Earning $30 an hour is a significant financial milestone for many professionals. It translates to an annual salary of approximately $62,400 before taxes, a figure that positions you comfortably above the national median income and opens the door to a wide range of rewarding and stable careers. Whether you're a student planning your future or a professional looking to increase your earning potential, understanding what it takes to reach this income level is the first step toward achieving your goals.

This guide will break down the numbers, explore the types of jobs that pay in this range, and detail the key factors that can help you secure a position earning $30 an hour or more.

What Does a "$30 an Hour" Professional Do?

While "$30 an hour" isn't a job title, it's a pay grade common across numerous skilled professions in diverse industries. The work is typically characterized by a need for specialized knowledge, formal training, or significant hands-on experience. You are no longer just performing tasks; you are solving problems, managing projects, and providing valuable expertise.

Here are a few examples of roles where earning $30 an hour is common:

- Registered Nurse (RN): Providing and coordinating patient care, educating patients about health conditions, and offering emotional support.

- Web Developer: Designing, creating, and maintaining websites and web applications, ensuring functionality and a seamless user experience.

- Skilled Tradesperson (e.g., Electrician, Plumber): Installing, maintaining, and repairing essential systems in residential and commercial buildings. This work requires apprenticeships and licensing.

- Marketing Specialist: Developing and implementing marketing campaigns to promote a company's products or services, often specializing in digital areas like SEO or content marketing.

- Accountant: Preparing and examining financial records, ensuring records are accurate, and that taxes are paid properly and on time.

The common thread is value. These professionals possess skills that are in high demand and are critical to the function of their organizations or clients.

Average $30 an Hour Yearly Salary

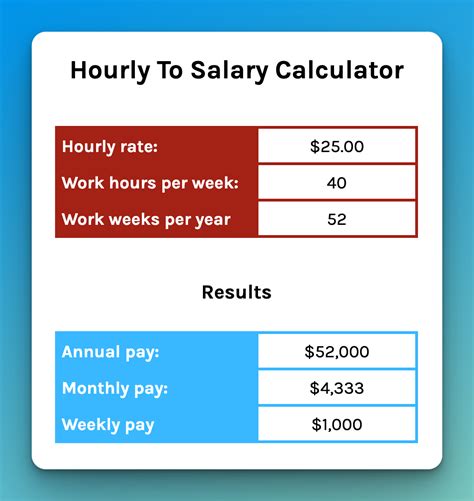

Let's start with the straightforward math. An hourly wage of $30 translates to the following annual and monthly income (before taxes, assuming a standard work schedule):

- Annual Salary (40-hour week): $30/hour x 40 hours/week x 52 weeks/year = $62,400 per year

- Monthly Gross Income: $62,400 / 12 months = $5,200 per month

This salary is well above the median hourly wage for all occupations in the United States, which was $23.11 in May 2023, according to the U.S. Bureau of Labor Statistics (BLS). Earning $30 an hour puts you in a strong financial position in many parts of the country.

However, this figure is a baseline. Top earners in these fields can make significantly more, with senior-level positions often commanding salaries upwards of $85,000 to $100,000+ per year. Conversely, entry-level positions in these fields might start closer to $22-$25 per hour ($45,000-$52,000 per year) as you build experience.

Key Factors That Influence Salary

Reaching the $30/hour benchmark isn't just about choosing the right job title; it's about strategically building your professional profile. Several key factors will determine how quickly you can achieve and exceed this income level.

### Level of Education

Formal education is often the foundation for higher earning potential. A relevant degree or certification demonstrates a baseline of knowledge and dedication.

- Associate's or Bachelor's Degree: For many professional roles like nursing, accounting, or marketing, a degree is a standard requirement. For instance, data from Salary.com shows that Accountants with a Bachelor's degree earn significantly more than those without.

- Certifications and Licenses: In skilled trades and IT, specific certifications can be more valuable than a traditional degree. An electrician with a journeyman or master license or a web developer with an AWS Certified Developer certification can command a premium wage.

- Master's Degree: For roles requiring advanced specialization, a master's degree can be the key to unlocking higher pay brackets. A Nurse Practitioner, for example, requires a master's and earns substantially more than an RN.

