Introduction

In the intricate world of work, few numbers carry as much weight as your salary. It's more than just a figure on a paycheck; it's a measure of value, a tool for financial security, and a key driver of career decisions. Now, in 2025, one specific number—the federal salary threshold for overtime pay—is set to redefine the financial landscape for millions of American workers and the companies they work for. This change isn't just a bureaucratic update; it's a catalyst, highlighting the critical importance of a specialized and increasingly vital profession: the Compensation Manager or Analyst.

These are the professionals who navigate the complex intersection of law, finance, and human resources. They are the architects of pay structures, ensuring that compensation is not only competitive and fair but also legally compliant. With the median salary for Compensation and Benefits Managers hovering around $136,380 per year according to the U.S. Bureau of Labor Statistics, it's a career path that offers substantial financial rewards alongside significant strategic impact. As a career analyst who has spent over two decades in and around human resources, I've seen firsthand how a well-designed compensation strategy can transform a company's culture and performance. I vividly recall a time a previous overtime rule change was announced, sending ripples of panic through leadership. It was the calm, data-driven expertise of our compensation director that turned chaos into a structured, strategic plan, saving the company from massive compliance risks and boosting morale among newly eligible employees. That moment crystallized for me that compensation isn't just about numbers; it's about stability, strategy, and respect.

This guide is designed to be your definitive resource for understanding not only the implications of the 2025 salary threshold but also the rewarding career path dedicated to mastering it. We will dissect the role of a compensation professional, explore the significant earning potential, and provide a step-by-step roadmap for those inspired to pursue this field. Whether you're an employee curious about your pay, an HR professional looking to specialize, or a student charting your future, this article will equip you with the knowledge you need to thrive.

### Table of Contents

- [What Does a Compensation Manager Do?](#what-does-a-compensation-manager-do)

- [Average Compensation Manager Salary: A Deep Dive](#average-compensation-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Compensation Manager Do?

At its core, the role of a Compensation Manager or Analyst is to design, implement, and manage a company's entire compensation structure. They are the strategic thinkers who answer the fundamental question: "How do we pay our people fairly, competitively, and legally?" This goes far beyond simply processing payroll. They are internal consultants, data scientists, and legal experts rolled into one, ensuring that every dollar spent on salary, bonuses, and incentives drives business goals and fosters employee engagement.

Their work is a meticulous blend of art and science. The "science" involves rigorous data analysis—benchmarking jobs against market data, conducting salary surveys, analyzing pay equity across demographics, and modeling the financial impact of pay-related decisions. The "art" lies in understanding the unique culture of their organization, communicating complex pay information clearly, and balancing the competing needs of employees, managers, and the company's budget.

Core Responsibilities and Daily Tasks:

A compensation professional's responsibilities are diverse and strategically critical. Here’s a breakdown of their typical duties:

- Job Analysis and Evaluation: They systematically study jobs to determine the tasks, responsibilities, skills, and knowledge required. Using this information, they assign a "value" to each role within the organization, often creating a formal job leveling and grading structure.

- Market Pricing and Benchmarking: They are constantly gathering and analyzing external salary data from surveys and industry reports to ensure their company's pay is competitive. This helps attract and retain top talent.

- Salary Structure Design: They create the formal salary ranges (minimum, midpoint, maximum) for every job grade. This structure provides a consistent and equitable framework for all pay decisions, from hiring offers to promotions.

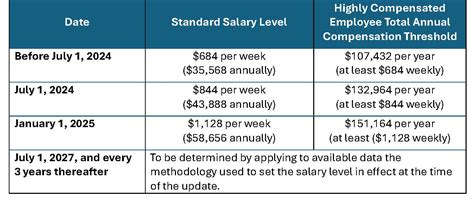

- Compliance and Governance: This is where the 2025 salary threshold comes into sharp focus. A primary duty is ensuring all pay practices comply with federal, state, and local laws, most notably the Fair Labor Standards Act (FLSA), which governs minimum wage and overtime pay. They determine which employees are "exempt" (salaried, not eligible for overtime) and "non-exempt" (hourly, eligible for overtime) and ensure the company adheres to the rules.

- Incentive and Bonus Plan Management: They design and administer short-term and long-term incentive plans, such as annual bonuses, sales commissions, and stock options, aligning these rewards with individual and company performance.

- Pay Equity Audits: With a growing focus on Diversity, Equity, and Inclusion (DEI), compensation professionals conduct regular audits to identify and remedy any pay gaps based on gender, race, or other protected characteristics.

