If you're meticulous, a great communicator, and have a knack for numbers, a career as an Accounts Receivable (A/R) Specialist can be a stable and rewarding entry point into the world of finance and accounting. This critical role ensures the financial health of a company by managing the money owed to it. But what does this responsibility translate to in terms of salary?

This guide provides a data-driven look at the earning potential for an Accounts Receivable Specialist, exploring the national averages and the key factors that can significantly increase your paycheck. For prospective professionals, this role offers a clear path for growth, with salaries ranging from a solid starting wage to over $70,000 for experienced specialists in high-demand markets.

What Does an Accounts Receivable Specialist Do?

At its core, an Accounts Receivable Specialist is a financial gatekeeper. Their primary mission is to ensure that the company receives payments for goods or services and to accurately record those transactions. They are the crucial link between a company delivering a service and actually getting paid for it.

Key responsibilities typically include:

- Invoicing: Generating and sending out accurate invoices to clients.

- Payment Processing: Recording and reconciling incoming payments.

- Collections: Following up on overdue accounts through email, phone calls, and official notices.

- Account Management: Maintaining customer account records, tracking payment statuses, and resolving billing discrepancies.

- Reporting: Creating reports on the status of accounts receivable, aging accounts, and collection activities for management.

Average Accounts Receivable Specialist Salary

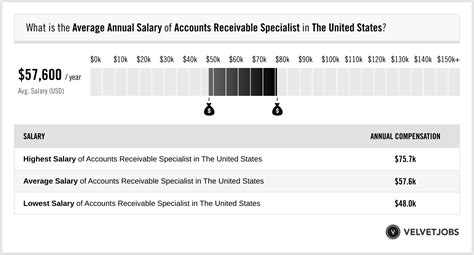

When we analyze compensation for A/R Specialists, we see a consistent and promising range. According to recent data, your earnings will depend heavily on your experience, location, and the complexity of your role.

- National Average: Data from leading salary aggregators like Salary.com places the median annual salary for an Accounts Receivable Specialist in the United States at around $54,360 as of early 2024, with a typical range falling between $48,460 and $61,540.

- Aggregator Data: Payscale reports a similar average base salary of approximately $52,000 per year, while Glassdoor estimates a total pay average (including potential bonuses) of around $56,000.

- Broader Context from BLS: The U.S. Bureau of Labor Statistics (BLS) groups this role under the broader category of "Bookkeeping, Accounting, and Auditing Clerks." As of May 2023, the BLS reported a median annual wage of $47,440 for this category. While this figure is slightly lower, it encompasses a wide variety of roles, and specialists with focused A/R skills often command higher pay.

Entry-level positions typically start in the low to mid-$40,000s, while senior specialists, team leads, or those with niche expertise can earn upwards of $65,000 to $75,000 annually.

Key Factors That Influence Salary

Your salary isn't just one number; it's a reflection of the value you bring. Several key factors can dramatically impact your earning potential as an A/R Specialist.

###

Level of Education

While a bachelor's degree isn't always a strict requirement, it significantly boosts earning potential and career mobility.

- High School Diploma or Associate's Degree: This is often the minimum requirement for entry-level roles, placing you at the starting end of the salary spectrum.

- Bachelor's Degree: A four-year degree in Accounting, Finance, or Business Administration is highly preferred by employers and is often a prerequisite for senior roles or positions at larger corporations. It demonstrates a deeper understanding of financial principles and can lead to a higher starting salary and faster promotions.

- Certifications: Professional certifications validate your expertise. Earning a credential like the Certified Accounts Receivable Professional (CARP) or Certified Receivables Management Professional (CRMP) can increase your marketability and salary.

###

Years of Experience

Experience is arguably the most significant factor in determining your salary. Employers pay a premium for professionals who have a proven track record of managing accounts effectively.

- Entry-Level (0-2 Years): At this stage, you'll handle foundational tasks like generating invoices and processing payments. Expect a salary in the $42,000 - $48,000 range.

- Mid-Level (3-5 Years): With a few years of experience, you'll manage more complex accounts, handle difficult collections, and operate with more autonomy. Your salary will likely move into the $50,000 - $60,000 range.

- Senior/Lead (5+ Years): Senior specialists often take on the most challenging accounts, mentor junior staff, help develop A/R policies, and may be involved in financial reporting and analysis. Their salaries can climb to $65,000+, especially with leadership responsibilities.

###

Geographic Location

Where you work matters. Salaries are adjusted based on the local cost of living and demand for financial professionals. Metropolitan areas with a high concentration of corporate headquarters typically offer the highest pay.

- High-Paying States: States like California, New York, Massachusetts, Washington, and the District of Columbia consistently offer salaries that are 15-30% above the national average to compensate for a higher cost of living.

- Average-Paying States: Most of the country falls around the national median, including states like Texas, Florida, and Illinois.

- Lower-Paying States: Rural areas and states with a lower cost of living, such as Mississippi, Arkansas, and West Virginia, will typically offer salaries below the national average.

###

Company Type

The size, industry, and financial health of your employer play a crucial role.

- Industry: High-revenue industries like Technology, Biotechnology, Professional Services, and Finance tend to pay the most. The complexity of B2B transactions in these sectors requires a higher level of skill.

- Company Size: Large, multinational corporations generally have more structured pay scales and offer higher salaries and better benefits packages than small businesses or non-profits.

- Public vs. Private: Publicly traded companies often have larger and more complex A/R departments, which can translate to higher pay for skilled specialists.

###

Area of Specialization

Developing specialized skills can make you a more valuable asset and boost your salary.

- Complex Collections: Expertise in negotiating payments for high-value, delinquent accounts is a highly sought-after skill.

- B2B vs. B2C: Business-to-business (B2B) A/R is often more complex, involving larger invoice amounts, credit checks, and relationship management, which can command higher pay than business-to-consumer (B2C) roles.

- ERP Software Proficiency: Advanced knowledge of Enterprise Resource Planning (ERP) systems like SAP, Oracle NetSuite, or Microsoft Dynamics is a significant advantage.

- Industry-Specific Knowledge: Specialists in industries like healthcare (managing complex insurance billing and coding) or construction (handling project-based billing and liens) can earn more due to their specialized knowledge.

Job Outlook

The career outlook for Accounts Receivable Specialists is stable. While the U.S. Bureau of Labor Statistics (BLS) projects a 2% decline for the broader "Bookkeeping, Accounting, and Auditing Clerks" category from 2022 to 2032, this figure requires context.

The projected decline is largely due to the automation of simple, repetitive tasks like data entry and basic payment processing. However, this trend increases the value of human specialists who can perform tasks that software cannot: complex problem-solving, client relationship management, negotiation, and financial analysis.

Professionals who adapt and build these higher-level skills will remain in strong demand. The core function of ensuring a company gets paid is not going away, but the nature of the work is evolving to be more analytical and strategic.

Conclusion

A career as an Accounts Receivable Specialist offers a durable and promising path into the financial sector. With a national median salary comfortably sitting in the $50,000s and significant room for growth, it is an excellent choice for detail-oriented individuals.

To maximize your earning potential, focus on these key takeaways:

- Build Experience: Move from entry-level tasks to handling complex, high-value accounts.

- Consider Further Education: A bachelor's degree or professional certification can unlock higher-paying opportunities.

- Develop Niche Skills: Become an expert in a specific industry or a critical software system like SAP or Oracle.

- Be Strategic About Location: If possible, consider opportunities in major metropolitan areas or high-growth industries.

By strategically developing your skills and experience, you can transform a job as an Accounts Receivable Specialist into a prosperous and fulfilling long-term career.