Table of Contents

- [What Does an Accountant in Florida Do?](#what-they-do)

- [Average Accountant Salary in Florida: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence an Accountant's Salary](#key-factors)

- [Job Outlook and Career Growth for Accountants in Florida](#job-outlook)

- [How to Become an Accountant in Florida: A Step-by-Step Guide](#how-to-start)

- [Conclusion: Is a Career in Accounting in Florida Right for You?](#conclusion)

For anyone standing at the crossroads of their career, peering down the path of accounting, the state of Florida represents a vibrant and compelling landscape. With its booming economy, diverse industries ranging from tourism and real estate to international trade and technology, the Sunshine State offers more than just pristine beaches—it offers immense opportunity. But opportunity must be measured, and for a prospective accountant, the most critical metric is often compensation. What can you *really* expect to earn?

The answer is both promising and complex. An accountant salary in Florida is not a single, static number but a dynamic figure influenced by a host of powerful factors. While the average salary provides a solid benchmark, often ranging from $70,000 to over $85,000 annually, the true potential can soar well into six figures for those with the right credentials, experience, and specialization. Early in my career, I consulted for a rapidly growing hospitality startup in Miami. Their books were a chaotic mess, a direct reflection of their explosive but disorganized growth. The day they hired a Certified Public Accountant (CPA), everything changed. She didn't just clean up the numbers; she created a financial roadmap that allowed them to secure funding, optimize spending, and triple their valuation in two years. That experience solidified for me that a great accountant is not a number-cruncher; they are a strategic architect of success.

This guide is designed to be your comprehensive roadmap. We will dissect every component of an accountant's salary in Florida, explore the factors that drive earning potential, and lay out a clear, actionable plan to launch and advance your career. Whether you're a student mapping out your future, a professional considering a career change, or an existing accountant looking to maximize your income, this article will provide the authoritative data and expert insights you need to navigate your path with confidence.

What Does an Accountant in Florida Do?

At its core, the role of an accountant is to be the steward of financial information. They are the professionals who prepare, analyze, and maintain the financial records that every organization—from a small non-profit in the Panhandle to a multinational corporation headquartered in Tampa—relies on to operate ethically, legally, and profitably. Their work provides the critical clarity that enables business leaders to make informed, strategic decisions.

While the stereotype of a solitary figure hunched over a calculator persists, the modern accountant's role is far more dynamic and collaborative. Their responsibilities are vast and vary significantly based on whether they work in public accounting, corporate (or "industry") accounting, government, or for a non-profit organization.

Core Responsibilities and Daily Tasks:

An accountant's work is often cyclical, with a rhythm dictated by monthly, quarterly, and annual reporting requirements. Here’s a breakdown of their typical duties:

- Financial Record Keeping: This is the bedrock of accounting. It involves meticulously recording all financial transactions, including sales, purchases, expenses, and payroll, using accounting software like QuickBooks, SAP, or Oracle NetSuite.

- Reconciliation: At the end of a period (usually a month), accountants reconcile bank statements and other financial accounts to ensure the records are accurate and that all transactions have been properly accounted for.

- Preparing Financial Statements: This is a key output of their work. They compile and prepare essential reports like the Balance Sheet (a snapshot of assets, liabilities, and equity), the Income Statement (showing revenues and expenses over a period), and the Cash Flow Statement (tracking the movement of cash).

- Budgeting and Forecasting: Accountants are crucial in planning for the future. They work with department heads and executives to create annual budgets and financial forecasts, helping to set financial goals and monitor performance against them.

- Tax Compliance and Preparation: A major area of focus, especially in Florida with its unique tax laws (like the absence of a state income tax for individuals). Accountants ensure that businesses and individuals comply with federal, state, and local tax regulations, prepare tax returns, and identify strategies for minimizing tax liability.

- Auditing: Auditors, a specialized type of accountant, review an organization's financial records to ensure accuracy and compliance with laws and regulations. This can be an internal audit (conducted by company employees) or an external audit (conducted by an outside public accounting firm).

- Financial Analysis: This is where accountants transition from historians to strategists. They analyze financial data to identify trends, evaluate performance, calculate key financial ratios, and provide insights that guide business strategy, such as identifying areas for cost reduction or opportunities for investment.

### A Day in the Life: "Maria," a Senior Accountant in Orlando

To make this more concrete, let's imagine a day for Maria, a Senior Accountant at a mid-sized technology firm in Orlando.

