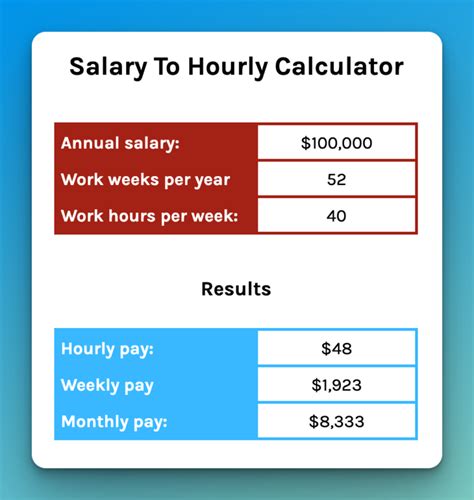

Are you currently earning around $39 an hour, or aspiring to? It’s a significant financial milestone, one that places you squarely in a professional tier where career stability, growth, and substantial earning potential become not just a dream, but an expectation. Converting that hourly rate to an annual salary reveals a figure of approximately $81,120 per year. This isn't just a number; it's a gateway to a new level of professional responsibility and financial security. But what does it truly take to build a sustainable and thriving career at this level and beyond? How do you transform that hourly potential into a salaried position with benefits, bonuses, and a clear path for advancement?

This guide is designed to be your definitive resource. We're going beyond simple math to explore the very fabric of the careers that command this level of compensation. We will dissect the roles, analyze the salary data with forensic precision, and lay out a strategic roadmap for you to follow. In my years as a career analyst, I've coached countless professionals through the transition from hourly contract work to high-impact salaried roles. I vividly remember a client, a data analyst named Sarah, who was stuck on a $40/hour contract with no benefits. By helping her identify and articulate the high-value skills she already possessed and strategically targeting companies that valued her specialization in data visualization, she landed a salaried position at $85,000 with a full benefits package and a signing bonus. Her story is a testament to the fact that with the right knowledge and strategy, this transition is not only possible but transformative. This article is that coaching session, scaled for you.

---

### Table of Contents

- [What Does a Professional Earning $81,000 a Year Actually Do?](#what-does-a-professional-earning-81000-a-year-actually-do)

- [The $81,000 Salary: A Deep Dive into National Averages and Compensation](#the-81000-salary-a-deep-dive-into-national-averages-and-compensation)

- [Key Factors That Influence Your Salary Potential](#key-factors-that-influence-your-salary-potential)

- [Job Outlook and Long-Term Career Growth](#job-outlook-and-long-term-career-growth)

- [How to Build Your $81,000+ Career: A Step-by-Step Guide](#how-to-build-your-81000-career-a-step-by-step-guide)

- [Conclusion: Charting Your Course to Career Success](#conclusion-charting-your-course-to-career-success)

---

What Does a Professional Earning $81,000 a Year Actually Do?

A salary of around $81,000 (or $39 per hour) represents a critical juncture in a professional's journey. It signifies a move beyond entry-level tasks into a realm of specialized knowledge, independent judgment, and tangible impact on a business's objectives. While the specific industries can vary dramatically—from healthcare and technology to finance and marketing—the roles at this pay grade share a common DNA.

These are not positions focused on mere task execution; they are about problem-solving, project management, and contributing specialized expertise. Professionals at this level are often the skilled "doers" who form the backbone of a successful team or department. They are trusted to manage significant components of a project, analyze complex data to provide insights, or oversee critical operational functions.

Common Responsibilities Across Industries:

- Project and Process Management: Owning a project from conception to completion, or managing a key part of a larger initiative. This involves planning, resource allocation, and ensuring deadlines are met.

- Data Analysis and Reporting: Gathering, interpreting, and presenting data to inform strategic decisions. This could be financial modeling for an analyst, analyzing patient outcomes for a nurse, or tracking campaign metrics for a marketer.

- Specialized Skill Application: Applying a deep-seated skill set that required years of education and experience to develop. Examples include a software developer writing complex code, a senior accountant navigating intricate tax laws, or a registered nurse performing advanced clinical procedures.

- Client or Stakeholder Management: Acting as a key point of contact for internal teams or external clients, requiring strong communication and relationship-building skills.

