For ambitious students, dedicated researchers, and aspiring professionals across the Sunshine State, securing a position that offers a stipend can feel like a major victory. It's an opportunity to gain invaluable hands-on experience in your chosen field, build a powerful network, and receive payment for your contributions. But as the offer letter lands in your inbox, a critical and often confusing question emerges: Are stipends in Florida considered base salary? The answer is far more complex than a simple "yes" or "no," and understanding the distinction is paramount for your financial planning, tax obligations, and long-term career strategy.

This guide is designed to be your definitive resource, demystifying the world of stipends in Florida. We will dissect the legal, tax, and practical differences between a stipend and a salary, explore what you can expect to earn, and provide a roadmap for leveraging your stipend-based role into a successful and lucrative career. Over my fifteen years as a career analyst, I've seen countless bright individuals stumble over the nuances of their compensation. I recall a brilliant young biotech researcher who, after accepting a prestigious fellowship in Miami, was shocked to learn her stipend didn't qualify her for the apartment she wanted because the lending agency wouldn't recognize it as stable income. This guide is built to prevent that kind of surprise, empowering you with the knowledge to make informed decisions.

Whether you're a graduate student at the University of Florida, a tech intern in Tampa, or a medical fellow in Orlando, this comprehensive article will provide the clarity you need.

### Table of Contents

- [The Big Question: Are Stipends in Florida Considered Base Salary?](#the-big-question-are-stipends-in-florida-considered-base-salary)

- [Who Receives Stipends in Florida and Why? The Roles and The Rationale](#who-receives-stipends-in-florida-and-why-the-roles-and-the-rationale)

- [A Deep Dive into Florida Stipend Amounts](#a-deep-dive-into-florida-stipend-amounts)

- [Key Factors That Influence Your Stipend](#key-factors-that-influence-your-stipend)

- [From Stipend to Salary: Job Outlook and Career Growth in Florida](#from-stipend-to-salary-job-outlook-and-career-growth-in-florida)

- [How to Secure a High-Value Stipend Position in Florida](#how-to-secure-a-high-value-stipend-position-in-florida)

- [Conclusion: Navigating Your Career with Financial Clarity](#conclusion-navigating-your-career-with-financial-clarity)

The Big Question: Are Stipends in Florida Considered Base Salary?

At its core, the answer is no, a stipend is not considered a base salary in Florida from a legal and tax perspective. While both are forms of payment for your time and effort, their underlying purpose, regulatory framework, and financial implications are fundamentally different. A salary is a fixed payment for services rendered as an employee. A stipend is typically a fixed allowance intended to defray living expenses—like housing, food, and transportation—while you are in a training, research, or educational role.

Understanding this distinction requires looking at it from four key angles: legal, tax, lending, and employer perspective.

### The Legal Definition: Employee vs. Trainee

The primary legal distinction comes from the U.S. Department of Labor's Fair Labor Standards Act (FLSA). The FLSA mandates minimum wage and overtime pay for employees. However, a person receiving a stipend is often classified as a trainee, intern, or fellow, not an employee.

To determine if an individual is a "trainee" (and thus can be paid a stipend instead of a salary), the Department of Labor uses a "primary beneficiary test." This test assesses who is the primary beneficiary of the relationship: the individual or the organization?

Key factors in the "primary beneficiary" test include:

1. No Expectation of Compensation: The trainee understands they are not entitled to wages for the time spent in the internship.

2. Training Similar to an Educational Environment: The experience provides training that would be similar to that which would be given in a vocational school or academic institution.

3. Tied to a Formal Education Program: The experience is tied to the trainee's formal education program by integrated coursework or the receipt of academic credit.

4. Accommodates Academic Commitments: The experience accommodates the trainee’s academic commitments by corresponding to the academic calendar.

5. Limited Duration: The experience is limited to a period in which it provides the trainee with beneficial learning.

6. Work Complements, Not Displaces: The trainee’s work complements, rather than displaces, the work of paid employees while providing significant educational benefits.

7. No Entitlement to a Job: Both parties understand that the experience is conducted without entitlement to a paid job at its conclusion.

If your role in Florida meets these criteria, the organization can legally pay you a stipend that may fall below minimum wage and does not require overtime pay. If the organization is the primary beneficiary—meaning your work is displacing that of a regular employee and is critical to their operations without a significant educational component—you should legally be classified as an employee and paid a salary.

### The Tax Perspective: The Sting of Self-Employment Tax

This is where the difference hits your wallet most directly.

