Introduction

What does financial freedom mean to you? For many, it's not about extravagant wealth, but about stability, security, and the ability to make choices without being constrained by financial anxiety. A common benchmark for this level of comfort is earning an $80k salary after taxes. This figure represents a significant milestone—a take-home pay of nearly $6,700 per month that can comfortably support a family, allow for substantial savings, and fund personal goals, from homeownership to world travel.

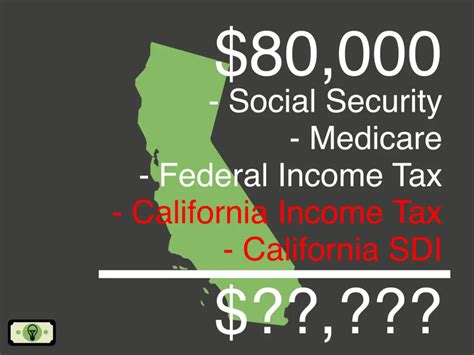

However, achieving a net income of $80,000 is not as simple as finding a job with an $80,000 salary. After federal, state, and local taxes, Social Security, Medicare, and deductions for benefits like health insurance and 401(k) contributions, an $80,000 gross salary can shrink considerably. To truly clear $80,000 in take-home pay, you typically need to aim for a gross annual salary in the $100,000 to $125,000 range, depending on your location and personal financial situation. This six-figure income bracket is the true target.

This guide is designed to be your definitive resource for reaching that goal. We will demystify the path to becoming a high-earning professional, moving beyond abstract numbers to provide a concrete, actionable roadmap. I've spent over a decade analyzing career trajectories and have seen firsthand what separates those who stagnate from those who strategically build their earning potential. I once mentored a young data analyst who was fixated on her net pay; by shifting her focus to acquiring high-impact skills that justified a six-figure gross salary, she doubled her income in three years and far surpassed her original goal. Her story is a testament to the power of a deliberate, informed career strategy—a strategy we will lay out for you in detail.

This article will explore the high-demand careers that can deliver this level of income, break down the exact factors that influence your pay, and provide a step-by-step plan to get you there. Whether you are a student choosing a major, a professional considering a career change, or someone looking to maximize your earning potential in your current field, this guide will provide the expert insights you need to build a prosperous and fulfilling career.

### Table of Contents

- [What Does a Six-Figure Professional Do?](#what-does-a-six-figure-professional-do)

- [The Six-Figure Salary: A Deep Dive into Compensation](#the-six-figure-salary-a-deep-dive-into-compensation)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for High-Earning Professions](#job-outlook-and-career-growth-for-high-earning-professions)

- [How to Get Started: Your Roadmap to a Six-Figure Career](#how-to-get-started-your-roadmap-to-a-six-figure-career)

- [Conclusion: Building Your High-Income Future](#conclusion-building-your-high-income-future)

---

What Does a Six-Figure Professional Do?

An income that nets you $80,000 after taxes isn't tied to a single job title but to a category of professions characterized by high demand, specialized skills, and significant responsibility. These roles are typically found in thriving sectors like technology, finance, healthcare, and strategic business management. Professionals in these fields are not just clocking in and out; they are problem-solvers, strategists, and creators who deliver substantial value to their organizations.

To make this tangible, let's explore what a typical day or project looks like in a few common careers that command a $100,000+ salary.

### 1. The Software Developer

A mid-level or senior software developer is at the heart of the digital economy. They design, build, and maintain the software and applications that power our world. Their work is a blend of creative problem-solving, logical precision, and collaborative teamwork.

- Core Responsibilities: Writing clean, efficient, and well-documented code; debugging and resolving technical issues; collaborating with product managers, designers, and other engineers to define features; participating in code reviews to maintain quality standards; and designing system architecture.

- Typical Projects: Building a new user-facing feature for a mobile app, developing a backend API to connect different services, migrating a legacy system to a modern cloud-based infrastructure, or creating an internal tool to automate a business process.

#### A Day in the Life of a Software Developer:

- 9:00 AM: Start the day with the team's daily stand-up meeting, briefly discussing yesterday's progress, today's goals, and any blockers.

