In the complex world of compensation and employment law, few terms cause as much confusion as "salaried non-exempt." While it may sound like a specific job title, it's actually a crucial pay classification that combines the stability of a salary with the overtime protections of an hourly employee. Understanding this classification is key to knowing your rights and maximizing your earning potential.

This article breaks down what it means to be a salaried non-exempt employee, which roles often fall into this category, and how factors like experience, location, and industry affect your overall compensation.

What is a Salaried Non-Exempt Employee?

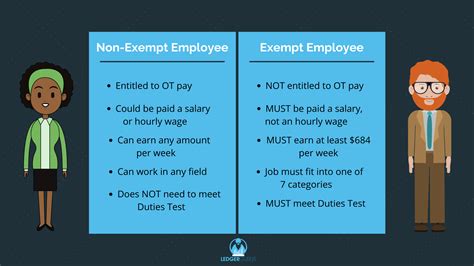

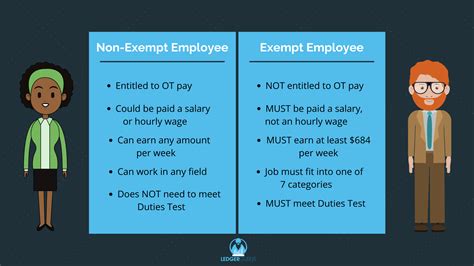

A salaried non-exempt employee is a professional who receives a fixed, predetermined salary each pay period but is also legally entitled to overtime pay under the Fair Labor Standards Act (FLSA).

Let's break that down:

- Salaried: You receive a consistent base salary (e.g., $55,000 per year) that doesn't fluctuate based on the quantity or quality of your work in a given week. This provides financial predictability.

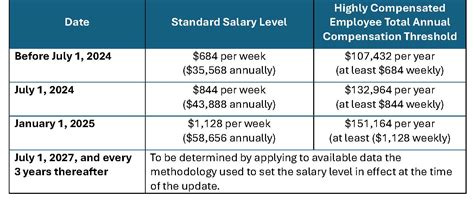

- Non-Exempt: This is the critical part. You are *not exempt* from federal overtime laws. This means if you work more than 40 hours in a workweek, your employer must pay you overtime, typically at a rate of 1.5 times your regular hourly rate.

This classification is often used for roles that are considered "white-collar" but do not meet the specific duties tests (executive, administrative, or professional) required to be classified as "exempt" from overtime. Common examples include:

- Paralegals and Legal Assistants

- Executive and Administrative Assistants

- IT Help Desk and Support Technicians

- Inside Sales Representatives

- Office Managers

- Certain junior-level accounting or marketing roles

Average Salaried Non-Exempt Salary

Because "salaried non-exempt" is a pay classification and not a job title, there is no single average salary. Your salary is determined by the specific role you perform. However, we can look at the typical salary ranges for common salaried non-exempt positions.

- Administrative Assistants: According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for secretaries and administrative assistants was $45,550 in May 2023. Salary.com reports a range typically falling between $46,104 and $57,094.

- Paralegals and Legal Assistants: The BLS reports a median annual wage of $60,970 for paralegals and legal assistants as of May 2023. Payscale shows a range from approximately $41,000 for entry-level positions to over $78,000 for experienced professionals.

- IT Help Desk Technicians (Tier 1/2): Glassdoor places the national average salary for an IT Help Desk Technician at around $58,000 per year. The range can be broad, from $45,000 to $75,000, depending heavily on the factors below.

Crucially, these figures represent *base salaries*. A key advantage of this classification is the potential to significantly increase total earnings through paid overtime.

Key Factors That Influence Salary

Your base salary and overall earning potential in a salaried non-exempt role are influenced by several key factors.

###

Level of Education

While many salaried non-exempt roles are accessible without a four-year degree, higher education can command a higher salary. For example, a paralegal with a bachelor's degree and a paralegal certificate will almost always earn more than one with only an associate's degree. Similarly, IT technicians who hold industry-standard certifications (like CompTIA A+, Network+, or various Microsoft credentials) can negotiate higher starting salaries and are more valuable to employers.

###

Years of Experience

Experience is one of the most significant drivers of salary. An entry-level administrative assistant may start at the lower end of the salary spectrum, while a senior executive assistant with 10+ years of experience supporting C-suite leaders can command a salary well above the median. In a non-exempt role, experience often translates to taking on more complex projects, which can lead to more opportunities for approved overtime and thus, higher total compensation.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of living and labor market demand. A paralegal in a high-cost metropolitan area like New York City or San Francisco will earn significantly more than a paralegal in a lower-cost area like Omaha, Nebraska, or Little Rock, Arkansas. For example, Salary.com data shows an IT Support Technician in San Jose, CA, can expect a base salary up to 30% higher than the national average.

###

Company Type and Industry

The size, profitability, and industry of your employer play a huge role. An IT technician at a large, multinational tech company or a major investment bank will likely have a much higher base salary and more robust benefits package than one working for a small non-profit or a local retail business. Industries like finance, technology, and specialized legal fields (e.g., corporate law) tend to offer higher compensation for their support staff.

###

Area of Specialization

Within a given job title, specialization can create a premium. A legal assistant who specializes in lucrative and complex patent law will typically earn more than one who works in general practice. An administrative assistant who has deep expertise in a specific software suite, like Salesforce or advanced project management tools, becomes a more indispensable—and better-paid—asset to their team.

Job Outlook

The job outlook for salaried non-exempt positions is tied directly to the outlook for the specific careers that fall under this classification.

- Paralegals and Legal Assistants: The BLS projects a 4 percent growth from 2022 to 2032, which is about as fast as the average for all occupations. As law firms and corporations look to increase efficiency and reduce costs, the demand for skilled paralegals to perform tasks once handled by lawyers will remain steady.

- Secretaries and Administrative Assistants: The BLS projects a decline of 7 percent over the next decade. However, this is largely for lower-level secretarial roles. The outlook for high-level executive assistants and specialized administrative professionals who can manage complex scheduling, master new technologies, and provide high-level project support remains strong.

- Computer Support Specialists (IT Help Desk): Demand in this field is projected to grow 5 percent from 2022 to 2032, faster than the average. As organizations of all sizes continue to rely on and upgrade their technology, the need for skilled support specialists to assist users is essential.

Conclusion

Being classified as a "salaried non-exempt" employee offers a powerful combination of financial stability and fair compensation for extra work. It provides the predictability of a set salary while ensuring you are paid for every hour you put in beyond the standard 40-hour week.

For anyone in or considering a career path that often uses this classification—such as a paralegal, IT technician, or high-level administrative professional—the key takeaways are:

1. Know Your Classification: Always confirm with HR whether your salaried position is exempt or non-exempt. It fundamentally impacts your rights and pay.

2. Understand Your Value: Your salary is determined by your role, skills, experience, and location, not just the classification.

3. Leverage the Overtime: See approved overtime not as a burden, but as a direct opportunity to increase your annual earnings substantially.

By understanding this important employment category, you can better navigate your career, negotiate your compensation, and ensure you are being paid fairly for your valuable contributions.