Ever looked at a property, a piece of art, or a business and wondered, "What is that *really* worth?" This question isn't just a matter of curiosity; it's the foundation of countless financial decisions, from securing a mortgage to settling an estate. For those with a keen analytical mind, a love for research, and an impeccable eye for detail, answering this question professionally can be a highly rewarding and lucrative career. This is the world of the appraisal agent.

Pursuing a career as an appraisal agent, more formally known as a real estate appraiser, offers a unique blend of fieldwork, data analysis, and independent problem-solving. It's a profession critical to the health of the economy, providing the objective valuations that banks, investors, and individuals rely on. The potential for a substantial appraisal agent salary is a significant draw, with the U.S. Bureau of Labor Statistics reporting a median annual wage of $64,980 as of May 2023, and top earners commanding well over six figures.

In my years as a career analyst, I've seen firsthand how crucial this role is. I once worked with a family who was selling the home their parents had built by hand. To them, the house was priceless, filled with memories. But to the bank and a potential buyer, it needed a concrete, defensible number. The appraiser who handled their case did so with not only incredible technical skill but also with a deep sense of empathy, understanding that their report was more than just numbers on a page—it was the key to this family's next chapter. This is the true impact of an expert appraiser.

This comprehensive guide will serve as your roadmap to understanding and achieving a successful career in appraisal. We will delve deep into every facet of the appraisal agent salary, explore the factors that can maximize your earning potential, and lay out a clear, step-by-step path to getting started.

### Table of Contents

- [What Does an Appraisal Agent Do?](#what-does-an-appraisal-agent-do)

- [Average Appraisal Agent Salary: A Deep Dive](#average-appraisal-agent-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does an Appraisal Agent Do?

Before we dive into the financial aspects, it's essential to understand the core function of an appraisal agent. While the term "appraisal agent" can be used broadly, it most commonly refers to a Real Estate Appraiser or Assessor. These professionals are the impartial arbiters of property value. They provide objective, well-supported opinions on the market value of real estate, which can range from single-family homes to sprawling commercial complexes.

Their work is foundational to the real estate and financial industries. A lender won't issue a mortgage without an appraisal to ensure the property is adequate collateral for the loan. A court may require an appraisal to divide assets in a divorce or estate settlement. Insurance companies use appraisals to determine replacement costs.

Core Responsibilities and Daily Tasks:

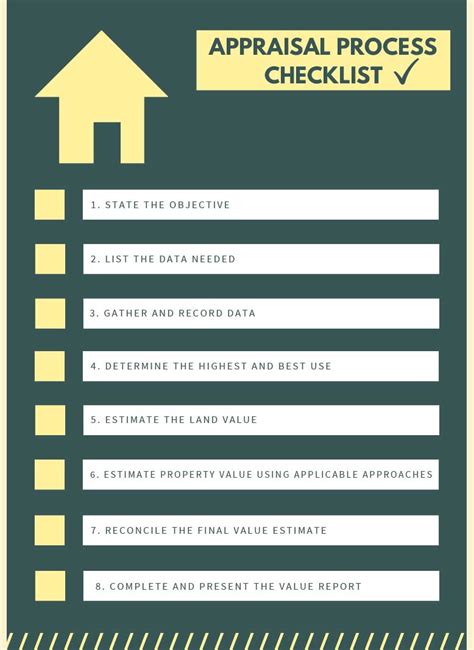

An appraiser's job is a methodical process that blends on-site investigation with behind-the-scenes analysis. Their duties typically include:

- On-Site Property Inspection: This is the fieldwork component. Appraisers visit properties to measure dimensions, assess the physical condition of the structure, note any unique features or defects, and take detailed photographs. They evaluate the quality of construction, the condition of the interior and exterior, and the functionality of the layout.

- Data Collection and Verification: Appraisers gather a vast amount of data. This includes public records on the property (deeds, tax records, zoning information) and data on comparable properties ("comps") that have recently sold in the area. They must verify the accuracy of this data through public databases like the Multiple Listing Service (MLS), county records, and sometimes direct contact with real estate agents or buyers.

- Market Analysis: They analyze local and regional market trends. Is the market appreciating or depreciating? How long are properties staying on the market? What is the inventory of available homes? This context is crucial for determining a property's value at a specific point in time.

