What is an Annualized Salary? A Guide for Savvy Professionals

Navigating the world of job offers, compensation packages, and financial planning can be complex. While some offers come with a straightforward annual salary, many others—especially for part-time, contract, or seasonal roles—are presented in hourly, weekly, or project-based terms. This is where understanding the concept of annualized salary becomes a critical skill, transforming confusing numbers into a clear, comparable figure that empowers your career decisions. This guide will demystify the term, show you how to calculate it, and explain why it's a powerful tool in your professional toolkit.

What Does "Annualized Salary Meaning" Actually Mean? A Clear Definition

An annualized salary is a projection of how much you would earn over a full calendar year based on your earnings from a shorter period. It's an estimate, not a guaranteed amount. The primary purpose is to convert different pay rates (hourly, weekly, monthly, seasonal) into a common, year-long format for easy comparison and financial planning.

Think of it as the financial equivalent of asking, "If I continued earning at this rate for a full year, what would my total income be?"

This is fundamentally different from a salaried employee's annual salary, which is a fixed, predetermined amount paid over one year, as agreed upon in an employment contract. An annualized salary is a calculation, whereas an annual salary is a contractual figure.

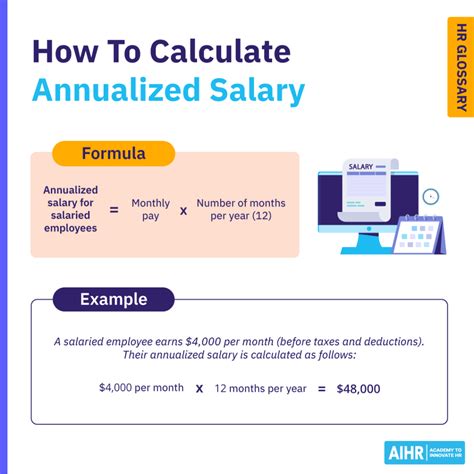

How to Calculate Your Annualized Salary

The formula for annualizing your income is simple in principle. The key is to know the number of pay periods in a full year for your pay frequency.

Standard Pay Periods in a Year:

- Hourly: Assumes a 40-hour work week.

- Weekly: 52 pay periods

- Bi-weekly (every two weeks): 26 pay periods

- Semi-monthly (twice a month): 24 pay periods

- Monthly: 12 pay periods

- Quarterly: 4 pay periods

Here are a few common scenarios:

#### Example 1: Calculating from an Hourly Wage

Let's say you're offered a part-time job at $25 per hour and expect to work 20 hours per week.

1. Calculate weekly earnings: $25/hour * 20 hours/week = $500 per week

2. Annualize the weekly earnings: $500/week * 52 weeks/year = $26,000 annualized salary

#### Example 2: Calculating from a Bi-Weekly Paycheck

You've just started a new job and your first bi-weekly, pre-tax paycheck is $2,300.

1. Identify the number of pay periods: A bi-weekly schedule has 26 pay periods per year.

2. Annualize the paycheck: $2,300/paycheck * 26 paychecks/year = $59,800 annualized salary

This figure is incredibly useful. For reference, the U.S. Bureau of Labor Statistics (BLS) reported that the median usual weekly earnings for full-time wage and salary workers in the second quarter of 2023 was $1,118. Annualized, this comes to $58,136, so a bi-weekly paycheck of $2,300 puts you right near the national median.

#### Example 3: Calculating for a Seasonal or Contract Role

Imagine you land a 3-month contract job that pays a total of $18,000.

1. Determine your monthly earnings: $18,000 / 3 months = $6,000 per month

2. Annualize the monthly earnings: $6,000/month * 12 months/year = $72,000 annualized salary

This shows that while the contract itself is only $18,000, the work commands a high-value rate equivalent to a $72,000 full-time salary.

Key Factors: Why Annualized Salary is Crucial for Your Career

Understanding this calculation isn't just a math exercise; it's a strategic tool. Here’s how it impacts different aspects of your professional life.

