---

Table of Contents

- [Introduction](#introduction)

- [What Does an Accounting Technician Do?](#what-does-an-accounting-technician-do)

- [Average Accounting Technician Salary: A Deep Dive](#average-accounting-technician-salary-a-deep-dive)

- [Key Factors That Influence an Accounting Technician's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Accounting Technicians](#job-outlook-and-career-growth)

- [How to Become an Accounting Technician: Your Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career as an Accounting Technician Right for You?](#conclusion)

---

Introduction

Have you ever wondered who keeps the financial heartbeat of a company steady, ensuring every transaction is recorded, every penny is accounted for, and every financial report is built on a foundation of accuracy? Long before the high-level strategies are set by a CFO, the meticulous, essential work is performed by a skilled professional: the Accounting Technician. This role is not merely about data entry; it's about maintaining the financial integrity of an organization, making it one of the most vital and accessible entry points into the world of finance and accounting. For those with a keen eye for detail, a love for order, and a desire for a stable, rewarding career, becoming an accounting technician is an exceptional path forward.

The financial rewards are equally compelling. While salaries can vary widely based on a multitude of factors, a skilled accounting technician can expect to earn a competitive wage. Nationally, the salary range for this role typically falls between $45,000 and $75,000 per year, with significant potential for growth as experience and specialized skills are acquired. I remember working on a complex project for a fast-growing tech startup where budgets were spiraling. It was our accounting technician, Maria, who, through her diligent reconciliation work, discovered a series of invoicing discrepancies that were costing the company thousands each month. Her work didn't just clean up the books; it directly impacted our profitability and taught me an invaluable lesson about the power of precision in the financial backbone of any enterprise.

This comprehensive guide is designed to be your definitive resource on the accounting technician salary, career path, and long-term potential. We will dissect every factor that influences your earning potential, from education and experience to the specific industry you choose. We will explore the job outlook in an age of automation, detail the exact steps you need to take to get started, and provide the data-backed insights you need to build a successful and lucrative career. Whether you are a recent graduate, a career changer, or simply exploring your options, this article will equip you with the knowledge to navigate your journey with confidence.

What Does an Accounting Technician Do?

An Accounting Technician is the operational cornerstone of any finance department. While a Certified Public Accountant (CPA) or a Controller might focus on high-level financial strategy, tax planning, and attestation, the accounting technician is on the front lines, managing the day-to-day financial transactions that form the lifeblood of the business. They are the meticulous record-keepers, the process-enforcers, and the primary guardians of the general ledger's accuracy.

Their work ensures that the financial data used for strategic decision-making is clean, reliable, and up-to-date. Think of them as the master organizers of a company's financial information, creating the orderly foundation upon which all other financial analysis and reporting are built.

Core Responsibilities and Daily Tasks:

The duties of an accounting technician are diverse and hands-on. While the specifics can vary depending on the size and type of the company, their responsibilities almost always include a combination of the following:

- Accounts Payable (AP): Processing, verifying, and reconciling vendor invoices. This involves ensuring that bills are accurate, properly approved, and paid on time to maintain good relationships with suppliers and avoid late fees.

- Accounts Receivable (AR): Creating and sending customer invoices, tracking payments, and following up on overdue accounts. Their efficiency in this area directly impacts the company's cash flow.

- Bank and Credit Card Reconciliations: Methodically comparing the company's internal financial records against bank statements to identify discrepancies, catch errors, and prevent fraud. This is a critical monthly or even weekly task.

- General Ledger Maintenance: Posting journal entries for everything from payroll to depreciation. They ensure that all transactions are coded to the correct accounts, maintaining the integrity of the chart of accounts.

- Payroll Processing: Assisting with the collection of timesheet data, calculating wages and deductions, and ensuring employees are paid accurately and on time. This requires a high degree of confidentiality and attention to detail.

- Financial Reporting Support: Assisting accountants in the preparation of key financial statements like the Income Statement, Balance Sheet, and Cash Flow Statement. This often involves pulling data, running preliminary reports, and preparing supporting schedules for the month-end close process.

