Are you diligently clocking in and out of a 40-hour workweek, feeling the ceiling of an hourly wage, and wondering what it takes to break into a salaried career? You're not just dreaming of a bigger paycheck; you're aspiring to a new level of professional ownership, long-term growth, and impactful work. The transition from being paid for your time to being compensated for your value is one of the most significant steps in anyone's career journey. It’s a move from executing tasks to driving outcomes.

The financial upside is substantial. While hourly wages can feel limiting, the national average salary for professionals in management and business roles is significantly higher, often starting in the $50,000 to $70,000 range for entry-level positions and climbing well into six figures with experience, according to data from the U.S. Bureau of Labor Statistics (BLS) and platforms like Salary.com. But this transition is about more than just money; it's about unlocking a future of greater autonomy, strategic responsibility, and continuous learning.

I’ll never forget the feeling of receiving my first salaried job offer. After years of working retail and hospitality jobs where my worth was calculated in 60-minute increments, seeing a single annual figure felt both exhilarating and intimidating. It signaled a fundamental shift in trust: the company was no longer just buying my time; they were investing in my potential and my ability to deliver results, regardless of whether it took 35 hours one week or 45 the next.

This guide is designed to be your comprehensive roadmap for making that exact transition. We will demystify the world of salaried work, break down the complex factors that determine your earning potential, and provide a clear, step-by-step plan to help you move from a 40-hour job to a thriving salaried career.

### Table of Contents

- [What Does a Salaried Professional Do?](#what-does-a-salaried-professional-do)

- [Average Salaried Professional Salary: A Deep Dive](#average-salaried-professional-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for Salaried Professionals](#job-outlook-and-career-growth-for-salaried-professionals)

- [How to Get Started: Your Step-by-Step Guide to a Salaried Career](#how-to-get-started-your-step-by-step-guide-to-a-salaried-career)

- [Conclusion: Your Future Beyond the Clock](#conclusion-your-future-beyond-the-clock)

---

What Does a Salaried Professional Do?

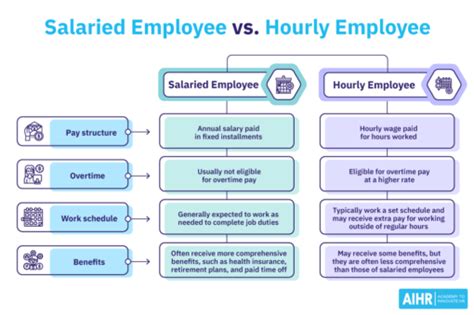

At its core, the difference between an hourly (non-exempt) and a salaried (exempt) role is a fundamental shift in the work agreement. An hourly employee is paid for the exact time they are on the job, including overtime. A salaried professional is paid a fixed annual amount to accomplish a set of goals and responsibilities, regardless of the specific hours worked. This distinction changes everything about the nature of the work.

While hourly roles are often task-oriented—operating a machine, serving customers, processing transactions—salaried positions are typically project-oriented and outcome-driven. A salaried professional's value is not measured by their presence, but by their contribution to the organization's larger objectives.

Core Responsibilities & Mindset Shift:

- Ownership and Accountability: Salaried employees are expected to take ownership of their domain. A Marketing Manager isn't just "posting on social media"; they are accountable for the company's brand presence and lead generation strategy. This requires a proactive, problem-solving mindset rather than a reactive, task-completing one.

- Strategic Contribution: Your work is expected to align with and contribute to broader business goals. You'll participate in planning, analysis, and strategic discussions. You are expected to think critically about *why* you are doing something, not just *what* you are doing.

- Project Management: Much of salaried work is organized into projects with start dates, end dates, and specific deliverables. This involves planning, collaboration with various teams, managing resources, and communicating progress to stakeholders.

- Collaboration and Communication: You are part of a larger ecosystem. A significant portion of your time will be spent in meetings, writing reports, giving presentations, and collaborating with colleagues across different departments to achieve a common goal.

### A Day in the Life: From Hourly Worker to Salaried Analyst

To make this tangible, let's compare a "before" and "after" scenario.

Before: A Day as an Hourly Data Entry Clerk

- 8:00 AM: Clock in. Review the stack of invoices for the day.

- 8:15 AM - 12:00 PM: Begin systematically entering invoice data into the accounting software. Focus on speed and accuracy.

- 12:00 PM - 1:00 PM: Clock out for a mandatory one-hour lunch.

- 1:00 PM - 4:45 PM: Continue data entry. If the pile is finished, ask the supervisor for the next batch of tasks.

- 4:45 PM: Clean up the workstation.

- 5:00 PM: Clock out. Work for the day is completely finished.

After: A Day as a Salaried Junior Business Analyst

- 8:45 AM: Arrive at the office, grab coffee, and review emails. See a note from the Sales Director asking for a quick analysis of last quarter's regional performance.