- Communication and Training: They are responsible for communicating the company's compensation philosophy to employees and training managers on how to make sound and fair pay decisions.

### A Day in the Life of a Senior Compensation Analyst

To make this role more tangible, let's imagine a typical day for "Alex," a Senior Compensation Analyst at a mid-sized tech company.

- 8:30 AM - 9:30 AM: Regulatory Review & Team Sync. Alex starts the day by scanning industry news and legal updates. Today's big topic is the final implementation plan for the new DOL overtime rule. Alex reads a detailed analysis from the Society for Human Resource Management (SHRM) and flags several employees whose salaries are close to the new 2025 salary threshold. In the team's daily huddle, Alex presents these findings and they strategize on a communication plan for the affected managers.

- 9:30 AM - 12:00 PM: Market Pricing Project. The engineering department wants to create a new "Machine Learning Engineer III" role. Alex's task is to determine a competitive salary range. He logs into the company's salary survey provider (like Radford or Mercer), benchmarks the detailed job description against similar roles in the tech industry, and pulls data for their specific geographic locations. He uses advanced Excel functions to model the data, creating a recommended salary band to present to the VP of Engineering.

- 12:00 PM - 1:00 PM: Lunch & Learn. Alex attends a virtual lunch session on new pay transparency laws being enacted in several states, taking notes on how this will affect the company's job postings and offer processes.

- 1:00 PM - 3:00 PM: Mid-Year Promotion Cycle Analysis. Alex pulls a report from the company's HRIS (Human Resources Information System), like Workday or SAP SuccessFactors. He analyzes all the proposed mid-year promotions, checking them against the company's compensation guidelines. He flags one proposal where the recommended salary increase is unusually high and another where the new salary would be below the new salary band minimum, preparing notes to discuss with the relevant HR Business Partner.

- 3:00 PM - 4:30 PM: Meeting with a Department Head. Alex meets with the Director of Marketing to discuss the department's salary budget for the upcoming year. The Director is concerned about losing two key employees to competitors. Alex presents benchmark data showing their marketing roles are paid, on average, 5% below the market median. Together, they brainstorm a strategy for targeted market adjustments for critical roles, which Alex will model and include in the annual budget proposal.

- 4:30 PM - 5:00 PM: Finalizing Communications. Alex drafts an email to the HR Business Partners summarizing the list of employees who will need to be reclassified from exempt to non-exempt due to the 2025 salary threshold change, outlining the next steps for manager training and employee communication.

This day illustrates the dynamic nature of the role—a constant cycle of analysis, strategy, collaboration, and problem-solving, all centered on the organization's most valuable asset: its people.

Average Compensation Manager Salary: A Deep Dive

The field of compensation management is not only strategically critical but also financially rewarding. Professionals who can master the complexities of pay structures, market analysis, and legal compliance are in high demand and are compensated accordingly. The salary potential is significant, with a clear and steep growth trajectory based on experience, specialization, and impact.

To provide a comprehensive picture, it's essential to look at data from multiple authoritative sources, as methodologies can vary. We will examine figures from the U.S. Bureau of Labor Statistics (BLS), which provides a robust median, as well as leading salary aggregators like Salary.com and Payscale, which offer more granular range data.

### National Averages and Salary Ranges

- U.S. Bureau of Labor Statistics (BLS): The BLS groups these roles under "Compensation and Benefits Managers." As of May 2023, the BLS reports the following:

- Median Annual Salary: $136,380

- Lowest 10%: Less than $81,350

- Highest 10%: More than $232,070

This data from the BLS Occupational Outlook Handbook is highly reliable and showcases the enormous range in earnings, with top-level directors and executives in the field earning well over $200,000 in base salary alone.

- Salary.com: Known for its employer-reported data, Salary.com provides even more detailed breakdowns. As of late 2023/early 2024, their data shows:

- Compensation Analyst I (Entry-Level): The median salary is around $68,000, with a typical range of $61,000 to $75,000.

- Compensation Analyst III (Senior): The median salary jumps to approximately $105,000, with a range of $94,000 to $116,000.

- Compensation Manager: The median salary is $129,500, with a typical range of $115,000 to $145,000.

- Compensation Director: At this level, the median salary is $187,000, with many earning well over $220,000.

- Payscale: Payscale provides aggregated data that includes bonuses and other forms of cash compensation, giving a slightly different view of "total pay." Their data indicates:

- Average Base Salary for a Compensation Manager: Approximately $97,000.