- 9:30 AM: Focus block. Dive into writing code for a new feature, such as implementing a new payment processing flow for an e-commerce site. This involves translating design mockups and product requirements into functional code.

- 12:00 PM: Lunch break.

- 1:00 PM: Pair programming session with a junior developer to help them troubleshoot a complex bug. This mentorship is a key part of a mid-level role.

- 2:30 PM: Code review. Carefully examine a teammate's submitted code, providing constructive feedback on logic, style, and potential performance issues.

- 3:30 PM: Meeting with a product manager and a UX designer to plan the technical requirements for the next sprint's features.

- 4:30 PM: Final coding block, pushing the day's completed work to the repository and preparing for tomorrow.

### 2. The Marketing Manager

A Marketing Manager is the strategic mind behind a company's customer acquisition and brand presence. They are no longer just focused on creative campaigns; today's marketing manager is a data-driven strategist who understands analytics, digital channels, and return on investment (ROI) as much as they understand branding and communication.

- Core Responsibilities: Developing and executing comprehensive marketing strategies; managing budgets and allocating resources across different channels (digital ads, content marketing, SEO, social media); analyzing campaign performance data to optimize results; managing a team of marketing specialists; and collaborating with sales, product, and public relations teams.

- Typical Projects: Launching a multi-channel marketing campaign for a new product, developing a content marketing strategy to increase organic website traffic by 30%, or overseeing a rebranding initiative.

#### A Day in the Life of a Marketing Manager:

- 9:00 AM: Review key performance indicator (KPI) dashboards. Check website traffic, lead generation numbers, and ad spend from the previous day.

- 10:00 AM: Weekly check-in with the digital advertising specialist to review campaign performance on Google Ads and social media, making budget adjustments based on ROI.

- 11:00 AM: Strategy meeting with the content team to brainstorm topics for the next quarter's blog posts, white papers, and webinars, ensuring alignment with business goals.

- 12:30 PM: Lunch.

- 1:30 PM: Work on the marketing budget for the upcoming quarter, forecasting expenses and expected returns.

- 3:00 PM: Call with the sales director to discuss lead quality and ensure marketing efforts are generating promising prospects for the sales team.

- 4:00 PM: Review and provide feedback on a draft of an upcoming email newsletter and a new landing page design.

### 3. The Financial Analyst (Corporate)

A corporate Financial Analyst is a critical partner to business leaders, providing the data-driven insights needed to make sound financial decisions. They are the storytellers of a company's financial health, translating complex numbers into actionable business intelligence.

- Core Responsibilities: Building financial models to forecast revenue and expenses; analyzing financial statements and performance; preparing reports and presentations for senior management; conducting variance analysis (budget vs. actual); and assisting in the annual budgeting and long-range planning process.

- Typical Projects: Creating a financial model to evaluate the profitability of a potential new product line, analyzing the financial impact of a proposed acquisition, or preparing the quarterly financial review deck for the CFO.

#### A Day in the Life of a Financial Analyst:

- 8:30 AM: Check financial news and market trends.

- 9:00 AM: Begin working on the monthly financial close process, pulling data from various systems (ERP, accounting software) to analyze departmental spending against the budget.

- 11:00 AM: Meet with a department head (e.g., Head of Operations) to discuss their recent budget variance and understand the business drivers behind the numbers.

- 12:00 PM: Lunch while reading industry reports.

- 1:00 PM: Focus time. Build and refine a complex Excel model to forecast sales for the next 18 months, incorporating seasonality and new market data.

- 3:30 PM: Work on a presentation for the executive team, creating charts and summaries that clearly communicate key financial trends and insights from the latest forecast.

- 5:00 PM: Respond to ad-hoc data requests from leadership and plan the next day's tasks.

These examples illustrate a common thread: high-earning professionals manage complexity, take ownership of critical business outcomes, and possess skills that are difficult to replace.

---

The Six-Figure Salary: A Deep Dive into Compensation

Achieving a gross salary of $100,000 to $125,000 is a significant milestone that places you in a high-earning bracket. However, the "salary" is often just one piece of a much larger total compensation package. Understanding all the components is crucial for accurately assessing your financial picture and negotiating effectively.

