In an increasingly complex digital and financial world, the role of a fraud investigator has never been more critical. These professionals are the corporate and public sector's detectives, tasked with uncovering deception, protecting assets, and upholding justice. If you have an analytical mind, a strong sense of ethics, and a knack for solving puzzles, this career path can be both professionally fulfilling and financially rewarding.

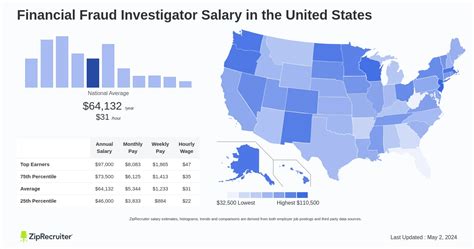

But what can you expect to earn? A fraud investigator's salary isn't a single number; it's a dynamic range influenced by a host of factors. On average, you can expect to earn a salary between $65,000 and $105,000 per year, with top professionals in specialized, high-demand fields earning well over six figures. This guide will break down the numbers, explore the key factors that drive your earning potential, and provide a clear picture of what a career in fraud investigation can offer.

What Does a Fraud Investigator Do?

Before diving into the salary details, it's important to understand the role. A fraud investigator is a specialized professional who examines evidence to determine if illicit financial activities have occurred. Their core responsibilities often include:

- Analyzing Financial Data: Sifting through bank statements, accounting records, and digital transactions to identify anomalies and red flags.

- Conducting Interviews: Questioning witnesses, claimants, and suspects to gather information and assess credibility.

- Performing Surveillance: In some roles, particularly in insurance or private investigation, this may involve monitoring subjects.

- Writing Detailed Reports: Documenting findings, evidence, and conclusions in a clear, concise manner for use in legal proceedings or internal action.

- Collaborating with Others: Working alongside legal counsel, law enforcement, and management to resolve cases.

Their ultimate goal is to uncover the truth, mitigate losses, and ensure that individuals or organizations who commit fraud are held accountable.

Average Fraud Investigator Salary

The salary for a fraud investigator can vary significantly, but we can establish a strong baseline using data from authoritative sources.

According to major salary aggregators like Salary.com, the median annual salary for a Fraud Investigator in the United States is approximately $70,500 as of early 2024. The typical salary range falls between $62,100 and $81,300.

However, other sources paint a slightly different picture, reflecting the diversity of roles within the field:

- Payscale reports an average base salary of around $66,000 per year.

- Glassdoor lists a national average total pay of about $81,000 per year, which includes base salary and additional compensation like bonuses.

The U.S. Bureau of Labor Statistics (BLS) groups many corporate fraud investigators under the category of "Financial Examiners." For this profession, the median annual wage was significantly higher at $96,170 in May 2023. The top 10% in this category earned more than $173,000, highlighting the high earning potential in specialized financial sectors.

This data shows that while a comfortable mid-career salary is standard, a six-figure income is well within reach, especially as you gain expertise and focus on high-value areas.

Key Factors That Influence Salary

Your specific salary will be determined by a combination of your qualifications, location, and the nature of your employer. Understanding these factors is key to maximizing your earning potential.

### Level of Education & Certifications

Education forms the foundation of your career. While a bachelor's degree in a field like Criminal Justice, Accounting, Finance, or Cybersecurity is typically the minimum requirement, advanced credentials can provide a significant salary boost. A master's degree (such as an MBA or a Master's in Forensic Accounting) can open doors to senior management and higher pay scales.

However, in the world of fraud investigation, professional certifications are paramount. The premier credential is the Certified Fraud Examiner (CFE) offered by the Association of Certified Fraud Examiners (ACFE). According to the ACFE's 2024 *Compensation Guide for Anti-Fraud Professionals*, CFEs earn 19% more than their non-certified counterparts. This "CFE premium" is a direct return on your investment in professional development and is recognized by employers globally.

### Years of Experience

As with any profession, experience is a primary driver of salary. The career ladder for a fraud investigator might look like this:

- Entry-Level (0-3 years): Investigators starting their careers can expect a salary in the range of $55,000 to $70,000. These roles focus on learning procedures, handling smaller cases, and assisting senior investigators.

- Mid-Career (4-8 years): With proven experience, investigators take on more complex cases with greater autonomy. Salaries typically rise to $70,000 to $95,000.

- Senior/Managerial (8+ years): Senior investigators, fraud managers, and directors who lead teams, set strategy, and handle high-stakes investigations can command salaries of $95,000 to $125,000+. Top-level directors in major corporations can earn substantially more.

### Geographic Location

Where you work matters. Salaries are often higher in major metropolitan areas with a higher cost of living and a greater concentration of corporate headquarters and financial institutions. According to BLS and aggregator data, some of the highest-paying states for financial and investigative professions include:

- New York

- California

- Virginia

- New Jersey

- Washington, D.C.

Conversely, salaries may be lower in rural areas and states with a lower cost of living. However, the rise of remote work has started to moderate these differences, allowing skilled investigators to work for high-paying companies regardless of their physical location.

### Company Type

The industry you work in has a massive impact on your paycheck.

- Financial Services: Banks, investment firms, and credit card companies are among the highest payers due to the high-risk, high-value nature of the assets they protect.

- Healthcare: With healthcare fraud costing the nation billions annually, skilled investigators who can navigate complex billing and coding regulations are in high demand and are compensated well.

- Government: Federal agencies like the FBI, SEC, and IRS offer competitive salaries (often based on the General Schedule (GS) pay scale), excellent benefits, and unparalleled case experience. State and local government roles may pay less but offer stable employment.

- Insurance: Investigating fraudulent claims (health, auto, property) is a massive field. Salaries are competitive and often include opportunities for performance-based bonuses.

- Corporate/Retail: Large corporations employ internal investigators to combat everything from asset misappropriation to vendor fraud. Salaries can vary widely based on the size and revenue of the company.

### Area of Specialization

As you advance in your career, specializing in a high-demand niche can dramatically increase your salary.

- Cyber Fraud & Digital Forensics: Investigators who can trace financial crimes through complex digital systems are at the top of the pay scale. Expertise in cybersecurity and data analytics is extremely lucrative.

- Forensic Accounting: Often requiring a CPA license in addition to a CFE, forensic accountants handle complex financial litigation, valuation, and high-level corporate investigations, commanding premium salaries.

- Anti-Money Laundering (AML): Professionals specializing in AML and Bank Secrecy Act (BSA) compliance are critical for financial institutions and are highly compensated for their regulatory expertise.

Job Outlook

The need for fraud investigators is stable and expected to grow. The BLS projects that employment for Financial Examiners will grow by 2% from 2022 to 2032.

While this rate is slower than the average for all occupations, it's essential to look beyond the number. The demand for skilled investigators remains robust and is driven by powerful trends: the rise of digital transactions, the increasing sophistication of financial crimes, and a constantly evolving regulatory landscape. As long as fraud exists, there will be a strong, consistent need for the professionals who fight it.

Conclusion

A career as a fraud investigator offers a unique blend of intellectual challenge, societal purpose, and financial stability. While a starting salary is respectable, your long-term earning potential is firmly in your control. By focusing on continuous learning, pursuing powerful credentials like the CFE, gaining diverse experience, and specializing in a high-demand niche, you can build a career that is not only rewarding but also highly lucrative.

For those with a passion for truth and an analytical mindset, the path of a fraud investigator is an excellent choice for a durable and prosperous professional future.