- Total Pay Range (including bonuses): $70,000 to $135,000+.

The differences between sources highlight the importance of considering the complete compensation package, the specific title (Analyst vs. Manager vs. Director), and the factors we will discuss in the next section.

### Compensation by Experience Level

The salary growth in this career is pronounced. As professionals gain more experience, they move from tactical execution to strategic leadership, and their compensation reflects this increased responsibility.

| Experience Level | Typical Title(s) | Typical Base Salary Range | Key Responsibilities & Focus |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Compensation Analyst I, HR Analyst (Comp Focus) | $60,000 - $78,000 | Data entry, running reports, assisting with salary surveys, basic job description reviews, learning the company's HRIS and pay structures. |

| Mid-Career (3-8 Years) | Compensation Analyst II/III, Senior Compensation Analyst | $80,000 - $115,000 | Independent market pricing for new and existing roles, managing the salary survey submission process, analyzing promotion/merit cycles, conducting initial pay equity analyses, and mentoring junior analysts. |

| Senior/Manager (8-15 Years) | Compensation Manager, Principal Compensation Analyst | $115,000 - $160,000+ | Designing and managing salary structures, overseeing incentive and bonus plans, ensuring FLSA compliance (e.g., managing the 2025 threshold transition), serving as a consultant to business leaders, managing a small team of analysts. |

| Director/Executive (15+ Years) | Director of Compensation, VP of Total Rewards | $170,000 - $250,000+ | Setting the overall compensation and total rewards strategy for the entire organization, designing executive compensation packages, presenting to the board of directors' compensation committee, leading a large team, and managing a multi-million dollar budget. |

*(Salary ranges are estimates based on a blend of data from BLS, Salary.com, and industry knowledge, and can vary significantly based on the factors discussed below.)*

### Beyond the Base Salary: Understanding Total Compensation

A compensation professional's pay is rarely just their base salary. Total compensation is a critical concept, particularly at the manager and director levels. Here’s a breakdown of the other components:

- Annual Bonus / Short-Term Incentives (STI): This is the most common additional cash component. It's typically a percentage of base salary, tied to both individual and company performance.

- Analysts: May receive a bonus of 5-10% of their base salary.

- Managers: Often have a target bonus of 10-20%.

- Directors/VPs: Can have target bonuses of 25-50% or even higher.

- Profit Sharing: Some companies distribute a portion of their annual profits to employees. This can be a significant addition to total pay, though it's variable by nature.

- Long-Term Incentives (LTI): Especially prevalent in publicly traded companies or high-growth startups, LTI aligns senior leaders with the long-term success of the company. These can include:

- Stock Options: The right to buy company stock at a predetermined price in the future.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time.

- LTI can add tens or even hundreds of thousands of dollars to an executive's annual compensation over the vesting period.

- Comprehensive Benefits: While not direct cash, the value of benefits is substantial. Compensation professionals often oversee benefits as part of a "Total Rewards" function and enjoy top-tier packages themselves, including:

- Premium health, dental, and vision insurance plans.

- Generous 401(k) matching contributions (e.g., a 100% match on the first 6% of an employee's contribution).

- Paid time off (PTO), parental leave, and wellness stipends.

When evaluating a career in this field, it's crucial to look beyond the base salary and consider the entire "total rewards" package, which paints a much more accurate picture of the true earning potential.

Key Factors That Influence Salary

While the national averages provide a solid baseline, a compensation professional's actual salary is determined by a complex interplay of several key factors. Understanding these variables is essential for anyone looking to maximize their earning potential in this field. This section delves into the most influential drivers of compensation, from education and experience to the specific skills you bring to the table.

### Level of Education

In a data-centric field like compensation, a strong educational foundation is paramount. While a bachelor's degree is typically the minimum requirement, the type of degree and any advanced qualifications can significantly impact starting salary and long-term career trajectory.

- Bachelor's Degree: This is the standard entry point. The most relevant majors are:

- Human Resources: Provides a foundational understanding of HR principles, employment law, and organizational behavior.

- Business Administration/Management: Offers a strong background in general business operations, finance, and strategy.

- Finance, Economics, or Mathematics/Statistics: These are increasingly valuable as the field becomes more quantitative. Graduates from these programs are highly sought after for their strong analytical and modeling skills. Candidates with a quantitative degree may command a starting salary at the higher end of the entry-level range.

- Master's Degree: An advanced degree is often a differentiator for senior-level roles and can lead to a 10-20% salary premium.

