In a world driven by data and uncertainty, companies are increasingly reliant on professionals who can navigate the complex landscape of risk. Enter the Risk Analyst: a critical thinker and data expert who identifies, analyzes, and mitigates potential threats to an organization's success. This vital role not only offers a dynamic and intellectually stimulating career but also comes with significant financial rewards. For those with a knack for numbers and strategy, a career in risk analytics can be exceptionally lucrative, with average salaries often exceeding $100,000 for experienced professionals.

This guide will break down everything you need to know about a risk analytics salary, from average compensation to the key factors that can maximize your earning potential.

What Does a Risk Analyst Do?

At its core, a Risk Analyst acts as a financial and operational guardian for a business. They are responsible for using quantitative and qualitative methods to assess potential risks that could impact the company's profitability or long-term stability.

Key responsibilities include:

- Data Analysis: Sifting through vast datasets to identify patterns, trends, and potential red flags.

- Financial Modeling: Building sophisticated models to forecast the potential impact of various risk factors (e.g., market volatility, credit defaults, operational failures).

- Risk Identification: Pinpointing financial, operational, strategic, and compliance risks across the organization.

- Strategy Development: Recommending and developing strategies to mitigate, transfer, or avoid identified risks.

- Reporting: Communicating complex findings clearly and concisely to senior management and stakeholders to inform decision-making.

Essentially, they answer the critical question: "What could go wrong, and what can we do to prepare for it?"

Average Risk Analyst Salary

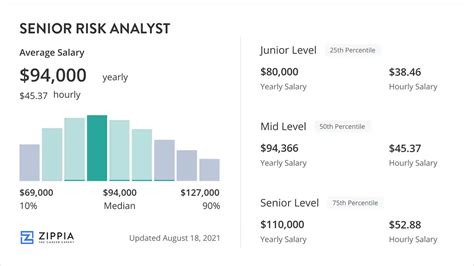

The compensation for a Risk Analyst is competitive and reflects the high-demand nature of their skills. While figures vary, we can establish a reliable picture by synthesizing data from several authoritative sources.

According to Salary.com, the median salary for a Risk Analyst in the United States is approximately $88,570 as of early 2024. However, the typical salary range is quite broad, generally falling between $78,250 and $100,690.

This range expands significantly when considering experience. Payscale provides a helpful perspective, showing a salary spectrum from $63,000 (for the bottom 10% of earners, likely entry-level) to over $124,000 (for the top 10%, representing senior and specialized roles). Glassdoor reports a similar national average base pay of around $94,500 per year.

It's clear that while a solid starting salary is typical, the potential for six-figure earnings is well within reach as you advance in your career.

Key Factors That Influence Salary

Your specific salary as a risk analyst isn't set in stone. It's influenced by a combination of your qualifications, choices, and market forces. Here are the most significant factors.

###

Level of Education

A strong educational foundation is the launching point for a career in risk analytics.

- Bachelor's Degree: This is the standard entry requirement. Degrees in Finance, Economics, Statistics, Mathematics, or Business Administration are most common and provide the necessary quantitative and analytical skills.

- Master's Degree: Pursuing a Master of Science in Finance (MSF), Quantitative Finance, Data Science, or a Master of Business Administration (MBA) with a finance or risk concentration can significantly increase earning potential. An advanced degree not only deepens your expertise but also qualifies you for more senior and specialized roles right out of school.

- Certifications: Professional certifications are highly respected in the industry and can lead to a substantial salary premium. The two most recognized are the Financial Risk Manager (FRM) from the Global Association of Risk Professionals (GARP) and the Professional Risk Manager (PRM) from the Professional Risk Managers' International Association (PRMIA).

###

Years of Experience

Experience is arguably the single most important factor in determining your salary. The career and compensation ladder typically looks like this:

- Entry-Level (0-2 years): Analysts fresh out of college or with minimal experience can expect to earn between $65,000 and $85,000. They focus on data gathering, running pre-built models, and supporting senior analysts.

