Introduction

Have you ever wondered about the crucial, behind-the-scenes roles that keep the global economy turning? In the vast, multi-trillion-dollar insurance industry, one such role stands out as both a vital support function and a strategic entry point into a lucrative career: the Underwriting Assistant. While underwriters make the final decisions on risk, it's their assistants who build the foundation for every sound judgment, meticulously gathering, organizing, and verifying the data that underpins it all. This is a career for the detail-oriented, the analytically minded, and those who find deep satisfaction in creating order from chaos.

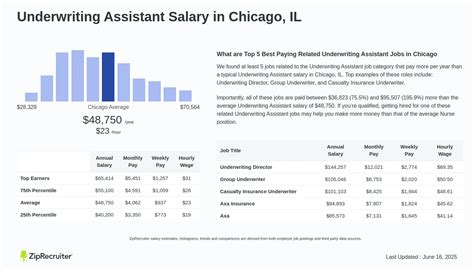

For those considering this path, the immediate question is often about compensation. The underwriting assistant salary is not only competitive for an entry-to-mid-level professional role but also serves as a springboard to significantly higher earnings. Nationally, you can expect an average salary in the range of $50,000 to $60,000, with entry-level positions often starting in the mid-$40,000s and experienced senior assistants commanding salaries well over $70,000, particularly in high-cost-of-living areas or specialized fields.

I once worked alongside an underwriting team for a complex commercial property portfolio. A senior underwriter told me something I've never forgotten: "Anyone can decline a bad risk. A great underwriter, with the help of a phenomenal assistant, can find a way to profitably write a *complicated* risk." That's the power of this role—you are not just a processor of paperwork; you are an enabler of smart business and a guardian of the company's bottom line.

This guide is designed to be your single, most comprehensive resource on the underwriting assistant career. We will dissect salary expectations, explore the factors that can maximize your income, map out your career trajectory, and provide a step-by-step plan to get you started.

---

### Table of Contents

- [What Does an Underwriting Assistant Do?](#what-does-an-underwriting-assistant-do)

- [Average Underwriting Assistant Salary: A Deep Dive](#average-underwriting-assistant-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does an Underwriting Assistant Do?

At its core, an Underwriting Assistant (UA)—also known as an Underwriting Technician or Associate—is the primary support system for one or more underwriters. While the underwriter is the final decision-maker on whether to accept, modify, or decline an insurance application, the UA is the engine that drives the entire process forward. They are the gatekeepers of information, ensuring that every piece of data is accurate, complete, and properly organized before it reaches the underwriter's desk.

This role is a dynamic blend of administrative prowess, analytical thinking, and client communication. You are the central hub connecting insurance agents, brokers, and internal departments. Your efficiency and attention to detail directly impact the team's productivity, profitability, and service levels. An underwriter with a top-tier assistant can handle a significantly larger and more complex book of business than one without.

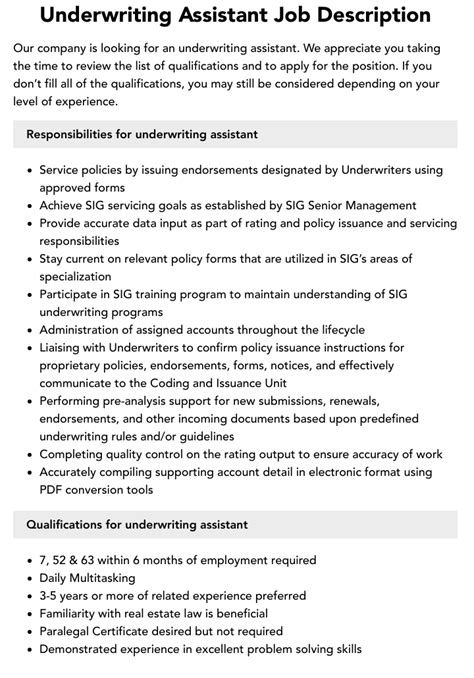

Core Responsibilities and Daily Tasks:

The day-to-day duties of an underwriting assistant are varied but revolve around the life cycle of an insurance policy. Key tasks include:

- Application Triage and Data Entry: Receiving new business applications, renewal requests, and policy change endorsements from agents. You'll be the first to review these submissions for completeness and accuracy, entering critical data into the company’s policy administration system (like Guidewire, Duck Creek, or Applied Epic).