- Valuation Analysis: This is the heart of the job. Appraisers typically use three main approaches to determine value:

1. Sales Comparison Approach: The most common method for residential properties, this involves comparing the subject property to similar, recently sold properties and making adjustments for differences (e.g., one home has a pool, another has a newer roof).

2. Cost Approach: This involves calculating the cost to replace the structure (including labor and materials), subtracting depreciation, and then adding the value of the land. It's often used for new construction or unique properties like schools or churches.

3. Income Approach: Primarily used for commercial or investment properties (like apartment buildings or office spaces), this approach determines value based on the income the property generates.

- Report Generation: The final product of an appraiser's work is a detailed, formal report. This legal document outlines the entire process, including the data collected, the analysis performed, and the final opinion of value. This report must conform to strict industry standards, primarily the Uniform Standards of Professional Appraisal Practice (USPAP).

> ### A Day in the Life of a Residential Appraiser

>

> 8:00 AM - 9:30 AM: Office Prep & Scheduling

> The day begins at the home office. You review your schedule, confirming two property inspections for the day. You pull the initial property data from the MLS for a new appraisal order that came in overnight, noting key features to look for during the inspection. You respond to emails from a lender who had a question about a report you submitted yesterday.

>

> 9:30 AM - 11:00 AM: First Property Inspection

> You drive to a suburban single-family home. After greeting the homeowner, you begin your methodical inspection. You walk the exterior, taking photos and noting the condition of the roof, siding, and landscaping. Inside, you use a laser measure to get precise room dimensions, sketch a floor plan, and photograph every room, paying close attention to upgrades (like a remodeled kitchen) or signs of deferred maintenance (like water stains).

>

> 11:00 AM - 1:00 PM: Research & Data Pull

> Back at the office, you upload your photos and start the deep research on the property you just visited. You search the MLS and public records for the best "comps"—at least three similar homes that have sold in the last six months within a one-mile radius. You scrutinize the details of these comps, comparing square footage, lot size, number of bedrooms/bathrooms, and condition.

>

> 1:00 PM - 1:30 PM: Lunch Break

>

> 1:30 PM - 3:00 PM: Second Property Inspection

> You head to a condominium downtown for your second inspection. The process is similar, but you pay special attention to the building's common elements, amenities (pool, gym), and the homeowner's association (HOA) fees, as these all impact value.

>

> 3:00 PM - 5:30 PM: Report Writing & Analysis

> The rest of the afternoon is dedicated to analysis and writing. You create the "sales comparison grid" for the first property, making dollar-value adjustments for differences between the subject property and the comps. This requires careful judgment and market knowledge. You then begin writing the narrative of the report, describing the property, the neighborhood, and the market, and clearly explaining your rationale for the final value conclusion. You aim to complete and deliver one full report each day to maintain a steady workflow.

Average Appraisal Agent Salary: A Deep Dive

The appraisal agent salary is not a single, fixed number but a wide spectrum influenced by numerous factors. However, by examining data from authoritative sources, we can build a clear picture of the earning potential in this field. Most appraisal agents are compensated either through a straight salary (if working for a government agency or a large bank) or, more commonly, on a fee-split basis where they earn a percentage of the fee charged for each appraisal they complete. This fee-based structure means that efficiency and volume directly impact total earnings.

National Averages and Salary Ranges

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for Appraisers and Assessors of Real Estate was $64,980 in May 2023. This is the midpoint, meaning half of all appraisers earned more than this, and half earned less.

The BLS provides a more detailed breakdown of the salary spectrum:

- Lowest 10%: Earned less than $36,610

- Median (50%): Earned $64,980

- Highest 10%: Earned more than $124,140

This wide range highlights the significant growth potential within the career. Entry-level trainees will start at the lower end, while experienced, certified general appraisers working on complex commercial properties will populate the highest-earning bracket.

Leading salary aggregator websites provide further granularity, often reflecting data from professionals actively in the field.

- Salary.com (as of late 2023) reports the median salary for a Real Estate Appraiser in the United States is $62,798, with a typical range falling between $54,342 and $72,836.

- Payscale.com shows a similar average base salary of around $61,000, but also indicates that total pay, including bonuses and profit sharing, can reach up to $98,000 for experienced professionals.

