Introduction

Imagine the feeling of financial stability. It’s the confidence that comes from knowing you can cover your bills, save for the future, and enjoy the fruits of your labor without constant stress. For many Americans, reaching a wage of $30 per hour is a significant milestone that transforms this vision into reality. It represents a pivot point—a shift from just getting by to truly building a life and a career with options. This wage, translating to approximately $62,400 annually, opens doors to greater financial freedom, better housing opportunities, and a more secure retirement. But what does it take to get there? Which jobs pay this well, and how can you strategically position yourself to land one?

This guide is designed to be your definitive resource for answering those questions. We will demystify the path to earning $30 an hour, providing a data-driven, step-by-step roadmap for professionals at any stage of their journey. Whether you're a recent graduate charting your course, a mid-career professional seeking to level up, or someone considering a complete career change, the information here will equip you with the knowledge and strategy needed to achieve this crucial financial goal.

Early in my career as a professional development analyst, I worked with a client named Sarah, a dedicated administrative assistant who felt stuck at a wage just under $20 an hour. She was brilliant and hardworking but couldn't see a path to the financial security she craved. Together, we identified her untapped skills in data organization and process improvement, charted a course for her to gain a certification in project coordination, and revamped her resume to highlight these new qualifications. Within a year, she landed a role as a Junior Project Coordinator, starting at $32 per hour. Seeing her text me a picture of the offer letter, filled with excitement and relief, was a profound reminder that with the right strategy, ambitious career goals are not just possible—they are attainable. This guide is built on the same principles that helped Sarah and countless others like her.

---

### Table of Contents

- [What Kind of Jobs Pay $30 Per Hour?](#what-kind-of-jobs-pay-30-per-hour)

- [Breaking Down a $30/Hour Salary: What It Really Means for Your Finances](#breaking-down-a-30hour-salary-what-it-really-means-for-your-finances)

- [The 6 Key Factors That Influence Your Path to $30 an Hour](#the-6-key-factors-that-influence-your-path-to-30-an-hour)

- [Job Outlook & Future-Proofing Your $30/Hour Career](#job-outlook--future-proofing-your-30hour-career)

- [Your Roadmap to Earning $30 Per Hour](#your-roadmap-to-earning-30-per-hour)

- [Conclusion: Taking Control of Your Earning Potential](#conclusion-taking-control-of-your-earning-potential)

---

What Kind of Jobs Pay $30 Per Hour?

A $30 per hour wage isn't confined to a single industry or profession. Rather, it represents a level of skill, experience, and value that can be found across a diverse spectrum of careers. Reaching this pay grade typically signifies that you have moved beyond an entry-level position and are now recognized for a certain level of expertise. These roles often require a combination of formal education, specialized training, or several years of hands-on experience. They are the backbone of the economy, demanding critical thinking, technical proficiency, and significant responsibility.

Let's explore the major categories of jobs where earning $30 per hour (or a $62,400 annual salary) is a common and achievable benchmark.

Common Industries and Job Categories:

- Healthcare and Social Assistance: This sector is ripe with opportunities at this pay level, often driven by the need for licensed and certified professionals. Examples include Registered Nurses (RNs), Diagnostic Medical Sonographers, Occupational Therapy Assistants, and experienced Licensed Practical Nurses (LPNs). The median pay for RNs, for instance, was $81,220 per year ($39.05 per hour) in May 2022, according to the U.S. Bureau of Labor Statistics (BLS).

- Technology and Information Technology (IT): With technology underpinning every modern business, skilled IT professionals are in high demand. Roles like Web Developers, Network and Computer Systems Administrators, Computer User Support Specialists (with experience), and Database Administrators frequently command salaries in this range or higher.

- Skilled Trades: A four-year degree is not the only path to a high-paying career. Skilled trades professionals are essential to our infrastructure and command excellent wages. Electricians, Plumbers, Pipefitters, and Steamfitters, Industrial Machinery Mechanics, and Construction Managers often earn well over $30 per hour, especially with union membership or specialized certifications. The BLS notes the 2022 median pay for electricians was $60,240 per year ($28.96 per hour), with the top earners making significantly more.

- Business, Finance, and Management: In the corporate world, this salary level is common for experienced professionals and those in analytical roles. Positions like Accountants and Auditors, Market Research Analysts, Human Resources Specialists, Logisticians, and Management Analysts typically fall within this bracket.

