Are you looking at a job offer for $16 an hour and wondering what that truly means for your lifestyle, your budget, and your future? You're not just considering a number; you're evaluating a potential stepping stone in your professional journey. A $16 per hour wage, which translates to an annual salary of approximately $33,280 before taxes, is a critical benchmark for millions of workers across the United States. It's the starting line for many essential careers, a transitional wage for those re-entering the workforce, and a foundational income for countless families.

Understanding the full picture of this income level is about more than just simple multiplication. It's about recognizing the opportunities it unlocks, the challenges it presents, and the strategic moves you can make to transform this starting point into a launchpad for significant career advancement and financial security. As a career analyst who has guided thousands of individuals through their professional paths, I've seen firsthand how a job at this pay scale can be a powerful catalyst for growth. I once mentored a young administrative assistant, fresh out of community college and starting at just over this rate. She felt discouraged by the numbers on paper, but by focusing on acquiring specific skills—mastering advanced Excel functions and learning basic project management software—she leveraged her "entry-level" role into a department coordinator position earning 40% more within just 18 months. Her story is a testament to the fact that your starting wage does not define your ultimate potential.

This in-depth guide is designed to be your ultimate resource for navigating a career that starts at or around the $16 per hour mark. We will dissect this wage from every angle, providing you with the data-driven insights and actionable advice you need to make informed decisions and build a prosperous future.

### Table of Contents

- [What Kinds of Jobs Pay $16 Per Hour?](#what-does-a-16-per-hour-professional-do)

- [The Annual Salary for $16 Per Hour: A Deep Dive](#average-annual-salary-for-16-per-hour-salary-a-deep-dive)

- [Key Factors That Influence Your Earning Potential](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for $16/Hour Roles](#job-outlook-and-career-growth)

- [How to Get Started and Grow Beyond $16 Per Hour](#how-to-get-started-in-this-career)

- [Conclusion: Turning a Starting Wage into a Fulfilling Career](#conclusion)

What Kinds of Jobs Pay $16 Per Hour?

A $16 per hour wage is characteristic of many vital entry-level and early-career positions that form the backbone of our economy. These roles often require a high school diploma or an associate's degree and are centered around providing essential services, support, and operational functions. While the specific tasks vary widely by industry, these jobs typically demand a core set of valuable soft skills: reliability, strong communication, customer-centricity, and the ability to work effectively in a team.

These are not just "jobs"; they are opportunities to build a foundational skill set that is transferable to countless higher-paying career paths. Let's explore some of the most common professions where a $16/hour wage is a typical starting point.

Common Roles and Core Responsibilities:

- Customer Service Representative: These professionals are the voice of a company. They handle customer inquiries, resolve complaints, process orders, and provide information about products and services via phone, email, or chat. They develop crucial skills in communication, problem-solving, and de-escalation. According to Payscale, the average entry-level wage for a Customer Service Representative hovers in this range, depending on the industry and location.

- Entry-Level Administrative Assistant: Often the organizational hub of an office, an administrative assistant manages schedules, answers phones, organizes files, handles correspondence, and performs basic bookkeeping. This role is a gateway to careers in office management, executive assistance, or project coordination.

- Certified Nursing Assistant (CNA): In the healthcare sector, CNAs provide direct patient care under the supervision of a nurse. They assist with daily living activities like bathing, dressing, and eating, and they monitor vital signs. The U.S. Bureau of Labor Statistics (BLS) notes the median pay for nursing assistants is around $17.35 per hour, but entry-level positions in many states start closer to the $15-$16 mark.

- Bank Teller: Tellers are the frontline of a bank, responsible for processing routine account transactions like deposits, withdrawals, and loan payments. They must be meticulous, trustworthy, and possess strong customer service skills. This role can lead to positions in personal banking, loan processing, or branch management.

- Retail Sales Associate / Team Member: This role involves assisting customers, operating cash registers, stocking shelves, and maintaining store appearance. High-performing associates can quickly advance to shift lead, key holder, or assistant manager positions, which come with higher pay.

### A Day in the Life: The Customer Service Representative

To make this more tangible, let's walk through a typical day for "Alex," an entry-level Customer Service Representative earning $16 an hour at a mid-sized e-commerce company.

- 8:45 AM: Alex arrives, grabs a coffee, and logs into the system. He reviews overnight customer emails and team updates to prepare for the day.

