Earning $65 an hour is a significant financial milestone, placing you in a high-income bracket that offers substantial financial security and opportunity. This rate translates to an impressive annual salary of approximately $135,200 per year, opening doors to a wide range of professional careers that demand skill, experience, and specialized knowledge. If you're aiming for this level of compensation, you're looking at roles that are not only rewarding financially but are also often at the forefront of their respective industries.

This article serves as your guide to understanding the $65-per-hour pay scale. We will break down the annual salary, explore the types of jobs that offer this rate, and detail the key factors—from education and location to specialization—that can help you achieve this career goal.

What Does a $65 an Hour Job Entail?

A job that compensates at $65 an hour is rarely an entry-level position. This pay rate is typically reserved for experienced professionals, individuals with advanced degrees, or those with highly sought-after specialized skills. The responsibilities are commensurate with the pay, often involving complex problem-solving, strategic decision-making, project leadership, and a high degree of autonomy.

Professionals earning this wage are valued for their expertise and their ability to deliver significant results for their organizations. Here are a few examples of roles where a $65/hour rate is common:

- Senior Software Engineer: Designs, develops, and maintains complex software systems. They often lead project teams, mentor junior developers, and make critical architectural decisions.

- Physician Assistant (PA): A licensed medical professional who works on healthcare teams with physicians. PAs diagnose and treat illnesses, perform physical exams, and prescribe medication, requiring a high level of medical knowledge and patient-care responsibility.

- IT Manager: Oversees an organization's entire technology infrastructure. Responsibilities include managing IT staff, developing tech strategy, ensuring cybersecurity, and managing the IT budget.

- Financial Manager: Responsible for the financial health of an organization. They produce financial reports, direct investment activities, and develop strategies for the long-term financial goals of their company.

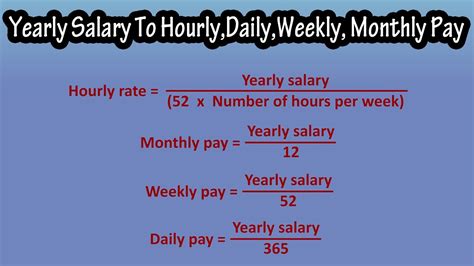

How Much is $65 an Hour Annually? A Salary Breakdown

To understand the full picture, let's do the math. A standard full-time work schedule consists of 40 hours per week for 52 weeks a year.

Calculation:

$65 per hour × 40 hours per week × 52 weeks per year = $135,200 per year

This six-figure salary is well above the U.S. median household income, which the U.S. Census Bureau reported as $74,580 in 2022. It is important to remember that $135,200 is the *gross annual income*—the amount earned before taxes, health insurance premiums, retirement contributions, and other deductions.

While $135,200 is the direct calculation, the salary range for jobs in this tier can vary significantly. According to data from salary aggregators like Salary.com and Payscale, roles that command a $65/hour rate often fall within a broader salary band of $115,000 to $160,000 or more, depending on the key factors we explore below.

Key Factors That Influence Salary

Reaching the $65/hour mark isn't just about finding the right job title; it's about building a professional profile that commands this level of compensation. Several key factors work together to determine your earning potential.

### Level of Education

A strong educational background is often a prerequisite for high-paying roles. While a bachelor's degree is the standard for many professional careers, an advanced degree can significantly accelerate your earning potential.

- Bachelor’s Degree: A B.S. in Computer Science or Finance can open the door to roles like Software Engineer or Financial Analyst. With experience, you can reach the $65/hour threshold.

- Master’s Degree: For some fields, a master's is essential. Physician Assistants, for example, must have a Master of Science in Physician Assistant Studies. In business, an MBA can fast-track a professional into a management role, such as an IT Manager or Marketing Manager, where this salary is common.

- Doctoral or Professional Degree: Fields like law, medicine, and specialized engineering often require a doctorate (Ph.D.) or professional degree (J.D., M.D.), which typically start at or far exceed the $65/hour rate.