- Salary (W-2 Income): When you earn a salary, you are an employee. You receive a Form W-2 at the end of the year. Your employer withholds federal income tax, state income tax (Florida has none), and FICA taxes (Social Security and Medicare) from each paycheck. Your employer pays a matching portion of the FICA taxes.

- Stipend (Often 1099 Income): When you receive a stipend, you are often classified as a non-employee or independent contractor. You may receive a Form 1099-MISC or 1099-NEC. Crucially, no taxes are withheld from your payment. You receive the full, gross amount.

This might seem great upfront, but you are responsible for paying the entire tax bill yourself. This includes:

- Federal Income Tax: You must calculate and pay this on your own, typically through quarterly estimated tax payments to the IRS.

- Self-Employment Tax: This is the big one. Because your provider did not pay the employer's share of FICA taxes, you are responsible for paying both the employee *and* employer portions. This amounts to a hefty 15.3% (12.4% for Social Security up to the annual limit and 2.9% for Medicare) on your entire stipend income, in addition to your regular income tax.

Important Caveat: Some educational stipends, particularly for degree-seeking students, might be considered scholarship income and reported on Form 1098-T. According to IRS Publication 970, amounts used for qualified tuition and fees are generally tax-free. However, any portion of the stipend used for living expenses (room, board, travel) is typically considered taxable income, though it may not be subject to self-employment tax. This area is complex, and consulting a tax professional is highly recommended.

### The Lender's View: Proving Your Income

When applying for a car loan, mortgage, or even a lease on an apartment, lenders want to see stable, predictable, and verifiable income.

- Salary is the gold standard. It's documented with W-2s and regular pay stubs, showing a clear history of employment and predictable future earnings.

- Stipend income is often viewed with skepticism. Lenders see it as temporary and non-guaranteed. Because it's often tied to a specific program (e.g., a 9-month fellowship or a 3-month internship), it doesn't represent long-term earning potential in their eyes. You will likely need to provide more extensive documentation, such as the full offer letter detailing the stipend's duration and amount, and you may still face rejection or less favorable terms.

### Summary: Stipend vs. Base Salary in Florida

| Feature | Base Salary | Stipend |

| :--- | :--- | :--- |

| Legal Classification | Employee | Often Trainee, Fellow, or Contractor |

| Governing Law | FLSA (Minimum Wage, Overtime) | "Primary Beneficiary Test" |

| Tax Form | Form W-2 | Often Form 1099-MISC / 1099-NEC |

| Tax Withholding | Automatic (Income & FICA taxes) | None (Recipient pays all taxes) |

| FICA Tax (SS & Medicare)| Employer pays half (7.65%) | Recipient pays all (15.3%) |

| Benefits Eligibility| Typically eligible for health insurance, 401(k), paid time off | Typically ineligible for benefits |

| Lender's Perspective | Stable, verifiable income | Temporary, less stable income |

| Primary Purpose | Compensation for work performed | Allowance to defray costs during training/education |

Who Receives Stipends in Florida and Why? The Roles and The Rationale

Stipends are prevalent across Florida's diverse economic landscape, from the burgeoning tech hubs of Miami and Tampa to the world-renowned research institutions in Gainesville and Orlando. Organizations use stipends for two main reasons: to attract top talent for non-employee roles and to manage costs and legal obligations associated with traditional employment. Understanding the common roles that receive stipends helps clarify why this payment structure exists.

### Core Roles Receiving Stipends

1. University Graduate Students (Master's and Ph.D. Candidates): This is one of the most common uses for stipends. Universities in Florida, such as the University of Florida (UF), Florida State University (FSU), and the University of Miami (UM), provide graduate assistantships. These students receive a stipend to cover living expenses while they conduct research or serve as teaching assistants. The primary purpose is to support their education, making a stipend the appropriate payment form.

2. Postdoctoral Researchers ("Postdocs"): After earning a Ph.D., many researchers undertake a postdoctoral fellowship. These positions, common at institutions like the Scripps Research Institute in Jupiter or the Moffitt Cancer Center in Tampa, involve advanced training. The stipend supports the researcher as they develop into an independent scientist.

3. Medical Residents and Fellows: While their pay is often called a "salary," the compensation for physicians in residency and fellowship training programs functions very much like a stipend. It's a predetermined amount set by the institution to support them during their specialized training period.

4. Interns (Corporate, Non-Profit, and Government): Many Florida businesses offer internships to college students and recent graduates. To comply with FLSA rules and qualify as a true "trainee" experience, these roles are often paid via a stipend. This is common in fields like marketing, communications, finance, and software development.

