Achieving an $80,000 annual salary is a significant milestone for many professionals, placing them well above the national average and opening doors to greater financial security and career opportunities. But what does that impressive yearly figure actually mean in terms of your day-to-day, hour-to-hour earnings?

Understanding how to convert your salary to an hourly wage is more than a simple math problem; it's a critical tool for budgeting, job offer negotiation, and assessing your true earning power. This article provides a comprehensive breakdown of an $80,000 salary, explores the key factors that help you reach this income level, and examines the career outlook for professions in this pay bracket.

Breaking Down an $80,000 Salary: The Hourly Math

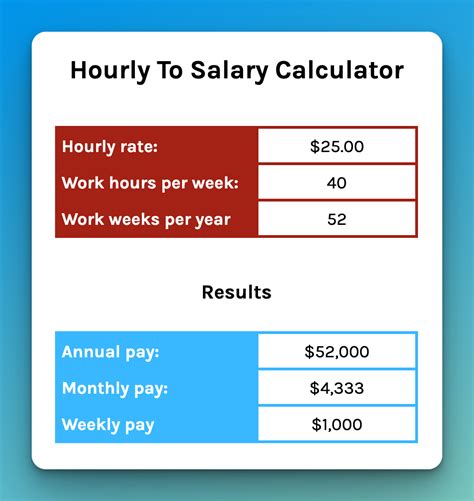

On the surface, calculating your hourly rate from an annual salary seems straightforward. The standard formula is based on a typical 40-hour workweek over 52 weeks a year.

The Standard Calculation:

- 52 weeks/year × 40 hours/week = 2,080 hours/year

- $80,000 / 2,080 hours = $38.46 per hour

This figure, $38.46 per hour, is your gross hourly wage. It’s the rate you are paid before any deductions are taken out. Your net, or take-home, hourly rate will be lower after federal and state taxes, Social Security, Medicare, health insurance premiums, and retirement contributions (like a 401(k)) are subtracted.

However, for many salaried professionals, the 40-hour week is more of a guideline than a rule. If you consistently work longer hours without overtime pay, your effective hourly rate decreases.

- For a 45-hour workweek: $80,000 / 2,340 hours = $34.19 per hour

- For a 50-hour workweek: $80,000 / 2,600 hours = $30.77 per hour

Understanding this effective rate is crucial for evaluating work-life balance and comparing a salaried position to a truly hourly (and potentially overtime-eligible) role.

Is $80,000 a Good Salary? A National Perspective

In one word: yes. An individual salary of $80,000 is excellent.

According to the U.S. Bureau of Labor Statistics (BLS), the median weekly earnings for full-time wage and salary workers in the United States were $1,145 in the first quarter of 2024. This translates to an annual salary of approximately $59,540.

An $80,000 salary is over $20,000 higher than the national median, placing you in a strong financial position as an individual earner. It's also above the median household income, which was $74,580 in 2022, according to the U.S. Census Bureau. While financial comfort is relative and highly dependent on location, an $80,000 salary provides a solid foundation for financial stability in most parts of the country.

Key Factors That Influence Your Salary

Reaching the $80,000 mark isn't just about landing the right job title; it's a combination of strategic career decisions. Here are the most significant factors that influence your earning potential.

### Level of Education

Education remains one of the strongest predictors of income. BLS data consistently shows that higher educational attainment correlates with higher earnings and lower unemployment rates.

- Bachelor's Degree: This is often the minimum requirement for professional roles that pay in the $80,000 range. Median weekly earnings for those with a bachelor's degree were $1,499 in 2023 (approx. $77,948 annually).

- Master's Degree: An advanced degree can provide a significant pay bump and open doors to senior or specialized positions. Median weekly earnings for master's degree holders were $1,759 in 2023 (approx. $91,468 annually).

For professions like engineering, finance, or healthcare administration, a master's degree can be the key that unlocks salaries well over the $80,000 threshold.

### Years of Experience

Experience is a powerful driver of salary growth. Companies pay a premium for seasoned professionals who can solve complex problems, manage teams, and operate with autonomy.

- Entry-Level (0-2 years): May start in the $55,000 - $70,000 range.

- Mid-Career (3-8 years): This is often the sweet spot where professionals cross the $80,000 threshold. They have proven their value and are ready for more responsibility.

- Senior/Lead (8+ years): At this stage, salaries can climb well into the six-figure range ($100,000+), especially in high-demand fields.

According to Salary.com, a Financial Analyst in the U.S. might start around $65,000, but with several years of experience, they can easily command a salary of $80,000 to $95,000.

### Geographic Location

Where you live is arguably the most dramatic factor influencing the value of your salary. An $80,000 salary in a low-cost-of-living (LCOL) area can afford a much higher quality of life than the same salary in a high-cost-of-living (HCOL) city.

For example, using Payscale's Cost of Living Calculator:

- An $80,000 salary in St. Louis, Missouri provides a comfortable lifestyle.

- To maintain that same standard of living in San Francisco, California, you would need to earn approximately $144,000.

- Conversely, if you moved from Boston, Massachusetts with an $80,000 salary, you would only need to earn around $52,000 in Houston, Texas to live similarly.

High salaries in cities like New York, San Jose, and Boston are often offset by extremely high housing, tax, and daily living costs.

### Company Type

The type of organization you work for plays a significant role in compensation strategy.

- Large Corporations: Typically offer higher base salaries, structured bonus plans, and comprehensive benefits packages (health, 401(k) matching).

- Startups: May offer a lower base salary but compensate with potentially lucrative stock options. The culture is often fast-paced with high-risk, high-reward potential.

- Government/Non-Profit: While these sectors may offer slightly lower salaries, they often provide excellent job security, generous pension plans, and superior work-life balance.

### Area of Specialization

An $80,000 salary is a common median for a wide variety of skilled professions. Your chosen field is a primary determinant of your earning potential. Here are some examples of roles where a mid-career professional can expect to earn around $80,000, according to data from the BLS and Glassdoor:

- Marketing Manager: ($79,000 national average)

- Financial Analyst: ($82,000 national average)

- Experienced Registered Nurse (RN): ($81,220 median pay, BLS 2022)

- Construction Manager: ($101,480 median pay, BLS 2022)

- Software Developer: ($127,260 median pay, BLS 2022, though mid-level salaries often fall in the $80k-$100k range outside of major tech hubs)

Job Outlook

The future is bright for careers that command an $80,000 salary, as they are typically knowledge-based roles that are in high demand. According to the BLS Occupational Outlook Handbook (2022-2032 projections):

- Employment for Software Developers is projected to grow 25%, much faster than the average for all occupations.

- Jobs for Marketing Managers are expected to grow 6%.

- The field for Financial Analysts is projected to grow by 8%.

These statistics indicate strong, sustained demand for skilled professionals, suggesting that opportunities to earn an $80,000 salary and beyond will remain plentiful in the coming decade.

Conclusion

Converting your $80,000 salary to its hourly equivalent—roughly $38.46 per hour—is the first step in understanding its true value. This salary level places you well ahead of the national median and represents a significant professional achievement.

However, the real-world value of that income is shaped by powerful factors. Your career trajectory toward this goal and beyond will be heavily influenced by your education, accelerated by your years of experience, and defined by your industry specialization. Crucially, the lifestyle this salary affords will be determined by your geographic location.

By strategically managing these factors, you can not only reach the $80,000 benchmark but also maximize its power to build a secure and fulfilling financial future. Use this knowledge to negotiate confidently, plan your career path, and make informed decisions that align with your professional and personal goals.