- Glassdoor lists a national average salary of approximately $73,600, which often includes base pay plus additional compensation reported by its users.

The slight variations between sources are normal and depend on their unique datasets and calculation methods. The consistent theme is a median salary in the low-to-mid $60,000s, with a clear path to earning $100,000 or more with the right experience and credentials.

Salary Progression by Experience Level

Your earning potential as an appraiser will grow substantially as you move from a trainee to a seasoned expert. The fee-split model particularly rewards experience, as seasoned appraisers can complete complex reports more efficiently and command higher fees.

Here is a typical salary progression based on aggregated data from Payscale and industry insights:

| Experience Level | Typical Title(s) | Typical Annual Salary Range | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Appraiser Trainee, Associate Appraiser | $35,000 - $50,000 | Works under a certified supervisory appraiser. Focuses on learning the fundamentals, assisting with inspections, and completing required training hours. Compensation is often a lower fee split or an hourly wage. |

| Mid-Career (3-9 years) | Licensed Residential Appraiser, Certified Residential Appraiser | $55,000 - $85,000 | Independently appraises residential properties (typically non-complex, under $1 million). Has established a client base (lenders, AMCs). Compensation is primarily fee-based, rewarding efficiency. |

| Senior/Experienced (10-20+ years) | Certified General Appraiser, Senior Appraiser, Principal | $85,000 - $150,000+ | Holds the highest level of certification. Can appraise all types of real estate, including complex commercial properties (office buildings, hotels, industrial sites), which command much higher fees. May own their own firm or manage a team of appraisers. |

Dissecting Total Compensation: More Than Just a Salary

For many appraisers, especially those not working on a fixed government salary, "total compensation" is a more accurate measure of earnings than base salary alone.

- Fee Splits: The most common model in private practice. A trainee might start on a 30/70 or 40/60 split (they receive 30-40% of the appraisal fee). An experienced, licensed appraiser in a firm might command a 50/50 or 60/40 split. Independent appraisers who own their own business keep 100% of the fee but are also responsible for all overhead costs (software, insurance, marketing).

- Bonuses: In larger firms or banks, annual or quarterly performance bonuses may be awarded based on the volume and quality of work completed.

- Profit Sharing: Some appraisal firms offer a profit-sharing plan, allowing employees to receive a portion of the company's profits, incentivizing everyone to work towards the firm's success.

- Benefits: When comparing a salaried position (e.g., at a bank) to an independent or fee-split role, it's crucial to factor in the value of benefits. Salaried roles typically include health insurance, retirement plans (like a 401k with a company match), paid time off, and disability insurance. An independent appraiser must fund all of these out of their own earnings.

- Reimbursements: Many firms will reimburse appraisers for mileage, software licensing fees (like MLS access), and continuing education costs, which can add thousands of dollars in value per year.

Understanding this complete compensation picture is vital when evaluating job offers and career paths within the appraisal industry.

Key Factors That Influence Salary

While the national averages provide a useful benchmark, an individual's appraisal agent salary is ultimately determined by a combination of personal qualifications, professional choices, and market forces. Mastering these factors is the key to maximizing your income. This is the most critical section for anyone serious about building a high-earning appraisal career.

### Level of Education and Certification

In the appraisal profession, your license is your livelihood. The level of license you hold is arguably the single most important factor determining your scope of work and, consequently, your earning potential. The Appraiser Qualifications Board (AQB) of The Appraisal Foundation sets the minimum national standards, which are then implemented (and sometimes exceeded) by individual state licensing boards.

- Appraiser Trainee: This is the starting point. You must work under the direct supervision of a Certified Appraiser. Your earnings are limited as you receive a small portion of the appraisal fee. The primary goal at this stage is to accumulate the required experience hours to upgrade your license.

- Licensed Residential Appraiser: To achieve this, you need to complete qualifying education, accumulate a set number of experience hours (typically 1,000-2,000 hours over at least 6-12 months), and pass the Licensed Residential Appraiser exam. This license allows you to appraise non-complex 1-4 unit residential properties with a transaction value up to $1 million. This opens the door to independent work on standard mortgage appraisals and significantly increases earning potential over a trainee.

