The Salaried Overtime Question: A Common Point of Confusion

It’s a scenario familiar to millions of professionals: the project deadline is looming, you stay late for the third night in a row, and you spend your Saturday morning answering emails to keep things moving. You're a salaried employee, so this is just part of the job, right? You don't get paid for those extra hours.

This belief is one of the most persistent and misunderstood aspects of the American workplace. The truth is, a significant number of salaried employees are legally entitled to overtime pay. The distinction has nothing to do with your job title or the fact that you receive a salary, but everything to do with federal and state labor laws.

Understanding your rights isn't just about compliance; it's about being compensated fairly for your time and effort. This article will break down the rules that govern overtime for salaried employees, clarify who is eligible, and explain how this critical pay is calculated.

Understanding the Basics: Salary vs. Hourly

Before diving into the complexities of overtime, it's essential to clarify the fundamental difference between how salaried and hourly employees are paid.

- Hourly Employees: Are paid a set rate for each hour worked. Under the Fair Labor Standards Act (FLSA), they are almost always entitled to overtime pay (1.5 times their regular rate) for any hours worked over 40 in a workweek. They are considered "non-exempt."

- Salaried Employees: Receive a fixed, regular payment (e.g., $65,000 per year) regardless of the quantity or quality of work performed in a given week. The common misconception is that all salaried employees are automatically ineligible for overtime.

The key to unlocking the overtime puzzle lies not in the payment method (salary) but in the legal classification of the employee: exempt vs. non-exempt.

The Key to Overtime: Exempt vs. Non-Exempt Status

This is the most critical concept to grasp. The U.S. Department of Labor (DOL) sets the rules under the Fair Labor Standards Act (FLSA). Whether a salaried employee can get overtime pay depends entirely on whether they are classified as Exempt or Non-Exempt.

- Exempt Employees: Are *exempt* from overtime rules. They are not entitled to overtime pay, no matter how many hours they work. To be classified as exempt, an employee must meet specific criteria related to their job duties and be paid a salary that meets a minimum threshold.

- Non-Exempt Employees: Are *not exempt* from overtime rules. They are protected by the FLSA and must be paid overtime at a rate of time-and-a-half for all hours worked beyond 40 in a workweek. A salaried employee can absolutely be non-exempt and therefore eligible for overtime.

To determine your status, employers must apply a series of tests. If you don't meet *all* the requirements for exemption, you are, by default, a non-exempt employee entitled to overtime.

Key Factors That Determine Overtime Eligibility

To be legally classified as "exempt" and therefore ineligible for overtime, a salaried employee must pass both the Salary Basis Test and the Duties Test.

### The Salary Threshold Test: How Much You Earn

This is a straightforward, numbers-based test. Under current federal law, to even be considered for exempt status, an employee must earn a salary of at least $684 per week, which equates to $35,568 per year.

- Source: U.S. Department of Labor (DOL), Fact Sheet #17A.

- Implication: If you are a salaried employee and earn less than $35,568 per year, you are automatically classified as non-exempt and are entitled to overtime pay, regardless of your job duties or title.

It is crucial to note that this threshold is subject to change. The DOL has proposed significant increases to this minimum salary, so it is vital to stay current on the latest regulations.

### The Duties Test: What You Actually Do

If you meet the salary threshold, your employer must then prove that your specific job responsibilities fall into one of the DOL's "exempt" categories. Your job title is irrelevant; what matters are your primary, day-to-day duties. The main exemption categories are:

- Executive Exemption: Your primary duty must be managing the enterprise or a recognized department. You must customarily direct the work of at least two other full-time employees and have the authority to hire or fire (or your recommendations on these matters must be given significant weight).

- Administrative Exemption: Your primary duty must be performing office or non-manual work directly related to the management or general business operations of the employer or its customers. Your role must also include the exercise of discretion and independent judgment with respect to matters of significance. This is one of the most complex and frequently misapplied exemptions.

- Professional Exemption: This is split into two types:

- Learned Professional: Your primary duty requires advanced knowledge in a field of science or learning (e.g., law, medicine, engineering, accounting), customarily acquired by a prolonged course of specialized intellectual instruction.