- Mid-Level (3-7 years): With a few years of experience, analysts take on more complex projects, build their own models, and have more client or stakeholder-facing responsibilities. Their salaries typically rise to the $85,000 to $115,000 range.

- Senior/Lead Analyst (8+ years): Senior analysts manage projects, mentor junior staff, and present findings to executive leadership. Their deep expertise commands salaries ranging from $115,000 to $150,000+. At this level, titles may shift to Risk Manager, Senior Risk Manager, or Director of Risk.

###

Geographic Location

Where you work matters. Salaries for risk analysts are significantly higher in major financial hubs where the demand for their skills is concentrated and the cost of living is higher.

For example, data from aggregators like Glassdoor and Salary.com consistently show that cities like New York City, San Francisco, Boston, and Chicago offer salaries that are 15-30% above the national average. A role that pays $90,000 in a mid-sized city could easily command over $115,000 in New York to attract top talent.

###

Company Type

The industry and type of company you work for play a huge role in your compensation package.

- Investment Banking & Hedge Funds: These firms are typically the highest payers, as risk management is directly tied to their core, high-stakes trading and investment activities.

- Financial Services & Commercial Banking: Large banks (e.g., JPMorgan Chase, Bank of America) and insurance companies (e.g., Prudential, MetLife) are massive employers of risk analysts and offer very competitive salaries and robust benefits.

- Consulting Firms: Firms like Deloitte, PwC, and EY have dedicated risk advisory practices that pay well, though the work often involves longer hours and frequent travel.

- Technology & Fintech: As tech companies increasingly move into financial services and manage vast amounts of sensitive data, the demand for operational and cybersecurity risk analysts is booming, with salaries that are competitive with the financial sector.

- Government: Government agencies offer excellent job security and benefits, but salaries tend to be lower than in the private sector.

###

Area of Specialization

Risk is not a monolith. Specializing in a high-demand area can make you a more valuable and higher-paid professional.

- Credit Risk: Analyzing the probability of borrowers defaulting on their loans. This is fundamental for any lending institution.

- Market Risk: Analyzing potential losses from fluctuations in financial market prices (e.g., interest rates, stock prices, foreign exchange rates). This is a highly quantitative and lucrative field.

- Operational Risk: Analyzing risks from internal process failures, human error, system breakdowns, or external events. This has grown in importance since the 2008 financial crisis.

- Cybersecurity Risk: A rapidly growing and increasingly critical field focused on protecting data and systems from cyber threats. Professionals with a blend of tech and risk skills are in extremely high demand.

Job Outlook

The future for risk analytics professionals is exceptionally bright. As business becomes more global, digital, and complex, the need for skilled individuals who can manage uncertainty has never been greater.

The U.S. Bureau of Labor Statistics (BLS), which groups Risk Analysts under broader categories like "Financial Analysts" and "Operations Research Analysts," projects strong growth. For Financial Analysts, the BLS forecasts a growth rate of 8% from 2022 to 2032, which is much faster than the average for all occupations. This translates to an estimated 32,200 new jobs over the decade.

The driving forces behind this growth include increasing regulatory scrutiny, the adoption of advanced data analytics technologies, and the emergence of new threats like climate and cybersecurity risks.

Conclusion

A career in risk analytics is a powerful choice for data-savvy individuals seeking a challenging and rewarding profession. The salary potential is high, with a clear path for advancement that rewards continuous learning, specialization, and experience.

Key takeaways for aspiring professionals:

- Strong Earnings: Expect a competitive starting salary with a clear trajectory toward six figures and beyond.

- Growth is Certain: Your earnings will grow substantially with experience, specialized skills, and professional certifications.

- You Have Control: Factors like your level of education, specialization, and choice of industry give you significant leverage to shape your career and income.

- High Demand: The robust job outlook ensures that skilled risk analysts will remain highly sought after for the foreseeable future.

For anyone looking to build a career at the intersection of finance, data, and strategy, the field of risk analytics offers a stable and prosperous path forward.