- Certified Residential Appraiser: This is the next tier. It requires more education, more experience hours (typically 1,500-2,500 hours over at least 18-24 months), and passing a more rigorous exam. A Certified Residential Appraiser can appraise any 1-4 unit residential property, regardless of its value or complexity. This is a crucial step for those wanting to work in high-cost-of-living areas or appraise luxury homes, leading to a notable salary bump.

- Certified General Appraiser: This is the highest level of state licensure and offers the greatest earning potential. It demands the most extensive education and experience (typically 3,000 hours, with a significant portion in non-residential work, over at least 30 months), often requiring a bachelor's degree. A Certified General Appraiser can appraise *any* type of real property, including commercial, industrial, and agricultural properties. Commercial appraisal fees are substantially higher than residential fees, often running into many thousands of dollars per assignment. This is the path to the six-figure salaries seen at the top end of the profession.

Beyond state licensure, professional designations from organizations like the Appraisal Institute can further boost credibility and income. The MAI (Member, Appraisal Institute) designation is the gold standard for commercial appraisers, while the SRA (Senior Residential Appraiser) is the premier designation for residential specialists. Earning these requires rigorous coursework, a comprehensive exam, and a demonstration of experience that goes beyond state requirements. An appraiser with an MAI designation can command the highest fees and is sought after for the most complex and high-stakes valuation assignments.

### Years of Experience

As with most professions, experience directly correlates with income. However, in appraisal, this correlation is exceptionally strong due to the nature of fee-based work and the trust-based relationships that drive business.

- Early Career (0-4 Years): The initial years are focused on learning and building speed. Your income will grow steadily as you move from Trainee to Licensed status. You'll become faster at inspections, more efficient at research, and more confident in your adjustments.

- Mid-Career (5-15 Years): During this phase, you build a reputation for quality and reliability. Lenders and appraisal management companies (AMCs) will begin to favor you for assignments in your geographic area. You may transition from working for a firm to starting your own business. This is where many appraisers see their income jump from the $60k-$70k range to the $80k-$100k+ range. Your deep knowledge of a specific sub-market becomes a valuable asset.

- Peak Career (15+ Years): Highly experienced appraisers, especially Certified General Appraisers, are at the top of the earnings ladder. They are sought after not just for mortgage work but also for litigation support (expert witness testimony), estate planning, tax appeals, and portfolio valuation for large investors. They may run successful firms with multiple appraisers working under them, generating income from both their own work and a share of their employees' work. Earning $150,000 to $200,000 or more is achievable at this stage, particularly for those with a strong business acumen and an MAI designation.

### Geographic Location

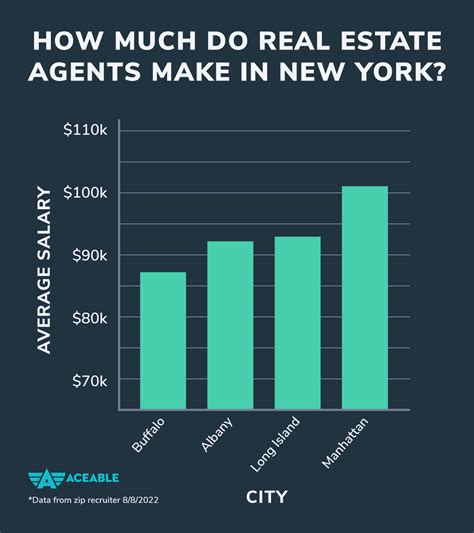

Where you work has a massive impact on your appraisal agent salary. This is driven by two main factors: the cost of living and the volume and value of real estate transactions.

Top-Paying States and Metropolitan Areas:

States with high property values and bustling real estate markets naturally offer higher appraisal fees and more work. According to BLS data, the top-paying states for appraisers and assessors are:

1. District of Columbia: Average annual salary of ~$101,470

2. California: Average annual salary of ~$90,650

3. Washington: Average annual salary of ~$86,300

4. Massachusetts: Average annual salary of ~$84,810

5. New York: Average annual salary of ~$84,060

Metropolitan areas within these and other states often pay even more. Cities like San Jose, San Francisco, New York City, Boston, and Seattle consistently rank among the highest-paying locations for appraisers due to the combination of extremely high property values and a high cost of living.

