Table of Contents

- [What Does an Accounting Clerk Do?](#what-does-an-accounting-clerk-do)

- [Average Accounting Clerk Salary: A Deep Dive](#average-accounting-clerk-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

Are you the person who finds deep satisfaction in a perfectly balanced checkbook? Do you possess a keen eye for detail, a love for numbers, and a desire for a stable, in-demand career that serves as the financial backbone of any successful business? If so, the role of an Accounting Clerk might be your perfect professional fit. This career isn't just about data entry; it's about ensuring the financial integrity of an organization, one transaction at a time. The national median salary for this essential role, as reported by the U.S. Bureau of Labor Statistics (BLS), is a solid $47,440 per year, with a wide range that rewards experience and expertise, often stretching well into the $60,000s and beyond for senior professionals.

As a career analyst who has guided countless individuals, I've seen firsthand how pivotal this position is. I once worked with a small manufacturing startup that was struggling with cash flow. It wasn't until their newly hired Accounting Clerk meticulously reviewed months of records that they discovered a systemic invoicing error that was costing them thousands each month. That clerk didn't just balance the books; they saved the business. This story encapsulates the true value of the role: you are the guardian of a company's financial health, the detective who finds the missing penny, and the architect of financial order.

This comprehensive guide will illuminate every facet of the Accounting Clerk profession. We will dissect salary expectations, explore the factors that can significantly increase your earning potential, analyze the future job outlook, and provide a step-by-step roadmap to help you launch or advance your career. Whether you are a recent graduate or a professional considering a career change, this article is your definitive resource for understanding the true value and potential of an Accounting Clerk salary and career path.

---

What Does an Accounting Clerk Do?

At its core, an Accounting Clerk is a professional responsible for maintaining and processing the financial records of a company. They work under the supervision of an accountant or an accounting manager, handling the day-to-day transactional tasks that form the foundation of an organization's financial reporting system. Think of them as the meticulous organizers of the financial world. While a Certified Public Accountant (CPA) might design the complex financial strategy, the Accounting Clerk is on the front lines, ensuring the data that informs that strategy is accurate, timely, and impeccably organized.

Their responsibilities are diverse and critical, touching nearly every aspect of a company's financial operations. They are the essential personnel who ensure vendors are paid, customers are billed, and internal financial records are pristine.

### Core Responsibilities and Daily Tasks

While the specific duties can vary based on the size and industry of the company, most Accounting Clerks handle a combination of the following tasks:

- Accounts Payable (AP): Processing, verifying, and reconciling incoming invoices from vendors and suppliers. This involves matching purchase orders, receipts, and invoices, entering them into the accounting system, and preparing payments for approval.

- Accounts Receivable (AR): Creating and sending invoices to customers for goods or services rendered. They are also responsible for tracking incoming payments, applying them to the correct accounts, and following up on overdue balances.

- General Ledger (GL) Maintenance: Posting financial transactions to the general ledger, ensuring that all debits and credits are recorded accurately. This is the central repository of all financial data.

- Bank Reconciliations: Comparing the company's internal financial records against bank statements to identify discrepancies, resolve errors, and ensure all transactions have been accounted for.

- Preparing Financial Reports: Assisting in the creation of basic financial reports, such as balance sheets, income statements, and cash flow statements, for internal review by management.

- Payroll Support: In smaller companies, an Accounting Clerk may assist the payroll department by collecting timesheet data, verifying hours, and preparing payroll reports.

- Data Entry and Filing: Meticulously entering financial data into accounting software (like QuickBooks, SAP, or Oracle) and maintaining organized digital and physical files for auditing and reference purposes.

### A Day in the Life of an Accounting Clerk

To make this more concrete, let's walk through a typical day for "Alex," an Accounting Clerk at a mid-sized marketing firm.

- 9:00 AM: Alex starts the day by opening the accounting software and checking the main finance email inbox. They find several new invoices from freelance writers and a payment notification from a major client.

- 9:30 AM: The first task is Accounts Payable. Alex takes the three vendor invoices, cross-references them with the project manager's approved work orders, and codes them to the correct expense accounts before entering them into QuickBooks for the weekly payment run.

- 11:00 AM: Alex shifts to Accounts Receivable. They see that the client's payment has been received via ACH transfer. They apply the payment to the outstanding invoice in the system, marking it as paid, which immediately updates the company's cash position.