- Expense Report Processing: Reviewing and processing employee expense reports, ensuring compliance with company policy and proper documentation before issuing reimbursements.

### A Day in the Life of an Accounting Technician

To make this role more tangible, let's walk through a typical day for "Alex," an Accounting Technician at a mid-sized manufacturing company.

- 9:00 AM - 10:30 AM (Reconciliation & Review): Alex starts the day by checking the company's bank accounts online. They download the previous day's transactions and begin the daily bank reconciliation in the accounting software (like NetSuite or QuickBooks). They match deposits to customer payments and identify any unfamiliar charges that need investigation.

- 10:30 AM - 12:00 PM (Accounts Payable): The morning's mail and email have brought in a stack of new vendor invoices. Alex reviews each one for accuracy, checks that the goods or services were received, and routes them electronically to the correct department manager for approval.

- 12:00 PM - 1:00 PM (Lunch)

- 1:00 PM - 2:30 PM (Accounts Receivable & Collections): Alex runs an aged receivables report to see which customer invoices are overdue. They send out polite reminder emails for invoices past 30 days and make a friendly phone call to a client whose invoice is now over 60 days past due. They also generate and send out new invoices for products shipped that morning.

- 2:30 PM - 4:00 PM (Month-End Close Prep): It's the third week of the month, so Alex's manager, the Controller, has asked for help preparing for the month-end close. Alex begins preparing the journal entry for the monthly depreciation of company assets and compiles a schedule of prepaid expenses, calculating how much to expense for the current month.

- 4:00 PM - 5:00 PM (Ad-Hoc Tasks & Wrap-Up): A project manager stops by with a question about the budget for their latest project. Alex pulls a quick report showing expenses-to-date versus the budget. Before logging off, Alex ensures all of the day's approved vendor bills are scheduled for payment in the upcoming weekly check run and files all relevant digital paperwork.

This example illustrates the blend of routine tasks (reconciliation, AP/AR) and more analytical, project-based work that defines the role. It is a position that demands both consistency and adaptability.

Average Accounting Technician Salary: A Deep Dive

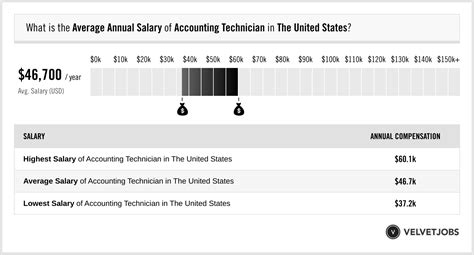

Understanding your potential earnings is a critical step in evaluating any career path. For accounting technicians, the salary landscape is promising, offering a stable income with clear avenues for growth. Compensation is influenced by a blend of experience, location, education, and specialized skills. Here, we'll break down the numbers using data from the most reliable sources available.

It's important to note that the U.S. Bureau of Labor Statistics (BLS), the gold standard for occupational data, groups Accounting Technicians under the broader category of "Bookkeeping, Accounting, and Auditing Clerks." This provides a foundational benchmark for the profession.

According to the most recent BLS data from May 2022, the salary distribution for this category is as follows:

- Median Annual Wage: $45,860 (or $22.05 per hour). This means half of all workers in the occupation earned more than this amount, and half earned less.

- Lowest 10% Earned: Less than $30,330. This typically represents true entry-level positions, part-time roles, or positions in very low-cost-of-living areas.

- Highest 10% Earned: More than $69,180. This figure points to the earning potential for senior-level technicians, those with specialized skills, or individuals working in high-cost-of-living metropolitan areas.

While the BLS provides a solid baseline, salary aggregator websites that collect real-time, user-reported data for the specific title "Accounting Technician" often report slightly different and often higher figures, reflecting a more modern and targeted data set.

As of late 2023, here’s a composite look at what these platforms report:

- Salary.com: Reports a median salary for an Accounting Technician I at $48,501, with a typical range falling between $43,763 and $54,167. For a more senior Accounting Technician III, the median jumps to $64,952, with a range of $58,367 to $72,551.

