An accounts receivable (AR) career is a fantastic entry point into the world of finance and a stable, essential role in any business. As the professionals responsible for ensuring a company gets paid, AR specialists are the guardians of a business's most critical resource: its cash flow. But what does this vital role mean for your paycheck?

While salary can vary, a skilled accounts receivable professional can expect to earn a competitive wage, with a typical salary range falling between $45,000 and $75,000+ per year. In this article, we’ll break down the average accounts receivable salary and explore the key factors that can help you maximize your earning potential in this rewarding field.

What Does an Accounts Receivable Specialist Do?

At its core, the accounts receivable department manages all the money owed to a company. An AR specialist, clerk, or coordinator is the hands-on professional who ensures these funds are collected in a timely and efficient manner. It’s a role that requires a keen eye for detail, strong organizational skills, and excellent communication abilities.

Key responsibilities typically include:

- Generating and Sending Invoices: Creating accurate invoices for goods or services sold.

- Tracking Payments: Monitoring accounts to ensure payments are received on time.

- Reconciling Accounts: Matching payments received with outstanding invoices to ensure the books are balanced.

- Client Communication and Collections: Contacting clients regarding overdue payments and negotiating payment plans.

- Reporting: Preparing reports on the status of accounts receivable for management.

Average Accounts Receivable Salary

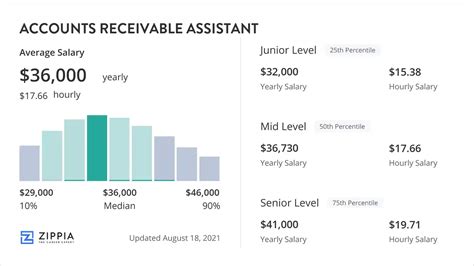

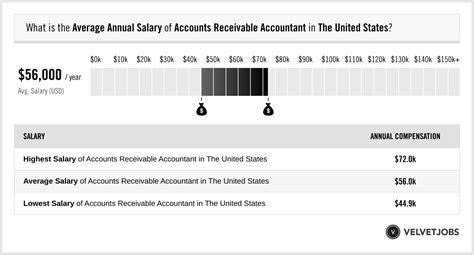

When analyzing salary data, it's important to look at multiple sources to get a complete picture. While figures vary based on title (e.g., clerk, specialist, manager), we can establish a reliable baseline.

According to reputable salary aggregators like Salary.com, the median annual salary for an Accounts Receivable Specialist in the United States is approximately $58,500 as of late 2023, with most positions falling within the $51,800 to $66,400 range. Payscale reports a similar average base salary of around $54,000 per year.

The U.S. Bureau of Labor Statistics (BLS) groups this role under the broader category of "Bookkeeping, Accounting, and Auditing Clerks." For this group, the BLS reports a median annual wage of $47,440 as of May 2023. The lower BLS figure often includes a wider variety of entry-level and part-time clerical roles, while data from salary aggregators tends to reflect the more specialized, full-time "specialist" positions.

Here’s a typical progression:

- Entry-Level (AR Clerk): $42,000 - $50,000

- Mid-Career (AR Specialist): $50,000 - $65,000

- Senior/Lead (Senior AR Specialist): $65,000 - $75,000+

For those who advance into management roles, such as an Accounts Receivable Manager, salaries can climb significantly higher, often exceeding $85,000 or more.

Key Factors That Influence Salary

Your specific salary is determined by a combination of factors. Understanding these levers is the key to negotiating a better salary and charting a lucrative career path.

### Level of Education

While a bachelor's degree isn't always required to enter the field, higher education directly correlates with higher earning potential.

- High School Diploma or GED: This is the minimum requirement for many entry-level AR clerk positions, placing you at the starting end of the salary range.

- Associate's Degree: An associate's degree in Accounting, Business, or Finance makes you a more competitive candidate and can lead to a higher starting salary. It demonstrates a foundational understanding of accounting principles.