- Mentorship and Training: While not typically full-time managers, professionals at this level often guide and mentor junior team members, helping to build the team's overall capability.

### A Day in the Life: "Alex," a Mid-Level Financial Analyst

To make this tangible, let's imagine a day in the life of "Alex," a Financial Planning & Analysis (FP&A) Analyst at a mid-sized tech company, earning an $82,000 salary.

- 8:45 AM: Alex arrives, grabs coffee, and reviews overnight emails. There's a query from the Director of Marketing about the Q3 advertising budget's performance-to-plan.

- 9:15 AM: Alex logs into the company's financial planning software (like Anaplan or Oracle NetSuite). They pull the latest actuals for the marketing department and begin comparing them against the forecasted budget. They note a significant overspend in digital ads but also a corresponding, and impressive, spike in lead generation.

- 11:00 AM: Alex has built a concise variance analysis report. Using Excel and Tableau, they create a few charts to visualize the data, highlighting the ROI of the overspend. They draft an email to the Marketing Director, providing the analysis and suggesting a quick 15-minute call to discuss the implications for the Q4 forecast.

- 12:30 PM: Lunch. Alex often uses this time to connect with colleagues from other departments to better understand their business needs.

- 1:30 PM: Alex joins the weekly departmental meeting. They present their findings on the marketing budget, fielding questions from the CFO and other senior leaders. Their clear, data-backed explanation helps the leadership team understand the strategic value of the ad spend.

- 3:00 PM: The majority of the afternoon is dedicated to a larger, ongoing project: building the financial model for a potential new product launch. This requires deep focus, involving complex formulas, scenario analysis (best case, worst case, base case), and collaboration with the product development team to validate assumptions about cost and market size.

- 5:15 PM: Before logging off, Alex reviews their to-do list for tomorrow, prioritizing tasks related to the end-of-month reporting cycle. They send a final update on the product launch model to their manager, feeling a sense of accomplishment for moving a critical strategic initiative forward.

Alex's day is a blend of reactive analysis (the marketing budget query) and proactive, long-term strategic work (the new product model). This is the hallmark of an $81,000/year professional: they possess the expertise to not only report on what has happened but to help the organization decide what to do next.

The $81,000 Salary: A Deep Dive into National Averages and Compensation

An annual salary of $81,120 is a powerful benchmark. But how does it stack up against national averages, and what does the full compensation picture look like? A salary is just one piece of the puzzle; a comprehensive understanding requires looking at typical ranges, bonuses, and the invaluable benefits that come with a full-time, salaried role.

First, let's ground ourselves in the data. The U.S. Bureau of Labor Statistics (BLS) reported in the third quarter of 2023 that the median weekly earnings for full-time wage and salary workers was $1,118, which annualizes to $58,136. This immediately puts an $81,120 salary well above the national median, positioning it as a strong, competitive professional income.

This salary level is characteristic of experienced professionals with specialized skills. It's rarely an entry-level figure but is a very common target for those with 3-7 years of experience in a demanding field.

### Salary Ranges by Experience Level

Salary growth is not linear. It accelerates as you move from an entry-level contributor to an experienced, trusted expert. Here’s a typical progression for professional roles that cluster around the $81k mark, such as Financial Analysts, Registered Nurses, Project Managers, and Software Developers.

Typical Professional Salary Progression (National Averages)

| Experience Level | Years of Experience | Typical Salary Range (Annual) | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $55,000 - $70,000 | Focus on learning, executing defined tasks, and supporting senior team members. |

| Mid-Career | 3-7 Years | $70,000 - $95,000 | This is the sweet spot where $81,120 sits. Professionals manage their own projects, operate with greater autonomy, and begin to specialize. |

| Senior | 8-15 Years | $95,000 - $130,000+ | Leads complex projects, may manage a team, develops strategy, and mentors others. |

| Principal/Lead | 15+ Years | $120,000 - $180,000+ | Sets technical or strategic direction for a department. Recognized as a top expert in their field within the company. |

*Source: Data compiled and synthesized from averages reported by Payscale, Salary.com, and Glassdoor for relevant professional roles, cross-referenced with BLS industry data (2023-2024).*

As the table shows, a $39/hour or $81k salary is a hallmark of a mid-career professional who has successfully navigated the initial learning curve of their field and is now a reliable, value-adding member of the team.