- Payscale.com: Shows an average base salary of approximately $49,150 per year. The full range spans from around $37,000 for entry-level roles to over $68,000 for highly experienced professionals.

- Glassdoor: Lists a total pay average (including base and additional pay like bonuses) of around $58,600 per year, with a likely range between $47,000 and $74,000.

Conclusion on National Averages: A realistic expectation for a qualified accounting technician in the United States is a starting salary in the low-to-mid $40,000s, progressing to a median salary in the $50,000 to $60,000 range with a few years of experience, and capping out in the $70,000s or even low $80,000s for senior, specialized roles in high-demand markets.

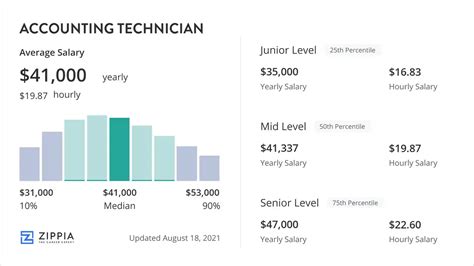

### Salary by Experience Level

Your value—and therefore your salary—grows significantly as you move from a novice to an experienced professional. Experience translates into greater efficiency, the ability to handle more complex tasks, and the capacity to work with less supervision.

Here is a typical salary progression you can expect throughout your career:

| Experience Level | Years of Experience | Typical Salary Range | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level Accounting Technician | 0-2 Years | $40,000 - $52,000 | Basic data entry, processing AP/AR, matching invoices to purchase orders, assisting with bank reconciliations, learning company-specific software. Heavy supervision. |

| Mid-Career Accounting Technician | 3-8 Years | $50,000 - $65,000 | Managing full-cycle AP/AR, performing complex bank and GL reconciliations independently, assisting with month-end closing procedures, generating standard financial reports, potentially training junior staff. |

| Senior Accounting Technician | 9+ Years | $62,000 - $75,000+ | Overseeing transactional accounting functions, preparing complex journal entries (accruals, prepaids), assisting with audit preparation, troubleshooting accounting software issues, performing variance analysis, may have supervisory duties. |

*Note: These ranges are national averages and will be heavily influenced by the factors discussed in the next section.*

### Beyond the Base Salary: Understanding Total Compensation

Your salary is just one piece of the puzzle. When evaluating a job offer, it's crucial to look at the entire compensation package. Many companies, especially larger ones, offer significant additional financial benefits.

- Bonuses: Annual or quarterly performance-based bonuses are common, especially in for-profit companies. These can range from a few hundred dollars to 5-10% of your base salary, rewarding individual contributions and company success.

- Profit Sharing: Some companies distribute a portion of their annual profits to employees. This is a powerful incentive that directly links your work to the company's bottom line.

- Overtime Pay: As an accounting technician, you are often classified as a non-exempt employee under the Fair Labor Standards Act (FLSA). This means you are legally entitled to overtime pay (typically 1.5 times your hourly rate) for any hours worked over 40 in a week. This can significantly boost your income during busy periods like month-end, quarter-end, or year-end closing.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a major component of compensation. A strong plan with low deductibles and premiums can be worth thousands of dollars a year.

- Retirement Plans: Access to a 401(k) or 403(b) plan is standard. The most valuable part of this benefit is the employer match. A company that matches your contributions up to, say, 5% of your salary is giving you an immediate, guaranteed return on your investment.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A generous PTO policy contributes to work-life balance and is a key part of your total compensation.

- Tuition Reimbursement & Professional Development: Many companies will invest in their employees by helping to pay for further education, certifications (like a QuickBooks ProAdvisor or Certified Bookkeeper credential), or relevant workshops. This is a benefit that pays you back for years to come.

When comparing offers, always calculate the value of these benefits to understand your "total compensation," which provides a much more accurate picture of what a job is truly worth.