- Information Gathering and Verification: This is a crucial function. You will order and review necessary reports to assess risk. This can include Motor Vehicle Reports (MVRs) for auto insurance, property inspection reports, credit checks, or loss history reports from previous insurers.

- Preliminary Risk Assessment: While you don't make the final call, you will often perform an initial evaluation against pre-defined company guidelines. For example, you might flag an application that has too many prior claims or a property with a specific, high-risk feature (like an old roof or a swimming pool without a fence), bringing it to the underwriter's immediate attention.

- Communication and Correspondence: You are a primary point of contact for insurance agents. You will handle inquiries about the status of applications, request missing information, and communicate the underwriter's decisions or requirements. This requires professional and clear communication skills, both written and verbal.

- Policy Processing and Issuance: Once an underwriter approves an application, the UA is often responsible for processing the policy. This involves preparing the final policy documents, binders (temporary proof of insurance), and invoices, and ensuring they are delivered to the agent or insured accurately and on time.

- File Management and Documentation: Maintaining meticulous digital (and sometimes physical) files for each policy is paramount. Every email, report, and decision must be documented in the system, creating a clear audit trail for future reference, claims handling, or regulatory reviews.

### A "Day in the Life" of an Underwriting Assistant

- 8:30 AM: Log in and review the team's shared inbox. You see five new business submissions, a dozen requests for policy changes (endorsements), and a few status inquiries from agents. You prioritize the new business applications first.

- 9:00 AM: You begin processing a new application for a commercial auto policy. You enter the business information, vehicle details, and driver data into the system. You notice one driver's date of birth is missing. You send a polite, clear email to the agent requesting the information.

- 10:30 AM: For a new homeowners' application, you order a property inspection report and a CLUE (Comprehensive Loss Underwriting Exchange) report to check for prior claims history.

- 11:30 AM: An agent calls to ask about the status of a quote submitted yesterday. You quickly look up the file, see the underwriter has reviewed it and is waiting on one more piece of financial information. You relay this to the agent, providing a clear next step.

- 1:00 PM: After lunch, you focus on renewals. You run several renewal policies through the system, noting any that have had significant claims in the past year. You prepare these "flagged" files with summary notes for the underwriter's review.

- 2:30 PM: The reports you ordered this morning have come in. The homeowner's CLUE report is clean, but the property inspection notes the roof is 25 years old, which is outside your company's guidelines. You attach the report to the file and add a note for the underwriter: "Approved pending underwriting review of roof age."

- 4:00 PM: The underwriter has approved three new policies. You move into processing mode, issuing the official policy documents and binders and sending them electronically to the respective agents.

- 5:00 PM: You do a final check of your inbox, respond to a few last-minute emails, and create your to-do list for tomorrow, ensuring a smooth start to the next day.

This structured, task-oriented work provides a tangible sense of accomplishment and is the bedrock of a successful underwriting operation.

Average Underwriting Assistant Salary: A Deep Dive

Understanding the financial landscape is critical when evaluating any career path. The underwriting assistant role offers a competitive salary that provides a stable foundation and significant room for growth. Compensation is not just a single number; it's a combination of base salary, experience, location, and other financial incentives.

### National Averages and Salary Ranges

To get a comprehensive picture, we'll synthesize data from several authoritative sources. It's important to note that different platforms use different data sets and methodologies, but together they paint a clear picture.

- Salary.com: As of late 2023, Salary.com reports the median salary for an Underwriting Assistant I (entry-level) in the United States is $50,296. The typical range falls between $44,888 and $57,094. For a more experienced Underwriting Assistant II, the median salary increases to $57,208, with a range of $50,916 to $64,801.

- Payscale: Payscale provides a slightly different view, reporting an average salary for an Underwriting Assistant at $48,935. Their data shows a broad range, typically from $37,000 to $65,000, which reflects the wide variance based on the factors we'll discuss later.

- Glassdoor: Based on user-submitted data, Glassdoor reports a total pay estimate of $57,639 per year for Underwriting Assistants in the United States, with an average base salary of $51,190. The "likely range" for total pay is between $48,000 and $70,000.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups Underwriting Assistants under the broader category of "Insurance Claims and Policy Processing Clerks." For this group, the median annual wage was $46,550 in May 2022. The lowest 10 percent earned less than $35,270, and the highest 10 percent earned more than $65,300. While this category is broader, it confirms the general salary bracket.