- 9:15 AM: Attend a project kickoff meeting for a new software implementation. Take notes on key requirements and stakeholder concerns.

- 10:30 AM: Begin working on the Sales Director's request. Pull data from the CRM, import it into Excel/Tableau, and start analyzing trends. Notice an unusual dip in a specific product line.

- 12:30 PM: Take a 45-minute lunch break while responding to a few non-urgent messages on Slack.

- 1:15 PM: Spend two hours building a dashboard for the software implementation project to track progress, which is a long-term deliverable.

- 3:15 PM: Draft an email to the Sales Director with the initial findings, highlighting the product line dip and suggesting a deeper dive to understand the cause.

- 4:00 PM: Join a weekly team meeting to sync up on priorities and challenges.

- 5:15 PM: Wrap up the day by outlining a plan for tomorrow, which includes following up with the sales team and continuing work on the project dashboard. Leave the office, but the "product dip" problem is still percolating in the back of your mind.

The key difference is the transition from a defined set of tasks within a rigid timeframe to a dynamic set of responsibilities aimed at solving problems and creating value. The Analyst's day is fluid, self-directed, and focused on long-term goals.

---

Average Salaried Professional Salary: A Deep Dive

One of the primary motivators for moving from an hourly to a salaried role is, of course, the significant increase in earning potential and the stability of a predictable paycheck. While salaries vary dramatically based on the factors we'll explore in the next section, we can establish a strong baseline by looking at national averages and typical compensation structures.

A crucial data point from the U.S. Bureau of Labor Statistics (BLS) highlights this difference starkly. In the third quarter of 2023, the median usual weekly earnings for full-time wage and salary workers was $1,118, which annualizes to $58,136. However, for those in "Management, professional, and related occupations," that figure jumped to $1,478 per week, or $76,856 annually. This demonstrates an immediate and substantial pay premium for professional roles.

Reputable salary aggregators provide a more granular view. For example, Salary.com's 2023 data suggests that the median base salary for a "Professional, Individual Contributor" in the United States falls around $73,201, with a typical range between $65,562 and $81,959.

Payscale reports a similar figure, with the average base salary for a professional with a bachelor's degree at approximately $71,000 per year as of late 2023. It's important to remember that these are broad averages encompassing hundreds of different job titles.

### Salary Progression by Experience Level

Your salary isn't a static number; it's a dynamic figure that grows with your experience, skills, and contributions. Here’s a typical progression for a general business or professional role.

| Experience Level | Typical Years of Experience | Typical Salary Range (Annual) | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level Professional | 0 - 2 Years | $50,000 - $70,000 | Learning core job functions, requires significant guidance, focuses on execution. Titles: Coordinator, Associate, Junior Analyst. |

| Mid-Career Professional | 3 - 8 Years | $70,000 - $110,000 | Works independently, manages small projects, may mentor junior staff, develops specialized skills. Titles: Analyst, Specialist, Manager. |

| Senior/Lead Professional | 8 - 15+ Years | $110,000 - $160,000+ | Manages large/complex projects or teams, sets strategy, considered a subject matter expert (SME). Titles: Senior Manager, Lead Analyst, Director. |

| Executive/Principal | 15+ Years | $160,000 - $250,000+ | Leads entire departments or functions, responsible for major business outcomes and P&L. Titles: Director, Vice President, Principal Consultant. |

*Sources: Data compiled and synthesized from 2023 reports by Glassdoor, Payscale, Salary.com, and the U.S. Bureau of Labor Statistics.*

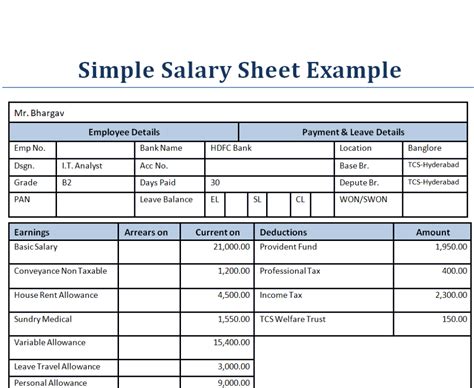

### Beyond the Base Salary: Understanding Total Compensation

A salaried position's financial benefits extend far beyond the bi-weekly paycheck. When you evaluate a job offer, you must consider the total compensation package, which can add another 20-40% to your base salary's value. Hourly roles often have limited benefits, but salaried packages are typically robust.

Key Components of a Total Compensation Package:

- Base Salary: The fixed, annual amount you are paid. This is the foundation of your compensation.

- Performance Bonuses: Annual or quarterly bonuses tied to individual, team, and/or company performance. These can range from 5% to 25%+ of your base salary, especially in fields like sales, finance, and tech.