Key Factors That Influence an Accounting Technician's Salary

While national averages provide a useful starting point, your actual salary will be determined by a specific set of factors. Understanding these variables is the key to maximizing your earning potential. By strategically focusing on these areas, you can actively steer your career towards higher compensation. This section provides an exhaustive breakdown of the levers you can pull to increase your value in the job market.

---

### 1. Level of Education and Certifications

Your educational background is the foundation upon which your career is built. While you can enter the field with a high school diploma and on-the-job training, formal education and professional certifications act as powerful salary accelerators.

- High School Diploma / GED: This is the minimum requirement for some entry-level data entry or clerical roles. However, earning potential and advancement opportunities will be severely limited.

- Certificate in Accounting or Bookkeeping: A 6-12 month certificate program from a community college or vocational school is a fast track into the profession. It provides foundational knowledge of accounting principles, debits and credits, and software basics. This can help you secure a better entry-level position than a high school diploma alone.

- Associate's Degree (A.A. or A.A.S.) in Accounting: This two-year degree is often considered the sweet spot for a dedicated accounting technician career. It provides a deeper understanding of financial and managerial accounting, business law, and economics. Employers highly value this credential, and it can lead to a starting salary that is $5,000 to $10,000 higher than that of a non-degreed candidate.

- Bachelor's Degree (B.S. or B.A.) in Accounting or Finance: While a bachelor's degree is the standard requirement for becoming a CPA, it can also significantly boost the salary of an accounting technician. Graduates with a four-year degree often start in more advanced "Staff Accountant" roles but may take a technician role in a large, prestigious company as a stepping stone. Their deeper theoretical knowledge makes them prime candidates for faster promotion and a salary premium of $10,000 to $20,000 over an associate's degree holder in the same role.

The Power of Certifications:

Certifications are the single most effective way to demonstrate specialized expertise and command a higher salary without pursuing another full degree.

- Certified Bookkeeper (CB): Offered by the American Institute of Professional Bookkeepers (AIPB), this certification is highly respected in the U.S. It requires passing a national exam covering advanced bookkeeping topics, internal controls, and payroll. Earning a CB designation can add 5-15% to your base salary as it signals a high level of competency.

- QuickBooks Certified ProAdvisor / Xero Certified Advisor: With the vast majority of small and mid-sized businesses running on software like QuickBooks or Xero, becoming a certified expert is a game-changer. These certifications demonstrate you can use the software at an advanced level, troubleshoot issues, and implement best practices. This is particularly valuable for roles in smaller companies and can easily justify a higher salary.

- Microsoft Office Specialist (MOS) Expert - Excel: Advanced Excel skills are non-negotiable for any high-performing accounting professional. Formal certification in Excel, showcasing your mastery of PivotTables, VLOOKUP, INDEX/MATCH, and Power Query, can differentiate you from other candidates and directly translate to higher pay.

---

### 2. Years of Experience

Experience is perhaps the most significant determinant of salary. As you accumulate years in the field, you build a track record of reliability, increase your speed and accuracy, and develop the institutional knowledge that makes you invaluable.

- Entry-Level (0-2 Years): At this stage, you are learning the fundamentals and proving your work ethic. Your primary value is your potential. Salary: ~$40,000 - $52,000.

- Mid-Career (3-8 Years): You are now a fully proficient and independent contributor. You can handle the entire lifecycle of AP/AR, perform complex reconciliations without assistance, and are a reliable resource for the month-end close. Your salary reflects this competence. Salary: ~$50,000 - $65,000.

- Senior/Lead (9+ Years): You are a subject matter expert. You may be the go-to person for the most complex transactions, audit support, or system issues. You might be training junior staff or leading a small team of AP/AR clerks. Your deep experience in troubleshooting and process improvement commands the highest salaries for this role. Salary: ~$62,000 - $75,000+.

---

### 3. Geographic Location

Where you work matters—a lot. Salaries for the same job can vary by 30% or more depending on the state and city due to differences in cost of living, demand for talent, and the concentration of certain industries.

