Before logging off, Alex reviews the open ticket queue, adds notes to any ongoing issues, and sends a summary report to the IT Manager.

Alex’s day shows that a $20/hour job is not just about completing simple tasks. It involves problem-solving, technical knowledge, clear communication, and time management—a valuable skill set that forms the foundation for future career growth.

Deconstructing the $20/Hour Salary: A Deep Dive into Your Annual Earnings

Understanding the numbers behind a $20 per hour wage is the first step in assessing its true value for your life and career goals. While the math seems straightforward, the real-world implications depend on a variety of factors, from your work schedule to the full scope of your compensation package.

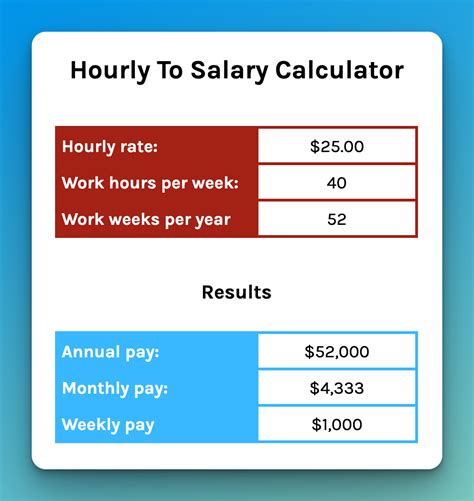

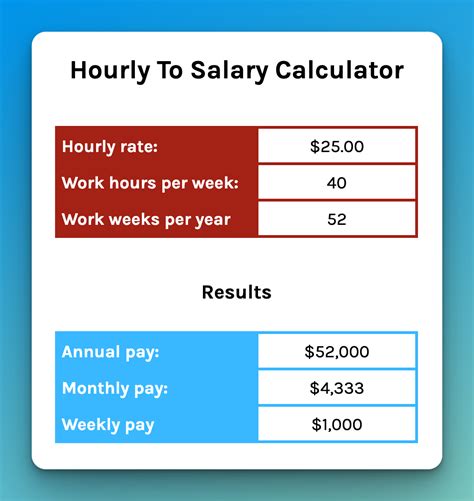

First, let's establish the baseline. A standard full-time work year is calculated as 40 hours per week for 52 weeks a year.

$20/hour × 40 hours/week × 52 weeks/year = $41,600 per year (gross salary)

This $41,600 figure is your gross annual income—the amount you earn before any deductions for taxes, insurance, or retirement savings. It's a critical number, but it doesn't tell the whole story.

### How Does $41,600 Compare?

To put this salary in context, we can compare it to national benchmarks. According to the U.S. Bureau of Labor Statistics (BLS), the median usual weekly earnings for full-time wage and salary workers in the fourth quarter of 2023 were $1,145, which translates to an annual salary of $59,540. (Source: BLS, Usual Weekly Earnings of Wage and Salary Workers, Q4 2023).

This means that a salary of $41,600 is approximately 70% of the national median income. In many low to moderate cost-of-living areas, this can be a very comfortable wage, especially for a single person or a dual-income household. However, in major metropolitan centers like New York City, San Francisco, or Boston, this salary would present significant financial challenges.

### Salary Trajectory by Experience Level

A $20 per hour wage can represent different career stages depending on the field. It might be a fantastic starting salary for one profession but a mid-career plateau for another. Here’s a general look at how this wage fits into different experience brackets for roles that commonly feature this pay scale.

| Experience Level | Typical Hourly Rate Range | Annual Salary Equivalent | Representative Job Titles |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | $17 - $22/hour | $35,360 - $45,760 | IT Help Desk Technician, Medical Assistant, Administrative Assistant, Customer Support Specialist |

| Mid-Career (3-7 years) | $23 - $30/hour | $47,840 - $62,400 | Senior Administrative Assistant, Bookkeeper, HVAC Technician, Executive Assistant |

| Senior/Experienced (8+ years) | $31 - $40+/hour | $64,480 - $83,200+ | Office Manager, Senior Paralegal, Journeyman Electrician, IT Systems Administrator |

*Note: These are generalized figures. Actual salaries vary significantly based on the factors discussed in the next section. Data synthesized from Payscale, Salary.com, and Glassdoor industry reports.*

As the table illustrates, a job paying $20/hour is an excellent launchpad. For someone starting as a Medical Assistant, it’s a competitive entry-level wage. With a few years of experience and perhaps an additional certification, they could reasonably expect to move into the $23-$28/hour range. This demonstrates the critical importance of viewing your salary not as a static number, but as a point on a dynamic career trajectory.

### Beyond the Hourly Rate: The Total Compensation Package

An expert career analyst will always advise you to look beyond the base pay. The true value of a job offer lies in its total compensation package. Two jobs offering $20/hour can have vastly different financial impacts.

Here are the key components to evaluate:

- Health Insurance: This is arguably the most valuable benefit. A good employer-sponsored health plan can be worth thousands of dollars per year. Look at the monthly premium (what you pay), the deductible (what you pay before insurance kicks in), and the co-pays. A job with a low-premium, low-deductible plan could be worth more than a slightly higher-paying job with poor or no health benefits.

