Table of Contents

- [What a $27/Hour Salary Really Means](#what-a-27-hour-salary-really-means)

- [What Kind of Jobs Pay $27 an Hour?](#what-kind-of-jobs-pay-27-an-hour)

- [Breaking Down a $27/Hour Salary: A Deep Dive into Your Earnings](#breaking-down-a-27-hour-salary-a-deep-dive-into-your-earnings)

- [The 6 Key Factors That Influence Your Salary](#the-6-key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth from a $27/Hour Foundation](#job-outlook-and-career-growth-from-a-27-hour-foundation)

- [Your Step-by-Step Guide to Landing a Job Paying $27 an Hour (or More)](#your-step-by-step-guide-to-landing-a-job-paying-27-an-hour-or-more)

- [Is a $27/Hour Career the Right Path for You?](#is-a-27-hour-career-the-right-path-for-you)

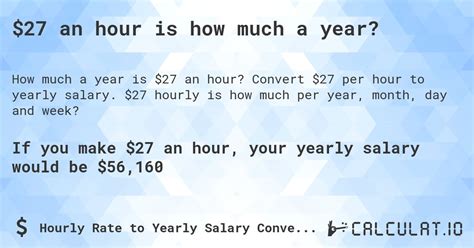

Earning $27 an hour marks a significant milestone in many professional journeys. It often signifies a departure from entry-level wages into a realm of skilled, stable, and respected employment. This income level, translating to an annual salary of approximately $56,160 before taxes, represents a critical threshold for financial independence and career advancement for millions of Americans. It’s a figure that suggests proficiency, experience, and value in the modern workforce. If you're aspiring to reach this level, currently earning it and planning your next move, or exploring the career paths that lead here, you've arrived at the definitive guide.

This article is designed not just to give you numbers, but to provide a strategic roadmap. We will dissect what it means to earn $27 an hour, explore the diverse jobs that offer this compensation, and detail the actionable steps you can take to achieve or surpass this goal. I remember early in my own career, the leap from a sub-$20 hourly wage to one closer to this mark felt transformative; it was the first time I could comfortably build savings while meeting all my obligations, and it opened my eyes to long-term career planning. This is more than a salary—it's a launchpad for your future.

Whether you're a recent graduate, a professional looking to pivot, or someone aiming for a well-deserved raise, this comprehensive analysis will equip you with the knowledge, data, and confidence to navigate your career path toward this rewarding benchmark.

What Kind of Jobs Pay $27 an Hour?

A $27-per-hour wage isn't confined to a single industry or job title. Instead, it represents a broad category of skilled roles that require a combination of specific training, education, and/or on-the-job experience. These are not typically entry-level, minimum-wage positions; they are the backbone of many industries, occupied by professionals who have honed their craft. These roles demand critical thinking, technical proficiency, and a high degree of responsibility.

Let's explore a few diverse examples of professions where earning $27 an hour is a common and achievable reality.

#### 1. The Technical Specialist: IT Support Specialist (Tier 2/3)

Information Technology (IT) Support is a critical function in nearly every modern business. While entry-level (Tier 1) help desk roles might start lower, a Tier 2 or Tier 3 IT Support Specialist who handles more complex technical issues frequently earns in the $25 to $35 per hour range.

- Core Responsibilities: Troubleshooting complex hardware and software problems, managing network issues, administering user accounts and permissions, implementing security protocols, and training junior staff. They are the problem-solvers who step in when the initial line of support is unable to find a solution.

- Required Skills: Deep knowledge of operating systems (Windows, macOS, Linux), network administration (TCP/IP, DNS, DHCP), cybersecurity fundamentals, and often specific software suites (e.g., Microsoft 365, Salesforce). Certifications like CompTIA A+, Network+, or Security+ are highly valued.

#### 2. The Legal Professional: Paralegal or Legal Assistant

In the legal world, paralegals are indispensable. They perform substantive legal work under the supervision of an attorney, and their expertise is crucial to a law firm's or corporate legal department's efficiency.

- Core Responsibilities: Conducting legal research, drafting legal documents (briefs, pleadings, contracts), managing case files, preparing for trials, and acting as a primary point of contact for clients.

- Required Skills: Exceptional research and writing abilities, a strong understanding of legal terminology and procedures, meticulous attention to detail, and proficiency with legal research software like Westlaw or LexisNexis. An associate's or bachelor's degree in paralegal studies, or a certificate, is standard.

#### 3. The Creative Expert: Graphic Designer

Experienced graphic designers who have moved beyond junior roles and built a solid portfolio command respectable wages. They work in corporate marketing departments, at creative agencies, or as successful freelancers.