Synthesizing this data, a realistic expectation for a candidate with a solid educational background and relevant skills is a starting salary in the $45,000 to $52,000 range. With a few years of experience, this can quickly climb into the $55,000 to $65,000 range.

### Salary Progression by Experience Level

Your value—and therefore your salary—grows significantly as you gain experience, master complex tasks, and demonstrate your reliability. Here’s a typical progression:

| Experience Level | Typical Salary Range (Annual) | Key Responsibilities & Capabilities |

| :--- | :--- | :--- |

| Entry-Level (0-2 years) | $42,000 - $53,000 | Focus on data entry, processing simple renewals and endorsements, ordering standard reports, and learning company guidelines and systems. Requires heavy supervision. |

| Mid-Career (3-5 years) | $52,000 - $64,000 | Handles more complex new business submissions and endorsements. Communicates independently with agents. May have limited authority to approve very simple, "in-the-box" risks. Begins training new assistants. |

| Senior/Lead (6+ years) | $60,000 - $75,000+ | Manages the most complex files, including large accounts. Acts as a subject matter expert on workflows and systems. Audits the work of other assistants, leads training, and works with IT on system improvements. May have small underwriting authority. |

*Sources: Data synthesized from Salary.com, Payscale, and Glassdoor, 2023.*

### Beyond the Base Salary: Understanding Total Compensation

Your paycheck is only one part of the equation. The insurance industry, particularly larger carriers, is known for offering robust benefits packages that significantly increase your total compensation.

- Annual Bonuses: This is a very common component. Bonuses are typically tied to both individual performance (quality, efficiency) and company performance (profitability). According to Payscale, the average bonus for an Underwriting Assistant is around $2,000, but this can vary widely. For a strong performer in a profitable year, a bonus of 5-10% of base salary is achievable at many companies.

- Profit Sharing: Some companies, especially mutual insurance companies (owned by policyholders), offer profit-sharing plans. At the end of a profitable year, the company distributes a portion of its profits to employees. This can add a significant, albeit variable, amount to your annual income.

- Health and Wellness Benefits: This is a major value-add. Most mid-to-large size insurance companies offer comprehensive benefits packages, including:

- Medical, dental, and vision insurance with competitive premiums.

- Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA).

- Life and disability insurance (short-term and long-term).

- Retirement Savings: A 401(k) or 403(b) plan is standard. The key differentiator is the employer match. A common matching formula is 100% of your contributions up to the first 3-6% of your salary. This is essentially free money and a critical tool for building long-term wealth.

- Paid Time Off (PTO): Expect a competitive PTO package that includes vacation days, sick leave, and paid holidays. This typically increases with seniority.

- Tuition Reimbursement and Professional Development: This is a hugely valuable benefit in this industry. Many companies will pay for you to pursue industry-specific designations like the Associate in General Insurance (AINS) or the highly respected Chartered Property Casualty Underwriter (CPCU). Earning these can cost thousands of dollars, and having your employer foot the bill is a massive financial and career-boosting perk.

When comparing job offers, it's essential to look at the entire compensation package. A job with a slightly lower base salary but an excellent bonus structure, a generous 401(k) match, and full tuition reimbursement may be far more valuable in the long run.

Key Factors That Influence Salary

While national averages provide a useful benchmark, your individual earning potential as an underwriting assistant is determined by a combination of several key factors. Understanding and strategically navigating these variables is the key to maximizing your income throughout your career. This is where you can move from an average earner to a top-tier professional.

### ### Level of Education

While a four-year degree is not always a strict requirement, it is increasingly preferred and directly impacts your starting salary and long-term growth potential.

- High School Diploma or GED: This is the minimum requirement for many entry-level UA positions, particularly at smaller agencies or in processing-heavy roles. However, candidates with only a high school diploma may find themselves on the lower end of the salary spectrum, likely starting in the low-to-mid $40,000s. Advancement to higher-paying senior assistant or full underwriter roles can be more challenging without further education.

- Associate's Degree: An Associate's degree, especially in Business, Accounting, or a related field, makes you a more competitive candidate. It signals a higher level of commitment and foundational knowledge. Employers are often willing to offer a higher starting salary, potentially in the mid-to-high $40,000s, and it provides a stronger base for future promotions.