- Retirement Savings: Does the company offer a 401(k) or 403(b) plan? More importantly, do they offer a company match? A common match is 50% of your contribution up to 6% of your salary. For a $41,600 salary, if you contribute 6% ($2,496), your employer would add an additional $1,248 to your retirement account. This is free money and a powerful tool for wealth-building.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A generous PTO policy provides financial security (you don't lose pay for being sick) and essential work-life balance. Ten days of PTO is effectively a bonus worth $1,600 (10 days x 8 hours/day x $20/hour).

- Overtime Pay: As an hourly employee, you are likely eligible for overtime pay (typically 1.5 times your hourly rate, or $30/hour) for any hours worked over 40 in a week. This can significantly boost your income, though it shouldn't be relied upon as a consistent source. Salaried employees, by contrast, are often "exempt" and do not receive overtime pay.

- Bonuses and Profit Sharing: Some companies offer annual or quarterly bonuses based on individual or company performance. This can add a significant, albeit variable, amount to your total earnings.

- Tuition Reimbursement & Professional Development: A company that invests in your growth is invaluable. A policy that pays for certifications, college courses, or industry conferences can directly lead to higher future earnings, making it one of the most impactful long-term benefits.

When comparing job offers, create a spreadsheet to calculate the real value of each. A $20/hour job with a great 401(k) match and excellent health insurance is often superior to a $22/hour job with no benefits.

Key Factors That Influence Your Earning Potential Beyond $20/Hour

While $20 per hour is a solid benchmark, it is by no means a ceiling. Your ability to earn significantly more is directly tied to a combination of strategic choices and market realities. As a career analyst, I've seen countless professionals transform their earning potential by focusing on these key levers. Understanding and actively managing these factors is the difference between staying at a certain wage level and building a high-growth career. This section provides an in-depth exploration of what truly moves the needle on your paycheck.

### ### Level of Education and Certification

Your formal education and specialized credentials are the bedrock of your earning potential. They signal to employers that you have a verified baseline of knowledge and a commitment to your field.

- High School Diploma vs. Post-Secondary Education: While many jobs are accessible with a high school diploma, those that consistently start at or above $20/hour often require an Associate's or Bachelor's degree. For example, the BLS notes that the median pay for paralegals and legal assistants, a field where an Associate's degree is common, was $59,200 per year ($28.46 per hour) in 2022. This contrasts sharply with roles requiring no post-secondary education, which have a much lower median pay.

- The Power of Certifications: In many skilled trades and technology fields, certifications can be even more valuable than a traditional degree. They are targeted, industry-recognized credentials that prove your proficiency with a specific skill or technology.

- In Technology: An aspiring IT professional might start at an $18/hour help desk role. By earning the CompTIA A+ and Network+ certifications, they immediately become a more attractive candidate for roles paying $22-$25/hour. Further specializing with a Cisco Certified Network Associate (CCNA) or a Microsoft Certified: Azure Fundamentals credential can push that to $30+/hour.

- In Healthcare: A Medical Assistant earning $19/hour can see their wage increase by 10-15% simply by obtaining the Certified Medical Assistant (CMA) or Registered Medical Assistant (RMA) credential. Specializing further with a certification in phlebotomy (CPT) or EKG technology (CET) adds another layer of value.

- In Skilled Trades: An apprentice electrician earning $20/hour is on a clear path. By completing their apprenticeship hours and passing the state exam to become a Journeyman Electrician, their earning potential can more than double, with median pay for electricians being $60,240 per year ($28.96 per hour) and experienced professionals earning far more (Source: BLS, Occupational Outlook Handbook).

- Tuition Reimbursement: Actively seek employers who offer tuition reimbursement. Using this benefit to pursue an Associate's or Bachelor's degree part-time while you work is one of the most powerful strategies for upward mobility. You gain experience and education simultaneously, without incurring significant student debt.

### ### Years of Experience: The Proven Growth Trajectory

Experience is the currency of the professional world. In nearly every field, there is a direct and measurable correlation between your years of relevant experience and your salary. Employers pay a premium for workers who have a proven track record of solving problems, navigating workplace challenges, and delivering results.

Let's model a hypothetical career path for an Administrative professional to illustrate this:

- Stage 1: Entry-Level (0-2 years): Administrative Assistant

- Salary: $18 - $21/hour ($37,440 - $43,680)

- Responsibilities: Answering phones, scheduling meetings, data entry, managing office supplies. The focus is on executing tasks as directed.

- Stage 2: Mid-Career (3-7 years): Executive Assistant

- Salary: $25 - $35/hour ($52,000 - $72,800)

- Growth Levers: At this stage, you've mastered the basics. You're now supporting a high-level executive or a team. You anticipate needs, manage complex calendars, prepare reports, and act as a gatekeeper. You've demonstrated reliability and discretion. Your value has shifted from *doing tasks* to *enabling productivity*.

