How Much Do Relationship Bankers Make? A Comprehensive Salary Guide for 2024

A career as a relationship banker offers a compelling blend of financial expertise and interpersonal skill, placing you at the center of a client's financial life. But beyond the satisfaction of helping people achieve their goals, what is the earning potential? This role provides a stable career path with a competitive salary that can grow substantially with experience and performance.

On average, a relationship banker in the United States can expect to earn a total compensation package ranging from $50,000 to $75,000 annually, with top performers in high-demand markets earning well over this figure. This guide will break down what a relationship banker does, the salary you can expect, and the key factors that will influence your paycheck.

What Does a Relationship Banker Do?

A relationship banker is far more than a traditional bank teller. They are the primary point of contact for a portfolio of bank clients, tasked with building and nurturing long-term relationships. Their goal is to understand a client's complete financial picture and proactively offer solutions to meet their needs.

Key responsibilities include:

- Client Relationship Management: Engaging with new and existing clients to understand their financial objectives.

- Needs-Based Selling: Identifying opportunities and cross-selling bank products and services, such as checking and savings accounts, credit cards, mortgages, auto loans, and personal loans.

- Financial Guidance: Providing advice on basic banking services and referring clients to specialists for more complex needs like investments or retirement planning.

- Problem Resolution: Assisting clients with account issues, disputes, or complex transactions.

- Onboarding and Account Maintenance: Opening new accounts and ensuring all client information is up-to-date and compliant with regulations.

Essentially, a relationship banker acts as a financial concierge, driving bank profitability by deepening client loyalty and engagement.

Average Relationship Banker Salary

The compensation for a relationship banker is typically composed of a base salary plus variable pay, which can include commissions, bonuses, or both, based on performance metrics.

According to data from several authoritative sources, the national average base salary for a relationship banker falls in the following range:

- Typical Base Salary Range: $45,000 to $60,000 per year.

- Average Base Salary: Approximately $52,500, according to a blended analysis of top salary aggregators.

However, the base salary is only part of the story. Because this is a sales-oriented role, total compensation is a more accurate measure of earning potential.

- Total Compensation (Base + Additional Pay): Data from Glassdoor indicates that the average total pay for a relationship banker is around $63,000 per year, with a likely range between $51,000 and $81,000. This additional pay can come from quarterly bonuses for meeting sales goals, commissions on loan products, and other performance incentives.

Salary.com reports a similar range for a "Relationship Banker I," with the median salary sitting at $49,853 as of late 2023, but notes that the range typically falls between $43,799 and $56,769 before bonuses are considered.

Key Factors That Influence Salary

Your specific salary as a relationship banker will depend on several critical factors. Understanding these variables can help you negotiate a better offer and plan your career trajectory.

### Level of Education

While a bachelor's degree is not always a strict requirement, it is highly preferred by most major banks and can directly impact your starting salary and advancement opportunities.

- High School Diploma or Associate's Degree: This is often the minimum educational requirement for entry-level positions, placing you at the lower end of the salary range.

- Bachelor's Degree: Candidates with a four-year degree in Finance, Business, Economics, or a related field are more competitive. They often command a higher starting salary and are seen as having a clearer path toward more senior roles, such as private banking or branch management.

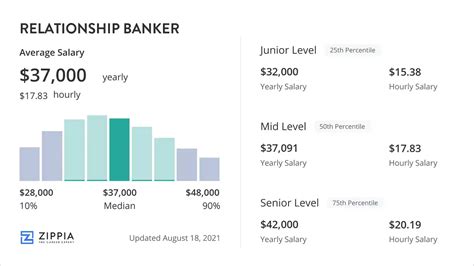

### Years of Experience

Experience is one of the most significant drivers of salary growth in this profession. As you build your skills and a track record of success, your value to the institution increases dramatically.

- Entry-Level (0-2 years): Relationship bankers at the start of their careers can expect a base salary in the $43,000 to $50,000 range. The focus is on learning products and building foundational sales skills.

- Mid-Career (3-9 years): With several years of experience, a proven ability to meet sales targets, and a strong client portfolio, bankers can see their base salary climb to the $55,000 to $65,000 range, with total compensation often exceeding $75,000.

- Senior/Experienced (10+ years): Senior relationship bankers, especially those who take on mentorship or leadership responsibilities, can earn base salaries of $65,000+. At this level, many transition into more specialized, higher-paying roles like Small Business Banker, Private Client Banker, or Branch Manager.

### Geographic Location

Where you work matters. Salaries are adjusted based on the cost of living and the demand for financial professionals in a specific metropolitan area.

- High-Cost, Major Financial Hubs: Cities like New York, San Francisco, Boston, and Chicago offer the highest salaries to compensate for a higher cost of living and a competitive market. In these areas, average salaries can be 15-30% higher than the national average.

- Mid-Sized and Smaller Cities: Salaries will be closer to the national average.

- Rural Areas: Compensation will typically be below the national average, reflecting a lower cost of living.

### Company Type

The type and size of the financial institution you work for play a crucial role in your compensation structure.

- Large National Banks (e.g., JPMorgan Chase, Bank of America): These institutions typically offer highly structured compensation plans with competitive base salaries and well-defined bonus programs. They also provide extensive benefits and clear career progression paths.

- Regional Banks and Credit Unions: While their base salaries may sometimes be slightly lower than those at the largest national banks, they can offer excellent benefits, a strong community focus, and potentially a better work-life balance. Their bonus structures may be more directly tied to branch or individual performance.

### Area of Specialization

As you advance in your career, specialization can lead to significant jumps in income.

- Consumer Banking: This is the standard track, focusing on individual clients and their day-to-day banking needs.

- Small Business Banking: Relationship bankers who specialize in serving small- to medium-sized businesses manage more complex needs (e.g., business loans, lines of credit, payroll services). This specialization requires deeper expertise and is compensated accordingly.

- Private Banking / Wealth Management: This is the most lucrative path. These bankers serve high-net-worth (HNW) and ultra-high-net-worth (UHNW) clients. The role requires advanced certifications (like Series 7 and Series 66 licenses) and involves managing complex investment, trust, and credit portfolios. Six-figure salaries are standard in this specialization.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not have a specific category for "Relationship Banker." However, the role is a hybrid of sales and client service, closely related to positions like Loan Officers and Financial Services Sales Agents.

For Loan Officers, the BLS projects a growth of 1% from 2022 to 2032, which is slower than the average for all occupations. However, this statistic doesn't tell the whole story. While technology and online banking may automate simple transactions, the need for skilled professionals to build relationships, provide personalized advice, and sell complex financial products remains strong. Banks will continue to rely on talented relationship bankers to drive growth and retain valuable clients.

Furthermore, the BLS reports the median annual wage for Loan Officers was $65,740 in May 2022, demonstrating the solid earning potential for experienced professionals in this career path.

Conclusion

A career as a relationship banker is a financially sound choice for individuals who are driven, personable, and have a strong interest in finance. While an entry-level position offers a solid starting salary, the real earning potential is unlocked through performance and specialization.

Key takeaways for prospective relationship bankers include:

- Expect a combination of base salary and performance pay. Your ability to meet sales goals will directly impact your total income.

- Experience and location are major salary drivers. Plan your career with these factors in mind.

- A bachelor's degree will open more doors and likely lead to a higher starting salary.

- Pursue specialization in areas like business banking or wealth management to significantly increase your long-term earning potential.

For those who thrive on building connections and delivering tangible results, the role of a relationship banker is not just a job—it's a rewarding career with a clear and promising financial future.