- Bachelor's Degree: This is the gold standard for those with serious career ambitions in underwriting. A Bachelor's degree in Business Administration, Finance, Economics, Risk Management, or Mathematics is highly desirable. Graduates can often command starting salaries in the $50,000 to $55,000 range. More importantly, a bachelor's degree is often a prerequisite for entry into an underwriter training program, which is the primary pathway to a six-figure income.

- Professional Certifications and Designations: This is where you can truly differentiate yourself and justify a higher salary. The insurance industry places immense value on specialized knowledge.

- Associate in General Insurance (AINS): This is a fantastic entry-level designation from The Institutes. It demonstrates a commitment to the industry and provides foundational knowledge of insurance principles and policies. Earning this can easily justify a raise or a higher starting salary.

- Chartered Property Casualty Underwriter (CPCU): This is the premier designation in the property and casualty industry, often referred to as the "PhD of insurance." While UAs don't typically hold this, actively working towards it signals immense ambition. Many companies offer salary bumps or bonuses for each completed CPCU exam and a significant increase upon completion of the full designation. It is the clearest sign that you are on the path to becoming a full underwriter.

### ### Years of Experience

As detailed in the previous section, experience is perhaps the most significant driver of salary growth in this role. The journey from a novice to a seasoned expert is directly reflected in your paycheck.

- 0-2 Years (The Learning Phase): Your primary value is your potential. Your salary ($42k-$53k) reflects the investment the company is making to train you. Your focus is on mastering the fundamentals: system navigation, basic product knowledge, and efficient processing.

- 3-5 Years (The Proficient Phase): You are now a reliable, independent contributor. You understand the nuances of the business and can handle a moderate volume of complex work with minimal supervision. Your salary growth reflects this increased responsibility ($52k-$64k). You may start to informally mentor junior team members.

- 6-8 Years (The Senior/Lead Phase): You are a subject matter expert. You are the go-to person for complex procedural questions and can troubleshoot issues that stump others. You may lead projects, formally train new hires, and work with underwriters on their most important accounts. Your salary ($60k-$75k+) reflects your role as a linchpin of the team.

- 8+ Years (The Pathway to Underwriting): At this stage, a highly skilled and ambitious UA is often at a crossroads. Many make the leap into an Underwriter Trainee role. This transition can sometimes involve a lateral salary move initially, but it unlocks a much higher long-term earning potential. An entry-level Underwriter I salary often starts in the $65,000 to $80,000 range, quickly accelerating past $100,000 with experience.

### ### Geographic Location

Where you work matters—a lot. Salaries for underwriting assistants can vary by as much as 25-30% or more based on the state and metropolitan area, driven primarily by the local cost of living and the concentration of insurance industry headquarters.

High-Paying States and Metropolitan Areas:

Cities with major insurance hubs or extremely high costs of living consistently offer the highest salaries.

| Metropolitan Area | State | Why It Pays More | Typical Salary Range for Mid-Career UA |

| :--- | :--- | :--- | :--- |

| San Jose / San Francisco Bay Area | CA | Extremely high cost of living, presence of tech-focused insurers. | $65,000 - $85,000+ |

| New York City | NY | High cost of living, global financial and insurance center. | $62,000 - $80,000 |

| Boston | MA | High cost of living, home to major national carriers like Liberty Mutual. | $60,000 - $78,000 |

| Hartford | CT | Known as the "Insurance Capital of the World," high demand for talent. | $58,000 - $75,000 |

| Chicago | IL | Major Midwest insurance hub for numerous large carriers. | $56,000 - $72,000 |

| Des Moines | IA | Unexpected hub; high concentration of life/health insurance HQs. | $55,000 - $70,000 |

*Source: Salary data is an estimated synthesis from BLS, Salary.com, and cost-of-living calculators for 2023.*

Average and Lower-Paying Regions:

Conversely, salaries tend to be lower in states with a lower cost of living and less of an insurance industry presence. States in the Southeast (excluding major hubs like Atlanta) and parts of the Mountain West often fall into this category, with typical salaries potentially 10-15% below the national average. However, the purchasing power of that salary may be equivalent or even greater than in a high-cost area. The rise of remote work has started to blur these lines, but location-based pay adjustments are still common practice.