- Core Responsibilities: Developing visual concepts for websites, advertisements, logos, brochures, and corporate reports. They collaborate with marketing teams and clients to create compelling visual narratives that align with a brand's identity.

- Required Skills: Mastery of the Adobe Creative Suite (Photoshop, Illustrator, InDesign), a strong understanding of typography, color theory, and layout principles. A good portfolio showcasing a range of successful projects is often more important than a specific degree.

#### A "Day in the Life" Example: A Mid-Level Marketing Specialist

To make this more concrete, let's walk through a typical day for a Marketing Specialist earning approximately $27 an hour at a mid-sized tech company.

- 9:00 AM - 9:30 AM: Start the day by reviewing analytics. Check the performance of ongoing email campaigns, social media posts, and Google Ads. Note key metrics like click-through rates, conversion rates, and engagement.

- 9:30 AM - 11:00 AM: Content planning meeting. Collaborate with the content writer and graphic designer to brainstorm topics for the company blog and social media for the upcoming month, aligning themes with a new product launch.

- 11:00 AM - 12:30 PM: Execute the weekly email newsletter. This involves segmenting the email list, writing compelling copy, selecting visuals, and scheduling the send through a platform like Mailchimp or HubSpot.

- 12:30 PM - 1:30 PM: Lunch break.

- 1:30 PM - 3:00 PM: Work on a specific project, such as setting up and optimizing a new pay-per-click (PPC) ad campaign for a target audience on LinkedIn. This involves keyword research, ad copy creation, and budget management.

- 3:00 PM - 4:30 PM: Meet with the sales team to discuss lead quality. Review which marketing channels are generating the most promising leads and strategize on how to better support their efforts.

- 4:30 PM - 5:00 PM: Wrap up the day. Respond to final emails, update project management boards (like Asana or Trello), and plan priorities for the next day.

This example illustrates a role that blends analytical skills, creativity, and collaboration—a hallmark of many jobs in the $27/hour salary range.

Breaking Down a $27/Hour Salary: A Deep Dive into Your Earnings

Understanding the headline number is one thing; knowing what it translates to in your bank account and overall financial picture is another. Earning $27 an hour is a solid income, but its real-world impact depends on various factors, from gross calculations to net pay and total compensation.

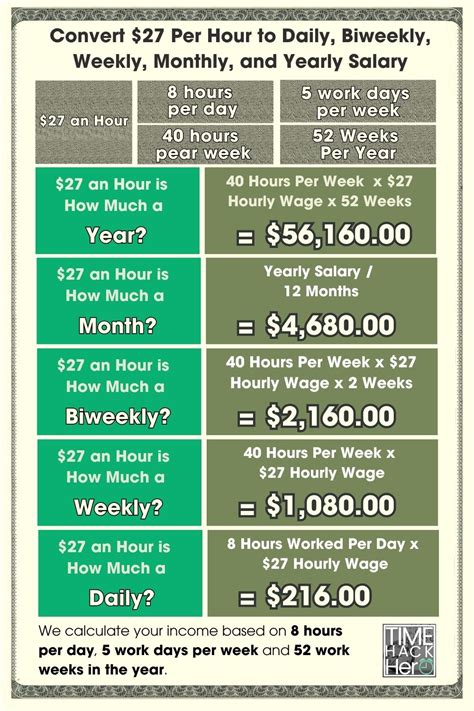

### From Hourly to Annual: The Gross Calculation

First, let's establish the baseline. A full-time job is typically calculated based on a 40-hour work week for 52 weeks a year.

- Hourly: $27.00

- Daily (8-hour day): $27.00 x 8 = $216

- Weekly (40-hour week): $27.00 x 40 = $1,080

- Monthly (approx. 4.33 weeks): $1,080 x 4.33 = $4,676.40

- Annual (52 weeks): $1,080 x 52 = $56,160

This gross annual salary of $56,160 places you comfortably above the U.S. median personal income, which the U.S. Census Bureau reported as $40,480 in 2022. It positions you as a solid middle-class earner in most parts of the country.

### The Reality of Take-Home Pay (Net Income)

Your gross salary is not what you'll see on your paycheck. Several deductions will reduce this amount to your net, or take-home, pay. These deductions are highly variable and depend on your individual circumstances.

Key Deductions:

1. Federal Income Tax: Your tax bracket, filing status (single, married, etc.), and dependents will determine this. For a single filer with no dependents, a $56,160 salary in 2023 would fall into the 22% marginal tax bracket.

2. State Income Tax: This varies significantly. Seven states have no state income tax (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Wyoming), while others, like California and New York, have relatively high rates.