### Beyond the Base Salary: Understanding Total Compensation

One of the most significant advantages of transitioning from an hourly rate to a salaried position is the access to a full suite of benefits and additional compensation, which can add 20-40% to your base salary's total value.

1. Performance Bonuses:

Many salaried roles, especially in corporate environments, are eligible for annual or quarterly bonuses tied to individual, team, and company performance. For a professional at the $81k level, this can range from 5% to 15% of their base salary. A 10% bonus would add an extra $8,100 to their annual earnings.

2. Profit Sharing & Stock Options:

- Profit Sharing: Some companies distribute a portion of their profits to employees. This is a direct reward for contributing to the company's success.

- Stock Options/Restricted Stock Units (RSUs): Particularly common in tech companies and startups, equity compensation gives you ownership in the company. RSUs are grants of company shares that vest over time (e.g., 25% per year over four years). This can become incredibly valuable if the company performs well.

3. Retirement Savings (401(k) or 403(b) Matching):

This is one of the most powerful wealth-building tools. A common company match is 50% of your contributions up to 6% of your salary.

- Example: On an $81,120 salary, you contribute 6% ($4,867).

- Your company matches 50% of that, adding another $2,433.50 to your retirement account for free. This is a guaranteed 50% return on your investment.

4. Health and Wellness Benefits:

Comprehensive insurance is a cornerstone of salaried employment. This typically includes:

- Medical, Dental, and Vision Insurance: Employer-subsidized plans drastically reduce healthcare costs compared to buying on the open market. The value of this subsidy can easily be $5,000 to $15,000 per year depending on family size.

- Health Savings Account (HSA) / Flexible Spending Account (FSA): Tax-advantaged accounts for healthcare expenses. Some employers even contribute seed money to HSAs.

- Disability and Life Insurance: Employer-paid short-term disability (STD), long-term disability (LTD), and life insurance provide a crucial financial safety net.

5. Paid Time Off (PTO):

Unlike many hourly roles, salaried positions come with a generous PTO package, including:

- Vacation Days: Typically starting at 2-3 weeks and increasing with tenure.

- Sick Days: For personal and family health needs.

- Paid Holidays: Typically 8-12 public holidays per year.

When you add it all up, an $81,120 base salary can easily equate to a total compensation package worth well over $100,000. This holistic view is critical when evaluating a job offer and understanding the true financial advantage of a salaried career path.

Key Factors That Influence Your Salary Potential

Reaching and exceeding the $81,000 salary mark is not a matter of luck; it's the result of a strategic combination of factors. Understanding these levers is the key to maximizing your earning potential throughout your career. As a career analyst, I've seen firsthand how a small investment in one of these areas can yield a disproportionately large return in salary negotiations. Let's break down the most critical components.

### 1. Level of Education and Certifications

Your educational foundation is often the ticket to entry, but advanced credentials are what unlock higher salary brackets.

The Impact of Degrees:

- Bachelor's Degree: This is the standard requirement for most professional roles in this salary range. Fields like finance, accounting, engineering, computer science, and nursing typically require a relevant bachelor's degree to even be considered.

- Master's Degree (MBA, MS, MSN): Pursuing a master's degree can significantly accelerate your earning potential. According to a 2022 report from the BLS, individuals with a master's degree had median weekly earnings that were nearly 20% higher than those with only a bachelor's degree. For specific roles, the impact is even more pronounced:

- An MBA can provide a salary premium of $20,000-$40,000 for roles in finance, management, and marketing.

- A Master of Science in Computer Science or Data Science can command a high premium in the tech industry.

- A Master of Science in Nursing (MSN) is often a prerequisite for high-paying specializations like Nurse Practitioner or Nurse Anesthetist, which command salaries well over $100,000.

The Power of Professional Certifications:

Certifications are a targeted way to prove your expertise in a specific domain. They are often faster and more cost-effective than a full degree and can provide an immediate salary boost.

