Earning $35 an hour is a significant financial milestone, placing you comfortably above the national average and opening doors to a wide variety of rewarding and stable careers. This rate translates to an impressive annual income that can support a robust lifestyle and facilitate long-term financial goals. But what does that number actually mean for your bank account, and what kind of jobs pay this well?

This guide breaks down everything you need to know about a $35 an hour salary. We will explore its annual equivalent, examine the types of jobs that offer this level of compensation, and detail the key factors—from your education to your location—that can help you achieve and even surpass this impressive earning potential.

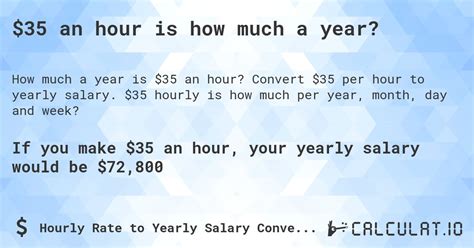

From Hourly to Yearly: Understanding Your Income at $35/Hour

First, let's translate the hourly rate into an annual salary. The calculation is straightforward, assuming a standard 40-hour workweek and 52 weeks in a year.

$35/hour x 40 hours/week x 52 weeks/year = $72,800/year (gross income)

This gross annual income of $72,800 is a strong figure. To put it in perspective, the U.S. Bureau of Labor Statistics (BLS) reported the median weekly earnings for full-time wage and salary workers in the fourth quarter of 2023 was $1,145, which annualizes to $59,540. Earning $72,800 places you well above this national median, signifying a skilled position with considerable responsibility.

Here’s a quick breakdown of your potential gross earnings:

- Daily: $280 (for an 8-hour day)

- Weekly: $1,400

- Bi-weekly: $2,800

- Monthly: ~$6,067

It's important to remember these figures are pre-tax. Your final take-home pay (net income) will depend on federal, state, and local income taxes, as well as deductions for things like health insurance, retirement contributions (e.g., 401(k)), and other benefits.

What Kind of Jobs Pay $35 an Hour?

A $72,800 salary is not typically associated with entry-level roles. Rather, it reflects a professional who has acquired specialized skills, a formal degree or certification, and several years of relevant experience. This income level is attainable across a diverse range of industries, from healthcare and technology to business and skilled trades.

Here are some examples of professions where earning $35 an hour ($72,800/year) is common, along with median salary data from the BLS (May 2022 data, the most recently available comprehensive data):

- Registered Nurse (RN): With a median annual wage of $81,220, RNs are central to the healthcare system. Many new graduates start near this range, with experienced nurses earning significantly more.

- Web Developer: These tech professionals design and create websites. The BLS lists their median annual pay at $80,730.

- Accountant or Auditor: Responsible for maintaining and inspecting financial records, accountants earned a median salary of $78,000 per year.

- Electrician: A highly skilled trade that doesn't require a four-year degree, electricians had a median pay of $60,240 per year, but experienced journeymen and master electricians in high-demand areas can easily surpass the $72,800 mark.

- Marketing Manager: These professionals plan and oversee marketing campaigns to generate interest in products or services. Their median pay is much higher at $140,040, but individuals with 3-5 years of experience in a Marketing Specialist role often find themselves moving into this pay bracket as they approach a management position.

Key Factors That Influence Salary

Reaching the $35-an-hour mark isn't just about choosing the right job title. Several factors will determine your specific earning potential. Understanding them is key to strategically planning your career path.

###

Level of Education

Your educational background is a primary driver of income. For many professional roles in the $70k-$80k range, a bachelor's degree is a minimum requirement. According to BLS data, individuals with a bachelor's degree have median weekly earnings ($1,432) that are significantly higher than those with only a high school diploma ($853).

However, a four-year degree isn't the only path. Specialized training, associate degrees, and professional certifications can also unlock this level of income. For example, a skilled tradesperson like a journeyman plumber or HVAC technician can earn well over $35 an hour through apprenticeship programs and certifications, bypassing the need for a traditional college degree.

###

Years of Experience

Experience is arguably one of the most critical factors. A recent graduate and a professional with 5-7 years of experience in the same role will have vastly different salaries.

- Entry-Level (0-2 years): You will likely start below $35/hour as you build foundational skills.