- Creative Professional: Your primary duty requires invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., music, writing, acting).

- Computer Employee Exemption: You must be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled worker in the computer field.

- Outside Sales Exemption: Your primary duty must be making sales or obtaining orders, and you must be customarily and regularly engaged away from the employer’s place of business.

### State and Local Laws: A Critical Factor

Federal law sets the floor, not the ceiling. Many states have their own labor laws that are more generous to employees. This is a critical factor that can change your eligibility.

For example, in California, the 2024 minimum salary threshold for exempt employees is $66,560 per year, significantly higher than the federal level. States like New York and Washington also have higher, often tiered, salary thresholds based on location.

Always check your state and city labor department websites, as their rules may provide you with protections even if you don't qualify under federal law.

### Company Policy and Employment Agreements

Some companies may choose to offer overtime pay to exempt employees as a perk or an incentive, even if they are not legally required to. This would be outlined in your employment contract or company handbook. However, a company cannot use its internal policy to deny you overtime if you are legally classified as non-exempt under federal or state law. The law always supersedes company policy in this regard.

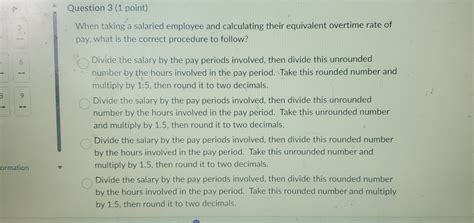

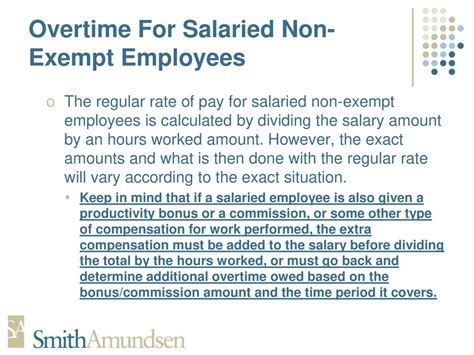

How Is Overtime Calculated for Salaried, Non-Exempt Employees?

If you are a salaried, non-exempt employee, you might wonder how overtime is calculated from a fixed salary. The process involves finding your "regular rate of pay."

1. Calculate the Weekly Salary: Divide your annual salary by 52 (weeks in a year).

- *Example:* $52,000 / 52 = $1,000 per week.

2. Calculate the Regular Hourly Rate: Divide the weekly salary by the number of hours the salary is intended to cover (typically 40).

- *Example:* $1,000 / 40 hours = $25 per hour.

3. Calculate the Overtime Rate: Multiply the regular hourly rate by 1.5.

- *Example:* $25 x 1.5 = $37.50 per hour.

4. Calculate Total Overtime Pay: Multiply the overtime rate by the number of overtime hours worked.

- *Example:* If you worked 45 hours, you have 5 overtime hours. 5 hours x $37.50 = $187.50 in overtime pay for that week.

Your total pay for that week would be your regular salary plus the overtime pay.

Conclusion: Key Takeaways for Salaried Employees

Navigating the rules of overtime can seem daunting, but understanding your rights is a crucial part of managing your career and ensuring you are paid fairly.

Here are the key takeaways:

- Salary Does Not Equal "No Overtime": The most important factor is your legal classification as "exempt" or "non-exempt," not your payment method.

- Know the Tests: Overtime eligibility hinges on three main factors: your salary level, your specific job duties, and the laws in your state.

- The Salary Threshold is a Hard Rule: If you are salaried below the federal minimum ($35,568/year) or your state's minimum (which may be higher), you are owed overtime.

- Duties Matter More Than Titles: A fancy title like "Manager" or "Administrator" does not make you exempt if your actual job duties don't meet the strict legal definitions.

- When in Doubt, Ask: If you believe you are being misclassified, consider speaking with your HR department for clarification or consulting with your state's labor agency or an employment law professional.

Being informed empowers you to have productive conversations about compensation and ensures you receive every dollar you rightfully earn.