Earning $23 an hour is a significant financial milestone. It places you well above the federal minimum wage and represents a wage that can support a stable lifestyle in many parts of the country. Annually, this translates to a gross income of approximately $47,840, a figure that opens doors to numerous skilled professions and opportunities for growth.

But what does earning $23 an hour truly look like? Which jobs pay in this range, and how can you leverage your skills and experience to get there—and beyond? This article breaks down the numbers, explores the influential factors, and provides a clear picture of the career paths available at this pay grade.

Breaking Down the Numbers: Your Annual and Monthly Income

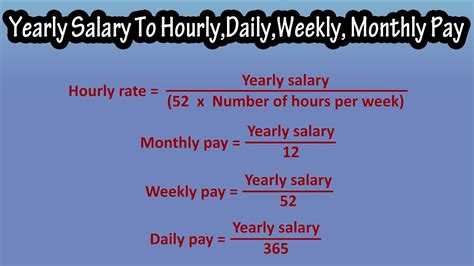

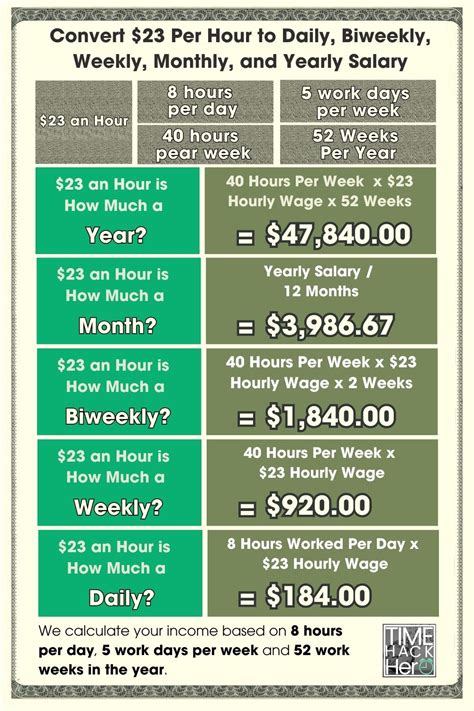

An hourly wage is just one piece of the financial puzzle. To understand its real-world impact, it's essential to look at the bigger picture. Assuming a standard 40-hour workweek and 52 weeks in a year, the calculation is straightforward:

- Annual Salary: $23/hour x 40 hours/week x 52 weeks/year = $47,840 per year (gross income)

- Monthly Income: $47,840 / 12 months = $3,987 per month (before taxes and deductions)

- Weekly Income: $23/hour x 40 hours = $920 per week (before taxes and deductions)

This pre-tax income is a solid foundation. According to the U.S. Bureau of Labor Statistics (BLS), the median weekly earnings for full-time wage and salary workers in the first quarter of 2024 was $1,139, which annualizes to about $59,228. This puts a $23/hour wage in a competitive position, especially for individuals in the early to middle stages of their careers.

Jobs That Often Pay Around $23 an Hour

A $23 hourly wage is not tied to a single industry. It spans a wide range of fields, often requiring a specific skill set, a certificate, an associate's degree, or a few years of experience. These are not just jobs; they are careers with paths for advancement.

Here are some examples of professions where the median or average pay hovers around $23 an hour:

- Experienced Administrative or Executive Assistant: Professionals who manage schedules, coordinate meetings, and handle office operations for mid-to-upper-level management.

- Bookkeeper: Responsible for recording financial transactions, managing accounts payable and receivable, and producing financial reports for small to medium-sized businesses.

- Pharmacy Technician: Assists pharmacists with dispensing prescription medication. Experienced technicians, especially those with certification (CPhT), often earn in this range.

- Paralegal or Legal Assistant: Provides crucial support to lawyers by conducting research, drafting documents, and organizing case files. This is often an entry-level wage for those with a bachelor's or associate's degree in paralegal studies.

- Skilled Trades (e.g., HVAC Technician, Plumber, Electrician): While apprentice wages are lower, technicians with a few years of experience can easily command $23 an hour or more.

- Customer Service Supervisor: Leads a team of customer service representatives, handles escalated issues, and monitors team performance.

- Medical Assistant: With experience and certification (like a CMA), medical assistants in specialized clinics or hospital settings can reach this pay level.

Key Factors That Influence Salary

Reaching—and exceeding—a $23 hourly wage rarely happens by chance. Several key factors directly influence your earning potential. Understanding them is crucial for career planning and salary negotiation.

