Navigating the complexities of your paycheck can feel like a full-time job in itself. You put in the long hours, meet your deadlines, and contribute significantly to your company's success. But as you watch the clock tick past 40 hours in a week, a persistent and crucial question often arises: "I'm a salaried employee, so does any of this extra time count for anything?" It's a question steeped in misconception, whispered in breakrooms, and often misunderstood by both employees and employers. The common belief is that a salary is a flat fee for your work, regardless of whether you work 30 hours or 60. But is that the whole story?

The truth is far more nuanced and is governed by a complex set of federal and state laws. Misunderstanding these laws can cost employees thousands of dollars in earned wages each year. The U.S. Department of Labor estimates that wage theft, which includes unpaid overtime, is a multi-billion dollar problem annually. I once coached a highly talented graphic designer who was consistently working 55-hour weeks for a boutique agency. She was salaried and simply assumed it was "part of the hustle." After we reviewed her actual day-to-day duties against federal guidelines, it became clear she was misclassified and was owed a significant amount in back overtime pay—a life-changing realization.

This guide is designed to be your definitive resource to demystify this topic. We will dissect the federal laws, break down the critical tests that determine your eligibility, and provide you with the knowledge to understand your rights. Whether you're a new graduate starting your first salaried job or a seasoned professional questioning your pay structure, this article will equip you with the authoritative information you need.

### Table of Contents

- [The Core Distinction: Exempt vs. Non-Exempt Employees](#the-core-distinction-exempt-vs-non-exempt-employees)

- [Understanding the Salary Threshold Test for Overtime Eligibility](#understanding-the-salary-threshold-test-for-overtime-eligibility)

- [Key Factors That Determine Overtime Exemption Status](#key-factors-that-determine-overtime-exemption-status)

- [The Evolving Landscape of Overtime Law: Trends and Future Changes](#the-evolving-landscape-of-overtime-law-trends-and-future-changes)

- [What to Do If You Believe You're Owed Overtime: A Practical Guide](#what-to-do-if-you-believe-youre-owed-overtime-a-practical-guide)

- [Conclusion: Empower Yourself with Knowledge](#conclusion-empower-yourself-with-knowledge)

The Core Distinction: Exempt vs. Non-Exempt Employees

At the heart of the overtime question is not whether you are paid a salary, but whether your specific job role is classified as "exempt" or "non-exempt" under the Fair Labor Standards Act (FLSA). This single distinction is the most critical piece of the puzzle.

The FLSA is the federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments. It mandates that most employees in the United States must be paid at least the federal minimum wage for all hours worked and overtime pay at a rate of one and a half times their regular rate of pay for all hours worked over 40 in a workweek.

Non-Exempt Employees: A "non-exempt" employee is one who is *not exempt* from the FLSA's overtime rules. This means they are entitled to overtime pay. The vast majority of workers in the U.S. are non-exempt. It doesn't matter if they are paid on a salaried, hourly, or piece-rate basis; if their job does not meet the specific exemption criteria set by the Department of Labor (DOL), they must be paid overtime.

Exempt Employees: An "exempt" employee is one who is *exempt* from the FLSA's overtime rules. To be considered exempt, an employee must meet all three of the following tests:

1. The Salary Basis Test: The employee must be paid on a salary basis, meaning they receive a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. The Salary Level Test: The employee's salary must meet a minimum specified amount. (We will cover this in detail in the next section).

3. The Duties Test: The employee's primary job duties must involve the kind of work associated with exempt executive, administrative, professional, computer, or outside sales employees.

An employer cannot simply declare that a job is exempt. The actual tasks and responsibilities of the job must fit the DOL's strict definitions. Job titles are irrelevant. An "Administrative Assistant" could be non-exempt, while a "Project Coordinator" with the same title at a different company could be exempt, based entirely on their day-to-day duties.

### A Scenario in the Life: Exempt vs. Non-Exempt Pay

To illustrate the difference, let's imagine two employees, Anna (Non-Exempt) and Ben (Exempt). Both have a base salary that equates to $1,000 per week. A major project requires both of them to work 50 hours in a particular week.

- Ben (Exempt): Ben's role meets the salary level, salary basis, and duties tests for the Administrative Exemption. He receives his regular weekly salary of $1,000. He is not entitled to any additional pay for the 10 overtime hours he worked. His effective hourly rate for that week is $20/hour ($1,000 / 50 hours).

- Anna (Non-Exempt): Anna is also paid on a salaried basis, but her job duties do not meet any of the exemption criteria. She is therefore non-exempt and entitled to overtime.

