So, you’re thinking about a career in accounting in New York City. You’re drawn to the electric ambition of the five boroughs, the skyline that scrapes the heavens, and the relentless hum of the global economy’s engine. You envision a career that’s not just a job, but a cornerstone of this financial ecosystem—a role that provides stability, commands respect, and offers significant financial rewards. You’re in the right place. An accounting career in NYC is more than just balancing books; it's about being the financial bedrock upon which the city's titans of industry, disruptive startups, and cultural institutions are built. The potential is immense, with a typical accounting salary in NYC ranging from $80,000 for entry-level positions to well over $200,000 for experienced, specialized professionals.

I still remember my first time walking through the Financial District as a young professional. The sheer scale of the buildings was dwarfed only by the palpable energy of the commerce happening within them. It struck me then that for every deal, every IPO, every transaction flashing across a screen, there was an army of meticulous, sharp-minded accountants ensuring accuracy, compliance, and strategic financial health. This guide is your map to joining their ranks and building a prosperous career in the world's financial capital.

---

### Table of Contents

- [What Does an Accountant in NYC Do?](#what-does-an-accountant-in-nyc-do)

- [Average Accounting Salary in NYC: A Deep Dive](#average-accounting-salary-nyc-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth in NYC](#job-outlook-and-career-growth-in-nyc)

- [How to Get Started in Your NYC Accounting Career](#how-to-get-started-in-your-nyc-accounting-career)

- [Is an Accounting Career in NYC Right for You?](#is-an-accounting-career-in-nyc-right-for-you)

---

What Does an Accountant in NYC Do?

Forget the outdated stereotype of a green-visored bookkeeper hunched over a dusty ledger. Today's accountant, especially in a dynamic market like New York City, is a strategic partner, a data interpreter, and a crucial advisor to business leaders. While the core of the job remains rooted in the principles of financial integrity and accuracy, the application of these principles is far-reaching and diverse.

At its heart, the role of an accountant is to prepare, analyze, and maintain financial records. This ensures that a company's financial operations are run efficiently, its records are accurate (in accordance with Generally Accepted Accounting Principles or GAAP), and that taxes are paid properly and on time. However, in NYC's hyper-competitive environment, the "why" behind the numbers is just as important as the "what."

Core Responsibilities and Daily Tasks Often Include:

- Financial Reporting: Preparing key financial statements, including the income statement, balance sheet, and statement of cash flows. This is the foundation of all financial analysis.

- Reconciliation: Meticulously reconciling bank statements, accounts payable, and accounts receivable to ensure every dollar is accounted for and that financial records are free of errors.

- Budgeting and Forecasting: Working with department heads to create annual budgets and developing financial forecasts to help leadership make informed strategic decisions about growth, hiring, and investment.

- Tax Compliance: Preparing and filing federal, state, and local tax returns. In a complex jurisdiction like New York City and State, this is a critical and highly valued skill.

- Auditing: This can be internal (reviewing a company's own processes for efficiency and compliance) or external (verifying a company's financial statements for accuracy, often as part of a public accounting firm).

- Data Analysis: Using advanced Excel, specialized accounting software (like Oracle NetSuite, SAP, or QuickBooks), and even data visualization tools (like Tableau) to identify trends, pinpoint inefficiencies, and provide actionable insights.

- Compliance and Risk Management: Ensuring the company adheres to regulations like the Sarbanes-Oxley Act (SOX) and identifying financial risks before they become major problems.

### A Day in the Life: A Senior Accountant in Midtown

To make this tangible, let's imagine a day for "Alex," a Senior Accountant at a mid-sized advertising agency in Midtown Manhattan.

- 8:45 AM: Alex arrives at the office, grabs a coffee, and scans emails. There’s an urgent query from the CFO about last month's client profitability report and a reminder about the Q3 budget meeting.

- 9:15 AM: Alex dives into the month-end close process, focusing on reconciling complex revenue streams from various client campaigns. This requires a deep understanding of revenue recognition standards (ASC 606).

- 11:00 AM: Alex joins the Q3 budget meeting with the heads of the Creative and Media Buying departments. Here, Alex is not just a number-cruncher but a strategic advisor, asking pointed questions about the ROI on a proposed software investment and modeling its impact on the department's profitability.

- 12:30 PM: Lunch with a mentor from the finance team at a nearby cafe to discuss career progression and pathways to an Accounting Manager role.

- 1:30 PM: Alex dedicates a block of "deep work" time to preparing schedules for the external auditors who are coming in next month. This involves compiling detailed support for key balance sheet accounts, a process that requires extreme attention to detail.

- 3:30 PM: Alex hops on a call with a junior accountant to review their work on bank reconciliations, providing guidance and coaching on how to investigate a tricky discrepancy.