- Creative and Media: For those with a creative flair and a professional portfolio, this wage is attainable. Technical Writers, experienced Graphic Designers (especially in UI/UX), Content Strategists/Managers, and Public Relations Specialists can reach and exceed the $30/hour mark.

### A Day in the Life: Marketing Specialist ($30/Hour)

To make this tangible, let's imagine a day for "Alex," a Marketing Specialist at a mid-sized tech company, earning approximately $62,000 a year.

- 9:00 AM - 9:30 AM: Alex starts the day by reviewing key performance indicators (KPIs) from ongoing digital marketing campaigns. They check the analytics dashboards for website traffic, conversion rates from a recent email blast, and engagement on social media platforms.

- 9:30 AM - 11:00 AM: Alex joins a weekly campaign strategy meeting with the marketing manager, a content writer, and a graphic designer. They brainstorm ideas for the upcoming quarter's product launch, and Alex provides data-driven insights on which channels performed best in the past, suggesting a focus on targeted LinkedIn ads and a webinar series.

- 11:00 AM - 1:00 PM: This is focused work time. Alex builds out a new email marketing sequence in HubSpot for a segment of their customer base. This involves writing compelling subject lines, segmenting the audience list, and setting up A/B tests to optimize open rates.

- 1:00 PM - 1:30 PM: Lunch break.

- 1:30 PM - 3:00 PM: Alex collaborates with the sales team. They need marketing materials for an upcoming trade show. Alex works to ensure the messaging on the new brochures and banners is consistent with the digital campaign and provides the sales team with talking points about new product features.

- 3:00 PM - 4:30 PM: Alex dedicates this time to content creation and scheduling. They draft social media posts for the week, create a script for a short promotional video, and coordinate with the graphic designer to get the necessary visuals.

- 4:30 PM - 5:00 PM: Alex wraps up the day by responding to final emails, updating project management software (like Asana or Trello) with their progress, and creating a to-do list for tomorrow.

This "day in the life" illustrates a key point: a $30/hour job isn't about simply clocking in and out. It involves proactive problem-solving, collaboration, specialized skills (like using marketing automation software), and a direct contribution to the company's goals.

Breaking Down a $30/Hour Salary: What It Really Means for Your Finances

Earning $30 per hour is a fantastic achievement, but what does that number translate to in your bank account and your daily life? Understanding the full financial picture—from gross annual income to net take-home pay and the impact of where you live—is critical for effective budgeting and long-term planning.

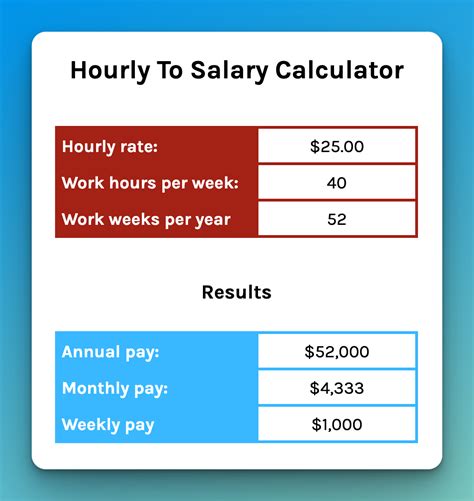

### The Annual, Monthly, and Weekly Numbers

First, let's calculate the gross (pre-tax) income based on a standard work schedule.

- Hourly Rate: $30

- Weekly Income: $30/hour * 40 hours/week = $1,200 per week

- Monthly Income (approx.): $1,200/week * 4.33 weeks/month = $5,196 per month

- Annual Income: $30/hour * 2,080 hours/year (40 hours/week * 52 weeks/year) = $62,400 per year

This $62,400 figure places you comfortably above the U.S. median household income, which was approximately $74,580 in 2022 according to the Census Bureau, but it's important to remember that household income often includes more than one earner. For a single individual, this is a very solid income.

### Gross vs. Net Pay: A Realistic Look

Your gross salary of $62,400 is not what you'll see in your bank account. Various deductions will reduce this amount to your net, or "take-home," pay. These deductions typically include:

- Federal Income Tax: Depends on your filing status (single, married, etc.) and tax bracket.

- State Income Tax: Varies significantly by state (some have none, others are high).

- FICA Taxes: A flat rate for Social Security (6.2%) and Medicare (1.45%).