- 8:30 AM: Maria arrives, grabs a coffee, and reviews her emails. She sees a query from the marketing director about a budget variance on a recent campaign. She flags it for follow-up. Her primary focus today is the "month-end close."

- 9:00 AM - 12:00 PM: She dives into reconciling several key balance sheet accounts. This involves exporting data from their ERP system into Excel, running pivot tables to summarize transactions, and investigating any discrepancies. She identifies a miscoded invoice and works with the accounts payable clerk to get it corrected.

- 12:00 PM: Maria joins a video call with the marketing director. She pulls up the financial report and walks him through the campaign expenses, explaining that some software subscription costs hit the books earlier than anticipated. They discuss reallocating funds to cover the difference. This is a perfect example of an accountant acting as a business partner.

- 1:00 PM: Lunch break.

- 1:30 PM - 4:00 PM: Her focus shifts to preparing a draft of the monthly financial statement package for her manager, the Controller. This requires deep concentration as she consolidates data and ensures everything ties out. She uses a data visualization tool, Tableau, to create a few charts that highlight key performance indicators (KPIs) for the executive summary.

- 4:00 PM - 5:00 PM: Maria spends the last hour of her day mentoring a junior accountant, showing him a more efficient way to perform a bank reconciliation using advanced Excel functions. She then plans her tasks for the next day, which will involve starting the cash flow statement analysis.

This example illustrates that an accountant's day is a blend of focused, analytical work, problem-solving, and collaboration with colleagues across the business.

Average Accountant Salary in Florida: A Deep Dive

This is the central question, and we'll approach it with authoritative data to provide the clearest possible picture. The salary of an accountant in Florida is competitive and reflects the state's robust and growing economy.

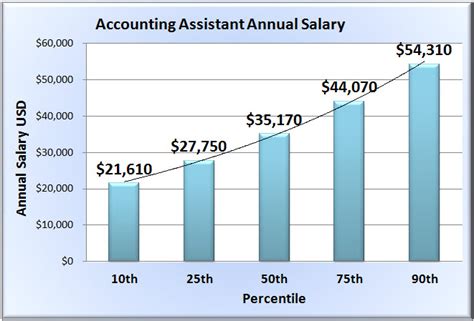

First, let's establish a national baseline. According to the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics (OEWS) data from May 2023, the most recent comprehensive data available, the median annual wage for Accountants and Auditors in the United States was $79,880. This means that half of all accountants in the country earned more than this amount, and half earned less. The national salary range is wide, with the lowest 10 percent earning less than $51,630 and the top 10 percent earning more than $139,360.

### Accountant Salaries in Florida: The State-Level View

Now, let's zoom in on Florida. The state's financial landscape is very strong for accounting professionals. The BLS data for Florida shows:

- Mean (Average) Annual Wage: $85,020

- Median (50th Percentile) Annual Wage: $79,060

It's noteworthy that Florida's *mean* salary is significantly higher than the national median, suggesting a strong presence of high-earning roles within the state. To get a more granular understanding, let's break down the salary distribution across different percentiles in Florida, according to the BLS:

- 10th Percentile: $51,190 (Typical for entry-level roles or bookkeepers)

- 25th Percentile: $62,180 (Early-career accountants)

- 50th Percentile (Median): $79,060 (Mid-career, experienced professionals)

- 75th Percentile: $99,750 (Senior accountants, managers, CPAs)

- 90th Percentile: $131,340 (Controllers, directors, specialized roles)

This data paints a clear picture: while a starting accountant might begin in the $50k-$60k range, there is a clear and well-trodden path to earning close to or over six figures with experience and specialization.

### Salary by Experience Level in Florida

Experience is arguably the single most significant driver of salary growth. Reputable salary aggregators like Salary.com provide excellent data that models this progression. The following table provides a typical salary trajectory for an accountant in Florida, based on an aggregation of data from sources like Salary.com, Glassdoor, and Payscale for 2024.