- 4:45 PM: Before logging off, Alex circles back to the CFO's morning email, pulling the necessary data from their ERP system, creating a clear and concise summary in Excel, and sending off a well-articulated explanation.

- 5:30 PM: Alex packs up, having navigated a day that blended technical accounting, strategic analysis, mentorship, and communication—a perfect snapshot of the modern accountant's role in NYC.

Average Accounting Salary in NYC: A Deep Dive

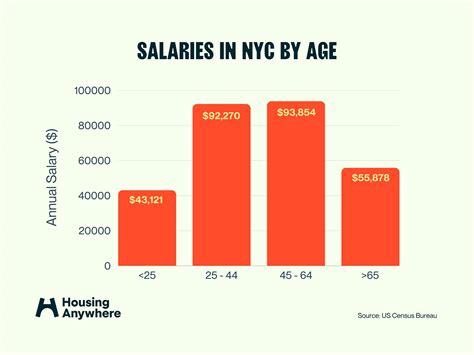

New York City is one of the highest-paying metropolitan areas for accountants in the United States, a premium that reflects both the high cost of living and the immense value placed on financial expertise in the city's economy. While salaries can vary dramatically based on the factors we'll explore in the next section, we can establish a strong baseline using data from authoritative sources.

First, let's set a national benchmark. According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for accountants and auditors was $78,000 in May 2022. The lowest 10 percent earned less than $48,560, and the highest 10 percent earned more than $138,570.

Now, let's zoom in on New York City, where these numbers see a significant increase. The New York-Newark-Jersey City, NY-NJ-PA metropolitan area is consistently ranked by the BLS as one of the top-paying metro areas for this occupation. The annual mean wage for accountants and auditors in this specific metro area was $107,330 as of May 2022, a nearly $30,000 premium over the national median.

However, data aggregators that update more frequently and can filter by a variety of factors provide an even more granular and current picture.

- Salary.com, as of late 2023, reports the average Staff Accountant I salary in New York, NY is $73,901, but the range typically falls between $67,294 and $81,304. For a more experienced Senior Accountant, the average jumps to $100,501, with a typical range of $91,014 to $110,950.

- Glassdoor, which incorporates user-submitted data, estimates the average base pay for an Accountant in New York, NY to be around $89,000 per year as of early 2024, with total pay (including bonuses and other compensation) reaching an average of $98,000.

- Payscale.com suggests a slightly lower average base salary of around $80,000, but this highlights the importance of considering the full compensation package and the specific factors influencing your individual offer.

### NYC Accounting Salary by Experience Level

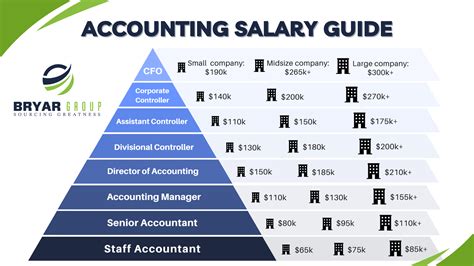

Salary progression is steep and rewarding in the NYC accounting field. Here is a table outlining what you can generally expect at different stages of your career. These figures represent a synthesis of data from BLS, Salary.com, and Glassdoor for the NYC market, focusing on corporate accounting roles. Salaries in public accounting (especially the Big Four) and high-finance may follow a more aggressive trajectory.

| Experience Level | Typical Title(s) | Typical Base Salary Range (NYC) | Estimated Total Compensation Range (NYC) |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Staff Accountant, Junior Accountant, Audit Associate | $70,000 - $90,000 | $75,000 - $95,000 |

| Mid-Career (3-5 years) | Accountant, Senior Accountant | $90,000 - $125,000 | $100,000 - $140,000 |

| Experienced (6-10 years) | Senior Accountant, Lead Accountant, Accounting Manager | $120,000 - $160,000 | $135,000 - $185,000 |

| Managerial / Director (10+ years) | Accounting Manager, Controller, Director of Finance | $150,000 - $220,000+ | $175,000 - $275,000+ |

*Note: These are estimates as of early 2024. Total compensation includes potential bonuses, profit sharing, and other cash incentives, which can vary widely.*

### Beyond the Base: Deconstructing Your Compensation Package

Your base salary is only one part of the equation. A comprehensive compensation package for an NYC accountant often includes several other valuable components:

- Annual Performance Bonus: This is extremely common in both public and private accounting. It's typically paid out once a year and can range from 5% to 20% (or more for senior and managerial roles) of your base salary, tied to both individual and company performance.

- Signing Bonus: For in-demand candidates, especially those with CPA licenses or experience in a hot niche, a signing bonus of $5,000 to $15,000 is often used to sweeten an offer.