- 9:00 AM - 12:00 PM: The phone lines and live chat are open. Alex spends the morning in a steady rhythm of problem-solving. He helps one customer track a missing package, guides another through the online checkout process, and processes a return for a third. He meticulously documents each interaction in the company's CRM (Customer Relationship Management) software—a key skill he's developing.

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 3:00 PM: The afternoon brings more complex issues. Alex handles a call from a frustrated customer whose product arrived damaged. He listens patiently, empathizes with their frustration (de-escalation), and follows company policy to arrange a free replacement and a discount on a future purchase. The customer ends the call satisfied.

- 3:00 PM - 4:30 PM: Alex has a "focus block" with no calls. He uses this time to respond to customer emails and follow up on cases from earlier in the week. He also completes a mandatory 30-minute online training module on a new product line.

- 4:30 PM - 5:00 PM: The call volume slows. Alex finalizes his notes for the day, organizes his task list for tomorrow, and checks in with his team lead about the complex damaged-product case before logging off.

In one day, Alex has practiced active listening, technical troubleshooting, data entry, conflict resolution, and written communication—all skills that are essential for advancing his career.

The Annual Salary for $16 Per Hour: A Deep Dive

The first step in understanding the financial reality of a $16/hour job is to do the math. From there, we must peel back the layers to understand what that number means in terms of take-home pay, benefits, and overall financial health.

The Basic Calculation: Gross Annual Income

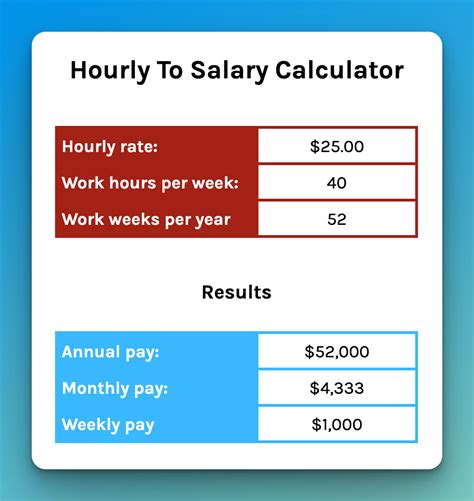

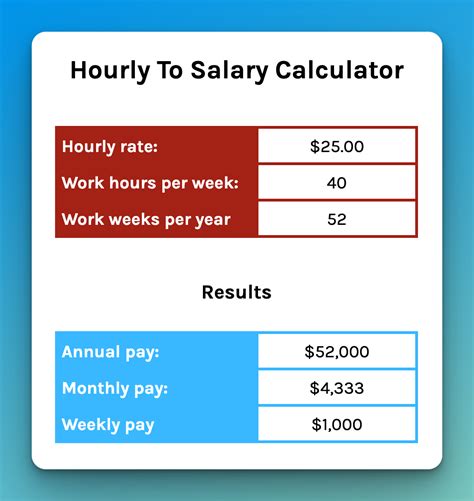

The standard calculation for converting an hourly wage to an annual salary assumes a full-time schedule of 40 hours per week for 52 weeks a year.

- $16 per hour x 40 hours per week = $640 per week

- $640 per week x 52 weeks per year = $33,280 per year

This $33,280 is your gross annual income. It's the headline number, the figure you see on your job offer letter. However, it's not the amount that will be deposited into your bank account.

From Gross to Net: Understanding Your Take-Home Pay

Your net income, or take-home pay, is what remains after deductions. For someone earning $33,280, these deductions can have a significant impact.

- Federal Income Tax: Your tax liability depends on your filing status (Single, Married Filing Jointly, etc.) and any dependents. For a single filer with no dependents, federal income tax would likely be in the 10-12% range on taxable income.

- State Income Tax: This varies dramatically. Some states like Texas, Florida, and Washington have no state income tax, while others like California, Oregon, and Minnesota have progressive rates that will take an additional percentage.

- FICA Taxes (Social Security and Medicare): This is a mandatory federal payroll tax. You will pay 6.2% for Social Security (on income up to a certain limit) and 1.45% for Medicare. Your employer pays a matching amount. That's a flat 7.65% reduction from your gross pay.

- Pre-Tax Deductions: These are costs taken out of your paycheck *before* taxes are calculated, which lowers your taxable income. Common examples include:

- Health, dental, and vision insurance premiums.