- 12:30 PM: Lunch Break.

- 1:30 PM: Time for the weekly bank reconciliation. Alex downloads the latest bank statement and compares it, line by line, with the transactions recorded in the general ledger. They identify a small bank fee that wasn't recorded and a duplicate entry for an office supply purchase, making the necessary adjustments to ensure the books match the bank's records perfectly.

- 3:00 PM: The Accounting Manager asks for a "Top 10 Overdue Invoices" report. Alex runs the aged receivables report, formats it in Excel with clear notes on which clients have been contacted, and sends it over for review.

- 4:30 PM: Alex spends the last part of the day filing digital copies of the day's processed invoices and payment receipts into the company's cloud storage system, ensuring a clean audit trail before planning the next day's priorities.

This example illustrates the blend of routine tasks and responsive, project-based work that defines the role. It requires precision, organization, and a deep understanding of fundamental accounting principles.

---

Average Accounting Clerk Salary: A Deep Dive

Understanding your potential earnings is a crucial step in evaluating any career path. For Accounting Clerks, the salary landscape is a promising one, offering a stable income with clear pathways for growth based on experience, skill, and location. While a six-figure salary is uncommon for a clerk-level position, the role provides a very respectable living and serves as a springboard to higher-paying roles within the accounting profession.

### National Averages and Typical Salary Ranges

To get the most accurate picture, it's essential to look at data from several authoritative sources.

- U.S. Bureau of Labor Statistics (BLS): The most reliable government source, the BLS's Occupational Outlook Handbook, reports the median annual wage for bookkeeping, accounting, and auditing clerks was $47,440 as of May 2023. The "median" means that half of all clerks earned more than this amount and half earned less. The BLS also provides a range: the lowest 10 percent earned less than $31,580, while the highest 10 percent earned more than $72,430.

- Salary.com: This reputable salary aggregator provides more granular data. As of late 2023, Salary.com reports the average Accounting Clerk I (entry-level) salary in the United States is around $46,901, but the typical range falls between $42,112 and $52,572. For an Accounting Clerk III (a senior or more experienced role), the average jumps to $58,491, with a range typically between $52,382 and $65,584.

- Payscale: Payscale offers a slightly different view, reporting an average base salary of around $46,500 per year. Their data emphasizes how total pay can increase with bonuses and profit-sharing, pushing the total compensation range from $35,000 to $62,000 annually.

- Glassdoor: Based on user-submitted data, Glassdoor reports an average total pay of $53,348 per year in the United States, which includes an estimated base pay of around $48,000 and additional pay (bonuses, tips) of about $5,000.

Key Takeaway: Synthesizing this data, a realistic expectation for an Accounting Clerk salary in the U.S. is a range of $42,000 to $65,000 per year. Your specific salary within this range will be heavily influenced by the factors we will explore in the next section.

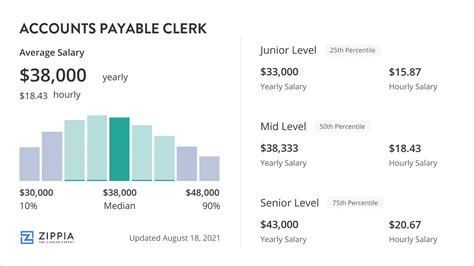

### Salary by Experience Level

Your value—and therefore your salary—grows significantly as you accumulate experience. Here’s a breakdown of what you can expect at different stages of your career.

| Experience Level | Typical Years of Experience | Typical Salary Range (Annual) | Key Responsibilities & Expectations |

| :--- | :--- | :--- | :--- |

| Entry-Level Accounting Clerk | 0-2 Years | $38,000 - $48,000 | Focus on routine tasks like data entry, processing AP/AR invoices, and basic reconciliations. Works under close supervision. |

| Mid-Career Accounting Clerk | 2-5 Years | $47,000 - $57,000 | Handles more complex reconciliations, prepares journal entries, assists with month-end closing, and may train junior clerks. Works more independently. |

| Senior/Lead Accounting Clerk | 5+ Years | $55,000 - $70,000+ | Oversees specific accounting functions (e.g., all of AP), handles complex and non-routine issues, assists with audit preparation, and generates more advanced reports for management. May have supervisory duties. |

*Source: Analysis compiled from BLS, Salary.com, and Payscale data.*

As you can see, an experienced and proficient Senior Accounting Clerk can earn nearly double what a newcomer might make, highlighting the immense value of on-the-job expertise.