- For Project Managers: A Project Management Professional (PMP)® certification from the Project Management Institute (PMI) is the gold standard. PMI's "Earning Power" salary survey consistently shows that PMP-certified professionals earn a significant premium—often 16% more than their non-certified peers.

- For Accountants and Financial Analysts: A Certified Public Accountant (CPA) license is a gateway to higher earnings and senior roles in accounting. A Chartered Financial Analyst (CFA)® designation is highly prestigious in the investment management world and can add a substantial premium to a financial analyst's salary.

- For IT Professionals: Certifications in high-demand areas are crucial. Examples include AWS Certified Solutions Architect (for cloud computing), Certified Information Systems Security Professional (CISSP) (for cybersecurity), and various Cisco or Microsoft certifications for networking and systems administration.

- For Nurses: Board certifications in a specialty, such as Critical Care Registered Nurse (CCRN)® or Certified Emergency Nurse (CEN)®, demonstrate a higher level of competence and can lead to higher pay and more desirable positions.

### 2. Years of Experience

While education opens the door, experience is what propels you up the salary ladder. Companies pay for proven results and the wisdom that comes from navigating real-world challenges.

- 0-2 Years (The Foundation): In this phase, your salary will likely be below the $81k mark. Your primary goal is to absorb as much as possible, build a track record of reliability, and master the core skills of your profession.

- 3-7 Years (The Growth Phase): This is where you hit your stride and where the $81k salary becomes very attainable. You are no longer just executing tasks; you are anticipating needs, managing small projects independently, and contributing valuable insights. Your salary growth is often steepest during this period as you prove your value. A professional in this phase might see their salary increase from $65,000 to $90,000.

- 8+ Years (The Expert Phase): As a senior professional, your value lies in your deep expertise, strategic thinking, and leadership. You are sought out for your judgment on complex problems. Salary growth continues, but it may be more tied to taking on leadership responsibilities or moving into more strategic roles. At this stage, salaries frequently cross the $100,000 - $120,000 threshold. For example, a senior software engineer with 10 years of experience at a major tech firm can easily earn upwards of $150,000 in base salary alone.

### 3. Geographic Location

Where you live and work is one of the most significant factors influencing your salary. A high cost of living (COL) in a major metropolitan area directly translates to higher wages for the same job.

High-Paying Metropolitan Areas:

Cities with major technology, finance, or biotech hubs consistently offer the highest salaries. However, this comes with a much higher cost of living.

- San Francisco Bay Area, CA: Remains the top-paying region, especially for tech roles. A software developer earning $81k in a smaller city could command $120,000 - $140,000 or more here.

- New York, NY: A global center for finance, law, and media. Financial analysts and marketing managers here see significant salary premiums.

- Boston, MA: A hub for biotech, healthcare, and education. Registered Nurses and life sciences professionals are in high demand.

- Seattle, WA: Home to Amazon and Microsoft, driving high wages for tech and related corporate roles.

Salary Comparison for a "Financial Analyst" Role (Mid-Career)

| City | Average Salary (Approx.) | Cost of Living Index (US Avg = 100) |

| :--- | :--- | :--- |

| New York, NY | $95,000 | 215.5 |

| San Francisco, CA | $102,000 | 243.6 |

| Chicago, IL | $83,000 | 118.0 |

| Dallas, TX | $80,000 | 102.3 |

| Kansas City, MO | $74,000 | 86.8 |

*Source: Salary data synthesized from Salary.com and Glassdoor (2024). Cost of living data adapted from Payscale's Cost of Living Calculator.*

This table illustrates that while you might earn $22,000 more in San Francisco than in Dallas for the same job, the cost of living is more than double. The rise of remote work has started to blur these lines, allowing some professionals to earn a high salary while living in a lower-cost area, but many companies still adjust pay based on location.

### 4. Company Type & Size

The type of organization you work for has a profound impact on your compensation structure and overall earnings.

- Large Corporations (Fortune 500): These companies typically offer higher base salaries, structured bonus programs, and top-tier benefits (excellent health insurance, generous 401k matches). The career path is often well-defined, but bureaucracy can sometimes slow things down. An analyst at a large bank might earn 10-20% more in base pay than one at a small regional company.