- Contributions to a 401(k) or 403(b) retirement plan.

- Contributions to a Health Savings Account (HSA) or Flexible Spending Account (FSA).

Example Scenario: Estimated Net Pay

Let's estimate the take-home pay for a single individual earning $33,280, living in a state with a modest income tax, and contributing to benefits.

| Item | Amount (Annual) | Notes |

| -------------------- | --------------- | ------------------------------------------------------------------------------------------------- |

| Gross Salary | $33,280 | The starting point. |

| FICA Taxes (7.65%) | -$2,546 | Mandatory payroll taxes. |

| Federal Income Tax | ~$2,000 | Estimated for a single filer after the standard deduction. |

| State Income Tax (4%)| ~$1,331 | Varies significantly by state. |

| Health Insurance | -$1,800 | Average employee contribution for single coverage, though this can vary wildly. |

| 401(k) Contribution (3%)| -$998 | A recommended starting point for retirement savings. |

| Estimated Net Pay| ~$24,605 | This translates to about $2,050 per month or $984 bi-weekly. |

This breakdown shows why it's crucial to look beyond the $33,280 figure. Your actual monthly budget will be based on a number closer to $2,050.

### Beyond the Paycheck: The Value of Total Compensation

At the $16/hour level, employee benefits are not just perks; they are a critical component of your total compensation that can be worth thousands of dollars. When comparing job offers, you must evaluate the entire package.

Key Components of Total Compensation:

- Health Insurance: A good employer-sponsored health plan is arguably the most valuable benefit. The average annual premium for employer-sponsored single coverage was $8,435 in 2023, with employees paying about $1,401 of that, according to the Kaiser Family Foundation (KFF). An employer covering a large portion of this premium is effectively giving you thousands of dollars in non-taxable compensation.

- Retirement Savings (401(k) or 403(b)): Many employers offer a matching contribution. A common match is 50% of your contribution up to 6% of your salary. On a $33,280 salary, if you contribute 6% ($1,997), a 50% match means your employer adds an extra $998 to your retirement account. This is free money and a powerful tool for wealth-building.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. Ten days of paid vacation and five sick days at $16/hour are worth $1,920 ($128/day x 15 days).

- Tuition Assistance/Professional Development: Some companies offer to pay for part or all of your college tuition or for certifications relevant to your job. This benefit can be worth $5,000 or more per year and is a direct investment in your future earning potential.

- Overtime and Shift Differentials: Roles in healthcare, manufacturing, or logistics often offer time-and-a-half pay ($24/hour) for hours worked beyond 40 per week. Evening or night shifts may also come with a "shift differential," adding an extra $1-$3 per hour to your base pay.

When you add the value of these benefits, a $16/hour job can have a total compensation value closer to $40,000 or more, making it much more financially viable than the initial salary suggests.

Key Factors That Influence Salary

While $16 per hour is a common benchmark, it is by no means a fixed number. Your individual earnings, even in entry-level fields, are influenced by a dynamic interplay of factors. Understanding these levers is the key to not only negotiating a better starting wage but also charting a course for significant income growth. This is the most critical section for anyone looking to move beyond the $16/hour baseline.

###

Level of Education

Your educational background provides the foundational knowledge for your career and is often the first filter used by hiring managers. While many $16/hour jobs require only a high school diploma or GED, additional education can immediately place you on a higher pay scale or accelerate your advancement.

- High School Diploma/GED: This is the baseline for most entry-level roles in customer service, retail, and food service. It qualifies you for the standard $15-$17 per hour starting wage in many regions.

- Certifications: This is one of the fastest ways to increase your value. A short-term certificate program (3-12 months) can provide specialized skills that employers are willing to pay a premium for.

- Example: A general administrative assistant might start at $16/hour. But an administrative assistant who has earned a Microsoft Office Specialist (MOS) Expert certification or a Certified Medical Administrative Assistant (CMAA) credential can often command a starting salary of $18-$22/hour. Similarly, a basic caregiver might make $15/hour, while a Certified Nursing Assistant (CNA) or Phlebotomy Technician (CPT) starts higher and has a clearer path for advancement.