3. FICA Taxes (Social Security and Medicare): This is a flat tax. You'll pay 6.2% for Social Security (on income up to $168,600 in 2024) and 1.45% for Medicare. Your employer matches these contributions.

4. Pre-Tax Deductions: These are costs taken out of your paycheck *before* taxes are calculated, which lowers your taxable income. Common examples include:

- Health, dental, and vision insurance premiums.

- Contributions to a 401(k) or 403(b) retirement plan.

- Contributions to a Health Savings Account (HSA) or Flexible Spending Account (FSA).

Sample Take-Home Pay Calculation:

Let's create a hypothetical scenario for a single individual living in a state with a moderate income tax (e.g., around 5%).

| Item | Monthly Amount | Notes |

| --------------------- | --------------- | ------------------------------------------------------------------ |

| Gross Monthly Income | $4,676 | $56,160 / 12 |

| Deductions: | | |

| Federal Income Tax | (~$400) | Varies by deductions, credits, and filing status. |

| State Income Tax (5%) | (~$234) | Varies greatly by state. |

| FICA Taxes (7.65%) | (~$358) | Social Security (6.2%) + Medicare (1.45%) |

| Health Insurance | (~$150) | Average employee contribution for a single plan. |

| 401(k) Contribution (5%) | (~$234) | Pre-tax contribution, reduces taxable income. |

| Total Deductions | (~$1,376) | *Estimated total monthly deductions.* |

| Net Monthly Income | ~$3,300 | Your approximate take-home pay. |

Therefore, a gross monthly income of nearly $4,700 could realistically become a net income of around $3,300. This is the figure you must use for budgeting, savings, and discretionary spending.

### Beyond the Paycheck: The Total Compensation Package

A $27/hour job is about more than just the wage. At this professional level, the benefits package becomes a significant part of your overall compensation and can add tens of thousands of dollars in value. When evaluating a job offer, you must look at the complete picture.

Key Components of a Strong Compensation Package:

- Health Insurance: A good employer plan with low premiums and deductibles is incredibly valuable. Employer contributions to health insurance are not taxed.

- Retirement Savings Plan: A 401(k) or 403(b) with a company match is essentially free money. A common match is 50% of your contributions up to 6% of your salary. On a $56,160 salary, a 6% contribution ($3,370) could receive a company match of $1,685 per year.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A standard package might offer 15 days of vacation, 5 sick days, and 10 paid holidays, totaling 30 paid days off per year.

- Bonuses and Profit Sharing: Depending on the industry and company performance, you may be eligible for annual or quarterly bonuses.

- Professional Development: Many companies will pay for certifications, training courses, or even tuition reimbursement for a relevant degree, investing in your long-term growth.

- Other Perks: These can include flexible work schedules, remote work options, wellness stipends, life insurance, and disability insurance.

A job offering $26 an hour with a fantastic benefits package (e.g., free health insurance and a 6% 401k match) can be far more lucrative than a job at $28 an hour with a poor benefits package. Always analyze the full offer.

The 6 Key Factors That Influence Your Salary

Reaching—and exceeding—the $27-per-hour mark is not a matter of chance. It is the result of a strategic interplay between your skills, choices, and the market forces around you. Understanding these levers is the single most important step you can take to maximize your earning potential. Whether you're negotiating a new role or planning your career trajectory, mastering these six factors will give you a decisive advantage.

### `

`1. Level of Education and Certifications`

`Your formal education and specialized credentials are the foundation of your earning power. They signal to employers that you have a verified baseline of knowledge and a commitment to your field.

Impact of Degree Levels:

- High School Diploma or GED: While many skilled trades and administrative roles can reach the $27/hour level through experience alone, a diploma is often the minimum requirement to get started.

- Associate's Degree (A.A., A.S.): This two-year degree is a powerful accelerator in many technical and healthcare fields. For example, a Registered Nurse (RN) with an Associate's Degree in Nursing (ADN) can easily surpass $27/hour. The median pay for RNs is $39.05 per hour or $81,220 per year, according to the BLS (2022). Similarly, paralegals with an associate's degree are seen as more competitive.

- Bachelor's Degree (B.A., B.S.): This is the standard for many professional roles in business, marketing, IT, finance, and communications. For a Marketing Specialist, a bachelor's degree is typically required to access jobs that pay in the $50k-$70k range. According to Payscale, the average salary for a Marketing Specialist is around $55,000, squarely in our target range. A bachelor's degree provides the theoretical framework and analytical skills that employers value for roles requiring strategic thinking.

