An accounting career in New York City offers not just a stable and in-demand professional path but also significant earning potential in the world's financial capital. For those considering this field—whether you're a student mapping out your future or a professional considering a move—understanding the salary landscape is critical. The average salary for an accountant in NYC is highly competitive, generally ranging from $75,000 for entry-level positions to over $150,000 for experienced, senior roles.

This guide will break down what an accountant in NYC earns, the key factors that dictate your salary, and the promising outlook for the profession.

What Does an NYC Accountant Do?

At its core, an accountant is the financial backbone of a business. They are responsible for preparing, maintaining, and analyzing financial records to ensure accuracy and compliance with laws and regulations. However, the role extends far beyond simple bookkeeping. In a dynamic market like New York City, accountants are strategic advisors who help organizations make sound financial decisions.

Key responsibilities often include:

- Preparing financial statements, such as balance sheets and income statements.

- Managing tax compliance and filing returns.

- Conducting internal audits to identify and mitigate financial risk.

- Advising management on budgeting, financial strategy, and cost-saving measures.

- Ensuring compliance with regulations like the Sarbanes-Oxley Act (SOX).

- Utilizing accounting software and data analytics tools to interpret complex financial data.

Average NYC Accounting Salary

New York City is one of the highest-paying metropolitan areas for accountants in the United States, reflecting both the high cost of living and the concentration of high-value financial, corporate, and professional services firms.

According to data compiled from leading salary aggregators, the figures for early 2024 are as follows:

- Average Base Salary: The average salary for a staff accountant in New York, NY, falls between $88,000 and $105,000. Salary.com reports a median salary of approximately $92,500, while Glassdoor data, based on user-submitted reports, indicates an average of $96,000.

- Typical Salary Range: This average is a midpoint. Your actual salary will vary based on experience.

- Entry-Level Accountant (0-2 years): $70,000 - $85,000

- Mid-Level Accountant (3-5 years): $90,000 - $115,000

- Senior Accountant (5+ years): $115,000 - $150,000+

It's important to note that these figures represent base salary. Many positions, especially in public accounting and finance, include annual bonuses that can add another 5% to 20% (or more) to the total compensation package.

Key Factors That Influence Salary

Your salary isn't a single, fixed number. It's a dynamic figure influenced by a combination of your qualifications, choices, and career path. Here are the most significant factors.

### Level of Education

Your educational background forms the foundation of your earning potential. While a bachelor's degree in accounting is the standard requirement, advanced credentials can provide a significant salary boost.

- Bachelor's Degree: The prerequisite for entry-level accounting roles.

- Master's Degree: A Master of Accountancy (MAcc) or an MBA with a concentration in accounting can make you a more competitive candidate and often leads to a higher starting salary.

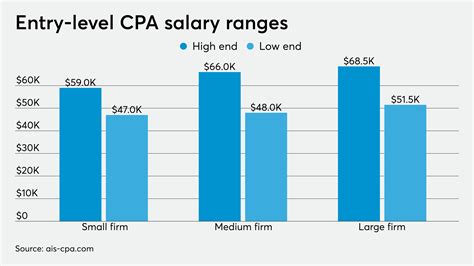

- CPA License: The Certified Public Accountant (CPA) license is the gold standard in the industry. Professionals who earn their CPA license often see a salary premium of 5% to 15%, according to the Association of International Certified Professional Accountants. In a competitive market like NYC, the CPA is essential for advancement to managerial and senior-level positions.

### Years of Experience

Experience is arguably the single most powerful driver of salary growth. As you accumulate years in the field, you develop specialized skills, take on more complex responsibilities, and demonstrate a track record of success.

- Entry-Level (0-2 Years): Focus on foundational tasks like journal entries, reconciliations, and assisting with financial statement preparation.

- Mid-Level (3-5 Years): You begin to manage entire accounting cycles, prepare complex reports, and may start supervising junior staff. This is often where salaries see a significant jump.

- Senior/Managerial (5+ Years): At this stage, you are overseeing teams, driving financial strategy, managing audits, and serving as a key advisor to leadership. Roles like Accounting Manager, Controller, or Director of Finance fall into this category and command the highest salaries.

### Geographic Location

While this article focuses on NYC, it's worth noting that "NYC" can mean different things. Salaries are typically highest in Manhattan, where the world's largest financial institutions and corporate headquarters are located. Salaries in the outer boroughs (Brooklyn, Queens, the Bronx, Staten Island) or adjacent areas in New Jersey and Long Island may be slightly lower, though still highly competitive by national standards. The U.S. Bureau of Labor Statistics (BLS) confirms that the New York-Newark-Jersey City metropolitan area is one of the top-paying regions for accountants in the nation.

### Company Type

The type of organization you work for has a massive impact on your compensation and work environment.

- Public Accounting (The "Big Four"): Deloitte, PwC, EY, and KPMG are known for offering some of the highest starting salaries to attract top talent. The work is demanding with long hours, but the training is world-class and provides unparalleled exit opportunities into high-paying corporate roles.

- Mid-Size and Regional Firms: These firms offer a competitive salary, often with a better work-life balance than the Big Four. They provide excellent experience across a diverse client base.

- Corporate (Industry) Accounting: Working "in-house" for a company can offer a wide salary range depending on the industry. An accountant at a major investment bank or a high-growth tech company in NYC will likely earn significantly more than one at a non-profit or smaller retail company.

- Government and Non-Profit: These roles typically offer lower base salaries but often compensate with excellent benefits, job security, and a strong sense of mission.

### Area of Specialization

As you advance in your career, specialization allows you to become an expert in a high-demand niche, leading to greater earning potential.

- Audit/Assurance: The traditional path, focused on verifying the accuracy of financial records. This is the bedrock of public accounting.

- Tax Accounting: Specializing in corporate, international, or individual tax can be very lucrative, especially with complex and ever-changing tax laws.

- Advisory/Consulting: This is often the highest-paying area. Specialists in fields like Mergers & Acquisitions (M&A), IT Risk, or Forensic Accounting are highly sought after and command premium salaries for their expert knowledge.

- Internal Audit: Working within a company to improve internal controls and processes is a stable and well-compensated corporate career path.

Job Outlook

The future for accountants is bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

The BLS projects about 126,500 openings for accountants and auditors each year, on average, over the decade. This steady demand is driven by economic growth, changing financial regulations, and the need for financial accountability in all sectors. In a global hub like NYC, this demand is even more concentrated, ensuring a robust job market for qualified professionals for years to come.

Conclusion

A career in accounting in New York City is a financially rewarding and professionally stimulating path. While the average salary provides a strong baseline, your ultimate earning potential is in your hands. It is not a fixed number but a reflection of the value you build through strategic decisions.

For anyone aspiring to succeed in this field, the key takeaways are clear:

- Invest in Education: Pursue a CPA license to maximize your earning potential and career opportunities.

- Gain Diverse Experience: Whether in public accounting or a dynamic industry, build a strong skill set in your early years.

- Find Your Niche: Specialize in a high-demand area like advisory, tax, or forensic accounting to become an indispensable expert.

By focusing on these factors, you can navigate the competitive NYC market and build a successful and lucrative accounting career.