- Associate's Degree (A.A., A.S.): A two-year degree from a community college often signals a higher level of commitment and specialized knowledge. In fields like healthcare, IT, or business, an associate's degree can be the ticket to roles that start above the $20/hour mark. For example, a Help Desk Technician with an A.S. in Information Technology will earn more than a general customer service rep.

- Bachelor's Degree (B.A., B.S.): While many graduates with a bachelor's degree aim for salaried roles starting above $50,000, some entry-level positions in fields like non-profit, social services, or some marketing coordinator roles might begin in the $18-$22/hour range. The degree, however, dramatically broadens the scope for future promotions into management and strategic roles that are inaccessible without it.

###

Years of Experience

Experience is a powerful driver of wage growth. In nearly every field, demonstrated competence and a track record of reliability are rewarded with higher pay and more responsibility. The journey from $16/hour is often a predictable and achievable progression.

Let's model the salary trajectory for a typical role, like a Customer Service Representative or Administrative Support Specialist:

| Career Stage | Years of Experience | Typical Hourly Wage | Annual Gross Salary | Key Responsibilities & Skills |

| ----------------- | ------------------- | ------------------- | ------------------- | ----------------------------------------------------------------------------------------------------- |

| Entry-Level | 0-2 years | $16 - $18/hour | $33,280 - $37,440 | Learning core processes, handling basic tasks, following scripts, focusing on reliability and accuracy. |

| Mid-Career | 2-5 years | $19 - $24/hour | $39,520 - $49,920 | Handling complex issues, training new hires, contributing to process improvement, minimal supervision. |

| Senior/Lead | 5-8+ years | $25 - $30+/hour | $52,000 - $62,400+ | Acting as a team lead, managing escalations, analyzing performance data, mentoring junior staff. |

| Supervisor/Manager | 8+ years | Salaried ($65k+) | $65,000+ | Managing a team, setting goals, handling budgets and hiring, reporting to upper management. |

*Data is illustrative and based on aggregated data from sources like Salary.com and Payscale for common career progressions in administrative and customer support fields.*

This table demonstrates a clear path: by mastering your current role and proactively seeking new responsibilities, you can realistically aim to increase your hourly wage by 50% or more within five years.

###

Geographic Location

Where you live and work is one of the most significant factors determining both your pay and how far that pay goes. A $16/hour wage can feel very different depending on the local cost of living and labor market. Companies must adjust their pay scales to be competitive and to account for varying minimum wage laws.

- High Cost of Living (HCOL) Areas: In major metropolitan centers like New York City, San Francisco, Boston, or San Diego, a $16/hour wage is often at or below the legal minimum wage and is not considered a living wage. In these cities, equivalent "entry-level" roles must start much higher, often in the $20-$25/hour range, simply to attract candidates. For example, the minimum wage in Seattle is over $19/hour as of 2024.

- Medium Cost of Living (MCOL) Areas: In many mid-sized cities and suburbs, such as Phoenix, AZ; Dallas, TX; or Charlotte, NC, $16/hour is a very common starting wage for the types of roles discussed. It's competitive for entry-level work but requires careful budgeting to live comfortably.

- Low Cost of Living (LCOL) Areas: In more rural parts of the country and smaller cities, particularly in the South and Midwest, a $16/hour wage can be significantly above the minimum wage and represent a solid, stable income for entry-level positions. In these locations, this wage provides greater purchasing power.

Illustrative Comparison of Purchasing Power for a $33,280 Salary:

| City | Cost of Living Index (US Avg = 100) | What $33,280 "Feels Like" (Compared to US Avg) | Typical Starting Wage for Admin Assistant |

| ----------------- | ----------------------------------- | ---------------------------------------------- | ----------------------------------------- |

| Manhattan, NY | 227.5 | $14,628 | $22 - $28 / hour |

| San Jose, CA | 216.5 | $15,371 | $21 - $26 / hour |

| Indianapolis, IN | 83.7 | $39,761 | $16 - $19 / hour |

| Omaha, NE | 81.6 | $40,784 | $16 - $19 / hour |

| Jackson, MS | 74.4 | $44,731 | $14 - $17 / hour |

*Source for Cost of Living Index: Payscale's Cost of Living Calculator. "Feels Like" salary is calculated for illustrative purposes to show purchasing power.*

This table starkly illustrates that a job paying $16/hour in Indianapolis offers nearly triple the purchasing power of the same wage in Manhattan. When evaluating a job offer, always use a cost-of-living calculator to understand what the salary means *in that specific location*.