- Master's Degree (M.A., M.S., MBA): While not always necessary for a $27/hour role, a master's degree is a key driver for advancing *beyond* it into senior, management, or highly specialized positions. For example, a Data Analyst with a bachelor's might earn $30/hour, while one with a master's in data science could command $45/hour or more.

The Power of Certifications:

In the modern workforce, targeted certifications can be as valuable as a formal degree, especially in the tech industry. They demonstrate up-to-date, practical skills.

- For IT Professionals: A CompTIA Security+ or Certified Ethical Hacker (CEH) certification can elevate an IT Support Specialist's pay significantly.

- For Project Managers: The Project Management Professional (PMP) certification is a gold standard that almost guarantees an income well above $27/hour. The median salary for PMP holders is significantly higher than for non-certified peers.

- For Skilled Trades: A journeyman license for an Electrician or Plumber represents years of apprenticeship and testing, and these professionals often earn well over $30/hour. The BLS reports the 2022 median pay for electricians was $29.59 per hour.

### `

`2. Years of Experience`

`Experience is the currency of the professional world. In nearly every field, there is a direct and predictable correlation between your years of relevant experience and your compensation.

The Typical Salary Trajectory:

- Entry-Level (0-2 Years): In this stage, you are learning the ropes and proving your capabilities. Your salary might start in the $18-$22/hour range. Your focus should be on absorbing as much knowledge as possible and demonstrating reliability.

- Mid-Career (3-8 Years): This is the sweet spot for reaching and solidifying a $27/hour income. You have moved from a trainee to a competent, independent contributor. You can manage projects with minimal supervision and may begin mentoring junior colleagues. For example, a graphic designer with 5 years of experience and a strong portfolio will have much more negotiating power than a recent graduate.

- Senior/Lead (8+ Years): With extensive experience, you become an expert. You are not just performing tasks; you are setting strategy, leading teams, and solving the most complex problems. At this stage, your hourly rate should be well north of $27. Senior Paralegals, Lead IT Administrators, or Senior Marketing Managers often earn in the $35-$50/hour range ($72k - $104k annually).

Experience-Based Salary Data Comparison (Example: Web Developer)

*(Source: Salary.com, 2023 data, generalized for illustration)*

- Web Developer I (Entry-Level): $25 - $32 / hour

- Web Developer II (Mid-Career): $33 - $42 / hour

- Web Developer III (Senior): $43 - $55 / hour

This clearly shows how experience directly translates to higher pay within the same job family.

### `

`3. Geographic Location`

`Where you work is one of the most significant factors determining your pay. A $56,160 annual salary can provide a very comfortable lifestyle in one city and feel stretched thin in another due to vast differences in cost of living and local market demand.

High-Paying Metropolitan Areas:

Major tech hubs and financial centers typically offer the highest salaries to attract top talent and compensate for a high cost of living.

- Examples: San Francisco/San Jose, CA; New York, NY; Boston, MA; Seattle, WA; Washington, D.C.

- In these cities, a role that pays $27/hour in the rest of the country might pay $35-$40/hour or more. However, housing, taxes, and daily expenses will also be significantly higher.

Average-Cost Areas:

Many mid-sized cities offer a great balance of strong job markets and reasonable cost of living, making them ideal places to maximize the value of a $27/hour salary.

- Examples: Austin, TX; Denver, CO; Raleigh, NC; Atlanta, GA; Minneapolis, MN.

- Here, your $56,160 salary can afford a comfortable lifestyle, including homeownership and savings.

Lower-Cost Areas:

Salaries are often lower in rural areas and smaller cities, but so is the cost of living.

- Examples: Midwest and Southern states outside of major metro areas.

- A job paying $22/hour here might offer the same purchasing power as a $27/hour job in a more expensive region.

Salary Variation by Location for a "Financial Analyst I"

*(Data generalized from sources like Glassdoor and Salary.com for illustrative purposes)*

| City | Average Hourly Rate | Annual Salary Equivalent |

| -------------------- | ------------------- | ------------------------ |

| San Francisco, CA | $41.00 | ~$85,280 |

| New York, NY | $38.50 | ~$80,080 |

| Chicago, IL | $32.00 | ~$66,560 |

| Dallas, TX | $30.00 | ~$62,400 |

| National Average | $29.00 | ~$60,320 |

| Kansas City, MO | $27.50 | ~$57,200 |

This table clearly demonstrates that the same job title can see a salary swing of 30-50% based on location alone. The rise of remote work has complicated this, but many companies still use location-based pay bands.

### `

`4. Company Type & Size`

`The type of organization you work for has a profound impact on your compensation structure, culture, and career opportunities.