- Master of Business Administration (MBA): Highly valued for director and VP-level roles, an MBA signals strong business acumen and strategic thinking.

- Master's in Human Resources (MHR) or Industrial-Organizational Psychology: These specialized degrees provide deep expertise in HR strategy, organizational development, and workforce analytics.

- Professional Certifications: Certifications are perhaps the most direct way to increase your value and salary as a compensation professional. They validate specialized knowledge and a commitment to the profession. The gold standard is offered by WorldatWork, the leading professional association for total rewards.

- Certified Compensation Professional (CCP®): This is the most recognized and respected certification in the field. Earning a CCP requires passing a series of exams on topics like base pay administration, market pricing, variable pay, and job analysis. According to Payscale, professionals holding a CCP can earn 5-15% more than their non-certified peers.

- Global Remuneration Professional (GRP®): For those working in multinational corporations, the GRP demonstrates expertise in managing compensation across different countries, currencies, and legal systems.

- Certified Executive Compensation Professional (CECP®): A highly specialized certification for those who focus on designing pay packages for top executives, a very lucrative niche.

### Years of Experience

As detailed in the previous section, experience is arguably the single most significant factor in salary growth. The career path is well-defined, with each step bringing a substantial increase in both responsibility and pay.

- Analyst I/II (0-4 years): The focus is on execution and learning. You are a "doer," running reports, gathering data, and supporting senior team members. Your value is in your accuracy, diligence, and growing analytical skills.

- Senior Analyst (5-8 years): You transition from doer to thinker. You begin to own complex projects, lead market pricing studies, and serve as a subject matter expert for specific business units. Your salary increases as you demonstrate independence and strategic insight. At this stage, a Senior Analyst in a high-cost-of-living area can easily earn over $120,000.

- Manager (8-15 years): The focus shifts to management and strategy. You are responsible for the work of other analysts, the design of entire pay programs, and for advising senior leadership. Your compensation reflects your leadership scope and the direct impact you have on company-wide pay strategy and compliance—including navigating complex changes like the 2025 salary threshold.

- Director/VP (15+ years): At this level, you are a key business leader. Your focus is on long-term total rewards strategy, executive compensation, and aligning pay with the overarching goals of the business. Salaries at this level, especially when including long-term incentives, can reach $250,000 to $400,000+ at large corporations.

### Geographic Location

Where you work has a massive impact on your paycheck. Companies adjust their salary bands based on the local cost of labor and cost of living. A Compensation Manager in San Francisco will earn significantly more than one in a similar role in a smaller Midwestern city.

The rise of remote work has added a new layer of complexity. Some companies pay based on the employee's location, while others have adopted a single national pay band. However, for now, location remains a primary driver of salary variance.

Here's a sample comparison of median salaries for a Compensation Manager across different U.S. metropolitan areas, based on data from sources like Salary.com and Glassdoor:

| Metropolitan Area | High-Paying Cities | Estimated Median Salary |

| :--- | :--- | :--- |

| San Francisco Bay Area, CA | (San Francisco, San Jose) | $160,000 - $185,000+ |

| New York City, NY | New York, NY | $150,000 - $170,000+ |

| Boston, MA | Boston, MA | $140,000 - $160,000+ |

| Seattle, WA | Seattle, WA | $135,000 - $155,000+ |

| Washington, D.C. | Washington, D.C. | $130,000 - $150,000+ |

| Los Angeles, CA | Los Angeles, CA | $130,000 - $150,000+ |

| Metropolitan Area | Average-Paying Cities | Estimated Median Salary |

| :--- | :--- | :--- |

| Chicago, IL | Chicago, IL | $125,000 - $140,000+ |

| Dallas, TX | Dallas, TX | $120,000 - $135,000+ |

| Atlanta, GA | Atlanta, GA | $118,000 - $130,000+ |

| Phoenix, AZ | Phoenix, AZ | $115,000 - $128,000+ |

It's crucial to use a cost-of-living calculator to understand the real-world value of these different salary figures. A $130,000 salary in Dallas may provide a higher quality of life than a $160,000 salary in San Francisco.

### Company Type & Size

The type of organization you work for will also heavily influence your compensation package.

- Large Corporations (Fortune 500): These companies typically offer the highest base salaries and most structured bonus plans. They have large, specialized compensation teams and well-defined career ladders. The work is often complex, dealing with thousands of employees across multiple locations.

- Tech Startups (High-Growth):