Unlocking Your Earnings Potential: A Deep Dive into the PNC Personal Banker Salary

A career as a Personal Banker at a major institution like PNC Bank can be a highly rewarding entry point into the financial services industry. It combines customer service, sales, and financial guidance, offering a clear path for professional growth. But what can you realistically expect to earn?

This guide provides a data-driven look at the typical PNC Personal Banker salary. While starting salaries are competitive, your total compensation can grow significantly, often ranging from $45,000 to over $70,000 annually when factoring in experience, location, and performance-based incentives. We'll break down the numbers, explore the factors that influence your pay, and look at the future of this dynamic role.

What Does a PNC Personal Banker Do?

Before diving into the numbers, it's essential to understand the role. A PNC Personal Banker is the face of the bank for many customers. They are relationship builders and problem-solvers who work in a branch environment to help individuals and small businesses manage their finances.

Key responsibilities typically include:

- Building Customer Relationships: Engaging with clients to understand their financial needs and goals.

- Account Management: Opening and managing checking accounts, savings accounts, and certificates of deposit (CDs).

- Product Sales and Guidance: Recommending and explaining bank products like credit cards, personal loans, auto loans, and lines of credit.

- Problem Resolution: Assisting customers with account issues and providing effective solutions.

- Referrals: Identifying opportunities to refer clients to specialists in areas like mortgage lending, investments, and wealth management.

The role is a blend of customer service excellence and sales acumen, with a strong emphasis on ethical guidance and building long-term trust.

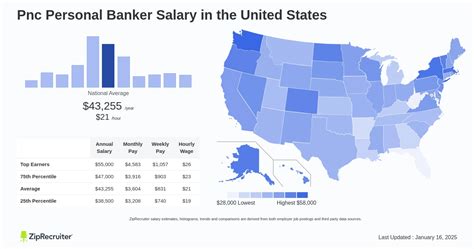

Average PNC Personal Banker Salary

A Personal Banker's compensation is typically composed of a base salary plus additional pay, which can include commissions, bonuses, and incentives. This structure rewards performance and is a key component of your total earnings.

Based on an analysis of recent data from authoritative sources:

- Glassdoor reports that the estimated total pay for a PNC Personal Banker is approximately $56,400 per year in the United States, with an average base salary of around $47,000. This total pay figure includes potential additional compensation like cash bonuses and commissions.

- Salary.com places the median salary for a "Personal Banker I" (an entry-level role) in the U.S. at around $45,500, with a typical range falling between $40,800 and $50,400. More experienced "Personal Banker II" roles have a median salary closer to $52,000.

- Payscale data for the general Personal Banker role indicates an average base salary of about $46,200, with total pay (including bonuses and profit sharing) reaching up to $68,000 for top earners.

It's clear that while the base salary provides a stable foundation, your ability to meet sales goals and client needs directly impacts your overall income. A realistic salary range for most PNC Personal Bankers, from entry-level to experienced, is $45,000 to $70,000+ per year.

Key Factors That Influence Salary

Your specific salary as a PNC Personal Banker isn't a single number; it's influenced by several critical factors. Understanding these variables can help you maximize your earning potential throughout your career.

###

Level of Education

While a bachelor's degree is not always a strict requirement, it is highly preferred by major banks like PNC and can give you a competitive edge. Candidates with a bachelor's degree in Finance, Business, Economics, or a related field may command a higher starting salary. More importantly, a degree is often essential for long-term advancement into roles like Branch Manager, Financial Advisor, or corporate banking positions. An associate's degree or a high school diploma combined with strong sales or customer service experience (e.g., as a bank teller) can be a sufficient entry point.

###

Years of Experience

Experience is one of the most significant drivers of salary growth in this role. As you build your skills and client portfolio, your value to the bank increases.

- Entry-Level (0-2 years): In this stage, you'll likely hold a "Personal Banker I" or "Associate Personal Banker" title. Your focus will be on learning PNC's products, mastering compliance, and building foundational customer service skills. Expect a salary at the lower end of the typical range.

- Mid-Career (2-5 years): With a proven track record, you may advance to a "Personal Banker II" or "Senior Personal Banker" role. You'll handle more complex client needs, take on larger sales goals, and may mentor junior bankers. Your base salary and bonus potential will see a significant increase.

- Experienced (5+ years): Senior and relationship bankers at this level are experts in their field. They manage high-value client portfolios and are a primary source of referrals to other bank departments. Their compensation will be at the highest end of the scale, and they are prime candidates for leadership positions.

###

Geographic Location

Where you work matters. Banks adjust their pay scales to account for the local cost of living and the competitiveness of the job market. A PNC Personal Banker in a major metropolitan area with a high cost of living, such as Chicago, Philadelphia, or Washington D.C., will almost certainly earn more than a banker in a smaller city or suburban area. When researching opportunities, always consider salary data specific to your city or state for the most accurate picture.

###

PNC's Position as a Major National Bank

Working for a large, established national bank like PNC comes with distinct advantages. These institutions typically have standardized compensation structures, which means pay is often competitive and predictable. Furthermore, they offer robust benefits packages that contribute to your total compensation, including comprehensive health insurance, retirement savings plans (like a 401(k) with a company match), and paid time off. They also provide structured training programs and clearly defined career paths, giving you the tools to advance and increase your earnings over time.

###

Area of Specialization

This is a crucial factor for maximizing your income. While the core personal banker role is generalist, obtaining specific licenses or developing expertise in a niche area can unlock significantly higher commissions and bonuses.

- Financial Licensing: Earning FINRA licenses like the Series 6 and Series 63, along with a state life insurance license, qualifies you to offer investment and insurance products to clients. Bankers with these licenses (often called Relationship Bankers or Financial Specialists) have substantially higher earning potential due to commissions from these sales.

- Small Business Banking: Some personal bankers specialize in serving the needs of small business owners. This requires a deeper understanding of business credit, cash flow management, and business-specific products, which often corresponds to higher compensation.

- Mortgage Expertise: Being a top performer in identifying and referring clients for mortgages can lead to significant incentive pay.

Job Outlook

The banking industry is evolving. According to the U.S. Bureau of Labor Statistics (BLS), employment for traditional Tellers is projected to decline as automation and online banking handle more routine transactions.

However, the outlook for relationship-focused roles like Personal Bankers remains stable. The BLS projects that employment for "Securities, Commodities, and Financial Services Sales Agents"—a category that includes licensed bankers—is expected to grow 3 percent from 2022 to 2032. This reflects the industry's shift away from transactional tasks and toward providing personalized, expert advice that technology cannot replace. The future of banking lies in relationship management, making the skills of a personal banker more valuable than ever.

Conclusion

A career as a PNC Personal Banker offers a competitive salary and a clear path for financial and professional growth. While a starting salary typically falls in the $45,000 to $50,000 range, your total compensation is heavily influenced by your performance, experience, and willingness to specialize.

Key Takeaways:

- Total Compensation is Key: Look beyond the base salary to the bonus and commission structure, as this is where significant earning potential lies.

- Experience Pays: Your salary will grow as you gain experience and prove your ability to build a client base.

- Location Matters: Expect higher pay in major metropolitan areas to offset the cost of living.

- Specialize to Maximize: Obtaining financial licenses to sell investment and insurance products is the fastest way to increase your earnings substantially.

For individuals with strong interpersonal skills, a drive to succeed, and a genuine interest in helping others, the Personal Banker role at PNC is not just a job—it's a gateway to a prosperous career in the financial world.