5. Fellows (Non-Profit and Public Policy): Think tanks, foundations, and government agencies often create fellowships. These are prestigious, fixed-term positions designed for individuals to work on a specific project or policy area. The stipend supports them for the duration of the fellowship, which might last anywhere from a few months to two years.

### A Day in the Life: The Research Fellow

To make this tangible, let's imagine a day in the life of "Maria," a postdoctoral research fellow at a marine biology institute in St. Petersburg, Florida.

- 8:00 AM: Maria arrives at the lab. She's not punching a clock; her work is project-based. Her first task is to check on the coral specimens from yesterday's experiment, recording data on their growth and health.

- 9:00 AM - 12:00 PM: She spends the morning conducting a complex DNA sequencing protocol. This is a high-level skill she's honing during her fellowship—a key part of her "training." Her work is guided by a principal investigator (PI), but she has significant autonomy.

- 12:00 PM - 1:00 PM: Lunch with other postdocs and graduate students. They discuss their research challenges and a recent academic paper. This collaboration is a core part of the educational experience.

- 1:00 PM - 4:00 PM: Maria analyzes the data from her morning experiment using specialized statistical software. She's preparing a chart for the weekly lab meeting. This work contributes to the lab's overall research goals, but it is also building her personal portfolio of skills and publications.

- 4:00 PM - 5:00 PM: She attends a seminar by a visiting professor from a different university, a networking and learning opportunity organized by the institute.

- After 5:00 PM: Maria heads home. She wasn't paid overtime for her 9-hour day because she is not an employee under FLSA. Her bi-weekly stipend payment is a fixed amount, regardless of whether she works 40 or 55 hours in a given week, as her role is focused on training and achieving research outcomes.

Maria's experience clearly benefits her career development, making the stipend a legally sound method of payment for the institute.

A Deep Dive into Florida Stipend Amounts

While a stipend isn't a salary, the amount you receive is critically important to your quality of life. Stipend amounts in Florida are not standardized and can vary dramatically based on the field, institution, location, and the prestige of the program. It's essential to research the typical range for your specific situation.

Remember, when you see these numbers, you must mentally deduct your estimated tax burden (potentially 20-40%, including federal income tax and the 15.3% self-employment tax) to understand your true take-home pay.

### Typical Stipend Ranges in Florida

Below are estimated annual stipend ranges for common roles in Florida. These figures are synthesized from data from university financial aid offices, job postings, and self-reported data on platforms like Glassdoor and Payscale as of late 2023 and early 2024.

1. University Graduate Assistantships (Ph.D. & Master's Students)

- General Range: $18,000 - $35,000 per academic year (9 months).

- University of Florida (UF): According to their Graduate School, the minimum stipend for a 0.5 FTE (full-time equivalent) assistantship for 2023-2024 is approximately $17,000 for 9 months, though many STEM programs pay significantly more, often in the $25,000 - $32,000 range.

- Florida State University (FSU): Stipends are comparable, with the university noting a minimum of around $16,000, but with many departments paying in the $20,000 - $30,000 range.

- University of Miami (UM): As a private institution, stipends can be higher. Prestigious programs, like those at the Miller School of Medicine, may offer Ph.D. stipends in the $30,000 - $40,000 range.

2. Postdoctoral Research Fellows

Postdoc stipends are often benchmarked against the National Institutes of Health (NIH) Kirschstein National Research Service Award (NRSA) scale. This provides a nationwide standard that many Florida institutions follow.

- NIH NRSA Scale (2023): This is the most authoritative source.

- 0 Years of Experience: $56,484

- 1 Year of Experience: $56,880

- 2 Years of Experience: $57,348

- 3 Years of Experience: $59,628

- Senior Fellows (7+ years): $68,604

- Institutional Practice: Most major research centers in Florida (e.g., Scripps, Moffitt, Mayo Clinic Jacksonville) will offer stipends that are at or above the NIH NRSA scale to remain competitive. You can reasonably expect $56,000 - $65,000 depending on your experience level.

3. Corporate Internships

Internship pay is highly variable and often quoted as an hourly rate, even if paid out in a lump-sum stipend.

- Hourly Rate Equivalent: $15 - $45+ per hour.

- Undergraduate Intern (Non-Technical): For roles in marketing, HR, or communications, expect $15 - $25 per hour. A 12-week, full-time summer internship could equate to a total stipend of $7,200 - $12,000.

- Undergraduate Intern (Technical): For competitive roles in software engineering, data science, or finance, pay is much higher. Expect $25 - $50+ per hour. Major tech or financial firms in Miami or Tampa could pay a summer stipend of $12,000 - $24,000.

