California's dynamic and massive economy, the largest in the United States, presents a landscape of incredible opportunity for finance professionals. For aspiring and current accountants, the Golden State offers not just a robust job market but also highly competitive compensation. If you're considering a career in accounting in California, you can expect a salary that reflects the state's high demand for financial expertise, with the average professional earning well over the national average.

This guide will break down everything you need to know about an accountant's salary in California, from average earnings to the key factors that can significantly increase your pay.

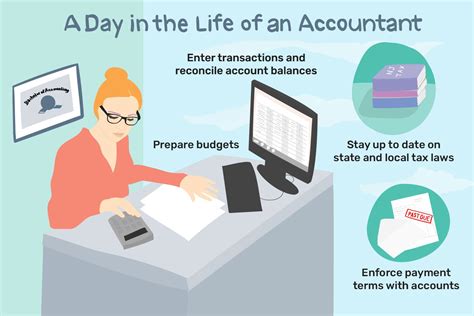

What Does an Accountant Do?

At its core, an accountant is a vital steward of financial integrity and strategy for businesses, government agencies, and individuals. They are responsible for preparing, maintaining, and analyzing financial records to ensure accuracy and compliance with laws and regulations. While the role is often associated with "crunching numbers," modern accountants are strategic advisors who play a crucial role in decision-making.

Key responsibilities typically include:

- Preparing financial statements, such as balance sheets and income statements.

- Ensuring compliance with tax laws and filing tax returns.

- Conducting internal audits to identify and mitigate financial risk.

- Analyzing financial data to provide insights for budgeting and forecasting.

- Advising management on financial strategies and investment decisions.

Average Accountant Salary in California

California stands out as one of the top-paying states for accountants in the nation. According to the most recent data from the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics (May 2023), the mean annual wage for "Accountants and Auditors" in California is $103,130.

This figure represents a strong average, but actual salaries can vary widely. A more practical way to view compensation is through a range:

- Entry-Level Accountants (0-2 years of experience): Typically earn between $65,000 and $80,000.

- Mid-Career Accountants (3-7 years of experience): Can expect to earn between $85,000 and $115,000.

- Senior Accountants / CPAs (8+ years of experience): Often earn upwards of $120,000, with top earners in specialized roles or major metropolitan areas exceeding $150,000.

Reputable salary aggregators corroborate these figures. For example, Salary.com reports the median salary for a mid-level Accountant II in California to be around $92,500, while Glassdoor places the average total pay (including bonuses and profit sharing) in a similar range.

Key Factors That Influence Salary

Your specific salary as an accountant in California is not set in stone. Several key factors will directly impact your earning potential. Understanding them is crucial for maximizing your career's financial trajectory.

### Level of Education and Certification

Your educational background and professional credentials are the foundation of your earning potential. While a Bachelor's degree in Accounting or a related field is the standard entry requirement, advanced qualifications act as powerful salary accelerators. The most significant of these is the Certified Public Accountant (CPA) license. Obtaining a CPA license is widely considered the gold standard in the accounting profession and can increase your salary by 10-15% or more. It also opens doors to leadership positions and specialized fields like auditing and forensic accounting. A Master's degree, such as a Master of Accountancy (MAcc) or an MBA with a concentration in accounting, can also provide a significant salary boost.

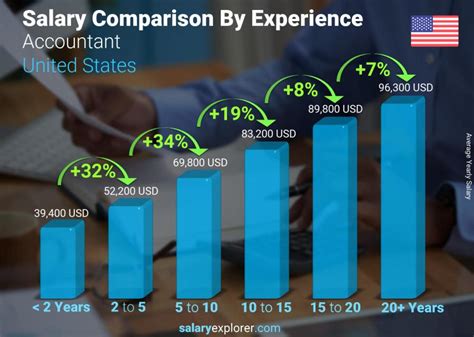

### Years of Experience

Experience is a primary driver of salary growth. As you progress from an entry-level staff accountant to a senior accountant, manager, or controller, your responsibilities increase, and your compensation follows suit.

- Staff Accountant (0-3 years): Focuses on foundational tasks like bookkeeping, financial statement preparation, and account reconciliation.

- Senior Accountant (4-8 years): Takes on more complex tasks, may supervise junior staff, and gets involved in financial analysis and reporting.

- Manager/Controller (8+ years): Oversees the entire accounting department, manages financial strategy, and reports directly to executive leadership. Each step up this ladder comes with a substantial pay increase.

### Geographic Location

In a state as large and diverse as California, where you work matters—a lot. Major metropolitan areas with a higher cost of living and a greater concentration of large corporations offer significantly higher salaries than smaller cities or rural areas.

Here's a comparison of mean annual salaries for accountants in different California metropolitan areas, according to the BLS (May 2023):

- San Jose-Sunnyvale-Santa Clara: $124,560

- San Francisco-Oakland-Hayward: $116,210

- Los Angeles-Long Beach-Anaheim: $100,560

- San Diego-Carlsbad: $97,850

- Sacramento-Roseville-Arden-Arcade: $95,780

- Bakersfield: $83,720

Working in the Bay Area or Los Angeles can result in a salary that is 20-30% higher than in the Central Valley.

### Company Type and Industry

The type of organization you work for has a major impact on your compensation.

- Public Accounting (Big Four): The "Big Four" firms (Deloitte, PwC, EY, KPMG) and other large national firms are known for offering the highest starting salaries to attract top talent. The work is demanding, but the experience and pay are exceptional.

- Industry/Corporate Accounting: Working "in-house" for a large company, particularly in high-growth sectors like tech, entertainment, or biotech, can be very lucrative. These roles often offer excellent benefits and stock options.

- Government: Federal, state, and local government accounting jobs typically offer lower base salaries compared to the private sector. However, they compensate with outstanding job security, excellent benefits, and a better work-life balance.

- Non-Profit: While rewarding, non-profit organizations generally offer lower salaries due to budget constraints.

### Area of Specialization

General accounting is a solid career, but developing a specialization can make you a more valuable—and higher-paid—asset. High-demand specializations that often command premium salaries include:

- Forensic Accounting: Investigating financial fraud and crime.

- International Tax: Navigating the complex tax laws of multinational corporations.

- Information Technology (IT) Auditing: Assessing the financial controls and security of IT systems.

- Financial Advisory Services: Providing strategic advice on mergers, acquisitions, and corporate finance.

Job Outlook for Accountants in California

The future for accountants in California looks bright. The BLS Occupational Outlook Handbook projects a nationwide growth of 4% for accountants and auditors from 2022 to 2032, which is about as fast as the average for all occupations. This will result in about 126,500 openings each year, on average, over the decade.

In California, this demand is amplified. The state's complex regulatory environment, thriving startup culture, and the presence of countless multinational corporations mean that skilled accountants are always needed to ensure compliance, manage growth, and mitigate risk. As globalization and the digital economy continue to expand, the need for professionals who can manage complex financial data will only increase.

Conclusion

Choosing a career as an accountant in California is a strategic move with high potential for financial and professional growth. With an average salary exceeding $100,000 and a strong job market, the opportunities are abundant.

To maximize your success on this path, focus on the key drivers of compensation:

- Invest in Education and Certification: Prioritize earning your CPA license.

- Gain Diverse Experience: Move from entry-level to senior roles to build your skills.

- Be Strategic About Location: Target major metropolitan areas like the Bay Area and Los Angeles for the highest salaries.

- Consider Specializing: Develop expertise in a high-demand niche to make yourself indispensable.

By understanding these factors, you can confidently navigate your career path and build a prosperous future as an accountant in the Golden State.