### ### Company Type & Size

The type of company you work for can have a profound impact on your salary, benefits, and work environment.

- Large National Carriers (e.g., Progressive, The Hartford, Travelers): These companies typically offer the most structured career paths and robust benefits packages. Their salaries are often competitive and well-defined by level and experience, but may be less negotiable. They are more likely to have large budgets for training and development, including tuition reimbursement for designations like the CPCU.

- Regional Insurance Companies: These mid-sized carriers can be a sweet spot. They may offer salaries competitive with the large nationals but with a potentially better work-life balance and a more tight-knit culture. You may have more visibility and opportunity to take on varied responsibilities sooner.

- Managing General Agents (MGAs) and Wholesalers: MGAs act as intermediaries between retail agents and insurance carriers, often handling specialized or hard-to-place risks. Working here can be dynamic and fast-paced. Salaries can be very competitive, sometimes with stronger bonus potential tied directly to the business you help write. This environment can provide excellent exposure to unique and complex underwriting challenges.

- Small, Local Agencies: While these companies employ UAs, the role might be blended with other customer service or administrative duties. The base salary might be on the lower end of the national spectrum, but there could be opportunities for commissions or bonuses tied to agency growth. This is a great place to learn the business from the ground up.

### ### Area of Specialization

Not all insurance is created equal. The complexity and profitability of the line of business you support directly influence your value and pay.

- Commercial Lines vs. Personal Lines: This is the most significant split.

- Personal Lines (Auto, Home): These policies are highly standardized and often processed in high volume. The underwriting rules are more rigid and automated. UA roles in personal lines are excellent entry points but tend to top out at the lower end of the senior salary scale.

- Commercial Lines (Business Property, General Liability, Workers' Comp): These policies are far more complex, unique, and require more in-depth analysis. A small business policy is simpler, but a large manufacturing or construction account involves millions of dollars in exposure. UAs in commercial lines, especially those supporting middle-market or large national accounts, are highly valued and command higher salaries due to the specialized knowledge required.

- Property & Casualty (P&C) vs. Life & Health:

- P&C: This is the largest sector and encompasses both personal and commercial lines. The skills are widely transferable.

- Life & Health: This is a more specialized path. The underwriting process involves analyzing medical records, lifestyle factors, and financial justifications. An underwriting assistant in this field (sometimes called a New Business Coordinator or Case Manager) develops a deep, specialized skill set. Salaries are comparable to P&C, with high-paying niches in areas like long-term care or disability insurance.

- Niche Specialties (Surplus Lines, Cyber, Marine, Professional Liability): Working in a highly specialized, high-margin field can be very lucrative. These "specialty lines" require deep domain expertise. A UA who becomes an expert in gathering the specific data needed for cyber liability or errors & omissions (E&O) policies is a rare and valuable asset, which is reflected in their compensation.

### ### In-Demand Skills

Beyond your formal qualifications, a specific set of hard and soft skills can make you a top-tier candidate and justify a higher salary.

- Technical Proficiency: Mastery of core industry software is a must. Experience with specific policy administration systems like Guidewire, Duck Creek, or Applied Systems is a huge plus. Advanced proficiency in Microsoft Excel (pivot tables, VLOOKUP) for analyzing data and reports is also highly valued.

- Analytical Mindset: The ability to look at a set of documents and spot inconsistencies, red flags, or missing information is the core of the job. You need to be able to think critically and connect the dots.

- Exceptional Attention to Detail: In insurance, a misplaced decimal point or an incorrect date of birth can have major financial and legal consequences. Your ability to be meticulous and accurate is non-negotiable and highly compensated.

- Superior Communication Skills: You must be able to write clear, concise, and professional emails and speak confidently with agents and colleagues. The ability to explain complex requirements simply is a key skill.

- Time Management and Organization: You will be juggling multiple applications, deadlines, and requests simultaneously. The ability to prioritize tasks effectively using tools like Outlook, Asana, or a simple to-do list is essential for success and for handling a larger, more valuable workload.

- Problem-Solving: When an agent is frustrated or a file is stuck, can you figure out the bottleneck and propose a solution? Proactive problem-solvers are invaluable and are quickly identified as future leaders.

By focusing on these key areas, you can proactively build a profile that commands a top-of-market underwriting assistant salary and sets you up for long-term career success