- Stock Options/Equity: This is most prevalent in the tech startup scene (often referred to as "Silicon Alley" in NYC). While carrying more risk, equity can offer a significant financial windfall if the company is successful. It's less common in traditional corporate or public accounting roles.

- Retirement Savings (401k): Look for a strong company match. A typical match might be 50% of your contributions up to 6% of your salary, which is essentially free money and a critical component of long-term wealth building.

- Health and Wellness Benefits: Premium health, dental, and vision insurance are standard. Many NYC firms also offer wellness stipends (for gym memberships), mental health support, and generous paid time off (PTO).

- Professional Development: This is a key, high-value benefit. Companies often pay for CPA exam fees, review courses (like Becker or Wiley), annual CPE (Continuing Professional Education) credits, and other professional certifications. This is a direct investment in your future earning power.

When evaluating a job offer, it's crucial to look at the total value proposition, not just the base salary number. A role with a slightly lower base but an excellent bonus structure, strong 401(k) match, and full funding for your CPA could be far more lucrative in the long run.

Key Factors That Influence Your Salary

An "average" salary is a useful benchmark, but your personal earning potential is determined by a unique combination of factors. In a market as large and varied as New York City, understanding these levers is the key to maximizing your income. This is the most critical section for anyone looking to not just get a job, but build a high-earning career.

### ### Level of Education & Professional Certifications

Your academic and professional credentials are the price of entry and the foundation of your earning power.

- Bachelor's Degree: A Bachelor's degree in Accounting is the standard, non-negotiable requirement for nearly all professional accounting roles. A degree in Finance, Business Administration with an accounting concentration, or Economics can also be a viable entry point, provided you have completed the necessary accounting coursework.

- Master's Degree (M.Acc / MSA): A Master of Accountancy or a Master of Science in Accounting serves two primary purposes. First, it's the most common way to meet the 150-credit-hour requirement to sit for the CPA exam in New York and most other states. Second, it provides specialized knowledge in areas like taxation, auditing, or forensic accounting, making you a more attractive candidate and potentially boosting your starting salary by 5-10%.

- The CPA License (Certified Public Accountant): This is the single most impactful credential you can earn in the accounting profession. Becoming a CPA is the gold standard. It signifies a high level of competence, ethical grounding, and expertise.

- Salary Impact: Earning your CPA license can lead to an immediate salary increase of 10-15% over non-certified peers. According to the AICPA, CPAs consistently earn more throughout their careers, with a lifetime earnings premium that can exceed $1 million.

- Career Impact: The CPA is a legal requirement for certain roles, such as signing an audit report for a public company. It unlocks opportunities for advancement to senior management positions like Controller and Chief Financial Officer (CFO). In NYC's competitive market, many top-tier firms will not promote you to a manager-level position without it.

- Other Valued Certifications: While the CPA is king, other certifications can significantly enhance your salary in specialized roles:

- CMA (Certified Management Accountant): Ideal for those in corporate finance, financial planning, and analysis. It demonstrates expertise in strategic management and decision-making from a financial perspective.

- CIA (Certified Internal Auditor): The premier certification for internal audit professionals, focusing on governance, risk, and control.

- CFE (Certified Fraud Examiner): Highly sought after for forensic accounting roles, commanding a premium in this lucrative niche.

### ### Years and *Quality* of Experience

Experience is the most significant driver of salary growth over time. However, it's not just about the number of years on your resume; it's about the quality and progression of that experience.

- Entry-Level (0-2 Years): At this stage, you're learning the fundamentals: month-end close procedures, reconciliations, and supporting senior staff. Your primary goal is to absorb as much as possible and demonstrate reliability and a strong work ethic. Salaries typically range from $70,000 to $90,000.

- Mid-Career (3-5 Years): You've mastered the basics and are now taking ownership of more complex processes. You might be managing a key area of the close, training junior staff, or serving as the main point of contact for a specific business unit. This is often where specialization begins. A Senior Accountant in this bracket can expect to earn $90,000 to $125,000. Passing the CPA exam during this period provides a significant salary bump.

- Senior/Managerial (6-10+ Years): You are now a leader. As an Accounting Manager or Controller, you are not just executing tasks but managing teams, developing financial strategy, and presenting to senior leadership. Your experience is now a strategic asset to the company. Salaries at this level push into the $120,000 to $185,000+ range, with significant bonus potential. The quality of your experience—for example, managing an ERP system implementation or leading the accounting for an acquisition—becomes a major salary determinant.

### ### Geographic Location (Within the NYC Metro Area)

While we're focused on "NYC," where you work *within* the metropolitan area matters. The cost of living and the concentration of high-paying industries create salary micro-climates.

- Manhattan (Midtown & Financial District): This is the epicenter and commands the highest salaries. Proximity to Wall Street, major corporate headquarters, and the Big Four accounting firms creates intense competition for top talent. Expect salaries here to be at the absolute top end of any reported range.