- Startups: Base salaries may be slightly lower or on par with the market average. The real allure is equity (stock options). If the startup is successful, these options can be worth far more than any salary difference. The work environment is fast-paced and offers incredible learning opportunities, but comes with less job security.

- Government (Federal, State, Local): Government jobs are known for stability, excellent benefits, and pensions. Base salaries for roles like IT specialists or accountants might be slightly lower than in the private sector, but the total compensation and work-life balance can be very competitive. The BLS notes that in 2022, state and local government workers' benefits accounted for 37.7% of total compensation, compared to 29.1% for private industry workers.

- Non-Profits: These organizations are mission-driven. Salaries are typically lower than in the for-profit sector. However, the work can be incredibly rewarding, and some non-profits offer strong benefits packages. A development manager at a non-profit might earn $75,000, while a comparable marketing manager in a corporate role earns $90,000.

### 5. Area of Specialization

Within any given profession, certain specializations are more lucrative because they are in higher demand or require a more complex skillset.

- In Technology: A generalist software developer might earn $85,000. A developer specializing in DevOps, Cybersecurity, or Artificial Intelligence/Machine Learning can earn $110,000+ with the same years of experience.

- In Finance: A corporate financial analyst earning $81,000 is a standard role. An analyst specializing in Mergers & Acquisitions (M&A) or Investment Banking at a major firm will start at a much higher salary and have a bonus potential that can exceed their base pay.

- In Healthcare (Nursing): A Registered Nurse in a general med-surg unit may earn around $78,000. A nurse with the same experience who specializes in the Operating Room (OR), Cardiac Catheterization Lab, or Neonatal Intensive Care Unit (NICU) can command salaries closer to $90,000 due to the high-stakes environment and specialized training required.

- In Marketing: A generalist marketing manager might be at the $81k level. A specialist in Marketing Analytics, SEO Strategy, or Marketing Automation (e.g., Salesforce Marketing Cloud) will often earn a premium.

### 6. In-Demand Skills

Beyond your job title, the specific, demonstrable skills you possess are what truly drive your value. High-value skills are often transferable across industries and are a powerful negotiating tool.

High-Value Hard Skills:

- Data Analysis & Visualization: Proficiency in tools like SQL for querying databases, Python or R for statistical analysis, and Tableau or Power BI for creating compelling dashboards. This is a top-tier skill in finance, marketing, operations, and beyond.

- Cloud Computing Platforms: Expertise in Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) is in extremely high demand across all IT roles.

- Project Management Software: Mastery of tools like Jira, Asana, or Trello to manage complex workflows and agile teams.

- Financial Modeling: The ability to build complex, dynamic financial models in Excel is a non-negotiable skill for high-earning finance professionals.

- Cybersecurity Protocols: Understanding threat analysis, network security, and compliance frameworks like GDPR or SOC 2.

High-Value Soft Skills:

- Communication & Presentation: The ability to distill complex information into a clear, concise, and compelling narrative for senior leadership.

- Strategic Thinking: Moving beyond day-to-day tasks to understand how your work fits into the larger business objectives and identifying future opportunities or risks.

- Negotiation & Influence: The ability to build consensus, persuade stakeholders, and effectively negotiate for resources, deadlines, and, of course, your own salary.

- Leadership & Mentorship: Taking the initiative to guide junior colleagues, lead project sub-teams, and demonstrate leadership potential even without a formal management title.

By consciously developing these specific factors, you can actively steer your career towards higher compensation, transforming the $39/hour benchmark from a ceiling into a stepping stone.

Job Outlook and Long-Term Career Growth

A salary of $81,000 per year is an excellent milestone, but a truly successful career is defined by its long-term viability and potential for growth. Fortunately, the types of professional roles that command this salary—those requiring specialized skills, critical thinking, and advanced education—are projected to have strong growth prospects over the next decade.

The U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook is the authoritative source for this data. Let's examine the outlook for a few of the representative careers we've discussed, which are typical of this salary level.

Projected Job Growth (2022-2032) for Representative Professions:

| Profession | 2022 Median Pay | Projected Job