- Health Insurance Premiums: The amount you contribute to your employer-sponsored health plan.

- Retirement Contributions: Pre-tax deductions for a 401(k) or 403(b), which lower your taxable income.

- Other Deductions: Such as dental, vision, life insurance, or a Health Savings Account (HSA).

As a rough estimate, you can expect deductions to total between 20% and 30% of your gross pay. For a $62,400 salary, this means your annual take-home pay would likely be between $43,680 and $49,920, or roughly $3,640 to $4,160 per month.

### Total Compensation: Beyond the Hourly Wage

When evaluating a job offer, it's a common mistake to focus solely on the hourly rate. The true value of a job lies in its total compensation package. Two jobs offering $30/hour can have vastly different overall financial benefits.

Here’s what to look for beyond the base salary:

- Bonuses and Profit Sharing: Performance-based bonuses or company-wide profit sharing can add thousands of dollars to your annual earnings.

- 401(k) Matching: This is essentially free money. An employer who matches 100% of your contributions up to 5% of your salary is giving you an extra $3,120 per year ($62,400 * 0.05). This is a critical factor in wealth building.

- Health Insurance: A company with a generous health insurance plan that covers a high percentage of the premium saves you hundreds of dollars each month compared to a less generous plan.

- Paid Time Off (PTO): A generous PTO policy (vacation, sick days, holidays) is a valuable, non-monetary benefit that improves work-life balance.

- Professional Development: Does the company pay for certifications, training, or tuition reimbursement? This is an investment in your future earning potential.

- Other Perks: Stock options, flexible work schedules, commuter benefits, and wellness stipends all add to the overall value proposition.

### Cost of Living Analysis: How Far Your $30/Hour Goes

A $62,400 salary provides a comfortable lifestyle in many parts of the country, but it can feel stretched in high-cost-of-living (HCOL) areas. The purchasing power of your salary is heavily dependent on your geographic location.

Let's compare the lifestyle you could afford on a $62,400 salary in three different U.S. cities, using data from platforms like Payscale and Numbeo to estimate costs.

| Expense Category | High Cost of Living (HCOL)

San Jose, CA | Medium Cost of Living (MCOL)

Austin, TX | Low Cost of Living (LCOL)

Kansas City, MO |

| ------------------------- | ---------------------------------------------------- | -------------------------------------------------- | ------------------------------------------------- |

| Gross Annual Salary | $62,400 | $62,400 | $62,400 |

| Estimated Net Monthly | ~$3,900 (High CA state tax) | ~$4,100 (No state income tax) | ~$4,000 |

| Median 1-BR Rent | ~$2,800 | ~$1,600 | ~$1,100 |

| Rent as % of Net Pay | ~72% (Struggling) | ~39% (Manageable) | ~28% (Comfortable) |

| Lifestyle Outlook | Extremely difficult to live alone. Requires roommates or significant financial strain. Savings are minimal. | A comfortable lifestyle is possible, but budgeting is essential. Can save and invest moderately. | A very comfortable lifestyle. Significant room for savings, investments, and discretionary spending. |

As the table clearly demonstrates, the same salary can lead to vastly different financial realities. In Kansas City, a professional earning $30/hour can comfortably afford to live alone, save aggressively, and enjoy a high quality of life. In Austin, it's manageable but requires careful budgeting. In San Jose, that same salary is not a living wage for a single person, highlighting the critical importance of considering location in your job search and salary negotiations.

The 6 Key Factors That Influence Your Path to $30 an Hour

Reaching a $30 per hour wage is not a matter of luck; it's the result of a strategic combination of factors. Understanding and actively managing these elements can dramatically accelerate your journey to this income level and beyond. Whether you're aiming to turn a $20/hour job into a $30/hour career or starting from scratch, focusing on these six areas will give you the most leverage.

### 1. Level of Education and Certification

Your formal education and specialized credentials are often the foundation of your earning potential. They act as a signal to employers that you possess a verifiable baseline of knowledge and commitment.

- The Impact of a Degree: While many high-paying jobs don't require a bachelor's degree (especially in skilled trades), holding one can open doors and increase starting salaries in many corporate and technical fields. According to the BLS, in 2022, the median weekly earnings for those with a bachelor's degree were $1,432, significantly higher than the $853 for those with only a high school diploma. This breaks down to roughly $35.80/hour versus $21.33/hour, placing the $30/hour mark squarely in the territory of college-educated professionals or highly skilled workers without a degree.