###

Comparing Job Offers

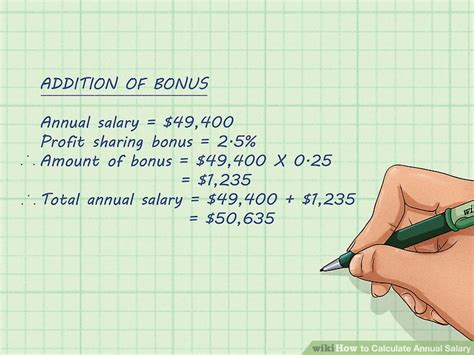

This is the most common and powerful use case. Imagine you have two offers:

- Offer A: A full-time salaried position at $65,000 per year.

- Offer B: A contract role paying $40 per hour, expecting 40 hours per week.

Without annualizing, it's difficult to compare these. Let's calculate for Offer B:

- $40/hour * 40 hours/week * 52 weeks/year = $83,200 annualized salary.

Suddenly, Offer B looks much more lucrative. However, you must also factor in that contract roles often don't include benefits like health insurance, paid time off, or retirement contributions, which have significant monetary value. Annualizing gives you the baseline number you need to start making a true apples-to-apples comparison.

###

Financial Planning and Budgeting

For freelancers, gig workers, or anyone with variable income, annualizing your earnings is essential for financial stability. If you have a great month and earn $7,000, annualizing it ($7,000 x 12 = $84,000) can give you a confidence boost. Conversely, if you have a slow month and earn $3,000 ($3,000 x 12 = $36,000), it serves as a reality check to adjust your budget and business development efforts. This helps you set realistic long-term goals for saving, investing, and major purchases like a home or car.

###

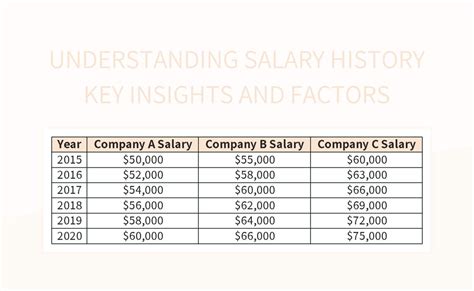

Understanding Mid-Year Raises or New Jobs

If you start a new job or receive a raise in the middle of the year, your W-2 at the end of the year won't reflect your new earning power. For example, you start a job on July 1st with a salary of $70,000. Your W-2 will only show $35,000 in earnings for that year. When applying for a loan or planning for the next year, your annualized salary of $70,000 is the accurate figure to use for your income.

###

For Employers: Projecting Labor Costs

From the other side of the desk, employers use annualization constantly. When they consider hiring a part-time employee or a contractor, they annualize the cost to understand its long-term impact on the budget. Knowing this helps you understand their perspective during salary negotiations. When you state your hourly rate, a savvy hiring manager is already converting it to an annual figure in their head.

###

Evaluating Freelance and Gig Economy Income

In the modern economy, more professionals are building careers from multiple income streams. You might drive for a rideshare service, do freelance graphic design, and work a retail job on weekends. Annualizing the income from each stream helps you understand which is most valuable and where to focus your energy for maximum earning potential.

Job Outlook Context: Where Does This Fit In?

The concept of annualized salary is becoming more important as work arrangements diversify. The BLS projects that gig economy and non-traditional work will continue to be a significant part of the labor market. As more roles shift to contract, freelance, or part-time structures, being able to accurately calculate and communicate your earning power through an annualized figure is no longer just helpful—it's essential for career growth. Whether you're a software developer comparing contract rates or a project manager evaluating a part-time consulting gig, annualization is your guide. According to Salary.com, even within the same job title, salaries can vary widely, making rate-to-salary conversion a vital skill for assessing your market value.

Conclusion: A Powerful Tool for Your Career Toolkit

Ultimately, "annualized salary" is more than a financial buzzword; it's a lens through which you can view your earning potential with clarity and confidence.

Key Takeaways:

- It's a Projection, Not a Promise: An annualized salary is an estimate used for comparison and planning, especially useful for non-salaried roles.

- Empowers Job Comparisons: It allows you to weigh diverse offers (hourly, contract, part-time) against traditional salaried roles.

- Essential for Financial Planning: It provides a stable, year-long income figure for budgeting and goal-setting, particularly for those with variable income.

- A Universal Language: Both employees and employers use this calculation, making it a key concept in salary negotiations and financial discussions.

By mastering this simple calculation, you equip yourself with the knowledge to better negotiate your worth, plan your financial future, and make strategic career moves that align with your long-term goals.