### Level of Education

Your educational background sets a foundational baseline for your income.

- High School Diploma or GED: Can lead to roles in skilled trades, manufacturing, or customer service where experience and on-the-job training are highly valued.

- Certifications & Associate's Degrees: These are powerful accelerators. A professional certification (like a CPhT for a pharmacy tech or a paralegal certificate) can directly boost your pay. An associate's degree in fields like nursing (ADN), accounting, or information technology opens doors to higher-paying technical roles.

- Bachelor's Degree: For many professional roles (like entry-level financial analysts, marketers, or human resources coordinators), a bachelor's degree is the standard entry requirement, and $23/hour ($47k/year) is a common starting salary in many markets.

### Years of Experience

Experience is one of the most significant drivers of income growth.

- Entry-Level (0-2 years): For some professional careers, $23/hour is a strong starting wage. For others, it might be the target after a year or two of learning the ropes.

- Mid-Career (3-8 years): By this stage, you have a proven track record. This is when workers often move past the $23/hour mark as they take on more complex responsibilities, specialize their skills, or move into supervisory roles.

- Senior/Experienced (8+ years): At this level, $23/hour would be considered low for most professional fields. Deep expertise and leadership skills should command a significantly higher wage.

### Geographic Location

Where you work matters immensely. A $23/hour salary provides a very different lifestyle in Omaha, Nebraska, compared to New York City.

- High Cost of Living (HCOL) Areas: In cities like San Francisco, Boston, or New York, a $23/hour wage may be closer to an entry-level service wage due to high housing, transportation, and daily expenses. Salary aggregator Payscale notes that the cost of living in Manhattan, NY, is 127% higher than the national average.

- Low Cost of Living (LCOL) Areas: In many parts of the Midwest and South, $23/hour represents a comfortable, middle-class income that can easily cover housing, savings, and discretionary spending.

- Remote Work: The rise of remote work has complicated this factor. Some companies are adjusting salaries based on the employee's location, while others offer a single national rate.

### Company Type

The type and size of your employer play a significant role in your compensation package.

- Large Corporations: Often offer higher base salaries and more robust benefits packages (health insurance, 401(k) matching, paid time off), which increase your total compensation.

- Startups: Might offer a lower base salary but compensate with stock options or a more flexible work environment.

- Non-Profits & Government: Pay can sometimes be slightly lower than in the private sector, but these roles often provide excellent job security, stable hours, and strong pension or retirement benefits.

### Area of Specialization

Within any given field, specialization pays. A generalist will almost always earn less than a specialist. For example:

- A paralegal specializing in high-demand corporate litigation will likely earn more than one in general family law.

- An HVAC technician certified to work on complex commercial refrigeration systems will command a higher wage than one who only services residential units.

- An executive assistant who supports C-suite executives in a tech company will earn significantly more than a departmental administrative assistant.

Job Outlook

The long-term demand for your chosen profession is a critical consideration. Fortunately, many of the careers that pay around $23 an hour have a strong or stable outlook.

The U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook provides excellent data on future growth:

- Medical Assistants: Projected to grow 14% from 2022 to 2032, much faster than the average for all occupations.

- Paralegals and Legal Assistants: Projected to grow 12% from 2022 to 2032, also much faster than average.

- Heating, Air Conditioning, and Refrigeration Mechanics and Installers (HVACR): Projected to grow 6% from 2022 to 2032, faster than the average.

This positive outlook means that not only are jobs available, but there is also sustained demand, which can lead to better job security and upward wage pressure over time.

Conclusion: Your Path Forward from $23 an Hour

Earning a $23 hourly salary is a commendable achievement that puts you in a position of financial stability and career potential. It serves as a gateway to the middle class for many Americans and is the backbone of numerous essential industries.

Here are the key takeaways for anyone earning or aspiring to this wage:

1. Know Your Worth: A $23/hour wage annualizes to nearly $48,000—a solid income that supports a wide array of skilled careers.

2. It's a Stepping Stone, Not a Ceiling: For most, this wage is a point on a larger journey. Use it as a foundation to build experience and skills.

3. Invest in Yourself: Continuously look for ways to increase your value through education, certification, and specialization.

4. Understand the Levers: Your experience level, location, and industry are powerful levers you can pull to increase your earnings. Be strategic about where you work and the skills you develop.

Whether you're just starting or looking to make your next career move, a $23/hour job represents a world of opportunity. By understanding the factors that shape your pay, you can take control of your career trajectory and build a prosperous future.