- Regular Rate of Pay: Her salary covers the first 40 hours. Her regular hourly rate is $25/hour ($1,000 / 40 hours).

- Overtime Rate: Her overtime rate is 1.5 times her regular rate: $25 x 1.5 = $37.50 per hour.

- Total Pay for the Week: She receives her $1,000 salary (for the first 40 hours) PLUS 10 hours of overtime pay.

- Overtime Pay: 10 hours x $37.50/hour = $375.

- Total Weekly Paycheck: $1,000 + $375 = $1,375.

In this scenario, Anna earns $375 more than Ben for the exact same number of hours worked, simply because of her FLSA classification. This demonstrates why understanding your status is not just a matter of principle—it's a matter of significant financial impact.

Understanding the Salary Threshold Test for Overtime Eligibility

While the duties an employee performs are crucial for determining exemption status, the first gate they must pass is the salary level test. If an employee's salary does not meet the minimum threshold set by the U.S. Department of Labor, they are automatically considered non-exempt and eligible for overtime, *regardless of their job duties*.

This threshold is a bright-line rule designed to protect lower-income salaried workers from being overworked without fair compensation.

### Current Federal Salary Thresholds (as of early 2024)

According to the DOL's final rule that took effect on January 1, 2020, the standard salary level is:

- $684 per week, which equates to $35,568 per year.

Any salaried employee earning less than this amount annually is non-exempt and must be paid overtime for hours worked beyond 40 in a week. There are no exceptions based on job duties if this salary threshold is not met.

Example: A "Store Manager" at a retail chain earns a salary of $34,000 per year. Even though their duties might align with the Executive Exemption (managing the store, directing employees), their salary is below the $35,568 threshold. Therefore, they are non-exempt and must be paid time-and-a-half for all overtime hours.

### The Highly Compensated Employee (HCE) Threshold

The DOL also has a separate, higher salary threshold for "Highly Compensated Employees" (HCEs). These employees are presumed to be exempt if they meet this higher salary level and satisfy a more minimal duties test.

- The current HCE total annual compensation threshold is $107,432 per year.

To qualify for the HCE exemption, an employee must earn at least this amount and also "customarily and regularly" perform at least one of the duties of an exempt executive, administrative, or professional employee. This is a much simpler duties test to meet than the standard tests for those exemptions.

### Important Note on Salary Calculation

For the purpose of the standard salary level test ($35,568), employers can use non-discretionary bonuses and incentive payments (including commissions) to satisfy up to 10% of the required salary level. To do this, these payments must be made at least annually.

For the HCE test, the total annual compensation of $107,432 can include commissions, non-discretionary bonuses, and other forms of non-discretionary compensation.

### Proposed Changes and Future Increases

The landscape of overtime law is dynamic. The DOL has announced a proposed rule that would significantly increase these salary thresholds. The proposed rule, published in the Federal Register in September 2023, suggests the following changes:

- Standard Salary Level: Increase to $1,059 per week ($55,068 per year).

- Highly Compensated Employee (HCE) Threshold: Increase to $143,988 per year.

- Automatic Updates: The proposal also includes a mechanism to automatically update these thresholds every three years to reflect current earnings data.

While this rule is not yet final, it signals a strong push to expand overtime protections to millions more salaried workers. If enacted, many employees who are currently exempt because their salary is between $35,568 and the new proposed threshold of $55,068 would automatically become non-exempt and eligible for overtime pay. This is a critical development for all salaried employees to monitor. You should always refer to the official [U.S. Department of Labor Wage and Hour Division (WHD) website](https://www.dol.gov/agencies/whd/overtime) for the most current, up-to-date information on salary thresholds.

Key Factors That Determine Overtime Exemption Status

If an employee meets both the salary basis and salary level tests, the final and most complex hurdle is the duties test. The employee's *primary duty* must align with one of the specific exemption categories defined by the DOL. "Primary duty" means the principal, main, major, or most important duty that the employee performs.

Remember, a job title does not determine exempt status. It is the actual work performed that matters. Let's explore the most common "white-collar" exemptions in extensive detail.

###

The Executive Exemption

This exemption is intended for employees who are leaders and managers within a business. It's not enough to have "manager" in your title; your duties must reflect true managerial responsibility.

To qualify for the executive exemption, an employee must meet all of the following criteria:

1. Primary Duty: The employee's primary duty must be managing the enterprise or a customarily recognized department or subdivision of the enterprise.

2. Direction of Employees: The employee must customarily and regularly direct the work of at least two or more other full-time employees (or their equivalent, e.g., four part-time employees).