First, let's establish a baseline. Salary data varies based on the source, but by aggregating information from reputable platforms, we can build a reliable picture for the high-demand roles discussed.

According to Salary.com, as of late 2023, the median salary for a Software Developer in the United States is around $119,000, with a typical range falling between $108,000 and $132,000. For a Marketing Manager, the median is approximately $112,000, and for a Financial Analyst, it's about $97,000 for a senior role (often designated as Financial Analyst III or IV), with experienced professionals easily clearing the six-figure mark. Glassdoor reports similar figures, with an average base pay of $105,000 for Software Engineers and $103,000 for Marketing Managers in the U.S.

These numbers are national averages. Your specific earnings will be heavily influenced by the factors we'll discuss in the next section.

### Salary Progression by Experience Level

Your earning potential grows significantly as you move from an entry-level position to a seasoned expert. Here is a typical salary trajectory for a high-demand role like a Software Developer:

| Experience Level | Typical Years of Experience | Typical Gross Salary Range (USD) | Key Responsibilities & Expectations |

| :--------------- | :-------------------------- | :-------------------------------- | :---------------------------------- |

| Entry-Level | 0-2 years | $75,000 - $95,000 | Learning the codebase, fixing bugs, writing well-defined features under supervision. Focus is on execution and learning. |

| Mid-Career | 2-5 years | $100,000 - $140,000 | Owning medium-to-large features, mentoring junior developers, participating in system design. Demonstrates independence. |

| Senior | 5-10+ years | $140,000 - $180,000+ | Leading complex projects, designing system architecture, setting technical direction, significant mentorship. High-level problem-solving. |

| Principal / Staff | 10+ years | $180,000 - $250,000+ | Technical authority for a large team or domain. Solves the most complex technical challenges. Influences company-wide strategy. |

*(Source: Aggregated data from Payscale, Salary.com, and Glassdoor, 2023. Ranges can be higher in top tech hubs and major corporations.)*

As you can see, the target salary range of $100k-$125k is most commonly achieved at the mid-career level, typically after gaining 2-5 years of valuable, hands-on experience.

### Beyond the Base Salary: Understanding Total Compensation

At the six-figure level, base salary is often only 70-80% of your total earnings. High-earning professionals must evaluate the entire compensation package.

1. Performance Bonuses:

This is a variable cash payment tied to individual, team, or company performance.

- Structure: Typically expressed as a percentage of your base salary (e.g., 10-20%).

- Example: A Marketing Manager with a $110,000 salary and a 15% target bonus could earn an additional $16,500 if performance goals are met, bringing their total cash compensation to $126,500.

- Prevalence: Very common in fields like finance, sales, and management. Increasingly common in tech as a way to reward high-impact work.

2. Equity Compensation (Stock Options & RSUs):

This is a major component of compensation, especially in the tech industry and at publicly traded companies. It gives you ownership in the company.

- Restricted Stock Units (RSUs): You are granted a certain number of shares that "vest" (become yours) over a period of time, typically 4 years with a 1-year "cliff" (you get nothing if you leave before one year). This is like a deferred cash bonus that fluctuates with the stock price.

- Stock Options (ISOs/NSOs): You are given the *option* to buy a certain number of shares at a predetermined "strike price." You profit if the company's stock price rises above your strike price. This is more common in startups and carries higher risk and potential reward.

- Impact: A strong equity package can add tens of thousands of dollars to your annual compensation, significantly boosting your overall earnings.

3. Retirement Savings Plans (401k/403b):

These tax-advantaged retirement accounts are a critical wealth-building tool. The key is the employer match.

- How it Works: You contribute a portion of your pre-tax salary, and your employer contributes a matching amount up to a certain percentage. A common match is "100% of the first 3% and 50% of the next 2%," which equates to a 4% match if you contribute 5%.

- Value: On a $115,000 salary, a 4% match is an extra $4,600 of "free money" per year towards your retirement.

4. Health and Wellness Benefits:

While not direct cash, the quality of these benefits has a huge impact on your net financial position.