High-Paying States and Metropolitan Areas:

Generally, states with major financial centers, tech hubs, and a high cost of living offer the highest salaries.

- Top-Tier States: California, New York, Massachusetts, Washington, New Jersey, and Alaska.

- Top-Tier Cities: San Francisco, San Jose, New York City, Boston, Seattle, and Washington D.C.

- An accounting technician in San Jose, CA might earn $70,000 - $85,000 for a role that would pay $50,000 in a smaller Midwestern city.

Average and Lower-Paying States:

States with a lower cost of living and less concentrated corporate presence will naturally offer lower base salaries, though the purchasing power may be comparable.

- Lower-Tier States: Mississippi, Arkansas, West Virginia, South Dakota, and Alabama.

- In a rural area of one of these states, an accounting technician salary might be in the $35,000 - $45,000 range.

The Rise of Remote Work: The pandemic has changed the geographic equation. Companies based in high-cost areas may hire remote technicians in lower-cost states. This can create a win-win: the employee enjoys a higher-than-local-average salary, and the company saves money compared to hiring locally. When searching for remote roles, be aware that some companies adjust salary based on your location, while others have a single national pay scale.

---

### 4. Company Type and Size

The environment you work in has a direct impact on your paycheck and overall compensation package.

- Startups and Small Businesses: These companies often offer lower base salaries due to tighter budgets. However, the trade-off can be significant: broader responsibilities (you might do a bit of everything), faster learning, and the potential for stock options, which could be extremely valuable if the company succeeds.

- Large Corporations (Fortune 500): These organizations typically offer the most competitive salaries, best-in-class benefits (robust health insurance, generous 401k matches), and highly structured career paths. The work may be more specialized and siloed, but the stability and compensation are top-tier. An accounting technician at a large public company will likely earn 10-20% more than their counterpart at a small local business.

- Government (Federal, State, and Local): Government roles are renowned for their stability, excellent benefits (pensions are still common in the public sector), and work-life balance. Base salaries may start slightly lower than in the private sector, but the total compensation package, when factoring in job security and benefits, is often superior. The GS (General Schedule) pay scale for federal jobs provides a transparent view of salary progression.

- Non-Profit Organizations: Driven by mission rather than profit, non-profits generally offer lower salaries than for-profit entities. The work can be incredibly fulfilling, but candidates must be prepared for a trade-off between passion and paycheck. The benefits packages, however, can sometimes be quite competitive.

---

### 5. Area of Specialization

As you gain experience, you can choose to specialize in a particular area of accounting. Developing deep expertise in a high-demand niche is a surefire way to increase your salary.

- Payroll Specialist: Technicians who master the complexities of payroll processing—including multi-state payroll, tax withholding laws, and benefits administration—are always in demand and can command a premium.

- Construction Accounting Technician: The construction industry has unique accounting needs, such as job costing, progress billings, and compliance with lien laws. Specializing in this area makes you highly valuable to construction firms.

- IT / Tech Industry Technician: Working for a tech or SaaS (Software as a Service) company exposes you to complex revenue recognition (ASC 606), deferred revenue schedules, and subscription billing models. Technicians with this experience are highly sought after and are among the highest paid.

- Forensic Accounting Technician: While less common, some technicians assist forensic accountants by gathering, organizing, and analyzing financial data for legal cases or fraud investigations. This highly detailed work requires extreme precision and can be very lucrative.

- Tax Technician: Working in a CPA firm during tax season, assisting with the preparation of individual and corporate tax returns, provides valuable, specialized experience that is rewarded financially.

---

### 6. In-Demand Skills (Hard and Soft)

Beyond your formal qualifications, the specific skills you possess are what make you effective and valuable. Cultivating the right mix of technical (hard) and interpersonal (soft) skills will directly impact your salary negotiations and career trajectory.

High-Value Hard Skills:

- Advanced ERP Software Proficiency: Experience with large-scale Enterprise Resource Planning (ERP) systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is a major differentiator. Companies that use these complex