Lower-Paying Areas:

Conversely, states with lower property values and less economic activity will have lower average salaries. Rural areas and states in the South and Midwest, such as Mississippi, Arkansas, and West Virginia, typically fall on the lower end of the pay scale, with average salaries often in the $45,000 to $55,000 range. While the fees per appraisal are lower, the cost of living is also significantly less, which must be factored into any comparison.

### Company Type & Size

The type of organization you work for defines your work style, stability, and compensation structure.

- Large National Appraisal Firms & AMCs: These companies offer a high volume of work. You'll likely work on a fee-split basis. The pros are a steady stream of assignments and minimal need for self-marketing. The cons can be lower fee splits and pressure to complete reports quickly.

- Small, Local Appraisal Firms: Working in a small firm (2-10 appraisers) can offer a more collaborative environment and potentially better fee splits. You might also get exposure to a wider variety of property types and have a closer relationship with a mentoring senior appraiser.

- Lending Institutions (Banks & Credit Unions): Many larger banks employ their own in-house staff appraisers. These are typically salaried positions with regular hours and a full benefits package. This path offers high stability and predictable income but may lack the high-end earning potential of a top-performing fee-based appraiser.

- Government (Assessor's Offices): County and municipal governments employ assessors to value property for tax purposes. These are stable, salaried government jobs with excellent benefits and retirement plans. The work is different from fee appraisal, focusing on mass appraisal techniques rather than single-property reports for lending purposes. The salary ceiling may be lower than in the private sector.

- Independent Contractor / Self-Employed: The ultimate goal for many appraisers. Being your own boss means you keep 100% of the appraisal fee. This offers the highest earning potential but also comes with the most risk and responsibility. You are responsible for all marketing, client relations, accounting, insurance, technology, and benefits. Success hinges on strong entrepreneurial skills in addition to appraisal expertise.

### Area of Specialization

Specializing in a particular niche is a powerful way to increase your value and income.

- Residential vs. Commercial: This is the most significant fork in the road.

- Residential: Focuses on 1-4 unit family homes. The volume is high, but the fees per appraisal are lower (typically $400 - $1,000). Success depends on efficiency and volume.

- Commercial: Focuses on income-producing properties like office buildings, retail centers, hotels, or industrial warehouses. The work is far more complex, takes much longer (weeks instead of days), and the reports are extensive. The fees are proportionally higher, ranging from $3,000 to $10,000 or much more for very complex assignments. This is the domain of Certified General Appraisers.

- Niche Specializations: Within commercial or residential, further specialization can make you a go-to expert. Examples include:

- Luxury and High-Value Properties: Requires a Certified Residential license and a deep understanding of unique features and high-end markets.

- Green Buildings and Sustainability: Appraising properties with LEED certification or energy-efficient features is a growing field.

- Litigation and Expert Witness Testimony: Requires impeccable report writing, a commanding knowledge of standards, and the ability to defend your valuation in court. This work pays a premium hourly rate.

- Agricultural Land: A highly specialized field requiring knowledge of soil types, crop yields, and government programs.

- Review Appraisal: Reviewing the work of other appraisers for quality control on behalf of lenders or AMCs.

### In-Demand Skills

Beyond your license, certain skills can directly translate to a higher appraisal agent salary.

- Technical & Analytical Skills:

- Advanced Data Analysis: The ability to use statistical analysis and regression modeling to support valuations is increasingly important.

- Software Proficiency: Mastery of industry-standard software like ACI, TOTAL, and particularly Argus Enterprise (for commercial real estate) is essential. Argus proficiency is a prerequisite for most high-paying commercial appraisal jobs.

- GIS (Geographic Information Systems): The ability to use mapping software to analyze location data, flood zones, and market boundaries can enhance report quality.

- Business & Soft Skills:

- Client Management and Negotiation: For independent appraisers, the ability to build and maintain relationships with lenders, attorneys, and private clients is paramount. Negotiating fair fees is a key skill.

- Time Management and Efficiency: In a fee-based world, time is money. The ability to manage a pipeline of multiple assignments simultaneously without sacrificing quality is what separates average earners from high earners.

- Exceptional Written Communication: An appraisal report is a complex legal document. The ability to write clearly, concisely