- Brooklyn & Queens: As these boroughs have become major business hubs themselves, with burgeoning tech scenes and corporate offices, accounting salaries have risen significantly. They may be slightly (5-10%) lower than peak Manhattan salaries, but the difference is shrinking, especially for desirable roles in areas like DUMBO or Long Island City.

- The Bronx & Staten Island: Salaries in these boroughs may be slightly lower than in Manhattan, reflecting a different mix of industries and a lower cost of living.

- NYC Suburbs (Westchester, NY; Stamford/Greenwich, CT; Northern NJ): These areas are home to a massive number of Fortune 500 headquarters and financial services firms (especially hedge funds in Greenwich). Salaries here are highly competitive with Manhattan and can sometimes be even higher for senior roles, as companies compete for talent that may not want the daily commute into the city. A Controller at a corporation in White Plains or Stamford will command a salary on par with their Manhattan counterpart.

### ### Company Type, Size, and Industry

The context of where you work is a massive determinant of your compensation. An accountant's salary can double or even triple based solely on their employer's industry and size.

- Public Accounting (The Big Four vs. Mid-Tier):

- The Big Four (Deloitte, PwC, EY, KPMG): Working at a Big Four firm in NYC is a prestigious, demanding, and structured path. They are known for long hours, especially during busy season, but offer unparalleled training, blue-chip clients, and a clear, lockstep salary progression. An entry-level Audit or Tax Associate might start around $80,000 - $85,000, with promotions and raises happening annually. By the manager level (around 5-6 years in), salaries can easily be in the $150,000 - $175,000+ range. The "Big Four" name on a resume acts as a powerful signal to future employers.

- Mid-Tier & Regional Firms (e.g., Grant Thornton, BDO, RSM): These firms offer a similar experience to the Big Four but often with a better work-life balance. Salaries are very competitive, sometimes just a small step behind the Big Four, making them a very attractive option.

- Private/Industry Accounting: This is the broadest category, with immense salary variation.

- Financial Services (Investment Banks, Hedge Funds, Private Equity): This is the top of the pyramid for accounting salaries. A Fund Accountant, Product Controller, or Valuation Specialist at a major NYC bank or fund will earn significantly more than their peers in other industries. It's not uncommon for mid-career professionals in these roles to earn $150,000 - $250,000+ in total compensation, with bonuses making up a huge portion of that. The work is high-stakes and demanding.

- Large Corporations (Fortune 500): Companies in sectors like media, consumer goods, and pharmaceuticals with HQs in NYC offer high, stable salaries, excellent benefits, and clear career paths. Pay is strong and predictable, making this a sought-after route.

- Tech & Startups ("Silicon Alley"): The tech scene in NYC offers a different kind of compensation package. Base salaries might be slightly below a large corporation, but they are often supplemented with potentially lucrative stock options (equity). The roles are often more dynamic, requiring accountants to be jacks-of-all-trades.

- Non-Profit & Government: These roles offer the lowest base salaries. An accountant for a non-profit or a city agency might earn 20-30% less than in the private sector. However, the trade-off is superior work-life balance, excellent job security, generous pension plans, and the satisfaction of mission-driven work.

### ### Area of Specialization

General accountants are always needed, but specialized experts command a premium. Developing deep knowledge in a specific, in-demand area is one of the fastest ways to increase your salary.

- Audit & Assurance (External): The classic public accounting path. Strong, structured salaries.

- Tax (Corporate, International, M&A): Tax is a highly complex and ever-changing field. Specialists in areas like international tax law or tax implications of mergers and acquisitions are extremely valuable and well-compensated.

- Transaction Advisory Services (TAS) / M&A: These professionals work on the financial due diligence for mergers, acquisitions, and other deals. It's a high-pressure, project-based field that sits between accounting and finance and commands salaries that rival those in investment banking.

- Forensic Accounting: These financial detectives investigate fraud, litigation support, and financial disputes. It's a niche, highly skilled field with very high earning potential.

- IT Audit & Risk Assurance: As technology becomes more intertwined with finance, accountants who can audit IT systems, understand cybersecurity risks from a financial perspective, and work with complex ERP systems are in massive demand. This is a rapidly growing and lucrative field.

- Managerial/Corporate Accounting: This includes roles focused on internal budgeting, forecasting, and strategic planning (FP&A - Financial Planning & Analysis), which are often a direct path to a CFO role.

### ### In-Demand Skills

Beyond your formal credentials, specific skills can make your resume stand out and justify a higher salary offer.

- Technical Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a power user, comfortable with PivotTables, VLOOKUP/INDEX(MATCH), Power Query, and ideally, VBA macros.

- ERP System Proficiency: Experience with large-scale Enterprise Resource Planning systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is