### Beyond the Base Salary: Total Compensation

It's crucial to look beyond the sticker price of your salary. Total compensation provides a more holistic view of your earnings and includes valuable financial benefits.

- Bonuses: Many companies, especially in the for-profit sector, offer annual performance bonuses. These can range from a few hundred dollars to several thousand, often tied to both individual performance and company profitability. According to Payscale, the average bonus for an Accounting Clerk is around $1,500 per year, but this can vary widely.

- Profit Sharing: Some organizations offer profit-sharing plans where a portion of the company's profits is distributed among employees. This can add a significant amount to your annual earnings, though it is not guaranteed and is dependent on the company's success.

- Health Insurance: Employer-sponsored health, dental, and vision insurance is a highly valuable component of compensation. The value of these benefits can easily be worth $5,000 to $15,000 per year, depending on the plan and coverage level.

- Retirement Savings: Most employers offer a 401(k) or 403(b) retirement plan. A key benefit is the employer match, where the company contributes a certain amount to your account based on your own contributions (e.g., matching 100% of your contributions up to 4% of your salary). This is essentially free money for your retirement.

- Paid Time Off (PTO): Paid vacation, sick leave, and holidays are also part of your compensation package.

- Tuition Reimbursement: A growing number of companies offer tuition assistance or reimbursement for employees pursuing further education or relevant certifications, which is a direct investment in your career growth.

When evaluating a job offer, always consider the full scope of the total compensation package, not just the base salary figure. A role with a slightly lower base salary but excellent benefits and a generous 401(k) match may be more financially advantageous in the long run.

---

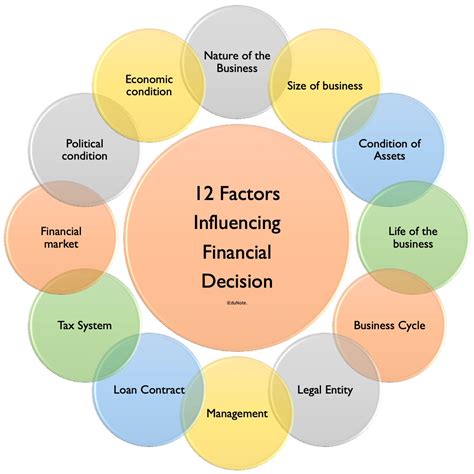

Key Factors That Influence Your Accounting Clerk Salary

While national averages provide a useful benchmark, your personal earning potential is not a fixed number. It’s a dynamic figure influenced by a combination of your qualifications, choices, and the environment in which you work. Mastering these factors is the key to maximizing your income and accelerating your career progression. This section provides a comprehensive breakdown of the elements that have the most significant impact on an Accounting Clerk's salary.

### 1. Level of Education

While you can enter the field with a high school diploma, your educational background directly correlates with your starting salary and long-term growth potential.

- High School Diploma or GED: This is the minimum requirement for many entry-level positions. With a diploma, you can expect a salary at the lower end of the spectrum, likely in the $35,000 to $42,000 range. Employers will place a heavy emphasis on your on-the-job training and proven skills.

- Associate's Degree (A.A. or A.A.S. in Accounting or Business): This is often considered the sweet spot for a dedicated Accounting Clerk career. A two-year degree demonstrates a solid foundation in accounting principles, business ethics, and relevant software. Graduates can command a higher starting salary, typically in the $42,000 to $50,000 range, and are often seen as more promotable.

- Bachelor's Degree (B.S. in Accounting or Finance): While a four-year degree might seem like an overqualification for a clerk-level role, it provides a significant advantage. It positions you as a prime candidate for "hybrid" roles or roles in more complex industries (like finance or tech). It also lays the direct groundwork for advancing to a Staff Accountant position. A Bachelor's degree can push your starting salary into the $48,000 to $55,000 range and dramatically accelerates your path to senior roles and management.

- Professional Certifications: Certifications act as a powerful salary booster. They are a formal validation of your skills and dedication.

- Certified Bookkeeper (CB): Offered by the American Institute of Professional Bookkeepers (AIPB), this certification demonstrates a high level of expertise and can lead to a salary increase of 10% or more.

- Certified Public Bookkeeper (CPB): Provided by the National Association of Certified Public Bookkeepers (NACPB), this is another highly respected credential.