- Graduate/MBA Intern: These are the most lucrative internships, with hourly equivalents often reaching $40 - $75+ per hour, leading to summer stipends of $19,000 - $36,000 or more.

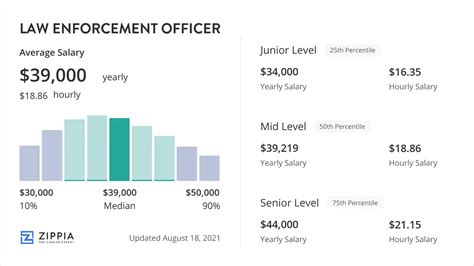

4. Medical Residents

Resident compensation is public information for many hospitals as they are part of accredited programs. These are often called "salaries" but function as fixed stipends that increase with each year of training (Post-Graduate Year or PGY).

- Source: Data from 2023-2024 residency program disclosures.

- PGY-1 (First-Year Resident): $58,000 - $62,000

- PGY-2: $60,000 - $64,000

- PGY-3: $62,000 - $67,000

- Senior Residents/Fellows: $65,000 - $75,000+

It's crucial to note that while these numbers resemble salaries, residents work notoriously long hours, often 60-80 hours per week, making the effective hourly rate quite low. They are, however, typically classified as employees for tax purposes (W-2) due to the nature of their work, which is a key distinction from other stipend roles.

Key Factors That Influence Your Stipend

Your potential stipend is not a lottery; it's a calculated figure based on a confluence of factors. Understanding these variables empowers you to target the right opportunities, negotiate more effectively, and maximize your earnings during your training period. This is the most critical section for anyone looking to secure a high-value stipend in Florida.

###

Level of Education and Field of Study

This is the most significant determinant of your stipend amount. The demand, required expertise, and funding sources tied to your academic field create a clear hierarchy.

- Ph.D. vs. Master's vs. Bachelor's: There is a direct correlation between educational level and stipend amount. A Ph.D. student will almost always receive a higher stipend than a Master's student in the same department, who in turn will earn more than an undergraduate intern. For postdoctoral fellows, who have already earned a doctorate, the stipend is higher still.

- STEM vs. Humanities: This is the starkest divide. Fields in Science, Technology, Engineering, and Mathematics (STEM) consistently command the highest stipends. This is driven by several forces:

- Funding Availability: Government agencies like the NIH and the National Science Foundation (NSF), as well as private corporations, pour billions of dollars into STEM research. These grants include specific budget lines for graduate student and postdoc stipends.

- Industry Competition: A talented computer science Ph.D. student has the option to leave academia for a six-figure job at a tech company. To keep them in the university system, departments must offer competitive stipends.

- Example: A Ph.D. student in computer engineering at a Florida university might receive a stipend of $32,000, while a Ph.D. student in history at the same university might receive $20,000.

- High-Demand Professional Fields: Fields like finance, business (MBA), and law also see higher-than-average internship stipends. A summer MBA intern at a private equity firm in Miami could earn a stipend that annualizes to over $150,000, while a public policy fellow at a Tallahassee non-profit might earn a stipend that annualizes to $50,000.

###

Years of Experience

For roles that span multiple years, experience is rewarded with a structured increase in compensation. This is most formalized in research and medical training.

- Postdoctoral Fellows: As noted previously, the NIH NRSA scale provides a clear, year-by-year increase. A postdoc in their fourth year ($59,628) earns more than a fresh graduate ($56,484). This recognizes their increased skill, independence, and contribution to the lab. Savvy postdocs will often cite the updated NRSA scale during annual reviews to request a commensurate raise if their institution's policy isn't automatic.

- Medical Residents: The PGY (Post-Graduate Year) system is a rigid hierarchy. A PGY-3 general surgery resident at a hospital in Jacksonville will earn more than a PGY-1 resident in the same program, reflecting their greater responsibility and experience. These increases are non-negotiable and are set by the institution's graduate medical education office.

- Corporate Interns: While less formalized, repeat interns often command higher pay. A software engineering student who returns to the same company for a second summer internship can often negotiate a higher stipend (e.g., a 10-15% increase) based on their proven track record and reduced training needs.

###

Geographic Location within Florida

Florida is not a monolith. The cost of living and concentration of high-paying industries vary significantly from city to city, directly impacting stipend amounts.

- High-Cost, High-Pay Zones (Miami, Fort Lauderdale, West Palm Beach): South Florida's booming finance and tech scenes, combined with a very high cost of living, drive stipends upward. A tech internship in Miami's Wynwood or a finance internship in Brickell will pay a premium to attract talent who can afford to live there. A graduate student stipend at the University of Miami will generally be higher than at a university in a lower-cost area to account for housing costs.

