Earning $50 an hour is a significant financial milestone. It translates to a six-figure income that can provide a comfortable lifestyle and robust financial security. But what does that number actually mean in terms of an annual salary, and what kinds of careers can get you there?

This guide breaks down the conversion from an hourly rate to an annual salary, explores the types of jobs that pay in this range, and details the key factors that influence your earning potential. Whether you are a student planning your future or a professional looking to advance, understanding the dynamics of a $50-per-hour wage is the first step toward achieving your career goals.

What Does $50 an Hour Translate To? The Annual Salary Breakdown

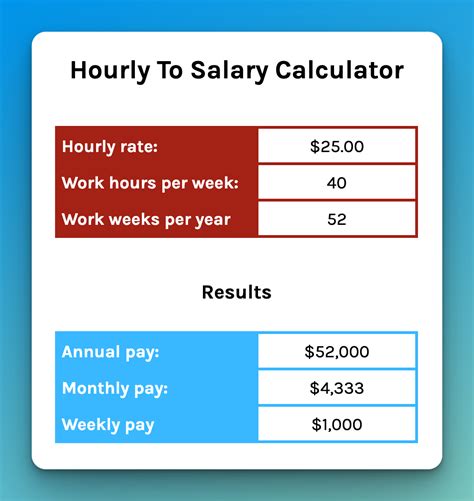

First, let's do the math. A full-time job is typically calculated based on a 40-hour workweek for 52 weeks a year.

The Calculation:

$50/hour × 40 hours/week × 52 weeks/year = $104,000 per year

This calculation assumes you are working full-time with no unpaid time off. For salaried employees, this is the standard gross income before taxes, insurance, and retirement deductions. For hourly workers, this figure can fluctuate based on overtime, which would increase earnings, or unpaid leave, which would decrease them. Earning $104,000 annually places you well above the national median household income, marking a significant professional achievement.

What Kinds of Jobs Pay $50 an Hour?

A salary of over $100,000 is not limited to one specific industry. It is attainable across several dynamic and growing fields, typically for professionals with a specialized skill set and several years of experience. Here are a few examples of professions where earning $50 an hour ($104,000/year) is common:

- Software Developer: These professionals design, develop, and maintain software applications. As technology becomes more integrated into our lives, their skills are in constant demand. While entry-level roles may start lower, mid-level and senior developers frequently exceed this pay grade.

- Physician Assistant (PA): Working under the supervision of physicians, PAs diagnose illnesses, develop and manage treatment plans, and prescribe medications. This role requires a master's degree and offers a rewarding career in the rapidly growing healthcare sector.

- Financial Manager: Tasked with the financial health of an organization, financial managers create financial reports, direct investment activities, and develop plans for the long-term financial goals of their company.

- IT Manager: These managers oversee a company's computer infrastructure, lead teams of IT professionals, and ensure all technology systems are secure and efficient. Their role is critical to the daily operations of nearly every modern business.

Average Salary in a $50/Hour Career

While $104,000 is the direct conversion, it's more accurate to think of it as a target within a broader salary range. Most professions have a salary spectrum based on experience.

- Entry-Level (0-2 years): In these fields, you might start between $70,000 and $90,000.

- Mid-Career (3-8 years): This is often the stage where professionals hit and exceed the $104,000 mark. The typical range is from $95,000 to $130,000.

- Senior-Level (8+ years): With significant experience and leadership responsibilities, earnings can climb to $150,000 and beyond.

For context, the U.S. Bureau of Labor Statistics (BLS) reports the 2023 median pay for the following roles:

- Software Developers: $132,270 per year

- Physician Assistants: $130,020 per year

- Financial Managers: $139,790 per year

These figures confirm that a salary of $104,000 is a very realistic benchmark within these professions.

Key Factors That Influence Your Salary

Reaching the $50-an-hour mark isn't just about choosing the right job title. Several key factors will determine how quickly you can achieve this level of income.

### Level of Education

In specialized fields, higher education often directly correlates with higher earning potential. For example, a Physician Assistant is required to have a master's degree, which is a primary reason for their high starting salary. Similarly, a Financial Manager with a Master of Business Administration (MBA) can often command a higher salary than a candidate with only a bachelor's degree. For a software developer, while a bachelor's degree is standard, a master's in a specialized field like artificial intelligence or cybersecurity can unlock higher-paying roles.

### Years of Experience

Experience is arguably the most significant factor in salary growth. Companies pay a premium for professionals who have a proven track record of solving problems, leading projects, and navigating complex challenges.

- Entry-Level: Focus is on learning and application of core skills.

- Mid-Career: You are expected to work independently, mentor junior staff, and manage small-to-medium sized projects. This is where most professionals cross the $100,000 threshold.

- Senior-Level: You are a strategic leader, responsible for major initiatives, and often influence the direction of your department or company.

### Geographic Location

Where you work matters immensely. A $104,000 salary provides a different lifestyle in a major metropolitan hub compared to a smaller city. Employers adjust compensation based on the local cost of living and the regional demand for talent. According to Glassdoor's salary data, a software developer role in San Francisco, CA, will pay significantly more than the exact same role in St. Louis, MO, to account for the drastic difference in housing and living expenses.

### Company Type and Industry

The type of company you work for plays a crucial role. A software engineer at a large tech firm (like Google or Microsoft) will typically earn more in base salary and total compensation (including stock options) than an engineer at a non-profit or a small startup. Similarly, a financial analyst at a major investment bank on Wall Street will earn more than one in a corporate finance department at a manufacturing company.

### Area of Specialization

Within every field, certain sub-specialties are more lucrative than others because of high demand and a limited supply of talent.

- In Technology: A generalist IT professional may earn less than a specialist in Cloud Computing (AWS, Azure) or Cybersecurity.

- In Healthcare: A PA specializing in a high-demand field like dermatology or cardiothoracic surgery may earn more than one in family medicine.

- In Finance: A financial manager with expertise in mergers and acquisitions (M&A) or international finance will often have a higher earning potential.

Job Outlook

The long-term outlook for careers in the $50/hour range is exceptionally strong. Many of these roles are in sectors fueled by technological innovation and societal needs.

According to the BLS's Occupational Outlook Handbook (projections for 2022-2032):

- Employment of software developers is projected to grow 25 percent, which is much faster than the average for all occupations.

- Employment of physician assistants is projected to grow 27 percent, also much faster than average, driven by the growing healthcare demands of an aging population.

- Employment of financial managers is projected to grow 16 percent, far outpacing the average as the economy grows and requires expert financial oversight.

This robust growth indicates that there will be a sustained demand for qualified professionals, ensuring strong job security and continued salary growth for those in these fields.

Conclusion: Charting Your Path to $50 an Hour

Earning $50 an hour, or $104,000 a year, is an achievable and rewarding goal for dedicated professionals. It represents a level of expertise that is highly valued across many of the economy's most critical sectors, including technology, healthcare, and finance.

To reach this milestone, focus on a strategic approach to your career:

- Choose a High-Growth Field: Align your interests with industries that have a strong future outlook.

- Invest in Education and Skills: Obtain the necessary degrees and continuously update your skills to stay relevant and specialized.

- Gain Meaningful Experience: Move from entry-level execution to mid-career independence and, eventually, senior-level leadership.

- Understand Your Market Value: Be aware of how factors like location, company type, and specialization affect your compensation.

By making deliberate choices and committing to professional development, you can build a successful career path that not only meets but exceeds this significant financial benchmark.