- Mid-Career (3-8 years): This is often when professionals hit and exceed the $35/hour mark. You've proven your value, can work independently, and may begin mentoring others.

- Senior-Level (8+ years): At this stage, your earnings should be well above $35/hour, as you take on leadership, strategy, and complex project management roles.

Salary aggregators like Payscale consistently show a strong positive correlation between years of experience and pay across nearly every profession.

###

Geographic Location

Where you work matters immensely. A $72,800 salary in a low-cost-of-living area like Omaha, Nebraska, provides far more purchasing power than the same salary in a high-cost city like San Francisco or New York City.

Companies adjust their pay scales based on the local cost of labor and living. For example, according to Salary.com's calculator, a Graphic Designer earning the national average of $63,000 might earn over $78,000 in Boston, MA, to compensate for the higher cost of living—pushing them well into the $35/hour range. Conversely, in a smaller market, their salary might be lower. Research the prevailing wages in your target city to set realistic expectations.

###

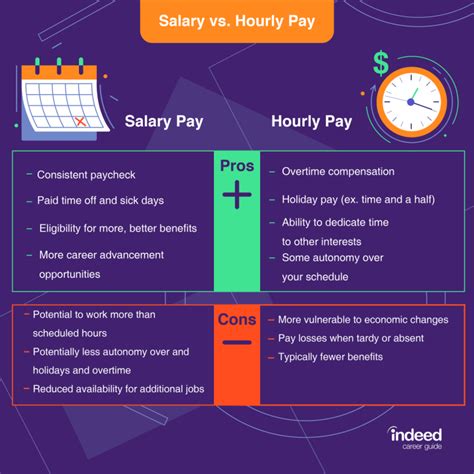

Company Type and Industry

The type of company you work for also impacts your pay. Large, multinational corporations often have more structured (and higher) pay bands than small businesses or non-profits.

- Large Tech Companies & Financial Firms: Often lead the market in compensation and benefits.

- Startups: May offer a lower base salary but compensate with stock options or equity.

- Government/Public Sector: Tend to offer strong job security and excellent benefits, though salaries may not reach the highest peaks of the private sector.

- Industry: Working in a high-growth, high-profit industry like technology, pharmaceuticals, or finance generally leads to higher earning potential than working in slower-growth sectors.

###

Area of Specialization

Within any given profession, developing a niche, in-demand skill set can significantly boost your income. A generalist will almost always earn less than a specialist.

For example, consider the field of accounting. A general staff accountant may earn around the median, but one who specializes in a high-demand area like forensic accounting, international tax law, or IT auditing for cybersecurity can command a much higher salary. Similarly, a web developer who specializes in cloud architecture or machine learning integration will earn substantially more than one focused solely on basic front-end design.

Job Outlook

The outlook for careers in the $35/hour range is exceptionally positive. Many of the professions that pay at this level—such as those in healthcare, technology, and skilled trades—are projected by the BLS to grow much faster than the average for all occupations through 2032.

- Registered Nurses: 6% growth (Faster than average)

- Web Developers: 16% growth (Much faster than average)

- Accountants and Auditors: 4% growth (About as fast as average)

This strong demand indicates not only job security but also continued wage growth, making these excellent fields to build a long-term, lucrative career.

Conclusion: Charting Your Path to $35 an Hour

Earning $35 an hour, or $72,800 annually, is a fantastic and achievable career goal. It represents a level of skill, experience, and value that is highly sought after in today's economy.

Here are the key takeaways for anyone aspiring to reach this income level:

1. It's a Strong, Above-Average Salary: A $72,800 annual income provides a solid foundation for financial security and a comfortable lifestyle.

2. Multiple Paths Lead Here: Whether you pursue a bachelor's degree, a master's degree, or a skilled trade apprenticeship, there are numerous routes to this pay grade.

3. Experience and Specialization are Key: Don't just get the job; become an expert in it. Continuously build your skills and specialize in a high-demand niche to accelerate your earnings.

4. Be Strategic About Location and Company: Your choice of where you work—both geographically and in terms of company type—can have a major impact on your paycheck.

By investing in your education, strategically gaining experience, and staying attuned to market demands, you can confidently chart a course to not only reach but exceed a $35 an hour salary.