- Major Metro Hubs (Tampa, Orlando, Jacksonville): These cities offer a balance. They have strong, diverse economies in sectors like healthcare, defense, logistics, and technology. The cost of living is lower than in South Florida, but the competition for talent is still robust. Stipends here are competitive but may not reach the absolute peaks of Miami. For example, a research fellowship at the Moffitt Cancer Center in Tampa will be nationally competitive but might not include the extra cost-of-living adjustment you'd see for an equivalent position in a city like San Francisco or Boston.

- University Towns (Gainesville, Tallahassee): These cities are dominated by their major universities (UF and FSU). The cost of living is significantly lower, which puts downward pressure on stipend amounts. A graduate student stipend of $25,000 in Gainesville goes much further than the same amount in Miami. While the stipends may seem lower on a statewide comparison, they are often quite generous relative to the local cost of living.

Data Comparison: Cost of Living vs. Average Rent (Data synthesized from Payscale and RentCafe as of early 2024)

| City | Cost of Living Index (vs. National Avg) | Average Rent (1-BR) | Typical Stipend Environment |

| :--- | :--- | :--- | :--- |

| Miami | 21% Above Average | ~$2,600 | Highest nominal stipends, but purchasing power can be lower. |

| Tampa | 3% Above Average | ~$1,800 | Strong, competitive stipends, especially in tech and healthcare. |

| Orlando | 2% Above Average | ~$1,750 | Good stipends, driven by hospitality, tech, and medical research. |

| Jacksonville | 7% Below Average | ~$1,450 | Solid stipends, particularly in logistics, finance, and healthcare. |

| Gainesville| 8% Below Average | ~$1,300 | Lower nominal stipends, but high purchasing power due to low CoL. |

###

Company Type & Size

The nature and resources of the organization offering the stipend play a massive role in how much they can and are willing to pay.

- Large Corporations (e.g., NextEra Energy, Raymond James, Microsoft): Large, publicly traded companies have the deepest pockets. They use high-paying internships and fellowships as a primary recruiting tool to build their talent pipeline. They compete for the best students and are willing to pay a premium. These roles often come with perks like housing allowances or relocation assistance, which are part of the total stipend package.

- Startups and Small Businesses: A venture-backed tech startup in Tampa might offer a competitive stipend to attract a crucial software engineering intern. However, an early-stage, bootstrapped startup may offer a very modest stipend or one that is heavily weighted with non-monetary benefits like equity options (which are highly speculative). You trade top-tier pay for potentially greater responsibility and a more dynamic environment.

- Universities and Research Institutes: As discussed, these are heavily dependent on grant funding. A well-funded lab with multiple R01 grants from the NIH can offer much higher stipends than a lab with limited funding. The prestige of the institution also matters; top-tier private universities like UM often have larger endowments and can offer more generous packages.

- Non-Profits and Government: These organizations are typically the most constrained financially. Stipends for fellowships at a local environmental non-profit or an internship with a state government agency in Tallahassee will be modest. The value proposition here is not the pay but the mission-driven work and unique public sector experience.

###

In-Demand Skills

Your unique skill set can make you a more valuable candidate and give you leverage to secure a better stipend. Organizations are willing to pay more for individuals who can contribute immediately with specialized, hard-to-find skills.

- Technical Skills: This is the clearest differentiator.

- Programming Languages: Proficiency in Python, Java, C++, or specific frameworks like React or TensorFlow.

- Data Science: Expertise in machine learning, statistical analysis, data visualization tools (like Tableau), and SQL.

- Cloud Computing: Certifications or experience with AWS, Azure, or Google Cloud.

- Laboratory Skills: Specific, advanced lab techniques can be highly valuable. For a biology postdoc, experience with CRISPR gene editing, advanced microscopy, or mass spectrometry is far more valuable than general lab skills.

- Quantitative and Financial Modeling: For finance or business internships, the ability to build complex financial models in Excel, perform valuation analysis, or use tools like Bloomberg Terminal is a significant advantage.

- Language Skills: In a global hub like Miami, fluency in Spanish or Portuguese can be a tie-breaker and a justification for a higher stipend in business, law, or communications roles.

By highlighting these specific, in-demand skills on your resume and in interviews, you shift the perception from being a "general trainee" to a "specialized contributor," which can directly translate to a better financial offer.

From Stipend to Salary: Job Outlook and Career Growth in Florida

A stipend-based role is not a final destination; it's a launchpad. The experience, skills, and network you build are the true assets that propel you into a full-time, salaried career. The job outlook for individuals coming out of internships, fellowships, and