| Experience Level | Typical Title(s) | Typical Salary Range in Florida | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Staff Accountant, Junior Accountant, Audit Associate | $55,000 - $70,000 | Data entry, bank reconciliations, assisting with month-end close, preparing journal entries, supporting senior staff. |

| Mid-Career (2-5 Years) | Accountant, Senior Accountant, Financial Analyst | $70,000 - $90,000 | Managing the full accounting cycle, preparing financial statements, complex reconciliations, light variance analysis, mentoring junior staff. |

| Experienced (5-10 Years) | Senior Accountant, Accounting Manager, Controller | $85,000 - $120,000+ | Supervising accounting staff, overseeing the entire close process, budgeting and forecasting, financial analysis and reporting to management. |

| Senior/Executive (10+ Years) | Controller, Director of Finance, Vice President of Finance, CFO | $120,000 - $250,000+ | Strategic financial planning, managing the entire finance and accounting department, risk management, investor relations, executive decision support. |

*Source: Analysis of data from BLS (May 2023), Salary.com (2024), and Glassdoor (2024).*

### Beyond the Base Salary: Understanding Total Compensation

A savvy professional knows that base salary is only one piece of the puzzle. Total compensation is a more holistic measure of your earnings and can significantly increase your overall income. The components vary by company size and type (public vs. private).

- Bonuses: Annual performance-based bonuses are very common, particularly in corporate and public accounting. These can range from 5% of base salary for a staff accountant to over 30% for managers and directors. Bonuses are often tied to individual performance, department goals, and overall company profitability.

- Profit Sharing: Some companies, especially private ones, offer profit-sharing plans where a portion of the company's profits is distributed among employees. This directly aligns the employee's financial success with the company's.

- Stock Options/Equity: This is more common in publicly traded companies or high-growth startups. Employees are granted the option to buy company stock at a predetermined price, which can be highly lucrative if the company performs well.

- Retirement Benefits: A 401(k) or 403(b) plan with a company match is a standard and valuable benefit. A typical match might be 50% of your contribution up to 6% of your salary, which is essentially free money for your retirement.

- Health and Wellness: Comprehensive health, dental, and vision insurance are critical components of a benefits package. Many larger Florida firms also offer wellness stipends, gym memberships, and robust mental health support.

- Paid Time Off (PTO): Florida has a competitive job market, so companies often offer generous PTO policies, including vacation days, sick leave, and paid holidays.

When evaluating a job offer in Florida, it's essential to look beyond the salary number and calculate the value of the entire compensation package. A role with a slightly lower base salary but a substantial bonus potential and excellent benefits could be more financially advantageous in the long run.

Key Factors That Influence an Accountant's Salary

Why does one senior accountant in Florida make $85,000 while another with the same title makes $115,000? The answer lies in a combination of factors that create a unique market value for every professional. Understanding and strategically navigating these factors is the key to maximizing your earning potential.

### 1. Level of Education and Professional Certifications

Your academic and professional credentials are the foundation of your career and a primary determinant of your starting salary and long-term growth.

- Bachelor's Degree: A bachelor's degree in accounting is the standard, non-negotiable entry point into the profession. It provides the fundamental knowledge of accounting principles, taxation, auditing, and business law.

- Master's Degree (M.Acc. or M.S.A.): A Master of Accountancy or a Master of Science in Accounting can provide a significant advantage. It not only offers specialized knowledge but is also the most common pathway to meeting the 150-hour credit requirement needed to sit for the CPA exam in Florida and most other states. Graduates with a master's degree often command a starting salary that is 5% to 15% higher than those with only a bachelor's.

- The CPA (Certified Public Accountant) License: This is the undisputed gold standard in the accounting world. Earning a CPA license is a rigorous process that requires passing a difficult four-part exam, meeting educational requirements (the 150-hour rule), and accumulating relevant work experience. The payoff is immense.

- Salary Premium: According to the AICPA (American Institute of Certified Public Accountants), CPAs can earn 10% to 15% more than their non-certified peers in similar roles. This premium can widen significantly in senior and specialized positions.

- Career Advancement: Many high-level positions, such as Controller, Director of Finance, and certainly any partner role in a public accounting firm, are exclusively available to CPAs. It signals a level of expertise, ethics, and commitment that employers are willing to pay a premium for.

- Other Certifications: While the CPA is king, other certifications can boost your salary in specific niches:

- CMA (Certified Management Accountant): Ideal for corporate accountants focusing on internal financial management, budgeting, and strategic decision-making.

- CIA (Certified Internal Auditor): The premier certification for professionals in internal audit.

- CISA (Certified Information Systems Auditor): Highly valuable for accountants who specialize in auditing IT systems and controls.