- Associate Degrees and Technical Colleges: For many high-demand fields like nursing (ADN), respiratory therapy, or web development, a two-year associate degree is the standard entry point and can quickly lead to earnings around or above $30/hour. For example, the median pay for Diagnostic Medical Sonographers, a role often requiring an associate degree, was $81,350 per year ($39.11/hour) in 2022 (BLS).

- The Power of Certifications: In the modern job market, targeted certifications can be just as valuable as a degree, if not more so. They demonstrate specific, in-demand skills.

- In IT: Certifications like CompTIA A+, Network+, Security+, or more advanced credentials like Certified Information Systems Security Professional (CISSP) can dramatically boost earning potential. A help desk technician earning $22/hour might jump to $30/hour or more after getting a network administration certification.

- In Project Management: A Project Management Professional (PMP) certification is a gold standard that often separates candidates and justifies a higher salary. According to the Project Management Institute (PMI), PMP holders in the U.S. report median salaries 32% higher than their non-certified peers.

- In Skilled Trades: A journeyman license for an electrician or plumber, or a welding certification from the American Welding Society (AWS), is a direct ticket to higher wages.

### 2. Years of Experience: The Earning Curve

Experience is perhaps the most powerful driver of wage growth. Employers pay for proven results and the wisdom that comes from navigating real-world challenges. The salary difference between an entry-level employee and a seasoned professional in the same role can be substantial.

Let's examine the typical salary progression for a role like a Market Research Analyst, which has a 2022 median pay of $68,230 per year ($32.80/hour) according to the BLS.

- Entry-Level (0-2 years): An individual starting in this role might earn $22 - $28 per hour ($45,000 - $58,000/year). They are learning the ropes, performing data collection, and creating basic reports under supervision.

- Mid-Career (3-8 years): After gaining experience, this professional is now at the $30 - $45 per hour ($62,000 - $93,000/year) level. They are managing projects independently, conducting complex analyses, and presenting findings to stakeholders. They have reached and surpassed our target wage.

- Senior/Lead (8+ years): A senior analyst or manager could earn $45 - $60+ per hour ($93,000 - $125,000+/year). They are now setting strategy, mentoring junior analysts, and influencing major business decisions.

This progression shows that while a role's *median* pay might be around $30/hour, you may need a few years of dedicated experience to reach that specific number. The key is to choose a field with a strong growth trajectory.

### 3. Geographic Location: Where Your Wage Goes Further

As demonstrated in the cost-of-living analysis, geography is a paramount factor. Companies in major metropolitan areas with high living costs must offer higher wages to attract talent. Conversely, the same job in a rural or low-cost-of-living area will almost always pay less in nominal terms, though its purchasing power might be equivalent or greater.

Data from salary aggregators like Salary.com and Glassdoor consistently show these variations. Let's look at the average salary for a Web Developer (a role commonly found around the $30-$40/hour mark) in different locations:

| City / Region | Average Annual Salary | Equivalent Hourly Wage | Analysis |

| ----------------------------- | --------------------- | ---------------------- | ------------------------------------------------------------------------------------------------------------------------ |

| San Francisco, CA | $105,000+ | $50.48+ | Extremely high wages are needed to offset the nation's highest housing and living costs. |

| New York, NY | $95,000+ | $45.67+ | A major tech hub with competitive salaries, but still very high cost of living. |

| Austin, TX | $82,000 | $39.42 | A booming tech scene has driven salaries up, while the cost of living remains lower than coastal hubs. |

| Chicago, IL | $78,000 | $37.50 | A large, established market with solid tech salaries and a more moderate cost of living than the coasts. |

| Raleigh, NC (Research Triangle) | $75,000 | $36.05 | A growing tech and research hub offering competitive wages with an affordable cost of living. A sweet spot. |

| Des Moines, IA | $65,000 | $31.25 | A lower cost of living means a salary just over the $30/hr mark can provide a very high quality of life. |

*(Source: Data synthesized from Glassdoor and Salary.com, 2023-2024)*

The takeaway: If you are willing and able to relocate, targeting cities in the "sweet spot" (like Raleigh, Austin, or Denver) can give you the best of both worlds: a strong salary and a manageable cost of living. Remote work has complicated this, but many companies are now adjusting salaries based on the employee's location.