- Stage 3: Senior/Managerial (8+ years): Office Manager or Senior Executive Assistant

- Salary: $38 - $50+/hour ($79,040 - $104,000+)

- Growth Levers: You are now a strategic partner. As an Office Manager, you oversee all administrative operations, manage budgets, negotiate with vendors, and supervise junior staff. As a Senior EA to a C-suite executive, you might manage board meeting logistics, handle confidential communications, and lead special projects. Your value is now in *strategic operational management*.

This trajectory, supported by salary data from aggregators like Salary.com, shows that a starting point of around $20/hour can realistically double within a decade through consistent performance and skill development.

### ### Geographic Location: The Cost-of-Living Factor

Where you live is one of the single most significant factors determining both your salary and how far that salary goes. A $20/hour wage can feel vastly different in a small town in the Midwest compared to a major coastal city.

Companies adjust their pay scales based on the local cost of living and the demand for labor. Here's a comparative analysis for a common role, the Bookkeeping Clerk, which has a national median pay of around $22.25/hour, making $20/hour a common starting wage.

| City | Estimated Average Hourly Wage for Bookkeeper | Cost of Living Index (100 = National Avg) | Analysis |

| :--- | :--- | :--- | :--- |

| New York, NY | $28.50 | 227.8 | A $20/hr wage would be significantly below the market rate and extremely difficult to live on due to the exorbitant cost of living. |

| San Francisco, CA | $29.75 | 269.3 | Similar to NYC, the high prevailing wage is a direct response to the nation's highest cost of living. A $41,600 salary is not sustainable here. |

| Chicago, IL | $24.00 | 118.2 | The market rate is higher than the national average. $20/hr would be a low starting wage, and while the COL is higher, it's more manageable than NYC/SF. |

| Dallas, TX | $22.50 | 103.5 | Dallas is very close to the national average in both pay and cost. A $20/hr wage is a reasonable entry-point and provides a decent standard of living. |

| Omaha, NE | $20.75 | 89.1 | Here, a $20/hr wage is right at the local market rate. Because the cost of living is over 10% below the national average, your purchasing power is significantly higher. |

*(Salary data synthesized from Glassdoor and Payscale, May 2024. Cost of Living data from Payscale.)*

Actionable Advice:

- Before moving for a job: Use online cost-of-living calculators to compare your current salary to the offer in the new city. An offer of $22/hour in a city that's 20% more expensive is effectively a pay cut.

- Leverage remote work: The rise of remote work has created a new arbitrage opportunity. If you can secure a job with a company based in a high-cost-of-living area (that pays accordingly) while you live in a low-cost-of-living area, you can dramatically increase your disposable income.

### ### Company Type, Size, and Industry

The type of organization you work for plays a huge role in your compensation and career opportunities.

- Startups vs. Large Corporations: A small, early-stage startup might offer a lower base salary but compensate with potentially valuable stock options and a fast-paced learning environment. A large, established corporation (e.g., a Fortune 500 company) will typically offer higher base pay, more structured salary bands, and robust benefits packages (better health insurance, larger 401k match, pensions).

- Non-Profit vs. For-Profit: For-profit companies are designed to generate revenue, which directly funds salaries. As a result, they generally pay more than non-profits for similar roles. However, non-profit work can offer immense personal satisfaction and unique experiences.

- Government Roles: Local, state, and federal government jobs are known for stability, excellent benefits (especially pensions, which are rare in the private sector), and strong work-life balance. The base pay may sometimes lag behind the top-tier private sector, but the total compensation package is often superior when accounting for job security and retirement benefits.

- Industry Matters: The industry you're in has a massive impact. An Administrative Assistant in the high-margin tech or finance industry is likely to earn more than an Administrative Assistant in the retail or hospitality sector, even if their core duties are identical. This is because their work supports a more profitable enterprise.

### ### Area of Specialization

Generalists are valuable, but specialists are paid a premium. Developing deep expertise in a specific niche is one of the fastest ways to increase your earning potential.

Let’s reconsider the IT Help Desk Technician role at $21/hour. Here are a few specialization paths they could take:

- Cybersecurity: By focusing on security-related tickets, pursuing certifications like CompTIA Security+ or Certified Ethical Hacker (CEH), they can transition into a Junior Security Analyst role, where starting salaries are often in the $65,000-$80,000 range.

- Cloud Computing: By learning the fundamentals of AWS, Microsoft Azure, or Google Cloud Platform and getting a foundational certification, they can move into a Cloud Support or Junior Cloud Administrator role, with salaries quickly climbing past $70,000.

- Network Administration: By mastering routing, switching, and firewall configuration and earning the CCNA, they can become a Network Administrator, a role with a median salary well over $80,000 per year, according to Salary.com.

This principle applies across fields. A general bookkeeper can specialize in forensic accounting. A general paralegal can specialize in high-demand patent law. A general marketing coordinator can specialize in technical SEO or paid ad management. Specialization equals value, and value commands a higher salary.

### ### In-Demand Skills (Hard and Soft)

Finally, your specific skill set is what you bring to the table every day. Cultivating high-value skills is a direct investment in your income.

High-Value Hard Skills:

- Data Analysis: Even basic proficiency in Microsoft Excel (PivotTables, VLOOKUPs, functions) can set you apart