- Software Certifications: Becoming a certified user in platforms like QuickBooks ProAdvisor or gaining certifications in enterprise systems like SAP S/4HANA Finance or Oracle NetSuite makes you a highly valuable asset, especially for companies that rely heavily on that specific software.

### 2. Years of Experience

As highlighted earlier, experience is arguably the single most powerful driver of salary growth in this profession. It's a direct measure of your ability to handle complexity, work independently, and contribute value beyond basic data entry.

- Entry-Level (0-2 years): Salary Range: $38k - $48k. You are learning the ropes, mastering the core AP/AR functions, and proving your reliability and attention to detail.

- Mid-Career (2-5 years): Salary Range: $47k - $57k. You're no longer just a trainee. You understand the "why" behind the transactions. You can assist with month-end closing procedures, train new hires, and troubleshoot common discrepancies without constant supervision. Your salary reflects this increased competence and autonomy.

- Senior/Experienced (5-10 years): Salary Range: $55k - $68k. At this stage, you are a subject matter expert in your domain (e.g., the go-to person for all AP-related issues). You may be responsible for reviewing the work of others, preparing complex reports for auditors, and implementing process improvements.

- Lead/Supervisor (10+ years): Salary Range: $65k - $75k+. While this often transitions into an "Accountant" or "Accounting Supervisor" title, highly experienced clerks in lead roles can reach this pay scale. They take on project management, department-level reporting, and some supervisory responsibilities.

### 3. Geographic Location

Where you work matters—a lot. Salaries for Accounting Clerks can vary dramatically between states and even between cities within the same state, largely driven by the cost of living and the concentration of large businesses.

| State / Metro Area | Average Annual Salary | Commentary |

| :--- | :--- | :--- |

| Washington, D.C. | ~$65,000+ | High cost of living and a high concentration of government, legal, and consulting firms drive up wages. |

| New York, NY | ~$64,000 | The financial capital of the world demands top talent, and salaries reflect the extremely high cost of living. |

| San Francisco, CA | ~$63,000 | A hub for tech and finance, the Bay Area offers high salaries to offset the nation's highest living costs. |

| Boston, MA | ~$61,000 | A strong presence in biotech, finance, and education creates high demand for skilled clerks. |

| Seattle, WA | ~$60,000 | Home to major tech and retail giants, Seattle's competitive market offers robust salaries. |

| National Average | ~$47,000 - $53,000 | A solid benchmark for comparison. |

| Lower-Cost States (e.g., Mississippi, Arkansas) | ~$38,000 - $42,000 | While the salary numbers are lower, the significantly lower cost of living can make these wages go much further. |

*Source: Data compiled and averaged from Salary.com, Indeed, and BLS regional data.*

Before accepting a job, always use a cost-of-living calculator to understand how a salary in a new city compares to your current location. A $60,000 salary in San Francisco may afford you a lower standard of living than a $45,000 salary in Omaha, Nebraska.

### 4. Company Type & Size

The type and size of your employer create different work environments and compensation structures.

- Large Corporations (Fortune 500): These companies typically offer higher base salaries, structured pay grades, and comprehensive benefits packages. An Accounting Clerk at a company like Microsoft or JPMorgan Chase will likely earn at the higher end of the scale due to the complexity of the work and the company's ability to pay. The environment is more structured and specialized.

- Small and Medium-Sized Businesses (SMBs): Salaries here might be closer to the national average. However, the experience can be invaluable. You'll likely wear more hats, gaining exposure to a wider range of accounting functions (AP, AR, payroll, etc.), which can accelerate your skill development.

- Startups: Compensation can be a mixed bag. The base salary might be slightly lower than at a large corporation, but it could be supplemented with stock options, which have the potential for a large payoff if the company succeeds. The work environment is fast-paced and less structured.

- Government (Federal, State, Local): Government positions are known for their exceptional job security and excellent benefits, including generous pensions and health insurance. While the base salary may be slightly below the private sector average, the total compensation package is often superior. For example, an "Accounting Technician" for the federal government might fall on the GS-4 to GS-6 pay scale, which translates to a salary of roughly $33,000 to $54,000 depending on location and step, with a clear path for advancement.

- Non-Profit Organizations: These organizations are mission-driven, which can be highly rewarding. However, due to budget constraints, salaries tend to be on the lower end of the spectrum. The trade-off is often a better work-life balance and the satisfaction of contributing to a cause you believe in.