- Health Insurance: A company with excellent, low-deductible health, dental, and vision insurance can save you thousands of dollars per year in premiums and out-of-pocket costs compared to a plan with high premiums and deductibles.

- Other Perks: This can include wellness stipends (gym memberships), mental health support, generous paid time off (PTO), and parental leave policies.

When evaluating a job offer, you must look beyond the base salary and calculate the total annual value of the entire package to understand if it will truly get you to your financial goals.

---

Key Factors That Influence Your Salary

Two professionals with the same job title and years of experience can have vastly different salaries. Your earning potential isn't set in stone; it's a dynamic figure influenced by a combination of strategic choices and market forces. Mastering these factors is the key to unlocking a six-figure income and achieving your goal of an $80k after-tax salary.

###

Level of Education

While a bachelor's degree is the standard entry point for most professional careers, the type of degree and any advanced education can significantly impact your starting salary and long-term trajectory.

- Undergraduate Degree: For technical roles like Software Developer or Data Scientist, a degree in Computer Science, Statistics, Mathematics, or a related STEM field is highly valued and often commands a higher starting salary. For business roles like Marketing Manager or Financial Analyst, degrees in Business, Finance, Economics, or Marketing are standard. A degree from a top-tier university can also provide an initial salary premium due to strong alumni networks and recruiting pipelines.

- Master's Degree / MBA: For many roles, a master's degree provides a substantial boost. A Master's in Computer Science or Data Science can open doors to specialized, higher-paying roles in fields like Artificial Intelligence or Machine Learning. A Master of Business Administration (MBA) is particularly powerful for those aspiring to management and leadership positions. According to a 2022 report from the Graduate Management Admission Council (GMAC), the median starting salary for MBA graduates was $115,000, a significant premium over bachelor's degree holders. In finance, roles in investment banking or private equity often require or strongly prefer an MBA from a top program.

- Certifications: In the modern workplace, specific, in-demand certifications can be just as valuable as a formal degree for boosting your salary. They signal proven expertise in a specific domain.

- Tech: AWS Certified Solutions Architect, Google Professional Cloud Architect, and Certified Information Systems Security Professional (CISSP) can add thousands to a developer's or IT professional's salary.

- Project Management: The Project Management Professional (PMP) certification is a globally recognized standard that can increase a project manager's salary by up to 20%, according to the Project Management Institute (PMI).

- Finance: The Chartered Financial Analyst (CFA) designation is the gold standard for investment professionals and leads to significantly higher earning potential. The Certified Public Accountant (CPA) is essential for high-level accounting roles.

- Marketing: Certifications in Google Analytics, HubSpot, or Salesforce Marketing Cloud demonstrate proficiency in key marketing technology platforms.

###

Years of Experience

Experience is arguably the single most important factor in salary growth. Your value to an employer increases as you move from executing tasks to leading projects, setting strategy, and mentoring others. As we saw in the salary progression table, the leap from entry-level to mid-career is where most professionals cross the $100,000 threshold.

- 0-2 Years (Building the Foundation): The focus is on learning and proving your competence. Salary growth comes from mastering your core responsibilities and absorbing as much knowledge as possible.

- 2-5 Years (The Acceleration Phase): This is the sweet spot for rapid salary growth. You've proven you can work independently and are starting to take on more complex tasks. This is the prime time to make a strategic job move or negotiate a significant raise, as you are now a proven asset with a track record of success. Your market value is at its peak relative to your experience level.

- 5-10+ Years (Expertise and Leadership): At this stage, salary growth is tied to specialization and leadership. You are no longer just a "doer"; you are a technical lead, a team manager, or a subject matter expert. Your salary reflects your ability to influence broader business outcomes. Senior professionals in high-demand fields can command salaries well above $150,000-$200,000.

###

Geographic Location

Where you live and work has a massive impact on your gross salary. Companies in high-cost-of-living (HCOL) areas must pay more to attract talent. However, it's crucial to balance a higher salary with the increased expenses.