3. Hiring/Firing Authority: The employee must have the authority to hire or fire other employees, or their suggestions and recommendations as to the hiring, firing, advancement, promotion, or any other change of status of other employees must be given particular weight.

Real-World Application:

- Likely Exempt: The General Manager of a restaurant who is responsible for the entire P&L, creates the weekly work schedules, hires all kitchen and front-of-house staff, conducts performance reviews, and has the authority to terminate employees. Their primary duty is management.

- Likely Non-Exempt: A "Shift Lead" at the same restaurant whose primary duty is working as a server alongside other staff. While they might occasionally be asked for input on a new hire and may be responsible for locking up, they do not have true authority to hire/fire, and their main job is performing the same non-exempt work as their subordinates. This is often referred to as a "working foreman" and is a common area of misclassification.

###

The Administrative Exemption

This is arguably the most frequently misunderstood and misapplied exemption. It is not for clerical or secretarial work. It is designed for employees whose work is essential to the running of the business itself, rather than the hands-on production or sales work.

To qualify for the administrative exemption, an employee must meet both of the following criteria:

1. Primary Duty: The employee's primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer's customers.

2. Discretion and Independent Judgment: The employee's primary duty must include the exercise of discretion and independent judgment with respect to matters of significance.

Breaking Down the Key Phrases:

- "Directly related to the management or general business operations": This refers to work in functional areas like tax, finance, accounting, budgeting, auditing, insurance, quality control, purchasing, procurement, advertising, marketing, research, safety and health, human resources, employee benefits, labor relations, public relations, government relations, computer network/internet/database administration, and legal/regulatory compliance.

- "Discretion and independent judgment": This is the crucial part. It implies that the employee has the authority to make an independent choice, free from immediate direction or supervision. They must compare and evaluate possible courses of conduct and act or make a decision after considering the various possibilities. Factors to consider include:

- Does the employee have authority to formulate, affect, interpret, or implement management policies or operating practices?

- Does the employee carry out major assignments in conducting the operations of the business?

- Does the employee perform work that affects business operations to a substantial degree?

- Does the employee have authority to commit the employer in matters that have significant financial impact?

- Does the employee have authority to waive or deviate from established policies and procedures without prior approval?

Real-World Application:

- Likely Exempt: A Human Resources Generalist who advises management on compliance with employment law, investigates employee complaints and recommends disciplinary action, develops company policies, and has the authority to interpret those policies.

- Likely Non-Exempt: An HR Assistant whose primary duties are clerical, such as screening résumés to match minimum qualifications, processing payroll changes dictated by others, maintaining employee files, and answering basic employee questions by referring to a policy manual. They are not exercising independent judgment on matters of significance.

- Likely Exempt: A Marketing Manager who develops the annual marketing strategy and budget for a product line, has the authority to select advertising vendors, and makes significant decisions about campaign messaging and channels.

- Likely Non-Exempt: A "Marketing Coordinator" whose primary job is to implement the manager's strategy by performing tasks like data entry into a CRM, scheduling social media posts written by others, and ordering promotional materials from a pre-approved list.

###

The Professional Exemption

This exemption covers two distinct types of professionals: "Learned Professionals" and "Creative Professionals."

1. The Learned Professional Exemption:

This is for jobs that require advanced knowledge in a field of science or learning.

To qualify, an employee must meet the following criteria:

- Primary Duty: The performance of work requiring advanced knowledge.

- Field of Science or Learning: The advanced knowledge must be in a field of science or learning.

- Prolonged Course of Study: The advanced knowledge must be customarily acquired by a prolonged course of specialized intellectual instruction.

This means professions that have a high educational barrier to entry, such as doctors, lawyers, dentists, registered nurses (but not licensed practical nurses), teachers, architects, engineers, accountants (CPAs), and scientists. The work is predominantly intellectual in character and requires the consistent exercise of discretion and judgment.

2. The Creative Professional Exemption:

This is for jobs that require invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor.

To qualify, an employee's primary duty must be the performance of work requiring:

- Invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor. Examples include musicians, composers, conductors, soloists, painters, actors, and writers.

The determination here is on a case-by-case basis. A journalist who simply rewrites press releases or reports facts (e.g., public records) is likely non-exempt. A journalist who conducts investigative reports, writes opinion columns, or performs interpretive analysis would likely be exempt. A graphic designer whose primary duty is to create original, creative visual concepts is likely exempt. A graphic designer whose primary duty is to make minor modifications to existing templates using established standards may be non-exempt.

