For students and professionals with a strong aptitude for mathematics, statistics, and financial theory, the field of actuarial science offers not just an intellectually stimulating career but also one of the most lucrative and stable professions available today. A common question we receive is, "What can I expect to earn as an actuarial analyst?" The answer is encouraging: a high starting salary with a clear, structured path to a six-figure income and beyond.

This guide will break down the earning potential of an actuarial analyst, from entry-level roles to senior positions, and explore the key factors that will shape your salary throughout your career.

What Does an Actuarial Analyst Do?

Before diving into the numbers, it's essential to understand the role. Think of actuarial analysts as the financial architects and risk managers of the business world. They use a powerful combination of mathematics, statistics, and financial theory to analyze and quantify the financial consequences of risk. Their work is the bedrock of the insurance industry, pension plans, and other financial institutions.

Key responsibilities include:

- Data Analysis: Collecting and analyzing vast datasets to build statistical models.

- Risk Modeling: Creating models to project the financial impact of uncertain future events, such as natural disasters, car accidents, or human mortality rates.

- Pricing: Determining the price for insurance policies or the required funding for pension plans to ensure they remain financially solvent.

- Reporting: Communicating complex analytical findings to executives, clients, and regulators in a clear, concise manner.

Average Actuarial Analyst Salary

The compensation for actuarial analysts is highly competitive, reflecting the specialized skills and rigorous examination process required.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for actuaries was $114,850 in May 2023. This figure represents the midpoint, meaning half of all actuaries earned more, and half earned less. The BLS also reports a wide salary spectrum, with the lowest 10 percent earning less than $72,400 and the top 10 percent earning more than $220,160.

Salary aggregators provide a more granular look at the "analyst" title, which typically represents the earlier stages of an actuary's career:

- Salary.com reports that the typical salary range for an Actuarial Analyst I in the United States falls between $81,399 and $111,749 as of late 2023.

- Glassdoor places the estimated total pay for an Actuarial Analyst at around $104,800 per year, which includes an average base salary of $94,000 plus additional compensation like cash bonuses.

It's clear that even in the early stages, an actuarial analyst's salary is well above the national average for all occupations. However, this is just the starting point. Several key factors directly influence how quickly and how high that salary can climb.

Key Factors That Influence Salary

Your journey from an entry-level analyst to a high-earning, credentialed actuary is marked by several milestones. Each one has a significant impact on your compensation.

### Level of Education & Professional Exams

While a bachelor's degree in mathematics, statistics, actuarial science, or a related quantitative field is the standard entry requirement, the true driver of an actuary's salary is the professional credentialing process. These credentials are earned by passing a series of rigorous exams administered by professional societies like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

Companies directly reward this progress. It is standard practice for employers to provide paid study time and cover exam fees. More importantly, they offer salary increases and bonuses for each exam passed. An entry-level analyst with one or two exams can expect to earn significantly less than an analyst with four or five exams, even if they have the same years of experience. Achieving associate-level credentials (ASA/ACAS) and ultimately fellow-level credentials (FSA/FCAS) results in major salary jumps.

### Years of Experience

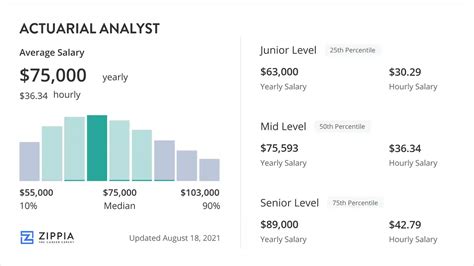

Experience, combined with exam progress, creates a predictable and steep salary trajectory.

- Entry-Level (0-2 years): An analyst starting their career, typically with 1-3 exams passed, can expect a salary in the range of $75,000 to $95,000.

- Mid-Career (3-7 years): By this stage, an analyst has likely passed several more exams and is approaching or has achieved their associate-level designation. Payscale notes that an Actuary with 5-9 years of experience earns an average total compensation of around $135,000.

- Senior/Fellow (8+ years): A fully credentialed Fellow with significant experience can command a salary well into the $160,000 to $250,000+ range. At this level, many move into management or highly specialized technical roles, with compensation often including significant performance bonuses and stock options.

### Geographic Location

Where you work matters. Major financial and insurance hubs offer higher salaries to attract top talent, though this is often balanced by a higher cost of living. According to the BLS, some of the top-paying states for actuaries include New York, Connecticut, New Hampshire, and the District of Columbia.

Metropolitan areas with a high concentration of insurance headquarters and consulting firms typically offer the most competitive salaries. These include:

- New York, NY

- Hartford, CT

- Chicago, IL

- Boston, MA

- Major cities in California and Texas

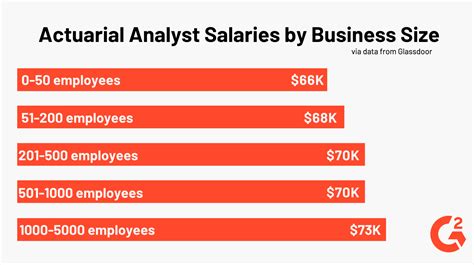

### Company Type

The type of company you work for is a major determinant of your salary and work environment.

- Insurance Carriers: This is the most common path. Actuaries specializing in Property & Casualty (P&C) insurance (e.g., auto, home) often earn slightly more than those in Life and Health due to the nature of the risks they model.

- Consulting Firms: Actuarial consulting can be one of the most lucrative paths. Consultants often work on diverse projects for multiple clients, and the pay reflects the demanding, high-impact nature of the work. Top performers can see their compensation rise very quickly.

- Government/Public Sector: Agencies like the Social Security Administration or the Pension Benefit Guaranty Corporation employ actuaries. While base salaries may be slightly lower than in the private sector, these roles often come with excellent benefits, job security, and a better work-life balance.

### Area of Specialization

Within the industry, your specialization can impact your earning potential. As mentioned, P&C actuaries tend to be on the higher end of the pay scale. Emerging and highly complex fields, such as cyber risk, predictive analytics, and enterprise risk management (ERM), are also creating high-demand, high-paying roles for actuaries who possess these specialized skills.

Job Outlook

The future for actuarial analysts is exceptionally bright. The BLS projects that employment for actuaries will grow by 23 percent from 2022 to 2032. This is much faster than the average for all occupations.

This incredible growth is fueled by several factors:

1. An increasing volume of data allows for more sophisticated risk analysis.

2. The financial world is becoming more complex, requiring expert risk management.

3. Companies need to plan for the future, from pricing new insurance products to managing massive pension funds.

This high demand ensures that the profession will remain both stable and financially rewarding for years to come.

Conclusion

The career of an actuarial analyst offers a rare combination of intellectual challenge, professional prestige, and outstanding financial reward. While the journey requires dedication and a commitment to continuous learning through the exam process, the path to a high salary is remarkably clear and predictable.

For individuals considering this career, the key takeaways are:

- Strong Starting Salary: You will begin your career with a competitive salary that far exceeds the national average.

- You Control Your Growth: Passing actuarial exams is the single most important factor in increasing your earnings in the first decade of your career.

- High Long-Term Potential: With experience and full credentials, a salary exceeding $200,000 is a very achievable goal.

- Excellent Job Security: With projected growth of 23%, your skills will be in high demand across multiple industries.

For those with a passion for numbers and a desire to solve complex financial puzzles, the path of an actuarial analyst is a well-defined and highly rewarding journey.