### 4. Industry, Company Type, and Size

The context in which you work matters immensely. The exact same job title—say, "HR Specialist"—will have a different salary range depending on the industry and the specific company.

- Industry: Some industries are simply more profitable and pay better than others. An HR Specialist in the Technology or Pharmaceuticals industry will almost certainly earn more than an HR Specialist at a Non-Profit or in the Retail sector. High-margin industries can afford to pay more to attract top talent.

- Company Size:

- Large Corporations (5,000+ employees): These companies typically offer higher base salaries, more structured salary bands, and extensive benefits packages (better 401k match, premium health insurance). The path to $30/hour is often clearly defined through promotions.

- Startups: Base salaries might be slightly lower than at large corporations, but they are often supplemented with potentially lucrative stock options. The risk is higher, but so is the potential reward if the company succeeds. Earning $30/hour is common for experienced hires.

- Small to Medium-Sized Businesses (SMBs): Salaries can vary widely. SMBs offer less bureaucracy and potentially more responsibility, but may not have the same budget for high salaries or lavish benefits as large corporations.

- Public vs. Private Sector:

- Private Sector: Generally offers higher top-end salaries and bonuses.

- Public Sector (Government): May offer slightly lower base salaries but often compensates with exceptional job security, generous pension plans, and excellent work-life balance. A government job paying $30/hour might have a total compensation package that rivals a higher-paying private sector role when pensions are factored in.

### 5. Area of Specialization within a Field

Within any given profession, there are niches and specializations. Developing expertise in a high-demand, high-value sub-field is one of the fastest ways to increase your earnings.

Let's consider the broad field of Nursing. A Registered Nurse (RN) is a great career, but certain specializations command a significant premium:

- General RN (Medical-Surgical): This is the baseline, with median pay around $39/hour.

- Specialized RN (Operating Room, ICU, ER): The high-stress, highly technical nature of these roles often pushes pay into the $42 - $50+/hour range.

- Specialized RN (Neonatal, Labor & Delivery): These highly sought-after roles also command premium wages.

The same principle applies everywhere:

- IT: A generalist "IT Support Specialist" might make $25/hour. An "IT Support Specialist" who specializes in Cybersecurity or Cloud Infrastructure (AWS/Azure) could easily make $35/hour.

- Marketing: A "Marketing Coordinator" handling general tasks might make $24/hour. A "Marketing Coordinator" who specializes in Search Engine Optimization (SEO) or Marketing Automation could make $32/hour.

- Accounting: A general staff accountant might be just under our target. An accountant who specializes in Forensic Accounting or International Tax Law will be well over it.

### 6. In-Demand Skills That Command a Premium

Beyond job titles and specializations, specific, transferable skills can make you a more valuable candidate and justify a higher salary. Cultivating these skills is a direct investment in your earning power.

- Hard Skills (Technical/Quantifiable):

- Data Analysis and Visualization: Proficiency in tools like SQL, Python/R, Tableau, or Power BI. Nearly every industry needs people who can interpret data to make business decisions.

- Cloud Computing: Knowledge of platforms like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform.

- Digital Marketing Tools: Expertise in Google Analytics, Google Ads, HubSpot, Salesforce, or Marketo.

- Coding/Programming: Even basic proficiency in languages like Python, JavaScript, or HTML/CSS can set you apart in many non-developer roles.

- Project Management Software: Mastery of tools like Jira, Asana, Trello, or Monday.com.

- Soft Skills (Interpersonal/Qualitative): These are often the deciding factor in promotions and leadership roles.

- Communication (Written and Verbal): The ability to clearly articulate complex ideas to different audiences.

- Leadership and Mentorship: Experience in training junior colleagues or leading project teams, even informally.

- Negotiation and Persuasion: The ability to build consensus and advocate for your ideas (and your salary!).

- Problem-Solving and Critical Thinking: Moving beyond just identifying problems to proposing and implementing solutions.

- Adaptability and Learning Agility: A demonstrated passion for learning new skills and adapting to changing technologies and business needs.

By strategically developing these six areas, you can create a compelling case for why you are worth $30 per hour and build a career that continues to grow in value over time.

Job Outlook & Future-Proofing Your $30/Hour Career

Achieving a $30 per hour wage is a milestone, not a final destination. To ensure