###

Other Key Exemptions

- Computer Employee Exemption: This is a specialized exemption for computer professionals. To qualify, an employee must meet the salary requirements OR be paid on an hourly basis of at least $27.63 per hour. Their primary duty must consist of work like the application of systems analysis techniques, the design/development/testing of computer systems or programs, or the design/testing of computer software. Important: This exemption does not apply to employees engaged in the manufacture or repair of computer hardware, nor does it apply to help desk staff or employees whose work is highly dependent on using computers but who are not computer systems professionals.

- Outside Sales Exemption: This exemption has no salary requirement. To qualify, an employee's primary duty must be making sales or obtaining orders/contracts for services, and they must be customarily and regularly engaged *away from* the employer's place of business. "Inside sales" employees (those who sell from an office via phone, email, or internet) do not qualify for this exemption and are generally non-exempt.

###

The Critical Impact of State Laws

This is a point that cannot be overstated: Federal law is the floor, not the ceiling. Many states have their own wage and hour laws that are more protective of employees than the FLSA. When state and federal laws conflict, the employer must follow the law that provides the greater benefit to the employee.

Key states with stricter overtime laws include:

- California: California has significantly higher salary thresholds for exempt employees, which are tied to the state minimum wage and vary by employer size. As of 2024, the minimum salary for an exempt employee in California is $66,560. California also has very specific and strict definitions for the duties tests, often requiring that an exempt employee spend more than 50% of their time on exempt tasks. California also mandates overtime for hours worked over 8 in a day, not just 40 in a week.

- New York: New York also has higher salary thresholds that vary by region (New York City, Long Island/Westchester, and the rest of the state). For example, the 2024 exempt salary threshold for NYC is $1,200/week ($62,400/year).

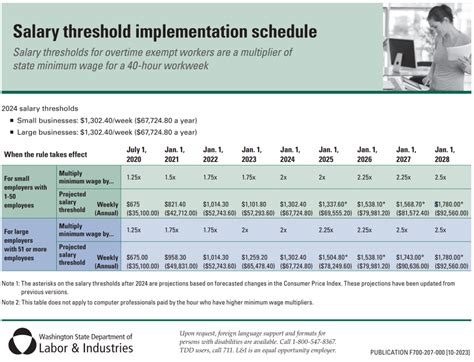

- Washington: Washington's salary thresholds are also on a multi-year schedule to increase and are tied to the state minimum wage.

- Alaska, Colorado, Nevada, and others also have their own specific rules regarding daily overtime or how exemptions are applied.

Actionable Advice: Always check the regulations from your specific state's Department of Labor or equivalent agency. A simple search for "[Your State] overtime laws" or "[Your State] exempt salary threshold" will usually lead you to the correct government resource. An employee who might be exempt under federal law could be non-exempt and entitled to overtime under their state's more stringent rules.

The Evolving Landscape of Overtime Law: Trends and Future Changes

The rules governing overtime pay are not static. They are constantly being debated, litigated, and updated to reflect the changing nature of work and the economy. Staying aware of these trends is crucial for both employees seeking to understand their rights and professionals aiming to stay compliant and competitive.

### Trend 1: Aggressive Regulatory Updates

As discussed previously, the Department of Labor's proposed rule to dramatically increase the exempt salary thresholds is the most significant trend on the immediate horizon. This move follows a pattern of presidential administrations using regulatory power to expand or contract overtime eligibility. The Obama administration attempted a similar large increase in 2016, which was ultimately blocked by a federal court. The Trump administration then implemented the more modest increase that is currently in effect.

The proposed 2023/2024 rule, if finalized, would re-classify millions of American workers from exempt to non-exempt status. Employers would face a stark choice:

1. Increase the salaries of newly non-exempt employees to meet the new threshold and maintain their exempt status.

2. Re-classify these employees as non-exempt and begin paying them overtime. This would likely involve either carefully managing their hours to stay at 40 per week or budgeting for the additional overtime pay.

What this means for you: If your salary is between the current threshold ($35,568) and the proposed threshold ($55,068), your overtime eligibility could change in the near future. It is vital to monitor news from the DOL and reputable HR news sources like the Society for Human Resource Management (SHRM) for updates on the final rule's status.

### Trend 2: The Impact of Remote and Hybrid Work

The massive shift to remote work has introduced new complexities into tracking work hours and defining the "workplace." For non-exempt employees, this has created challenges in accurately recording all compensable time. "Off the clock" work can become more common when the line between home and office is blurred. This includes time spent booting up systems, responding to after-hours emails and instant messages, and being "on-call." Under the FLSA, employers must pay for all time that they "suffer or permit" an employee to work, even if it wasn't pre-authorized.

For exempt employees, the "always-on" culture of remote work can lead to significant burnout, as there is no physical separation to signal the end of the workday. This has fueled discussions around a "right to disconnect."

