For those with a passion for finance, leadership, and customer relations, the role of a Bank Branch Manager is a rewarding and influential career path. Standing at the helm of a local branch for a global financial giant like JPMorgan Chase offers a unique blend of community engagement and corporate impact. But what does this responsibility translate to in terms of compensation?

A career as a Chase Bank Branch Manager is not only professionally fulfilling but also financially lucrative, with a typical total compensation package often reaching well into the six-figure range, driven by a combination of a strong base salary and performance-based incentives.

This article provides a data-driven analysis of a Chase Bank Branch Manager's salary, the factors that shape it, and the future outlook for this dynamic profession.

What Does a Chase Bank Branch Manager Do?

Before diving into the numbers, it's essential to understand the scope of the role. A Chase Bank Branch Manager is the CEO of their branch. They are responsible for the branch's overall success, which involves a wide array of duties:

- Team Leadership & Development: Hiring, training, coaching, and managing a team of bankers, tellers, and financial advisors.

- Operational Excellence: Ensuring the branch runs smoothly, adheres to all banking regulations and security protocols, and meets compliance standards.

- Sales and Market Growth: Driving business development by promoting bank products like loans, mortgages, investment services, and credit cards. They are responsible for meeting and exceeding branch sales goals.

- Customer Relationship Management: Building and maintaining strong relationships with clients, resolving complex issues, and ensuring a high level of customer satisfaction.

- Financial Performance: Managing the branch's budget and profitability, analyzing performance data, and reporting to regional management.

In essence, they balance the needs of their customers, their team, and the broader goals of the JPMorgan Chase corporation.

Average Chase Bank Branch Manager Salary

The compensation for a Chase Bank Branch Manager is more than just a base salary; it's a comprehensive package that includes significant performance-based bonuses.

According to data from Salary.com, the average base salary for a Branch Manager at JPMorgan Chase & Co. typically falls between $88,000 and $112,000, with a median base salary around $98,700 as of late 2023.

However, the base salary is only part of the story. Glassdoor reports that the total pay for a Chase Branch Manager is, on average, around $111,500 per year, with "additional pay" (including cash bonuses, commissions, and profit sharing) ranging from $7,000 to $30,000 annually. This highlights the critical role of performance incentives in overall earnings.

Therefore, a realistic salary range for a Chase Bank Branch Manager, including base pay and bonuses, is approximately $95,000 to $140,000+, depending on a variety of influencing factors.

Key Factors That Influence Salary

Your specific salary as a Chase Branch Manager will be determined by several key variables. Understanding these factors can help you negotiate better compensation and plan your career trajectory.

###

Level of Education

A bachelor's degree in finance, business administration, economics, or a related field is typically the minimum educational requirement for this role. While a degree is a prerequisite, an advanced degree like a Master of Business Administration (MBA) can be a significant differentiator. An MBA can lead to a higher starting salary and may accelerate your path toward managing larger, more complex branches or moving into regional leadership positions, which command higher pay.

###

Years of Experience

Experience is arguably the most critical factor influencing a branch manager's salary. Compensation grows in tiers based on proven leadership and performance:

- Assistant Branch Manager/Entry-Level Manager (1-3 years): Individuals in this bracket are often learning the ropes or managing smaller branches. Their compensation will be at the lower end of the salary spectrum.

- Mid-Career Manager (4-9 years): With a solid track record of meeting goals and managing teams effectively, these managers earn salaries closer to the median and can expect substantial performance bonuses.

- Senior/Experienced Manager (10+ years): Senior managers with a decade or more of experience are often entrusted with the largest, most profitable, and highest-traffic branches. Their base salaries are at the top of the range, and their bonus potential is significantly higher due to the larger business volume they oversee.

###

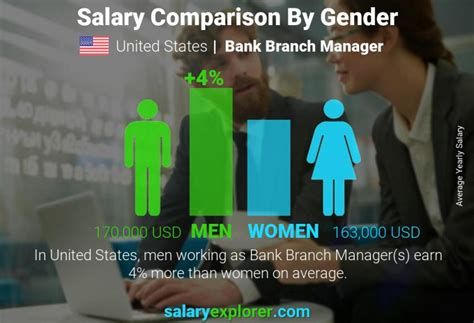

Geographic Location

Where your branch is located has a major impact on your earnings. Chase adjusts its salary bands based on the local cost of living and market competition. A branch manager in a high-cost metropolitan area like New York City, San Francisco, or Boston will earn a significantly higher base salary than a manager in a smaller city in the Midwest or South. For example, data from Payscale shows that financial managers in New York City earn over 25% more than the national average.

###

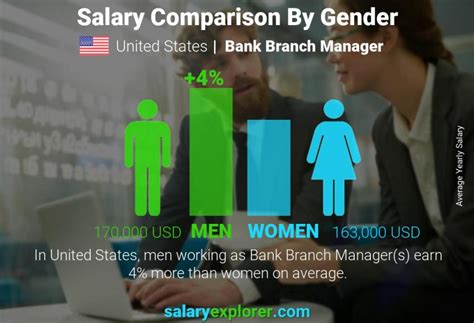

Company Type

While this article focuses on Chase, it's helpful to understand where it stands in the industry. As one of the "Big Four" American banks, JPMorgan Chase is a top-tier employer. It generally offers more competitive salaries, robust benefits packages, and higher bonus potential compared to smaller regional banks or local credit unions. The trade-off is often a higher-pressure, more performance-driven environment. Credit unions, for example, may offer a different work-life balance but with a lower ceiling on potential earnings.

###

Area of Specialization and Branch Performance

Not all branches are created equal. A manager’s bonus, and thus a large portion of their total compensation, is directly tied to the branch's performance against Key Performance Indicators (KPIs). These KPIs often include:

- New deposit growth

- Loan origination (mortgages, auto loans, small business loans)

- New investment and wealth management clients

- Customer satisfaction and retention scores

A manager of a high-performing branch located in an affluent area with a strong focus on small business lending or private client services has a much higher earning potential than one in a less commercially active location.

Job Outlook

The career outlook for financial managers remains very strong. According to the U.S. Bureau of Labor Statistics (BLS), employment for financial managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

The BLS projects about 77,800 openings for financial managers each year over the decade. While technology and automation are changing the face of retail banking, the need for skilled, relationship-focused leaders to manage teams, handle complex financial services, and drive growth ensures that the role of the branch manager will remain critical.

Conclusion

A career as a Chase Bank Branch Manager offers a clear path to a six-figure income and a significant leadership role within a globally respected financial institution.

Key Takeaways:

- Total Compensation is Key: Look beyond the base salary. Bonuses and incentives tied to performance make up a substantial portion of your annual earnings.

- Experience Pays: Your value and salary will grow directly with your experience and a proven track record of success.

- Location Matters: Expect higher compensation in major metropolitan areas to offset the cost of living.

- Performance Drives Earnings: Your ability to lead your team to meet and exceed sales and operational goals will have the biggest impact on your take-home pay.

For aspiring financial professionals, the Chase Bank Branch Manager role represents a challenging yet highly rewarding career opportunity with excellent long-term growth and earning potential.