### 5. Area of Specialization

Within the "Accounting Clerk" umbrella, several specializations exist. While there is significant overlap, deep expertise in one area can command a higher salary, especially in larger organizations that have dedicated departments for each function.

- Accounts Payable (AP) Clerk: Specializes in managing vendor relationships and outflows of cash.

- Accounts Receivable (AR) Clerk: Focuses on customer invoicing and ensuring timely cash inflows. Expertise here is critical for a company's cash flow.

- Payroll Clerk: A highly sensitive and detail-oriented role responsible for ensuring everyone is paid accurately and on time. Due to the complexity of tax law and regulations, experienced Payroll Clerks are always in demand and can often earn a premium.

- Auditing Clerk: Assists internal or external auditors by gathering documentation, preparing schedules, and verifying financial records. This role requires an exceptional level of accuracy and organization.

### 6. In-Demand Skills

Beyond your formal qualifications, the specific skills you bring to the table can directly translate into a fatter paycheck. Employers are willing to pay more for candidates who can add immediate and tangible value.

High-Value Technical Skills:

- Advanced Microsoft Excel: This is non-negotiable. You need to be a power user, comfortable with PivotTables, VLOOKUP/HLOOKUP/XLOOKUP functions, complex formulas, and data visualization. This skill alone can differentiate you from the majority of applicants.

- Enterprise Resource Planning (ERP) System Proficiency: Experience with large-scale accounting software is a massive advantage.

- SAP S/4HANA: The gold standard in many large, multinational corporations.

- Oracle NetSuite: Very popular with mid-sized and high-growth companies.

- Microsoft Dynamics 365: A major player in the ERP space.

- Small Business Accounting Software: Mastery of QuickBooks (Online and Desktop) and Xero is essential for roles in SMBs.

- Data Analysis: The ability to not just record data, but to analyze it for trends, spot anomalies, and create insightful reports is the future of the profession.

Essential Soft Skills:

- Meticulous Attention to Detail: A single misplaced decimal can have significant consequences. This is the most crucial soft skill.

- Integrity and Discretion: You will be handling sensitive financial information. Absolute trustworthiness is paramount.

- Problem-Solving: When reconciliations don't balance, you need the analytical skills to investigate, identify the root cause, and propose a solution.

- Communication: You must be able to clearly communicate with vendors, customers, and internal team members both verbally and in writing.

- Time Management and Organization: Juggling AP, AR, and reporting deadlines requires exceptional organizational skills.

By strategically developing these skills, you transform yourself from a simple data processor into a valuable financial professional, and your salary will reflect that transformation.

---

Job Outlook and Career Growth

While salary is a snapshot of your current value, job outlook and career growth potential tell you about your future security and opportunities. For Accounting Clerks, the future is not one of decline, but one of evolution.

### Job Outlook for the Next Decade

According to the U.S. Bureau of Labor Statistics (BLS), employment for bookkeeping, accounting, and auditing clerks is projected to decline 5 percent from 2022 to 2032. At first glance, this might seem alarming, but it's crucial to understand the context behind this number.

The decline is not because the work is becoming less important; in fact, financial accuracy is more critical than ever. The decline is driven by technological advancements and automation. Software can now automate many of the routine, repetitive tasks that once consumed a clerk's day, such as basic data entry, invoice scanning, and simple reconciliations.

However, the BLS also projects about 157,600 openings for these clerks each year, on average, over the decade. These openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This creates a clear message: The future belongs to the tech-savvy Accounting Clerk who can leverage technology, not be replaced by it. The demand for clerks who simply perform manual data entry will shrink, but the demand for clerks who can manage, analyze, and troubleshoot the automated systems will grow.

### Emerging Trends and Future Challenges

To thrive in the coming decade, you must stay ahead of these key trends:

1. The Shift from Data Entry to Data Analysis: Your value is no longer in keying in numbers. It's in your ability to look at the output from the accounting system and ask, "Does this make sense? What trends can I see? Where are the anomalies?" You are becoming a first-line financial analyst.

2. Cloud-Based Accounting: The move away from desktop software to cloud platforms like QuickBooks Online and Xero is nearly complete for SMBs. This allows for real-time collaboration and access to financial data from anywhere. Proficiency in these platforms is essential.

3. **Increased Focus on