Here's a look at how the median salary for a Software Engineer can vary dramatically by city, according to Glassdoor (2023 data):

- San Francisco Bay Area, CA: ~$165,000

- Seattle, WA: ~$145,000

- New York City, NY: ~$140,000

- Austin, TX: ~$125,000

- Chicago, IL: ~$115,000

- Atlanta, GA: ~$110,000

- Kansas City, MO: ~$98,000

While the San Francisco salary looks highest, the astronomical cost of housing means your disposable income (what's left after taxes and essential expenses) might not be that different from someone earning $125,000 in Austin.

The rise of remote work has complicated this. Some companies have location-based pay tiers, adjusting your salary if you move to a lower-cost area. Others have adopted a single national pay scale, creating a huge advantage for employees in lower-cost-of-living regions. When considering a job, always research the cost of living in that location to understand your true purchasing power. States with no state income tax, like Texas, Florida, Washington, and Nevada, can also significantly increase your take-home pay compared to high-tax states like California, New York, and Oregon.

###

Company Type & Size

The type of organization you work for is a major determinant of your compensation package.

- Large Tech Companies (FAANG & Co.): Companies like Google, Meta, Apple, Amazon, and Microsoft are known for offering top-of-the-market compensation. A mid-level engineer at one of these firms can easily have a total compensation package (salary + bonus + RSU grants) exceeding $200,000 - $250,000. The work is often at a massive scale, but the environment can be highly competitive.

- Established Corporations (Non-Tech): Large, established companies in industries like finance, healthcare, or consumer goods offer competitive salaries, excellent benefits, and more stability. A Financial Analyst at a Fortune 500 company will likely earn more and have a better bonus structure than one at a small, local business.

- Startups: Compensation at startups is a high-risk, high-reward proposition.

- Early-Stage: Base salaries are often lower than the market average to conserve cash. The tradeoff is a potentially significant equity grant. If the startup succeeds and goes public or is acquired, this equity could be life-changing. If it fails, the equity is worthless.

- Late-Stage (Pre-IPO): As startups mature and secure more funding, their base salaries become more competitive with established companies. They still offer significant equity, which is seen as less risky than at an early-stage company.

- Government & Non-Profit: These sectors typically offer lower base salaries than the private sector. However, they often compensate with exceptional job security, excellent benefits (pensions are common in government), and a better work-life balance.

###

Area of Specialization

Within any given career, specializing in a high-demand niche can dramatically increase your value. Generalists are valuable, but specialists with rare expertise command premium pay.

- Software Development: A generalist web developer might earn $120,000. A developer specializing in AI/Machine Learning, Cybersecurity, or Blockchain technology can earn $160,000+ due to the scarcity of talent and high business demand in these areas.

- Marketing: A general Marketing Manager is valuable. A Marketing Manager who specializes in Marketing Automation and CRM (like Salesforce or Marketo) or technical SEO possesses a specialized, revenue-generating skillset and can command a higher salary.

- Finance: A corporate Financial Analyst has a solid career path. A Financial Analyst who specializes in Investment Banking (M&A) or Quantitative Analysis ("Quants") works in a much more lucrative part of the industry, with salaries and bonuses that are multiples of a corporate finance role.

- Healthcare: A Registered Nurse (RN) earns a good living. An RN who becomes a Certified Registered Nurse Anesthetist (CRNA) enters one of the highest-paying professions in the U.S., with average salaries approaching $200,000, according to the BLS.

###

In-Demand Skills

Beyond your job title, the specific skills you possess are what employers are paying for. Cultivating a mix of technical (hard) and interpersonal (soft) skills will make you a more valuable and higher-paid professional.

High-Value Hard Skills:

- Programming & Data: Python, Java, C++, SQL, Cloud Computing (AWS, Azure, GCP)

- Data Science: Machine Learning, Statistical Analysis, Data Visualization (Tableau, Power BI)

- Finance: Financial Modeling, Valuation, Excel, Enterprise Resource Planning (ERP) systems (SAP, Oracle)

- Marketing: SEO/SEM, Google Analytics, CRM Software (Salesforce), Content Management Systems (WordPress)

High-Value Soft Skills (often the differentiator for leadership roles):

- Communication & Presentation: The ability to clearly explain complex topics to non-technical stakeholders.

- Project Management: The ability to lead projects, manage timelines, and deliver results.

- **Leadership