### 2. Years of Experience

As shown in the salary table above, experience is a powerful lever. The profession has a well-defined career ladder, and compensation increases predictably with each step.

- 0-2 Years (Associate/Staff): You are learning the ropes, mastering fundamental tasks, and proving your reliability. Your value is in your potential and ability to execute assigned tasks accurately.

- 2-5 Years (Senior): You have moved beyond basic tasks. You can manage processes, handle complex issues independently, and begin to mentor junior staff. Your salary increases reflect this added responsibility and autonomy. This is often when accountants make their first major salary jump, either through promotion or by changing jobs.

- 5-10 Years (Manager/Controller): You are now a leader. You manage people, oversee entire financial functions (like the month-end close or the annual audit), and contribute to strategy. Your compensation shifts to reflect your impact on the department and the business as a whole.

- 10+ Years (Director/VP/CFO): At this level, you are a strategic leader for the entire organization. Your decisions have a direct and significant impact on the company's profitability and long-term health. Compensation is high and heavily weighted towards performance incentives, bonuses, and equity.

### 3. Geographic Location Within Florida

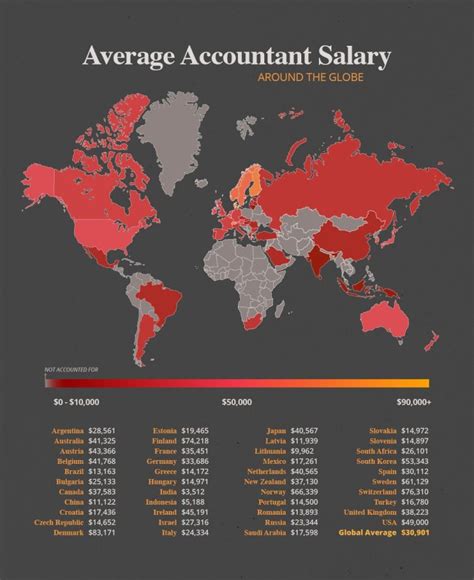

"Location, location, location" doesn't just apply to real estate. While Florida as a whole is a strong market, salaries can vary significantly between its major metropolitan areas due to differences in cost of living, industry concentration, and demand for talent.

Here’s a comparative look at median accountant salaries in Florida's major metro areas, based on BLS May 2023 data:

| Metropolitan Statistical Area | Median Annual Salary | Mean Annual Salary | Notes on Local Economy |

| :--- | :--- | :--- | :--- |

| Miami-Fort Lauderdale-West Palm Beach | $81,300 | $89,320 | Highest salaries. Hub for international trade, finance, real estate, and tourism. High cost of living drives wages up. |

| Tampa-St. Petersburg-Clearwater | $79,530 | $85,820 | Booming market. Strong in financial services, healthcare, technology, and professional services. A major hub for "Big Four" back-office operations. |

| Orlando-Kissimmee-Sanford | $77,210 | $82,460 | Known for tourism and hospitality, but has a rapidly growing tech, defense, and simulation industry. |

| Jacksonville | $75,990 | $80,480 | Strong in logistics, banking, and insurance (often called the "Hartford of the South"). Offers a lower cost of living, which slightly moderates salaries. |

| Tallahassee | $68,310 | $71,460 | As the state capital, this market is dominated by government accounting jobs, which typically offer excellent benefits and stability but lower base salaries than the private sector. |

*Source: U.S. Bureau of Labor Statistics, OEWS, May 2023.*

Key Takeaway: An accountant working for a large bank in Miami or a financial services firm in Tampa will likely earn more than an accountant in a similar role in Jacksonville or Tallahassee. However, this is often balanced by a higher cost of living in the major South Florida and Tampa Bay metro areas.

### 4. Company Type and Size

The environment where you work has a profound impact on your salary and career path.

- Public Accounting (especially the "Big Four"): Firms like Deloitte, PwC, EY, and KPMG are known for offering the highest starting salaries to attract top university graduates. The work is demanding, with long hours, especially during "busy season." However, the training is world-class, and the experience is a powerful resume-builder that often leads to high-paying jobs in the private sector after a few years.

- Large Corporations (Industry/Private Accounting): Companies in the Fortune 500 or other large enterprises offer competitive salaries, excellent benefits, and better work-life balance than public accounting. They have large, structured finance departments with clear career paths from staff accountant up to CFO.