- Health Insurance: This is a major financial benefit. Companies typically cover a large portion (70-90%) of the monthly premiums for medical, dental, and vision insurance. The value of this benefit alone can be worth $5,000 to $15,000 per year.

- Retirement Savings Plans (401(k) / 403(b)): A critical wealth-building tool. Most companies offer a "match," where they contribute a certain amount to your retirement account based on your own contributions. A common match is 50% of the first 6% you contribute, which is essentially a 3% raise that gets invested for your future.

- Paid Time Off (PTO): This includes vacation days, sick leave, and personal days. Salaried roles typically start with 2-3 weeks of vacation and a separate bank of sick days, which increases with tenure. This provides flexibility and work-life balance that is often absent in hourly work.

- Stock Options or Equity: Particularly common in startups and tech companies, this gives you the opportunity to own a small piece of the company. If the company does well, this can become extremely valuable over time.

- Other Perks and Benefits: These can include:

- Life and Disability Insurance: Provides a financial safety net for you and your family.

- Professional Development Stipend: Money specifically for courses, certifications, and conferences.

- Wellness Programs: Gym memberships, mental health support (e.g., EAP programs).

- Commuter Benefits: Pre-tax funds for public transit or parking.

- Parental Leave: Paid time off for new parents, often far more generous than legally required.

When transitioning from an hourly job, it's vital to learn how to evaluate this entire package. A job with a $70,000 base salary and an excellent benefits package can be far more lucrative than a $75,000 offer with poor health insurance and no 401(k) match.

---

Key Factors That Influence Your Salary

Your salary is not a predetermined number. It is a highly variable figure influenced by a complex interplay of your personal background, choices, and the market you operate in. Understanding these factors is the key to maximizing your earning potential as you transition into and advance through a salaried career. This is where you can be strategic about your path.

###

1. Level of Education

For most professional salaried roles, a bachelor's degree is the foundational requirement. It signals to employers that you have a certain level of critical thinking, communication, and discipline. However, the impact of education doesn't stop there.

- Associate's Degree vs. Bachelor's Degree: While some entry-level salaried roles (e.g., administrative coordinator, customer support team lead) may be accessible with an associate's degree, a bachelor's degree opens up a significantly wider range of opportunities and a higher starting salary. The Federal Reserve Bank of New York reports that the median annual wage for recent college graduates (age 22-27) with a bachelor's degree is around $60,000, while for associate's degree holders it's closer to $45,000.

- Impact of Major: Your field of study matters immenseley. Graduates with degrees in STEM (Science, Technology, Engineering, and Mathematics), computer science, finance, and economics consistently command the highest starting salaries. For example, the National Association of Colleges and Employers (NACE) Winter 2023 Salary Survey shows projected starting salaries for computer science majors at over $86,000, while humanities majors are projected to start around $58,000.

- Advanced Degrees (Master's/MBA/Ph.D.): An advanced degree can act as a powerful salary accelerant.

- Master of Business Administration (MBA): An MBA from a reputable program is one of the most direct paths to a significant salary jump, often leading to roles in management consulting, corporate strategy, and finance. It's common for MBA graduates to see their pre-MBA salaries double, with median starting salaries from top programs often exceeding $175,000.

- Specialized Master's: A master's degree in a high-demand field like Data Science, Cybersecurity, or Finance can make you a highly sought-after expert, commanding a premium salary.

- Ph.D.: Primarily for roles in research & development, academia, or highly specialized quantitative fields (like a "quant" in finance), a Ph.D. can lead to very high earnings but is a much longer and more specialized path.

- Certifications: Professional certifications are a fantastic way to boost your salary without committing to a full degree program. They validate specific, in-demand skills.

- Project Management Professional (PMP): The Project Management Institute (PMI) reports that PMP holders earn, on average, 16% more than their non-certified peers.

- Certified Public Accountant (CPA): Essential for a high-earning career in accounting.

- SHRM-CP/SCP: Key for advancing in Human Resources.

- Technical Certifications: AWS Certified Solutions Architect, Google Professional Data Engineer, and Certified Information Systems Security Professional (CISSP) can add tens of thousands to your annual salary in the IT sector.

###

2. Years of Experience

Experience is perhaps the single most powerful driver of salary growth over a lifetime. As you move from an entry-level employee to a seasoned expert, your value to an organization—and your compensation—grows exponentially. Employers pay a premium for proven performers who can solve complex problems with minimal supervision.