###

Company Type & Size

The type of organization you work for can have a profound impact on your pay and benefits.

- Startups: Early-stage startups may be tight on cash and offer a wage at or slightly below the market rate. However, they might compensate with stock options (which are high-risk, high-reward) and opportunities for rapid growth and responsibility as the company expands.

- Small & Medium-Sized Businesses (SMBs): These local or regional companies are often the most common employers for $16/hour roles. Compensation can vary widely. A well-established, profitable SMB may offer competitive wages and a family-like culture, while a struggling one may offer lower pay and fewer benefits.

- Large Corporations: Fortune 500 companies (e.g., in finance, tech, pharmaceuticals, or large retail chains) typically have structured compensation bands. They often pay at or above the market rate to attract and retain talent. A customer service role at a large bank or tech company might start at $20-$22/hour, compared to $16/hour for a similar role at a small local business. They also tend to offer more robust benefits packages (better health insurance, larger 401(k) matches).

- Non-Profits: Driven by mission rather than profit, non-profits may offer slightly lower cash compensation. However, they often provide a strong sense of purpose, a good work-life balance, and sometimes excellent benefits, particularly in areas like paid time off.

- Government (Local, State, Federal): Government jobs are known for their stability, excellent benefits (pensions, generous health plans), and clearly defined pay scales ("GS" levels for federal jobs). An entry-level administrative or clerical role in a government agency might start in the $16-$20/hour range but comes with unparalleled job security and a predictable path for raises based on seniority.

###

Area of Specialization

Within a broad job category, specialization is a direct route to higher pay. By developing expertise in a specific niche, you become more valuable and harder to replace.

- General vs. Specialized Customer Service: A general call center agent handling basic inquiries might earn $16/hour. A Tier 2 Technical Support Representative who can troubleshoot software issues or a Bilingual Customer Service Representative (especially Spanish) can easily earn $19-$23/hour for the same base-level experience. A Financial Services Customer Representative who is licensed to discuss specific investment products will earn even more.

- General vs. Specialized Administrative Work: A general office assistant's duties might be covered by a $16/hour wage. However, a Legal Assistant or Paralegal with knowledge of legal terminology and procedures will start at a much higher rate. Similarly, an assistant who specializes in Medical Billing and Coding is a specialized healthcare professional with significantly higher earning potential than a general medical receptionist.

- Retail Generalist vs. Specialist: A cashier or general sales associate at a department store may earn a standard wage. An associate who works in a specialized department like high-end electronics, luxury cosmetics, or commissioned furniture sales can earn a higher base wage plus substantial commissions.

###

In-Demand Skills

Regardless of your official title, the specific skills you possess are your currency in the job market. Cultivating high-value skills is the most direct way to increase your hourly wage.

Skills That Can Immediately Boost Your Pay Beyond $16/Hour:

- Technical Proficiency:

- Advanced Microsoft Excel: Knowing VLOOKUP, pivot tables, and basic macros is a massive advantage in any office role.

- CRM Software: Experience with platforms like Salesforce, HubSpot, or Zendesk is highly sought after in sales and customer service.

- Bookkeeping Software: Proficiency in QuickBooks or similar software is a ticket to higher-paying administrative and bookkeeping roles.

- Typing Speed and Accuracy: For data entry and administrative roles, a high WPM (Words Per Minute) count is a quantifiable skill that can justify better pay.

- Communication Skills:

- Bilingualism: The ability to speak a second language, particularly Spanish, is in high demand in almost every customer-facing industry and often comes with a pay differential.

- Technical Writing: The ability to write clear, concise instructions or documentation is valuable in support and administrative roles.

- Public Speaking/Presentation Skills: Even at an entry level, being comfortable presenting information to a team can set you up for leadership roles.

- Industry-Specific Skills:

- De-escalation and Conflict Resolution: Essential in customer service, healthcare, and security, and a key skill for moving into lead positions.

- HIPAA Compliance: For anyone in or adjacent to healthcare, understanding patient privacy laws is mandatory and a valuable line on a resume.

- Sales/Upselling Techniques: In retail or customer service, the ability to ethically increase sales revenue is a skill that directly pays for itself and is often rewarded with bonuses or commissions.

By strategically developing these factors—gaining a