### Years of Experience

Experience is arguably the most critical factor in salary growth. Companies pay for proven expertise and the wisdom that comes from years of hands-on work.

- Entry-Level (0-2 years): In most fields, it's rare to start at $65/hour. New graduates are typically focused on building foundational skills.

- Mid-Career (3-8 years): This is the stage where many professionals cross the $135,000 annual salary threshold. You have a proven track record, can work independently, and may begin to take on leadership responsibilities.

- Senior/Lead Level (8+ years): At this stage, professionals are often considered experts. A Senior Software Engineer or a Financial Manager with over a decade of experience can command well over $65/hour. According to Payscale, a worker's salary can increase by 50% or more between their early career and late career.

### Geographic Location

Where you work has a massive impact on your salary. A high cost of living in major metropolitan areas necessitates higher wages to attract talent.

For example, a U.S. Bureau of Labor Statistics (BLS) report on Occupational Employment and Wage Statistics shows that the same job can have vastly different pay depending on the city. An experienced Registered Nurse in a major metropolitan area like San Jose, CA, could earn over $80/hour, while the same role in a smaller city in the Midwest might pay closer to $45-$50/hour.

High-paying tech and finance hubs like San Francisco, New York City, Seattle, and Boston consistently offer higher salaries. However, the rise of remote work is beginning to change this dynamic, allowing some professionals to earn a high salary while living in a lower-cost-of-living area.

### Company Type

The type and size of the company you work for can also influence your pay.

- Large Corporations & Big Tech: Companies like Google, Microsoft, or major financial institutions often offer the highest salaries, along with generous benefits and stock options. Glassdoor reviews consistently show these companies at the top of compensation charts.

- Startups: While early-stage startups might offer lower base salaries, they often provide equity (stock options) that can become highly valuable if the company succeeds.

- Government and Non-Profit: These sectors may offer lower base pay than their for-profit counterparts. However, they often compensate with excellent benefits, retirement plans, and strong job security.

### Area of Specialization

Within any given profession, specialization in a high-demand niche can dramatically increase your value. A generalist may do well, but a specialist often earns more.

- In Technology: A software engineer specializing in a cutting-edge field like Artificial Intelligence (AI), Machine Learning, or Cybersecurity will typically earn more than a general web developer.

- In Healthcare: A general practice Registered Nurse earns a solid wage, but a specialized nurse, such as a Certified Registered Nurse Anesthetist (CRNA), can earn upwards of $100/hour.

- In Finance: A corporate accountant's salary is respectable, but a Financial Manager specializing in international mergers and acquisitions will be in a much higher pay bracket.

Job Outlook

The long-term demand for a profession is a crucial consideration. Fortunately, many of the careers that pay in the $65/hour range have excellent growth prospects.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook:

- Software Developers: Employment is projected to grow 25% from 2022 to 2032, much faster than the average for all occupations.

- Physician Assistants: Employment is projected to grow 27% over the same period, also much faster than average, driven by growing healthcare demands.

- Financial Managers: Employment is projected to grow 16%, a robust rate reflecting the critical need for financial oversight in all industries.

Investing your time and education in a growing field ensures greater job security and continued upward mobility in your salary potential.

Conclusion

Achieving a salary of $65 an hour, or $135,200 annually, is a tangible and rewarding career goal. It is a benchmark of professional success, reflecting a high level of expertise, responsibility, and value to an employer.

While this income level is not typically available to those just starting out, it is well within reach for dedicated professionals who plan their careers strategically. By focusing on the key drivers of compensation—advancing your education, gaining valuable experience, targeting high-paying locations and companies, and developing in-demand specializations—you can build a clear path toward this impressive earning potential. For anyone considering a career in fields like technology, healthcare, or finance, the prospect of earning $65 an hour is not just a dream, but an achievable reality.