### Years of Experience

Experience is one of the most powerful drivers of salary growth. Companies pay for proven expertise and the ability to operate autonomously.

- Entry-Level (0-2 years): In this phase, you are learning the ropes. Your pay may start below the $30/hour mark as you build foundational skills.

- Mid-Career (3-8 years): With several years of experience, you have a track record of success. This is often when professionals cross the $30/hour threshold and begin to accelerate their earnings. Payscale data consistently shows a strong positive correlation between years of experience and salary across nearly every profession.

- Senior/Lead-Level (8+ years): At this stage, you are not just executing tasks but are likely leading projects, mentoring junior staff, and contributing to strategy. Your hourly rate can climb to $40, $50, or even higher.

### Geographic Location

Where you work matters—a lot. Salaries for the same job can vary dramatically based on the cost of living and local demand for skills.

- Major Metropolitan Areas: Cities like New York, San Francisco, and Boston offer the highest salaries to compensate for a very high cost of living. A software developer role that pays $35/hour in a mid-sized city might pay $50/hour in the Bay Area.

- Mid-Sized Cities and Suburbs: These areas often provide a sweet spot where wages are still strong, but the cost of living is more manageable, allowing your salary to go further.

- Rural Areas: Wages are typically lower in rural locations due to a lower cost of living and less competition among employers.

You can use the BLS Occupational Employment and Wage Statistics (OEWS) tool to compare average wages for specific occupations in different states and metropolitan areas.

### Company Type

The type of organization you work for has a significant impact on its compensation philosophy.

- Large Corporations: Major tech companies, financial institutions, and healthcare systems often offer higher base salaries, robust benefits packages, and bonuses.

- Startups: While startups may offer a lower base salary, they often compensate with stock options, which can have a high potential payoff if the company succeeds.

- Government: Federal, state, and local government jobs typically offer competitive salaries with exceptional job security and excellent retirement and health benefits.

- Non-Profits: These organizations usually offer lower salaries than their for-profit counterparts, but they can provide immense job satisfaction for those passionate about a specific cause.

### Area of Specialization

Within any given field, specializing in a high-demand niche can dramatically increase your earning potential.

- Nursing: An Emergency Room or Intensive Care Unit (ICU) nurse typically earns more than a general practice nurse due to the high-stress environment and specialized skills required.

- IT/Web Development: A developer specializing in in-demand areas like cloud computing (AWS, Azure), cybersecurity, or AI/machine learning will earn far more than a generalist front-end developer.

- Marketing: A specialist in technical SEO or paid-per-click (PPC) advertising often commands a higher salary than a generalist marketing coordinator.

Job Outlook

The long-term demand for skilled professionals is strong. Many of the careers that pay around $30 an hour are projected to grow faster than the national average.

According to the BLS Occupational Outlook Handbook (2022-2032 projections):

- Registered Nurses: Employment is projected to grow 6% ("faster than average").

- Web Developers: Employment is projected to grow 16% ("much faster than average").

- Electricians: Employment is projected to grow 6% ("faster than average").

- Accountants and Auditors: Employment is projected to grow 4% ("about as fast as average").

This positive outlook means that investing in the skills and education required for these roles is a secure bet for long-term career stability and growth.

Conclusion

Earning a $30 an hour yearly salary—equivalent to over $62,000 a year—is a highly achievable goal that signifies a successful professional career. It is not tied to a single job but is a benchmark of skill, experience, and value across many industries.

To reach this level, focus on these key takeaways:

1. Invest in Your Skills: Whether through a formal degree, a specialized certification, or a trade apprenticeship, acquire in-demand knowledge.

2. Gain Experience: Be patient in your early career and focus on learning. Your salary will grow as your expertise does.

3. Be Strategic: Understand how factors like location, company type, and specialization can impact your pay, and make choices that align with your financial and lifestyle goals.

4. Know Your Worth: As you build your skills and experience, use resources like the BLS, Glassdoor, and Salary.com to research compensation and negotiate effectively.

By taking a deliberate and informed approach to your career development, you can confidently work toward achieving—and surpassing—this important financial milestone.