### Trend 3: The "Right to Disconnect" Movement

While not yet federal law in the U.S., the "right to disconnect" is a growing global trend. Countries like France, Spain, and Italy have passed legislation that gives employees the right to not engage in work-related electronic communications (like emails or messages) outside of work hours.

In the U.S., some cities and states have proposed similar bills. While this movement is more about work-life balance than overtime pay directly, it is intrinsically linked. The core issue is the expectation of constant availability, which for non-exempt workers should be compensable time, and for exempt workers, contributes to unpaid labor and burnout. As this conversation evolves, it could lead to stricter requirements for employers on how and when they can contact employees after hours, potentially influencing future wage and hour regulations.

### Trend 4: Increased Scrutiny and Litigation

Misclassifying employees as exempt is one of the most common and costly mistakes an employer can make. The DOL's Wage and Hour Division is actively investigating these cases, and class-action lawsuits brought by private attorneys are on the rise. Industries like retail, hospitality, food service, and tech startups are often targeted because of the prevalence of "working manager" or ambiguous "coordinator" roles.

Companies are facing multi-million dollar settlements for misclassifying assistant managers, loan officers, IT support staff, and other roles who were salaried but did not meet the strict duties tests. This legal pressure is forcing many companies to be more cautious and to conduct internal audits of their job classifications, which may result in more salaried roles being correctly classified as non-exempt.

How to stay relevant and protected:

- Be a Lifelong Learner: Don't assume the rules you learned a decade ago are still in effect. Periodically check the DOL and your state's labor department websites.

- Document Everything: Regardless of your classification, keep a personal record of the hours you work. This is invaluable if you ever need to challenge your status.

- Review Your Job Description and Your Actual Duties: Do they align? Your job description should be a realistic reflection of what you spend the majority of your time doing. If your primary duty has shifted from strategic (exempt) to tactical (non-exempt), your classification may need to change too.

What to Do If You Believe You're Owed Overtime: A Practical Guide

Realizing that you might be misclassified and owed overtime pay can be intimidating. It's a sensitive issue that requires a careful, professional, and methodical approach. Acting rashly can damage professional relationships, while doing nothing can cost you significant earnings. Here is a step-by-step guide to navigate this process effectively.

### Step 1: Arm Yourself with Knowledge (Don't Accuse)

Before you approach anyone, do your homework. Reread the sections in this guide. Visit the DOL's FLSA website. Look up your state's specific overtime laws.

- Compare Your Job to the Duties Tests: Write down your primary day-to-day tasks. Be honest and objective. Do you *truly* exercise discretion and independent judgment on matters of significance? Do you *truly* have the authority to hire and fire? Does your primary role consist of performing the same work as the people you supervise?

- Check Your Salary: Is your weekly or annual salary above both the federal and your state's minimum threshold for exemption?

Your goal in this phase is not to build a legal case, but to form a well-reasoned belief. Approaching HR with a question is far more constructive than with an accusation.

### Step 2: Track Your Hours Meticulously

If you aren't already, start keeping a detailed, personal log of your work hours. This is the single most important piece of evidence you can have.

- Be Specific: Don't just write "9-6." Log your exact start time, your exact end time, and the duration of any unpaid meal breaks. Note when you check emails before or after your "official" workday.

- Use a Simple Method: A dedicated notebook, a spreadsheet on your personal computer, or a time-tracking app on your phone will work. Be consistent.

- Do This for Several Weeks: A pattern of consistent overtime over a month or two is much more compelling than a single long week.

### Step 3: Review Your Pay Stubs and Job Description

Gather your recent pay stubs and your official job description.

- Pay Stubs: Confirm your salary amount. Look for any language or codes that might indicate your FLSA status (though this is not always present).

- Job Description: Compare the duties listed in your official job description to the actual work you perform daily. Are there major discrepancies? Perhaps your role has evolved, but the documentation hasn't.

### Step 4: Schedule a Professional Conversation with HR or Your Manager

Once you have your information organized, it's time to raise the issue. In most cases, starting with your Human Resources department is the best path. They are trained in these regulations and are the appropriate channel for such queries. If you have a very small company without a dedicated HR person, you may need to speak with your direct manager or the business owner.

How to frame the conversation:

- Keep it calm and inquisitive, not confrontational. Your tone should be, "I'm trying to better understand my pay structure," not "You are breaking the law."

- Lead with a question: "Hi [HR Manager's Name], I was hoping you could help me. I was doing some reading to better understand federal and state pay regulations, and I'm a bit confused about how my role is classified. Could you walk me through whether my position is