- Startups and Small/Medium-Sized Businesses (SMBs): Salaries here can be more variable. Early-stage startups may offer lower base salaries but compensate with potentially lucrative stock options. SMBs may not match corporate salaries but can offer a broader range of responsibilities and a more direct impact on the business.

- Government (Federal, State, Local): Government accounting jobs (e.g., for the IRS, a state agency in Tallahassee, or a city like Orlando) offer the greatest job security and the best benefits, particularly pensions. However, their salary scales are often more rigid and top out lower than in the private sector.

- Non-Profit Organizations: Driven by mission rather than profit, non-profits typically offer lower salaries than for-profit entities. Professionals choose these roles for the personal fulfillment and positive community impact of their work.

### 5. Area of Specialization

General accounting is a solid career, but specialization is where you can truly accelerate your earnings. Certain niches are in high demand and command a significant salary premium.

- Forensic Accounting: These financial detectives investigate fraud, embezzlement, and other financial crimes. Their work is often tied to litigation, making their skills highly valuable. Forensic accountants can earn 15-25% more than general accountants.

- International Tax: For companies operating in Florida's massive international trade sector, accountants who understand the complexities of international tax treaties and transfer pricing are indispensable.

- IT Audit / Information Systems Accounting: As business becomes more digitized, professionals who can bridge the gap between accounting and technology are in high demand. CISAs and accountants with expertise in cybersecurity and data integrity command top dollar.

- Financial Planning & Analysis (FP&A): These are the forward-looking accountants who focus on budgeting, forecasting, and modeling to support strategic business decisions. This is often seen as a direct path to a CFO role.

- Mergers & Acquisitions (M&A): Accountants who specialize in the due diligence and financial integration required during mergers and acquisitions play a critical, high-stakes role and are compensated accordingly.

### 6. In-Demand Skills

Beyond your formal title, the specific tools and skills you master can make you a more valuable—and higher-paid—asset.

- Technical Skills:

- Advanced Excel: This is table stakes. Mastery of PivotTables, VLOOKUP/XLOOKUP, Power Query, and macros is expected.

- ERP Systems Proficiency: Deep experience with major Enterprise Resource Planning systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is a huge plus.

- Data Analytics and Visualization: Skills in tools like Tableau, Power BI, or Alteryx are increasingly required. The ability to not just report numbers but to visualize them and tell a story with data is a major salary-booster.

- SQL (Structured Query Language): The ability to pull and manipulate data directly from databases is a powerful skill that sets an accountant apart.

- Soft Skills:

- Communication and Presentation: You must be able to clearly explain complex financial concepts to non-financial stakeholders (like the marketing director in our example).

- Strategic Thinking: The most valuable accountants think like business owners. They use financial data to ask "why" and provide proactive advice.

- Leadership and Management: The ability to lead a team, mentor junior staff, and manage projects is essential for advancing to higher-paid roles.

By strategically developing these skills, you can actively increase your market value throughout your career in Florida's dynamic economy.

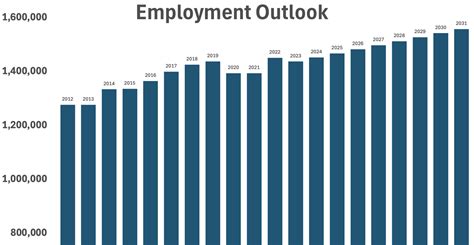

Job Outlook and Career Growth for Accountants in Florida

A healthy salary is attractive, but long-term career stability and growth potential are just as important. For accountants and auditors, both the national and Florida-specific outlooks are very positive.

### The National Picture: Steady and Essential Growth

The U.S. Bureau of Labor Statistics projects that employment for accountants and auditors will grow by 4 percent from 2022 to 2032. While this is about as fast as the average for all occupations, it translates to a significant number of job openings—approximately 126,500 openings each year, on average, over the decade.

This steady demand is driven by several enduring factors:

1. Economic Growth: As the economy grows, new businesses are created and existing ones expand, all of whom require accountants to manage their finances.

2. Regulatory Complexity: An ever-changing landscape of financial regulations and tax laws (like the Sarbanes-Oxley Act) necessitates the expertise of accountants to ensure compliance and avoid costly penalties.

3. Globalization: As businesses operate across borders, they need accountants skilled in international finance, trade, and tax laws.

4. Retirement: A