- Bachelor's Degree: A bachelor's degree in Accounting or Finance opens the door to senior specialist roles, team lead positions, and management tracks. It is often a prerequisite for jobs at larger corporations and in high-paying industries.

### Years of Experience

Experience is arguably the most significant factor in determining your salary. As you gain expertise, your value to an organization increases dramatically.

- Entry-Level (0-2 years): In this phase, you are learning the core functions: invoicing, payment processing, and basic reconciliation. Your focus is on accuracy and efficiency.

- Mid-Career (3-7 years): With several years of experience, you can handle more complex accounts, manage difficult collections, and begin to analyze AR aging reports. This is where you’ll see substantial salary growth.

- Senior/Experienced (8+ years): Senior professionals often take on strategic responsibilities. They may mentor junior staff, improve collection processes, work on credit analysis, and manage the company’s largest accounts. This level of experience commands the highest salaries within non-management roles.

### Geographic Location

Where you work matters. Salaries for AR professionals are adjusted based on the local cost of living and the demand for financial professionals in that market.

- High-Cost Metropolitan Areas: Cities like San Francisco, New York City, Boston, and Washington, D.C., consistently offer the highest salaries to compensate for a higher cost of living.

- Mid-Tier Cities: Major cities in states like Texas, Florida, and North Carolina offer competitive salaries with a more moderate cost of living.

- Lower-Cost and Rural Areas: Salaries will generally be lower in smaller towns and rural regions, but this is balanced by significantly lower living expenses.

The rise of remote work has started to blur these lines, but location-based pay is still a standard practice for many companies.

### Company Type

The size and industry of your employer play a major role in your compensation package.

- Company Size: Large, multinational corporations typically have larger budgets and more structured pay scales, often resulting in higher salaries and more comprehensive benefits than small to medium-sized businesses (SMBs).

- Industry: Industries with high revenue and complex billing cycles, such as Technology, Pharmaceuticals, Manufacturing, and Financial Services, tend to pay AR specialists more than industries like retail or non-profit.

### Area of Specialization

As you advance in your career, you can develop specialized skills that make you a more valuable—and higher-paid—asset.

- Credit Analysis: Some AR roles include responsibilities for assessing the creditworthiness of new customers, a skill that adds significant value.

- International Accounts: Specialists who can navigate the complexities of foreign currency, international payment laws, and different tax systems are in high demand and can command a premium salary.

- Collections: While all AR roles involve some collections, a dedicated collections specialist who excels at recovering aged debt can often earn performance-based bonuses on top of a competitive base salary.

- System Implementation: Professionals with experience in implementing or managing accounting software (like NetSuite, SAP, or Oracle) are highly sought after.

Job Outlook

The career outlook for accounts receivable professionals is a story of evolution. The BLS projects a 2% decline for the broad "Bookkeeping, Accounting, and Auditing Clerks" category between 2022 and 2032.

However, this statistic doesn't tell the whole story. The decline is primarily driven by the automation of routine, data-entry tasks. The role of the AR specialist is not disappearing; it is becoming more strategic. Companies need professionals who can move beyond basic invoicing and focus on analysis, client relationship management, negotiation, and process improvement—skills that automation cannot replace. This means that skilled, adaptable professionals who embrace technology will find strong and stable job security.

Conclusion

A career in accounts receivable offers a stable and rewarding path with clear opportunities for growth. While a starting salary may begin in the mid-$40,0.00s, your earning potential is directly in your control. By focusing on these key takeaways, you can build a lucrative career:

- Invest in Education: An associate's or bachelor's degree provides a significant long-term return.

- Build Experience: Master the fundamentals and actively seek out more complex and challenging responsibilities.

- Specialize: Develop expertise in high-demand areas like credit analysis or international accounts.

- Embrace Technology: Become proficient in modern accounting software and analytical tools.

As an essential pillar of a company's financial health, a skilled accounts receivable specialist will always be in demand, ensuring a promising and well-compensated career journey.