- Entry-Level (0-2 years): At this stage, you are paid for your potential. Your salary reflects the company's investment in training you. The focus is on learning the ropes. (Example Salary: $55,000)

- Mid-Career (3-8 years): You have mastered the core functions of your role and can operate independently. You begin to specialize and may take on mentorship or project lead responsibilities. This is often where the most significant percentage-based salary growth occurs as you switch jobs or get promoted. (Example Salary: $85,000)

- Senior Level (8-15 years): You are now a subject matter expert. You are not just executing; you are strategizing. You may manage teams, own major initiatives, and influence departmental direction. Your salary reflects your deep expertise and leadership. (Example Salary: $125,000)

- Expert/Executive Level (15+ years): At this stage, your compensation is tied to business impact. You are responsible for the performance of an entire function or business unit. Your experience is leveraged to make high-stakes decisions. (Example Salary: $180,000+)

Crucial Tip: The most effective way to leverage experience for a pay raise is by changing companies. While internal promotions typically come with a 5-10% raise, switching to a new company can often result in a 15-25% or even greater increase, as you are negotiating your value on the open market.

###

3. Geographic Location

Where you live and work has a massive impact on your paycheck. Companies adjust salaries based on the local cost of living and the competitiveness of the local talent market. A $90,000 salary in Des Moines, Iowa, provides a much higher standard of living than the same salary in San Francisco, California.

- High-Paying Metropolitan Areas: Major tech hubs and financial centers consistently offer the highest salaries in the nation. These include:

- San Jose, CA (Silicon Valley)

- San Francisco, CA

- New York, NY

- Boston, MA

- Seattle, WA

- Washington, D.C.

- Mid-Tier & Emerging Cities: Many cities offer a strong balance of good salaries and a more reasonable cost of living. These are increasingly popular destinations for professionals.

- Austin, TX

- Denver, CO

- Raleigh, NC (Research Triangle)

- Atlanta, GA

- Dallas, TX

- Lower-Paying Regions: Salaries tend to be lower in rural areas and in states with a lower overall cost of living, particularly in the South and parts of the Midwest.

Salary Comparison for a "Marketing Manager" Role:

| City | Average Base Salary | Cost of Living Index (US Avg = 100) |

| :--- | :--- | :--- |

| San Francisco, CA | $145,000 | 194.8 |

| New York, NY | $130,000 | 166.4 |

| Austin, TX | $110,000 | 108.9 |

| Chicago, IL | $105,000 | 102.5 |

| Kansas City, MO | $92,000 | 88.7 |

*Sources: Salary data synthesized from Glassdoor and Salary.com (2023). Cost of living data from Payscale.*

The Rise of Remote Work: The post-pandemic boom in remote work has complicated this factor. Some companies now pay a single national rate regardless of location. However, many major companies (like Google and Meta) have implemented location-based pay tiers, adjusting salaries down if an employee moves from a high-cost area to a lower-cost one. When seeking remote roles, it is critical to understand a company's pay philosophy.

###

4. Company Type & Size

The type of organization you work for is a major determinant of your salary and overall compensation package.

- Large Corporations (Fortune 500): These companies typically offer the most competitive base salaries, structured bonus plans, and comprehensive benefits packages (gold-plated health insurance, generous 401k matches). They have standardized pay bands and a clear hierarchy for advancement. The work is often more specialized.

- Tech Startups: Compensation here is a different beast. The base salary might be slightly lower than at a large corporation, but it's often supplemented by potentially lucrative stock options (equity). This is a high-risk, high-reward environment. Benefits can be less traditional but may include perks like unlimited PTO or free food.

- Small & Medium-Sized Businesses (SMBs): Salaries and benefits can vary wildly. Some may compete directly with large corporations, while others may offer lower pay. These roles often provide broader responsibilities and a chance to have a bigger, more visible impact on the business.

- Non-Profits: These organizations are mission-driven. As such, salaries typically lag behind the for-profit sector. However, they can offer excellent work-life balance and a strong sense of purpose. The Public Service Loan Forgiveness (PSLF) program can also be a significant financial benefit for those with student loans.

- Government (Federal, State, Local): Government salaries are often moderate and are publicly available through pay scales (like the GS scale for federal employees). While the base pay may not reach the heights of the private sector, government jobs are renowned for their job security, excellent benefits, and generous pension plans, which are a rare and valuable form of long-term compensation.

###

5. Area of Specialization

Just as your college major impacts your starting salary, your chosen professional field and area of specialization will dictate your long-term earning potential. All salaried jobs are not created equal.

- High-Earning Fields:

- Technology: Software Development, Cybersecurity, Data Science, Cloud Engineering, and AI/Machine Learning are consistently among the highest-paying specializations.

- Finance: Investment Banking, Private Equity, Quantitative Analysis, and Corporate Finance roles are known for very high base salaries and even larger bonuses.

- Healthcare Management: Hospital administrators and managers in specialized healthcare sectors command high salaries due to the complexity and importance of the industry.

- Engineering: Specialized engineers (e.g., Petroleum, Electrical, Computer Hardware) are highly compensated.

- Management Consulting: Top firms pay exceptionally high salaries to consultants who advise large corporations on strategy and operations.

- Mid-Earning Fields:

- Marketing: Roles like Digital