- Large Corporations (Fortune 500): These companies typically offer higher base salaries and more robust, structured benefits packages (e.g., better health insurance, generous 401k matches, pensions). They have standardized pay bands and clear paths for advancement. A role at a large tech company like Google or a financial giant like JPMorgan Chase will almost always pay more than the equivalent role at a small local business.

- Startups: Early-stage startups may offer a lower base salary compared to established corporations. However, they often compensate with equity (stock options), which can become extremely valuable if the company succeeds. They also offer rapid growth opportunities and the chance to take on significant responsibility quickly.

- Small to Medium-Sized Businesses (SMBs): Compensation can vary widely here. Pay might be slightly lower than at large corporations, but they can offer more flexibility, a better work-life balance, and a more direct impact on the company's success.

- Non-Profit Organizations: Non-profits typically pay less than for-profit companies. However, they offer immense personal satisfaction and missions that many find compelling. Benefits can be competitive, especially in larger non-profits.

- Government (Federal, State, Local): Government jobs are known for their stability, excellent benefits (especially pensions and healthcare), and work-life balance. While the base salary for a specific role might be slightly lower than in the private sector, the total compensation, when including the value of benefits and job security, is often highly competitive. Pay is determined by structured scales (like the GS scale for federal employees).

### `

`5. Area of Specialization`

`Within any given profession, specializing in a high-demand, high-value niche can dramatically increase your earning potential. Generalists are valuable, but specialists are often paid a premium for their rare expertise.

- In Information Technology: An IT Support generalist might make $27/hour. But an IT professional who specializes in Cloud Computing (AWS, Azure) or Cybersecurity (Threat Analysis) can command $40-$50/hour or more due to intense market demand for these skills.

- In Marketing: A general Marketing Coordinator may earn around $25/hour. A specialist in Search Engine Optimization (SEO) or Marketing Automation (HubSpot, Marketo) with a proven track record of driving revenue can earn $35+/hour.

- In Skilled Trades: A general handyman might have inconsistent earnings. A licensed HVAC technician who is certified in commercial refrigeration systems will have steady work at a much higher rate.

- In Healthcare: A general Medical Assistant might earn $20/hour. A specialized Surgical Technologist, who assists surgeons in the operating room, earns a median pay of $28.71 per hour, according to the BLS.

### `

`6. In-Demand Skills (Hard & Soft)`

`Finally, your specific skillset is the toolbox you bring to every job. Cultivating high-value skills is the most direct way to increase your worth to an employer.

High-Value Hard Skills:

These are teachable, technical abilities that can be measured.

- Data Analysis: Proficiency in tools like Excel (advanced functions like PivotTables and VLOOKUP), SQL for database querying, and visualization tools like Tableau or Power BI.

- Software/Programming Languages: Depending on the field, this could be Python for data science, JavaScript for web development, or proficiency in specific CRM software like Salesforce.

- Project Management: Knowledge of methodologies like Agile or Scrum and proficiency in software like Jira or Asana.

- Digital Marketing: Expertise in SEO, SEM (Google Ads), social media advertising, and content management systems (WordPress).

- Foreign Language Fluency: Bilingualism is a major asset in customer-facing, international, and healthcare roles.

Crucial Soft Skills:

These are interpersonal attributes that determine how you work and interact with others. They are often the deciding factor in promotions and leadership opportunities.

- Communication: The ability to clearly articulate complex ideas, both verbally and in writing. This includes active listening and presentation skills.

- Problem-Solving: The ability to identify issues, analyze them from multiple angles, and devise and implement effective solutions.

- Leadership: The ability to motivate a team, delegate effectively, and take ownership of outcomes, even without a formal management title.

- Adaptability: Thriving in a changing environment and quickly learning new technologies, processes, and skills.

- Negotiation: The ability to advocate for yourself, your team, and your ideas, whether negotiating a salary, a project deadline, or a vendor contract.

By strategically developing these six areas, you can build a compelling case for a $27/hour salary and create a clear path for future growth.

Job Outlook and Career Growth from a $27/Hour Foundation

A job paying $27 an hour is more than just a comfortable living; it’s a powerful foundation for long-term career growth. The types of roles that fall into this category—skilled technical, professional, and trade positions—are often in high-demand sectors of the economy. Understanding the outlook for these fields and the pathways to advancement is crucial for future-proofing your career.

### The Macro View: Job Growth in Key Sectors

The U.S. Bureau of Labor Statistics (BLS) provides employment projections that offer a valuable glimpse into the future of the job market. Overall employment is projected to grow by 3 percent from 2022 to 2032, but several sectors that house $